In a world with screens dominating our lives it's no wonder that the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons for creative projects, just adding an individual touch to the space, Income Tax Exemption On Home Loan Principal are now an essential resource. Through this post, we'll dive to the depths of "Income Tax Exemption On Home Loan Principal," exploring what they are, where to find them, and how they can enhance various aspects of your lives.

Get Latest Income Tax Exemption On Home Loan Principal Below

Income Tax Exemption On Home Loan Principal

Income Tax Exemption On Home Loan Principal - Income Tax Exemption On Home Loan Principal, Income Tax Benefit On Home Loan Principal And Interest, Income Tax Rebate On Home Loan Principal, Income Tax Rebate On Home Loan Interest And Principal, Tax Exemption On Home Loan Principal, Income Tax Exemption Limit For Housing Loan Principal, How Much Home Loan Principal Is Exempt From Tax, What Is The Exemption Limit For Housing Loan Principal, Tax Benefit On Home Loan Principal, Income Tax Exemption Limit On Home Loan

Home Loan Tax Benefits under Section 80C Principal Deductions Section 80C deals with the principal amount deductions For both self occupied and let out properties you

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Printables for free cover a broad assortment of printable materials online, at no cost. These resources come in various types, such as worksheets templates, coloring pages and more. The appealingness of Income Tax Exemption On Home Loan Principal lies in their versatility as well as accessibility.

More of Income Tax Exemption On Home Loan Principal

How Is Tax Exemption On Home Loan Calculated TESATEW

How Is Tax Exemption On Home Loan Calculated TESATEW

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961

Tax deduction under section 80 c of the Income Tax Act can be claimed for stamp duty and registration fees as well but it must be within the overall limit of Rs 1 5 lakh applied to principal repayment This benefit can be

Income Tax Exemption On Home Loan Principal have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor designs to suit your personal needs such as designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes them a great resource for educators and parents.

-

The convenience of You have instant access various designs and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption On Home Loan Principal

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Exemption Check Tax Benefits On Home Loan

How can you claim a deduction of the principal amount on pre payment Section 80C allows the deduction for the amount paid towards the principal repayment

Tax exemption of up to Rs 2 Lakh can be claimed 2 Section 80 C of the Income Tax Act This act allows a deduction of up to Rs 1 5 Lakh on the principal repayment amount of

We've now piqued your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Income Tax Exemption On Home Loan Principal for all motives.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning materials.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing Income Tax Exemption On Home Loan Principal

Here are some inventive ways in order to maximize the use of Income Tax Exemption On Home Loan Principal:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Exemption On Home Loan Principal are a treasure trove filled with creative and practical information for a variety of needs and pursuits. Their access and versatility makes them an invaluable addition to any professional or personal life. Explore the wide world of Income Tax Exemption On Home Loan Principal to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use the free printables in commercial projects?

- It's determined by the specific conditions of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright violations with Income Tax Exemption On Home Loan Principal?

- Certain printables might have limitations regarding usage. Be sure to check these terms and conditions as set out by the author.

-

How can I print Income Tax Exemption On Home Loan Principal?

- Print them at home with any printer or head to a print shop in your area for better quality prints.

-

What software do I need to open printables that are free?

- The majority are printed in the PDF format, and is open with no cost software such as Adobe Reader.

Home Loan Interest Exemption In Income Tax Home Sweet Home

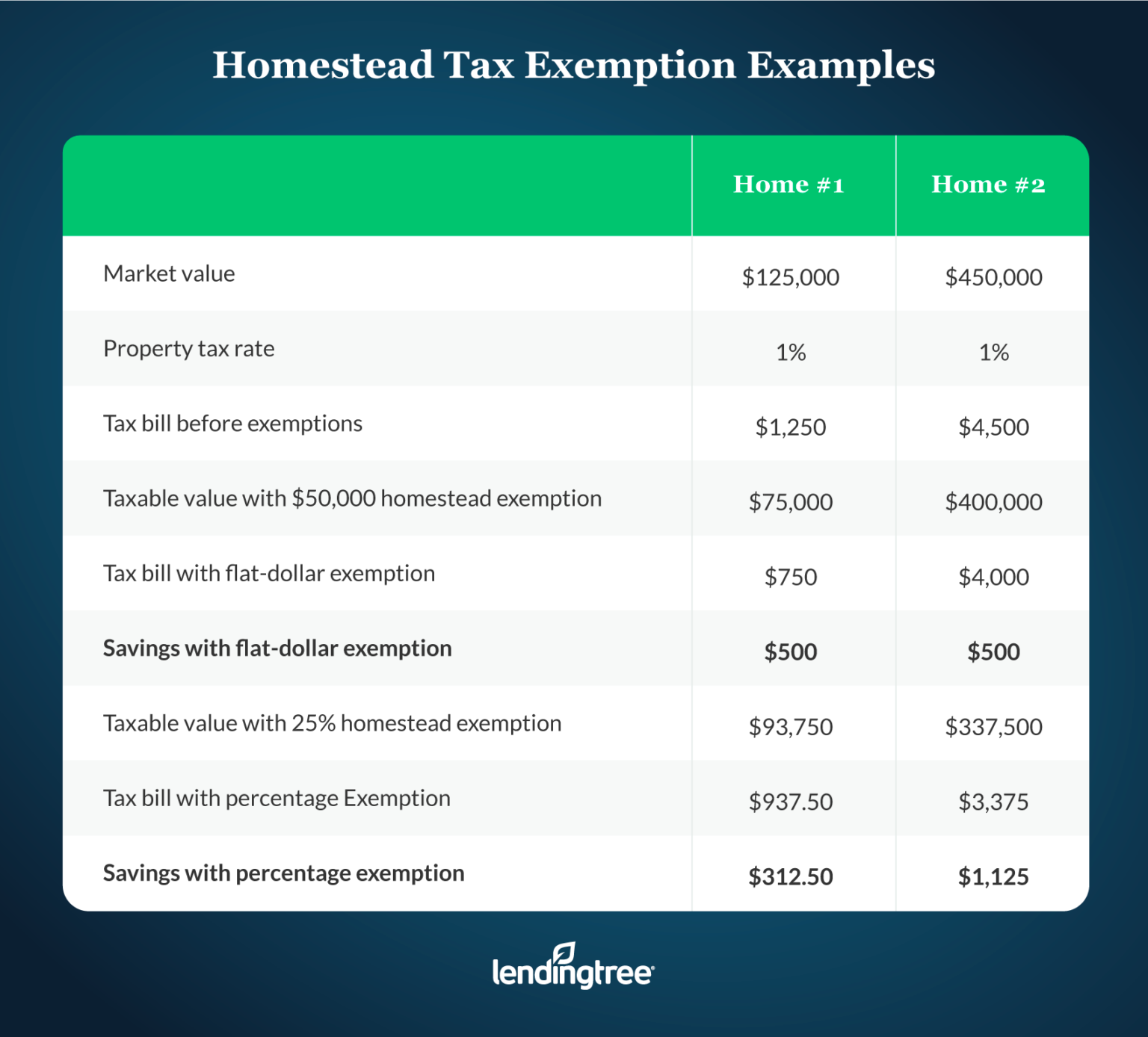

What Is A Homestead Exemption And How Does It Work LendingTree

Check more sample of Income Tax Exemption On Home Loan Principal below

Income Tax Benefits On Housing Loan Interest And Principal House Poster

All You Need To Know On Exempted Income In Income Tax Ebizfiling

How Is Tax Exemption On Home Loan Calculated TESATEW

How Housing Loan Tax Benefit

House Loan Limit In Income Tax Home Sweet Home

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

https://housing.com/news/home-loans-…

Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan principal

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan principal

How Housing Loan Tax Benefit

All You Need To Know On Exempted Income In Income Tax Ebizfiling

House Loan Limit In Income Tax Home Sweet Home

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

Can I Claim Both Home Loan And HRA Tax Benefits

Home Loan Tax Benefit 2018 19 Home Sweet Home Insurance Accident

Home Loan Tax Benefit 2018 19 Home Sweet Home Insurance Accident

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog