In the age of digital, where screens rule our lives yet the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes and creative work, or just adding an individual touch to the area, Income Tax Deduction On Recurring Deposit are now a useful resource. Here, we'll take a dive into the sphere of "Income Tax Deduction On Recurring Deposit," exploring what they are, how you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Deduction On Recurring Deposit Below

Income Tax Deduction On Recurring Deposit

Income Tax Deduction On Recurring Deposit - Income Tax Deduction On Recurring Deposit, Income Tax Deduction On Fixed Deposit, Income Tax Deduction On Fixed Deposit Interest, Income Tax Rebate On Recurring Deposit, Income Tax Rules On Fixed Deposit In India, Income Tax Exemption On Fixed Deposit Interest For Senior Citizens, Income Tax Rebate On Fixed Deposit Interest For Senior Citizens, Income Tax Rules For Tds On Fixed Deposits, Tax Deduction On Fixed Deposit, Tax Benefit On Recurring Deposit

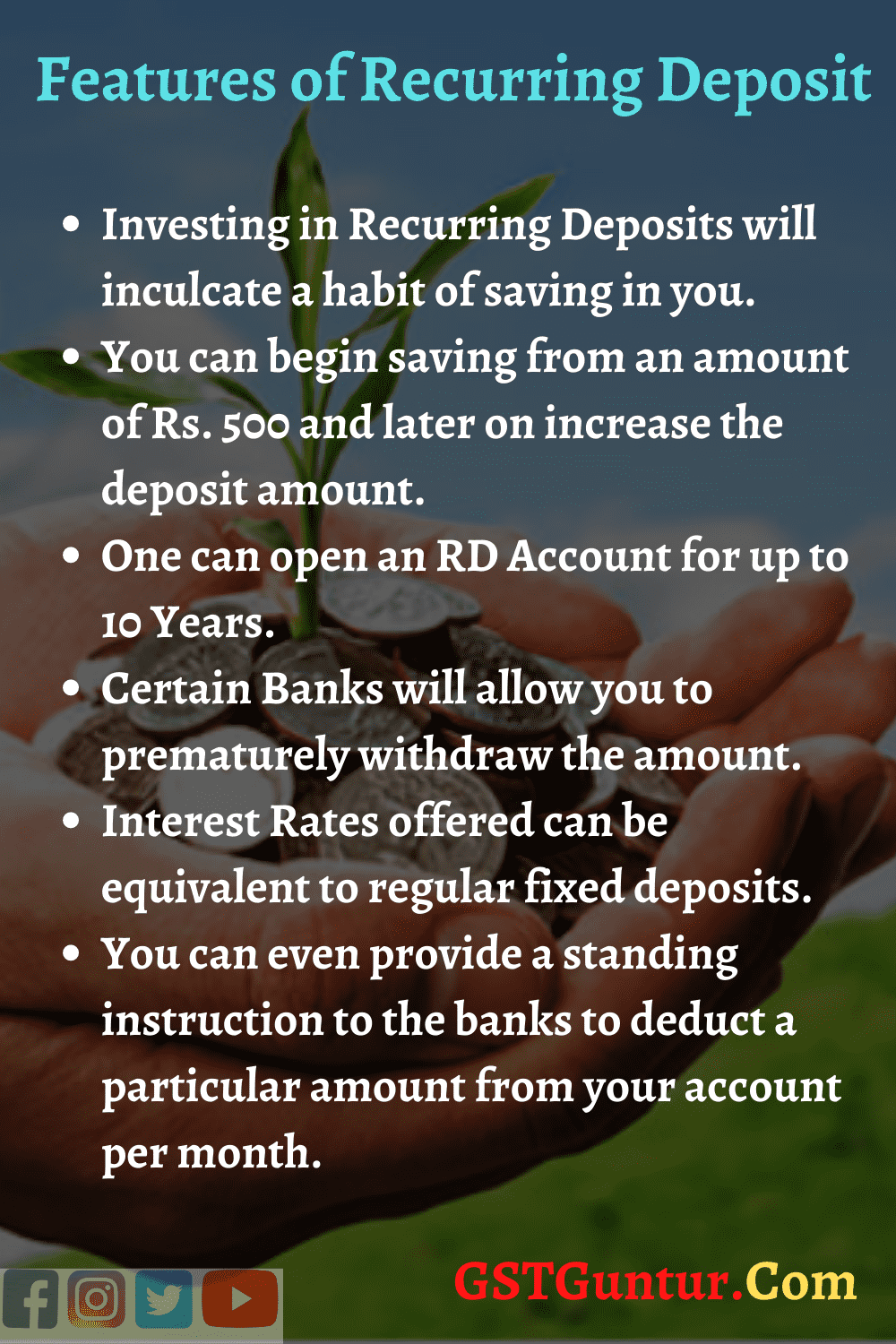

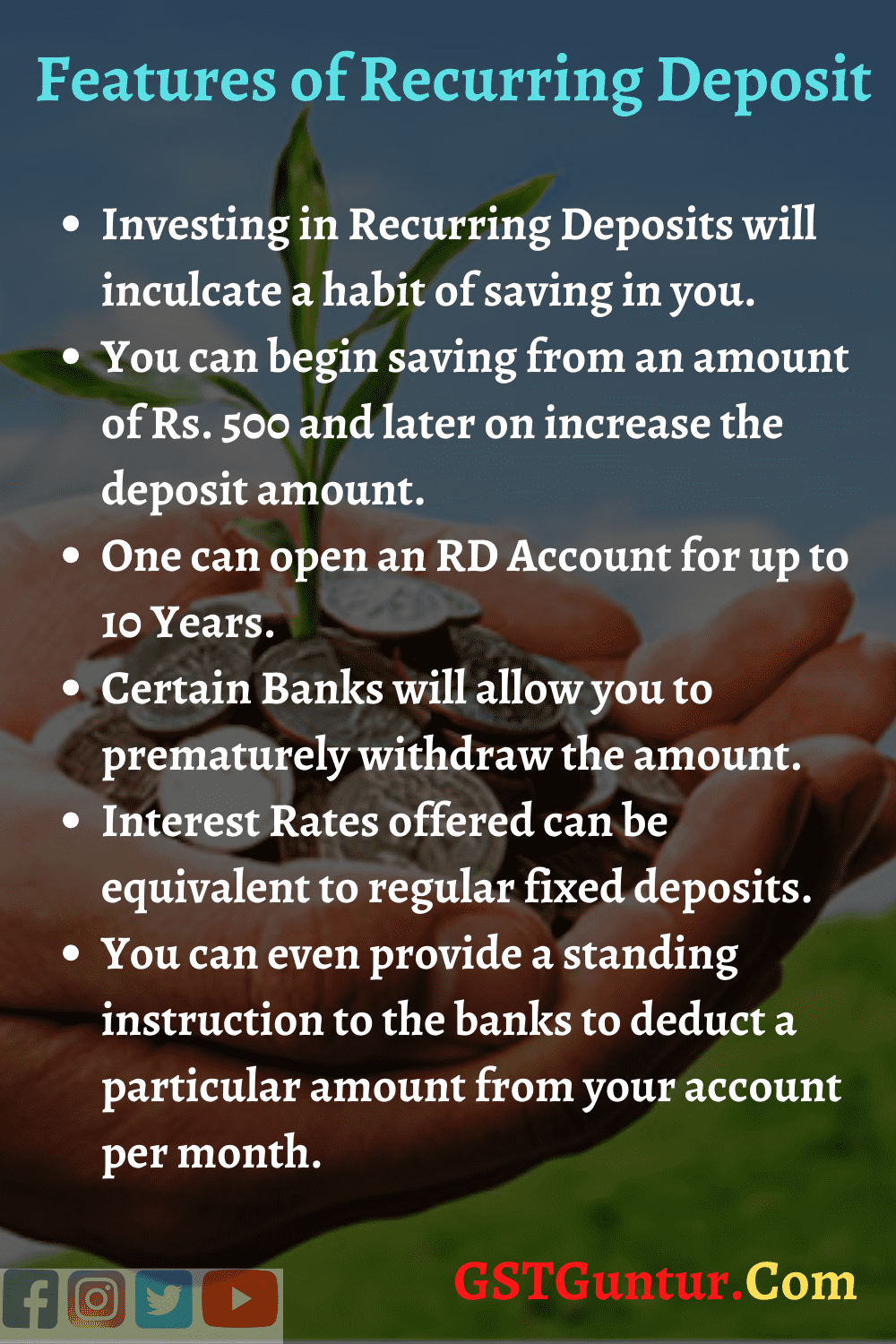

TDS on recurring deposits refers to the tax deducted at source by the bank or financial institution from the interest earned on your recurring deposit before

For regular people the TDS threshold is Rs 40 000 In other words if interest income exceeds Rs 40 000 the bank will lower TDS If not TDS won t be decreased and there won t be any interest paid into the

Income Tax Deduction On Recurring Deposit include a broad assortment of printable materials that are accessible online for free cost. They are available in a variety of styles, from worksheets to coloring pages, templates and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Deduction On Recurring Deposit

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Yes interest income generated from recurring deposit investments is subject to taxation according to the individual s applicable income tax slab rate How to save tax on RD

The investment amount is deducted from your gross taxable income reducing your tax payable However there is no tax exemption under Section 80C for

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: They can make printed materials to meet your requirements when it comes to designing invitations or arranging your schedule or decorating your home.

-

Educational Value: Printing educational materials for no cost provide for students of all ages, making them a vital device for teachers and parents.

-

Simple: immediate access a variety of designs and templates reduces time and effort.

Where to Find more Income Tax Deduction On Recurring Deposit

The Untold Secret To Recurring Deposits PTAIndia

The Untold Secret To Recurring Deposits PTAIndia

The interest earned on RDs is taxable If the total interest earned by an individual from RDs exceeds 10 000 in a financial year a TDS of 10 will be deducted at the source All

Log in Sign up Home Tax Planning Tax on Recurring Deposit RD Interest Rates Exemption Calculation in 2023

If we've already piqued your interest in printables for free Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Income Tax Deduction On Recurring Deposit suitable for many uses.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Income Tax Deduction On Recurring Deposit

Here are some ideas for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Deduction On Recurring Deposit are an abundance filled with creative and practical information catering to different needs and interests. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the many options of Income Tax Deduction On Recurring Deposit to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes, they are! You can print and download these items for free.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular conditions of use. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright concerns when using Income Tax Deduction On Recurring Deposit?

- Certain printables could be restricted regarding usage. Be sure to read the conditions and terms of use provided by the creator.

-

How do I print Income Tax Deduction On Recurring Deposit?

- You can print them at home using either a printer at home or in an in-store print shop to get premium prints.

-

What program do I need in order to open printables for free?

- The majority of printed documents are in PDF format. These can be opened using free software such as Adobe Reader.

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Income Tax Deduction

Check more sample of Income Tax Deduction On Recurring Deposit below

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

How Does Tax Deduction Work In India Tax Walls

Tax Deductions You Can Deduct What Napkin Finance

RD Calculator In Excel DOWNLOAD Recurring Deposit Interest Calculator

How To Fully Maximize Your 1099 Tax Deductions Steady

https://www.bankbazaar.com/recurring-deposit/…

For regular people the TDS threshold is Rs 40 000 In other words if interest income exceeds Rs 40 000 the bank will lower TDS If not TDS won t be decreased and there won t be any interest paid into the

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.charteredclub.com/tds-on-recurring-deposits

TDS Income Tax on Recurring Deposit TDS on Recurring Deposits would be deducted 10 of the Interest earned Earlier TDS was not deducted on Recurring Deposits but

For regular people the TDS threshold is Rs 40 000 In other words if interest income exceeds Rs 40 000 the bank will lower TDS If not TDS won t be decreased and there won t be any interest paid into the

TDS Income Tax on Recurring Deposit TDS on Recurring Deposits would be deducted 10 of the Interest earned Earlier TDS was not deducted on Recurring Deposits but

Tax Deductions You Can Deduct What Napkin Finance

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

RD Calculator In Excel DOWNLOAD Recurring Deposit Interest Calculator

How To Fully Maximize Your 1099 Tax Deductions Steady

Recurring Deposit Interest Rates In India For 2023

Section 194K Tax Deduction On Income From Mutual Fund Units

Section 194K Tax Deduction On Income From Mutual Fund Units

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1