In the digital age, when screens dominate our lives yet the appeal of tangible printed materials hasn't faded away. Be it for educational use such as creative projects or just adding an element of personalization to your home, printables for free are now a vital resource. With this guide, you'll take a dive into the world of "How To Calculate Canadian Federal Income Tax," exploring the different types of printables, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest How To Calculate Canadian Federal Income Tax Below

How To Calculate Canadian Federal Income Tax

How To Calculate Canadian Federal Income Tax - How To Calculate Canadian Federal Income Tax, How To Calculate Canada Federal Income Tax, How To Calculate Federal Income Tax In Ontario, How Much Canadian Federal Tax Calculator, How Is Federal Tax Calculated On Paycheck Canada, How To Calculate Personal Income Tax In Canada

Total remuneration of CAD 110 000 Capital gains of CAD 16 000 Foreign interest income of CAD 5 000 from which CAD 750 withholding has been deducted

TurboTax s free Canada income tax calculator Estimate your 2023 tax refund or taxes owed and check federal and provincial tax rates

Printables for free include a vast range of downloadable, printable items that are available online at no cost. These printables come in different types, like worksheets, templates, coloring pages and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of How To Calculate Canadian Federal Income Tax

Income Tax The Accounting And Tax Federal Income Tax Tax

Income Tax The Accounting And Tax Federal Income Tax Tax

2024 Tax Calculator To calculate your tax bill and marginal tax rates click here 2024 2023 Tax Calculator To calculate your tax bill and marginal tax rates click here 2023 2022

Welcome to the Income Tax Calculator suite for Canada brought to you by iCalculator CA Here you will find a comprehensive list of income tax calculators each tailored to a

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization They can make the design to meet your needs be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: These How To Calculate Canadian Federal Income Tax provide for students of all ages, which makes these printables a powerful tool for teachers and parents.

-

It's easy: Instant access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more How To Calculate Canadian Federal Income Tax

Why Amazon Paid No Federal Income Tax

Why Amazon Paid No Federal Income Tax

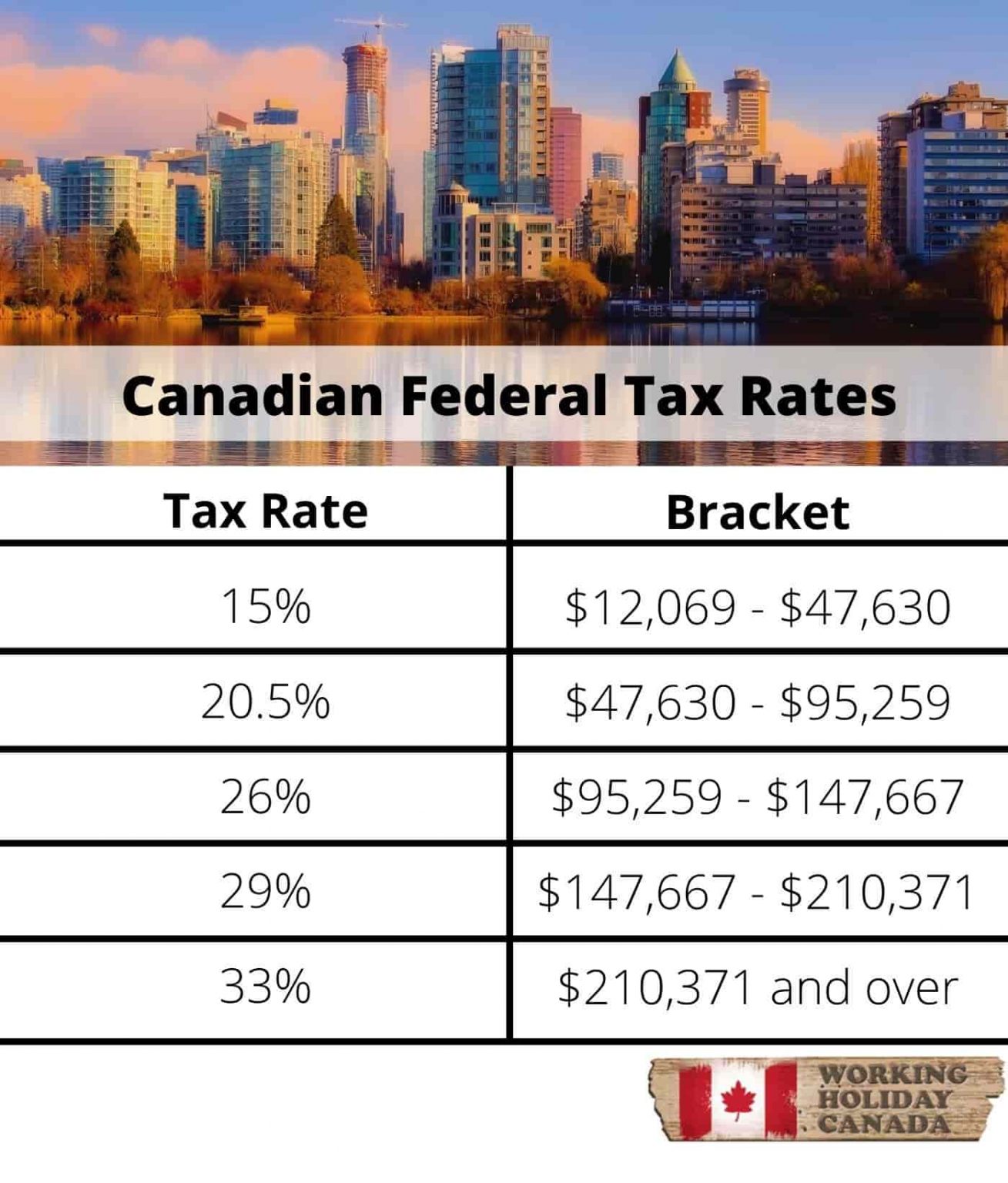

How is Income Tax Calculated in Canada Federal and Provincial Territorial Taxes Are Separate Tax Brackets Indexation of the Canadian Personal Income Tax System

Canadian Income Tax Calculator Estimate your net salary after tax paycheck deductions capital gains taxes RRSP savings CRA taxes owed and more Tax Year

Now that we've piqued your interest in printables for free We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of How To Calculate Canadian Federal Income Tax suitable for many motives.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide range of interests, starting from DIY projects to planning a party.

Maximizing How To Calculate Canadian Federal Income Tax

Here are some creative ways in order to maximize the use use of How To Calculate Canadian Federal Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How To Calculate Canadian Federal Income Tax are a treasure trove with useful and creative ideas for a variety of needs and pursuits. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the wide world of How To Calculate Canadian Federal Income Tax and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can print and download these documents for free.

-

Are there any free templates for commercial use?

- It's based on the rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations on use. Be sure to review the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home using printing equipment or visit a print shop in your area for high-quality prints.

-

What program do I need to run How To Calculate Canadian Federal Income Tax?

- The majority of PDF documents are provided in PDF format. These can be opened using free software such as Adobe Reader.

Annual Federal Withholding Calculator KerstinKeisha

Federal Income Tax Deadline Moved To July 15 Cleveland

Check more sample of How To Calculate Canadian Federal Income Tax below

How Canadians Can Keep More Of Their Tax Dollars Invested The Globe

The Rich Pay More Than Their Fair Share Of Federal Income Taxes Observer

Many States Will Be Moving Their Federal Income Tax Deadline To May 17

Federal Income Tax Treatment Of Crowdfunding Transactions Is Uncertain

Corporate Tax 2 Final Exam 220 Questions With Correct Answers Exam

How To Get Non Profit Status with Pictures WikiHow Federal Income

https://turbotax.intuit.ca/tax-resources/canada...

TurboTax s free Canada income tax calculator Estimate your 2023 tax refund or taxes owed and check federal and provincial tax rates

https://www.canada.ca/en/revenue-agency/services...

2024 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been

TurboTax s free Canada income tax calculator Estimate your 2023 tax refund or taxes owed and check federal and provincial tax rates

2024 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been

Federal Income Tax Treatment Of Crowdfunding Transactions Is Uncertain

The Rich Pay More Than Their Fair Share Of Federal Income Taxes Observer

Corporate Tax 2 Final Exam 220 Questions With Correct Answers Exam

How To Get Non Profit Status with Pictures WikiHow Federal Income

Canadian Final Income Tax Return US Canadian Cross Border Tax

Personal Income Tax Rate 2018 Joanne Walsh

Personal Income Tax Rate 2018 Joanne Walsh

The Role Of Tax Credits In Federal Income Tax Unlike Deductions