In this age of electronic devices, with screens dominating our lives but the value of tangible printed products hasn't decreased. For educational purposes such as creative projects or just adding an individual touch to your space, Can I Claim Hra And Deduction On Home Loan Interest As Well are now a useful resource. With this guide, you'll take a dive into the world "Can I Claim Hra And Deduction On Home Loan Interest As Well," exploring what they are, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Can I Claim Hra And Deduction On Home Loan Interest As Well Below

Can I Claim Hra And Deduction On Home Loan Interest As Well

Can I Claim Hra And Deduction On Home Loan Interest As Well -

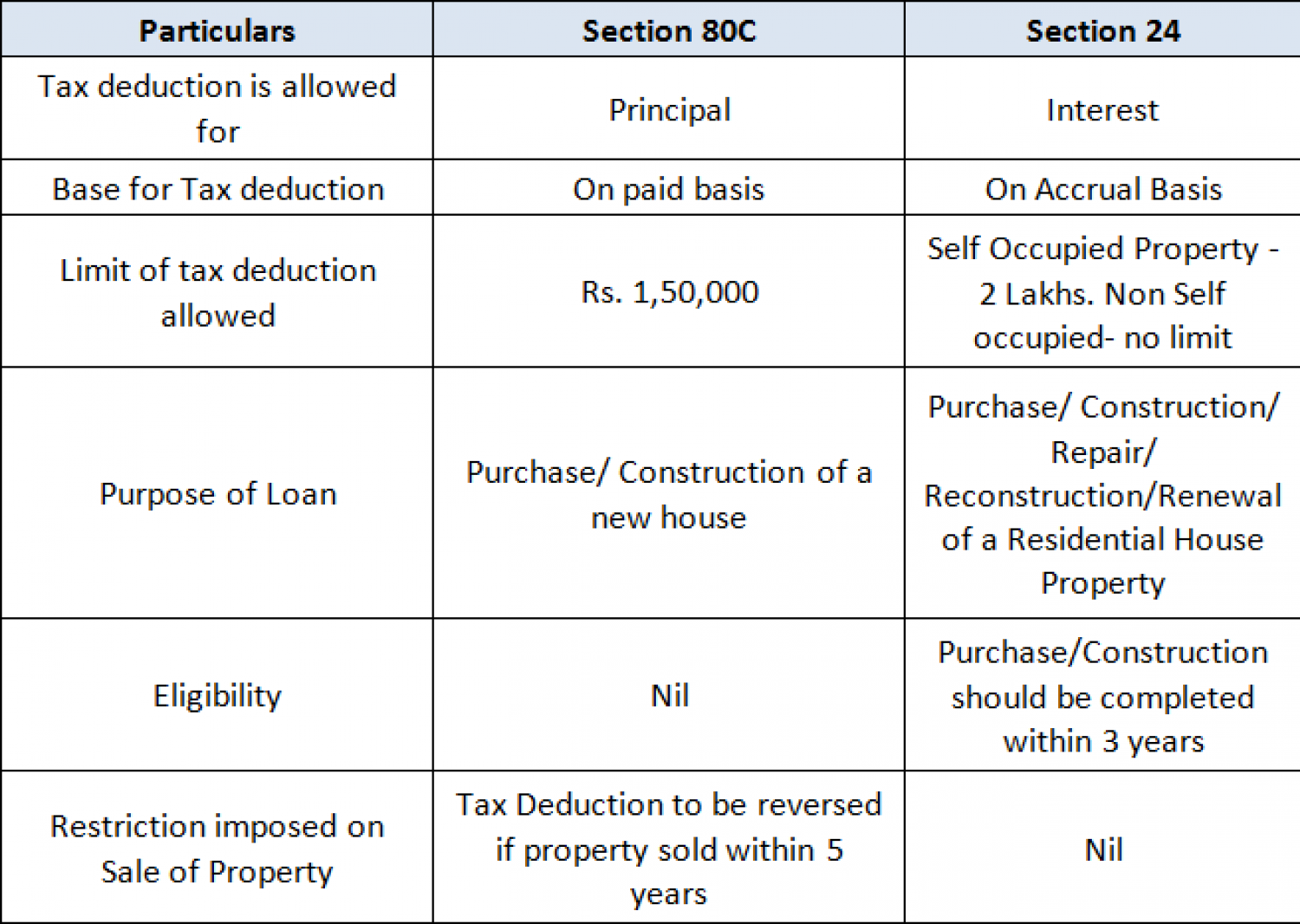

Tax benefits for home loans are available for interest payment as well as for repayment of the principal amount The benefit for principal repayment is available

As per the rule you cannot claim both a home loan and HRA in the same city But practically some people do claim up to the 1 lakh limit You can claim HRA but allowing it as a deduction by the

Printables for free include a vast selection of printable and downloadable materials available online at no cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. The attraction of printables that are free is their versatility and accessibility.

More of Can I Claim Hra And Deduction On Home Loan Interest As Well

Can You Claim HRA And Deduction On Home Loan Interest

Can You Claim HRA And Deduction On Home Loan Interest

A short answer to this is NO One may claim both HRA exemption and interest deduction on a home loan subject to the condition that certain requirements

According to income tax laws there are no legal restrictions vis vis claiming HRA benefits and home loan benefits at the same time The income tax laws allow you to claim various tax benefits with

Can I Claim Hra And Deduction On Home Loan Interest As Well have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization: The Customization feature lets you tailor printing templates to your own specific requirements such as designing invitations making your schedule, or decorating your home.

-

Education Value Downloads of educational content for free cater to learners of all ages, which makes these printables a powerful tool for parents and teachers.

-

Affordability: immediate access numerous designs and templates can save you time and energy.

Where to Find more Can I Claim Hra And Deduction On Home Loan Interest As Well

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

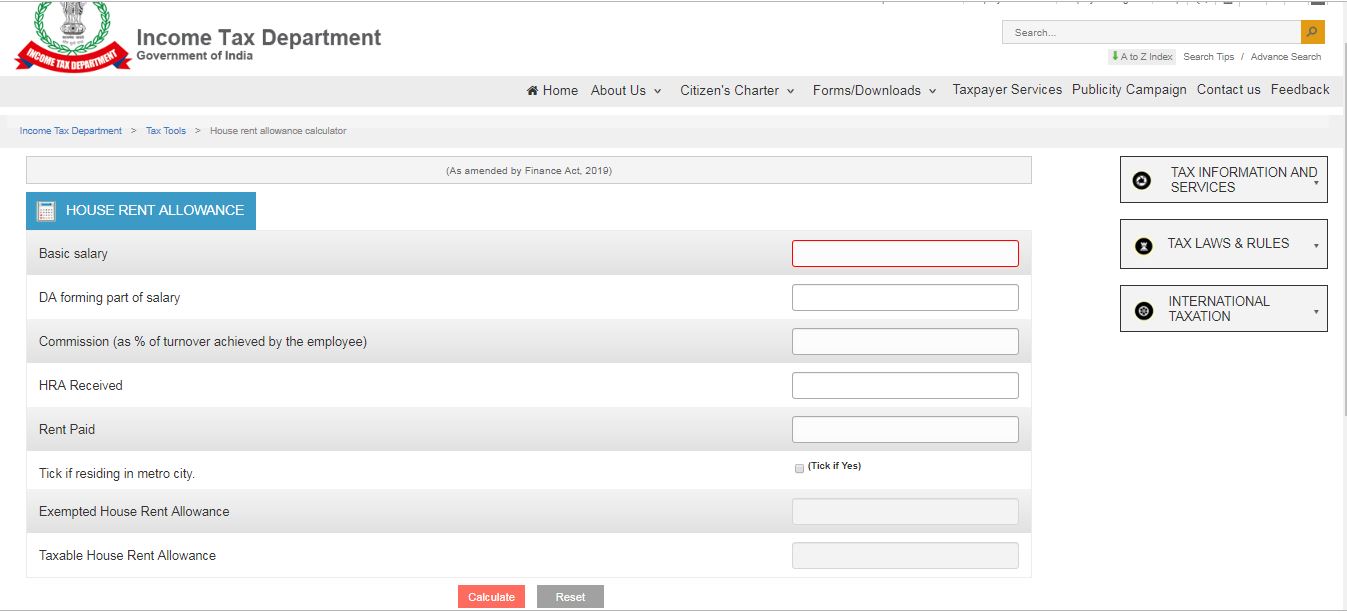

The answer is yes If you are living on rent in your city of job and own house in another city then income tax benefit can be claimed on HRA as well as Home loan

To answer the question yes you can claim both tax benefits together in the same year and significantly reduce your taxable income However you should maintain proper records

Now that we've ignited your interest in printables for free, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of needs.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing Can I Claim Hra And Deduction On Home Loan Interest As Well

Here are some innovative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Can I Claim Hra And Deduction On Home Loan Interest As Well are a treasure trove with useful and creative ideas designed to meet a range of needs and desires. Their accessibility and versatility make them a great addition to the professional and personal lives of both. Explore the many options of Can I Claim Hra And Deduction On Home Loan Interest As Well right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can I Claim Hra And Deduction On Home Loan Interest As Well really free?

- Yes, they are! You can download and print the resources for free.

-

Can I download free printables for commercial uses?

- It depends on the specific usage guidelines. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables might have limitations concerning their use. Make sure you read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit the local print shop for higher quality prints.

-

What program will I need to access printables free of charge?

- Most PDF-based printables are available as PDF files, which can be opened with free software, such as Adobe Reader.

How To Claim Hra And Home Loan In Income Tax Return A Y 22 23 YouTube

HRA House Rent Allowances Claim HRA Benefits Without Landlord s PAN

Check more sample of Can I Claim Hra And Deduction On Home Loan Interest As Well below

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Can You Claim HRA And Interest On Home Loan Together YouTube

Material Requirement Form Hra Exemption Calculator 201920

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

Can I Claim HRA Even If I m Staying At My Parents House

Understanding The Rules Can We Claim HRA And Home Loan Deductions

https://taxguru.in/income-tax/claim-hra-…

As per the rule you cannot claim both a home loan and HRA in the same city But practically some people do claim up to the 1 lakh limit You can claim HRA but allowing it as a deduction by the

https://m.economictimes.com/wealth/tax/how-to...

Can such a person claim income tax benefit for both HRA and home loan repayment Yes if you are living on rent in your city of job and own house in another

As per the rule you cannot claim both a home loan and HRA in the same city But practically some people do claim up to the 1 lakh limit You can claim HRA but allowing it as a deduction by the

Can such a person claim income tax benefit for both HRA and home loan repayment Yes if you are living on rent in your city of job and own house in another

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

Can You Claim HRA And Interest On Home Loan Together YouTube

Can I Claim HRA Even If I m Staying At My Parents House

Understanding The Rules Can We Claim HRA And Home Loan Deductions

ICICI Bank Home Loan Home Loans Loan Icici Bank

How To Claim HRA And Home Loan Both By HelloTax Financial Coach

How To Claim HRA And Home Loan Both By HelloTax Financial Coach

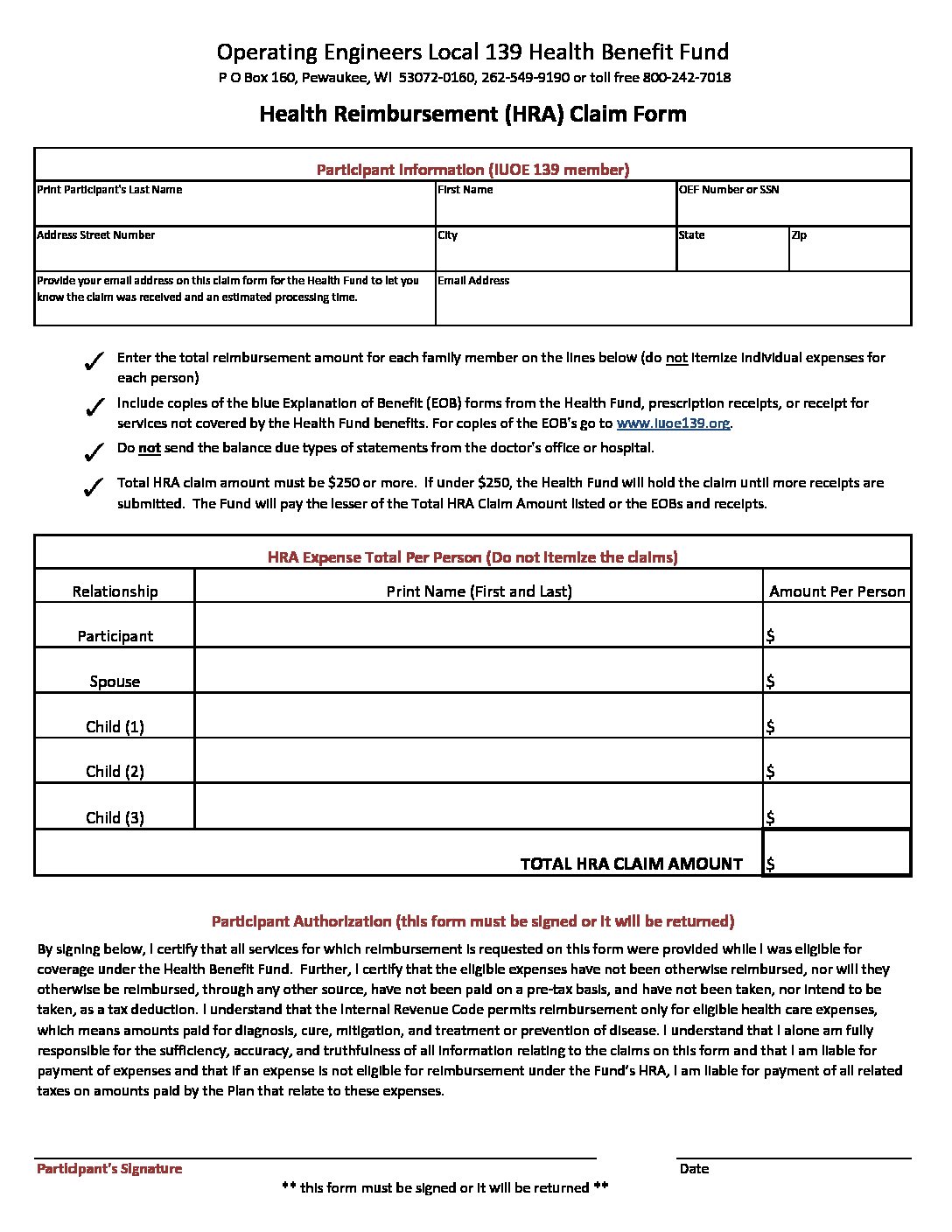

HRA Claim Form 2016 FINAL Operating Engineers Local 139 Health