In this digital age, in which screens are the norm it's no wonder that the appeal of tangible printed items hasn't gone away. In the case of educational materials project ideas, artistic or just adding a personal touch to your space, Income Tax Deduction For Home Health Care can be an excellent resource. The following article is a take a dive to the depths of "Income Tax Deduction For Home Health Care," exploring the different types of printables, where they are available, and how they can improve various aspects of your lives.

Get Latest Income Tax Deduction For Home Health Care Below

Income Tax Deduction For Home Health Care

Income Tax Deduction For Home Health Care - Income Tax Deduction For Home Health Care, Tax Deduction For Home Health Care, How Much Of Home Health Care Is Tax Deductible, Can You Deduct Home Health Care On Your Taxes

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you

Income Tax Deduction For Home Health Care include a broad range of printable, free materials online, at no cost. These printables come in different forms, like worksheets templates, coloring pages and much more. The appealingness of Income Tax Deduction For Home Health Care lies in their versatility as well as accessibility.

More of Income Tax Deduction For Home Health Care

What Is A Tax Deduction Definition Examples Calculation

What Is A Tax Deduction Definition Examples Calculation

According to IRS Publication 502 in general only medical services performed by a home care worker can be deducted Some examples of qualifying

The short answer is yes but there are some criteria you need to meet You must be unmarried or unmarried on the last day of the year You claim your parent as a

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify printables to your specific needs whether it's making invitations and schedules, or even decorating your house.

-

Educational Benefits: Free educational printables provide for students from all ages, making the perfect tool for teachers and parents.

-

It's easy: Fast access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Income Tax Deduction For Home Health Care

Income Tax Deductions For The FY 2019 20 ComparePolicy

Income Tax Deductions For The FY 2019 20 ComparePolicy

Is in home care tax deductible The cost of certain nonmedical home care services may be deductible if a doctor determines they are medically necessary and

Topic no 502 Medical and dental expenses If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to

We've now piqued your curiosity about Income Tax Deduction For Home Health Care and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Deduction For Home Health Care suitable for many needs.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad range of interests, from DIY projects to planning a party.

Maximizing Income Tax Deduction For Home Health Care

Here are some inventive ways that you can make use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Deduction For Home Health Care are an abundance of practical and innovative resources that cater to various needs and preferences. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the vast array of Income Tax Deduction For Home Health Care and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can print and download these materials for free.

-

Can I utilize free printables to make commercial products?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted in use. Always read the terms and conditions offered by the creator.

-

How do I print Income Tax Deduction For Home Health Care?

- You can print them at home with any printer or head to an area print shop for high-quality prints.

-

What software do I require to view printables at no cost?

- The majority of printed documents are in the format PDF. This can be opened using free programs like Adobe Reader.

The Master List Of All Types Of Tax Deductions INFOGRAPHIC

Income Tax Deductions FY 2016 17 AY 2017 18 Details

Check more sample of Income Tax Deduction For Home Health Care below

Tax Deduction Of Health Insurance Premium YouTube

Home Health Care Income Tax Deduction

Medical Tax Breaks Deductions An Untapped Advantage Carrington edu

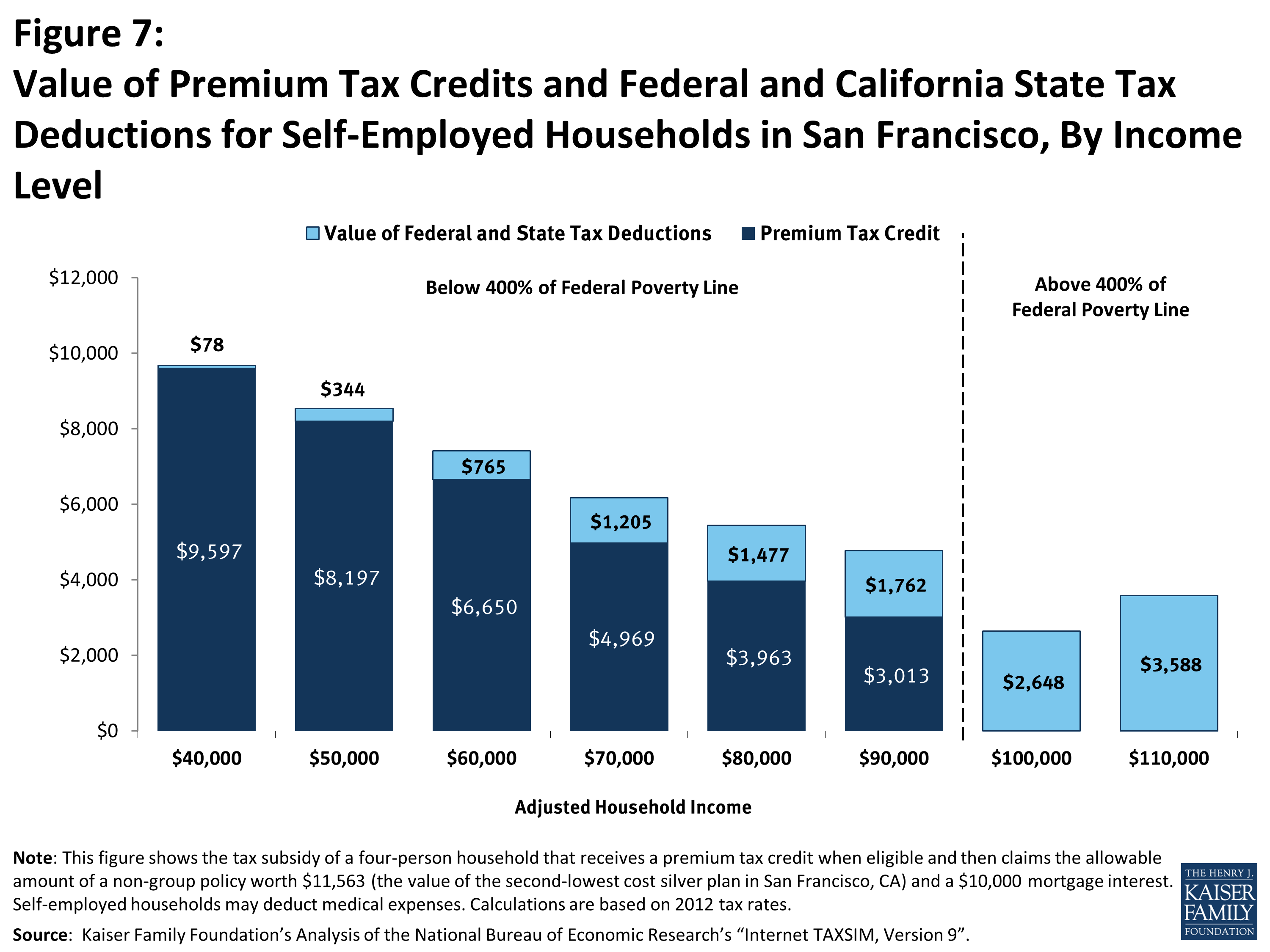

Tax Subsidies For Private Health Insurance III Special Tax Deduction

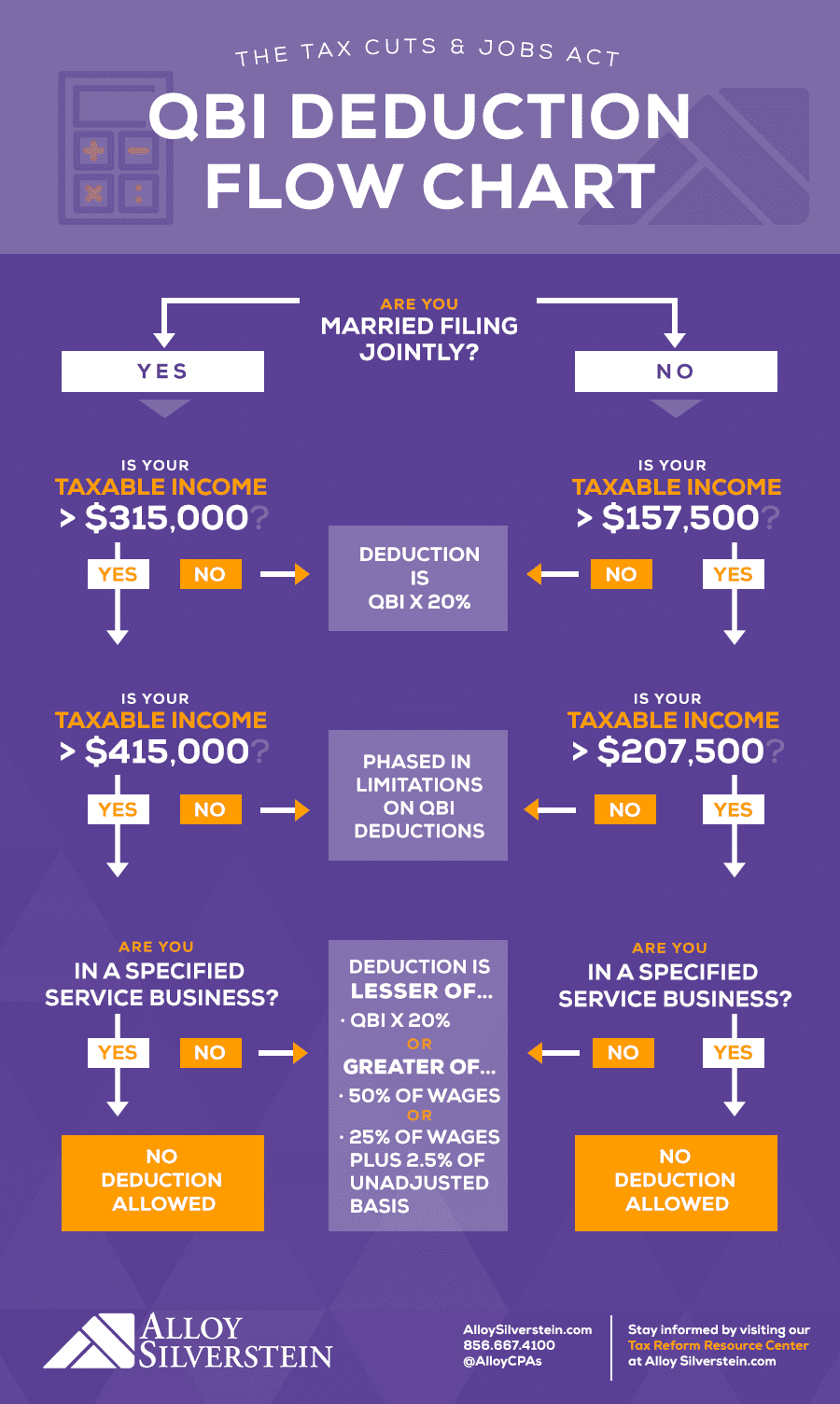

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

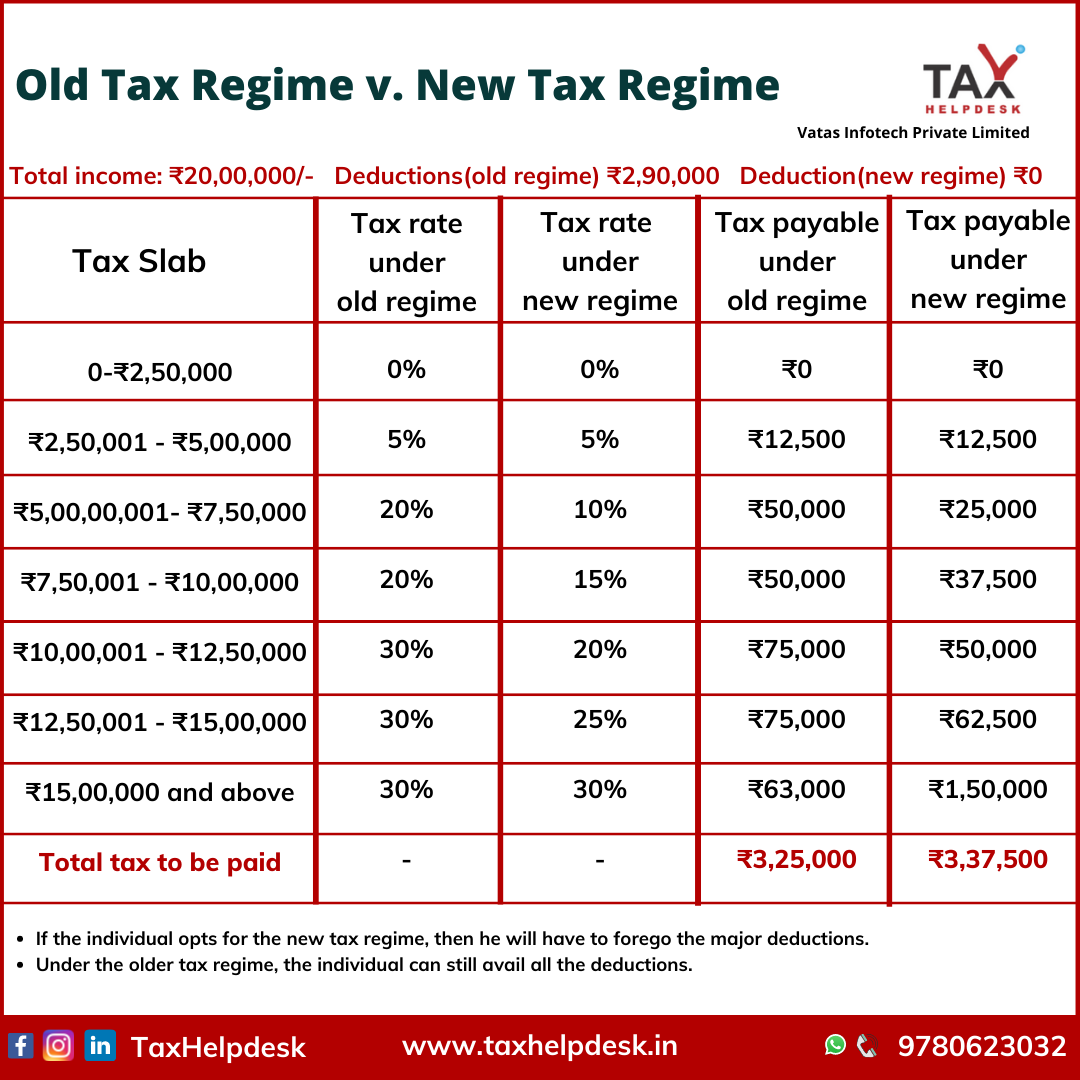

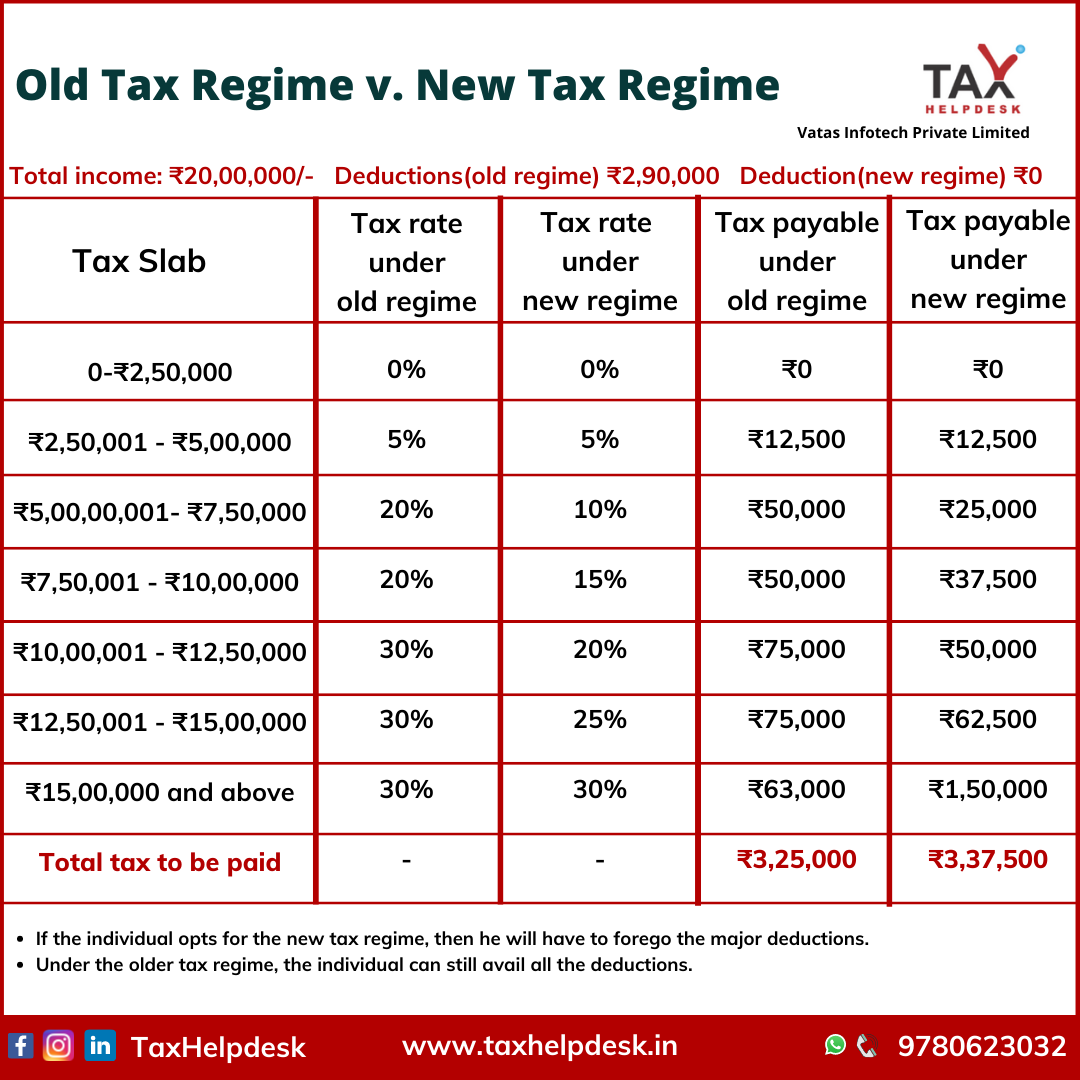

Income Tax Return Which Tax Regime Suits You Old Vs New

https://www.cpapracticeadvisor.com/2022/11/09/home...

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you

https://www.irs.gov/faqs/itemized-deductions...

Yes in certain instances nursing home expenses are deductible medical expenses If you your spouse or your dependent is in a nursing home primarily for

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you

Yes in certain instances nursing home expenses are deductible medical expenses If you your spouse or your dependent is in a nursing home primarily for

Tax Subsidies For Private Health Insurance III Special Tax Deduction

Home Health Care Income Tax Deduction

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

Income Tax Return Which Tax Regime Suits You Old Vs New

Pin By HealthCare On Healthcare Graphics And Quotes Medical

How To Maximize Your Charity Tax Deductible Donation WealthFit

How To Maximize Your Charity Tax Deductible Donation WealthFit

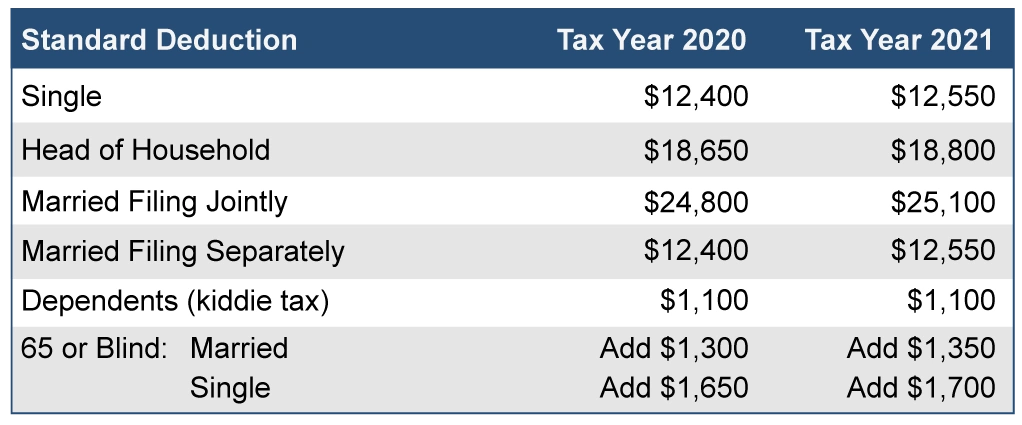

What Is The Standard Deduction For 2021