Today, where screens rule our lives it's no wonder that the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses for creative projects, just adding an individual touch to the home, printables for free have proven to be a valuable resource. For this piece, we'll dive through the vast world of "How Much Tax Do You Pay On A Lump Sum Pension Payout," exploring what they are, how they can be found, and how they can improve various aspects of your lives.

Get Latest How Much Tax Do You Pay On A Lump Sum Pension Payout Below

How Much Tax Do You Pay On A Lump Sum Pension Payout

How Much Tax Do You Pay On A Lump Sum Pension Payout - How Much Tax Do You Pay On A Lump Sum Pension Payout, Do You Pay Taxes On A Lump Sum Pension Payout, What Are The Taxes On A Lump Sum Pension Payout

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account IRA or other eligible retirement accounts Here are two things

Pension lump sum withdrawal tax calculator Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2024 25 2023 24 and 2022 23 tax years When you re 55 or older you can withdraw some or all of your pension pot even if you re not yet ready to retire

How Much Tax Do You Pay On A Lump Sum Pension Payout cover a large variety of printable, downloadable items that are available online at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility and accessibility.

More of How Much Tax Do You Pay On A Lump Sum Pension Payout

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Know You will pay taxes on your lump sum payout Your lump sum money is generally treated as ordinary income for the year you receive it rollovers don t count see below For this reason your employer is required to withhold 20 percent of the payout In addition to paying income tax you will owe an additional

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax if

How Much Tax Do You Pay On A Lump Sum Pension Payout have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: They can make printed materials to meet your requirements in designing invitations and schedules, or even decorating your house.

-

Educational Impact: Printables for education that are free cater to learners of all ages. This makes them a great device for teachers and parents.

-

An easy way to access HTML0: Quick access to many designs and templates reduces time and effort.

Where to Find more How Much Tax Do You Pay On A Lump Sum Pension Payout

How Much Tax Do You Pay On A 1000 Lottery Ticket In California What

How Much Tax Do You Pay On A 1000 Lottery Ticket In California What

Whether you get taxed immediately upon taking the lump sum or taxed later depends on what you do with the money when you receive it Taxed immediately If the money isn t rolled over into a tax deferred account you ll pay ordinary income tax on the amount of the lump sum when you receive it

Mandatory income tax withholding of 20 applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll over the taxable amount within 60 days Note that the default rate of

Now that we've ignited your interest in printables for free Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of How Much Tax Do You Pay On A Lump Sum Pension Payout to suit a variety of applications.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing How Much Tax Do You Pay On A Lump Sum Pension Payout

Here are some unique ways to make the most use of How Much Tax Do You Pay On A Lump Sum Pension Payout:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Tax Do You Pay On A Lump Sum Pension Payout are a treasure trove filled with creative and practical information catering to different needs and preferences. Their accessibility and versatility make they a beneficial addition to any professional or personal life. Explore the many options of How Much Tax Do You Pay On A Lump Sum Pension Payout now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes they are! You can download and print these tools for free.

-

Can I use the free printing templates for commercial purposes?

- It's determined by the specific terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues in How Much Tax Do You Pay On A Lump Sum Pension Payout?

- Some printables could have limitations regarding their use. Make sure you read these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home using either a printer at home or in a local print shop for high-quality prints.

-

What program will I need to access printables that are free?

- The majority of printed documents are in PDF format. They can be opened using free software such as Adobe Reader.

Key Tips To Consider If Choosing A Lump sum Pension Payout MoneyABCs

How Do I Calculate My Federal Pension Government Deal Funding

Check more sample of How Much Tax Do You Pay On A Lump Sum Pension Payout below

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

Should You Take A Lump sum Pension Payout

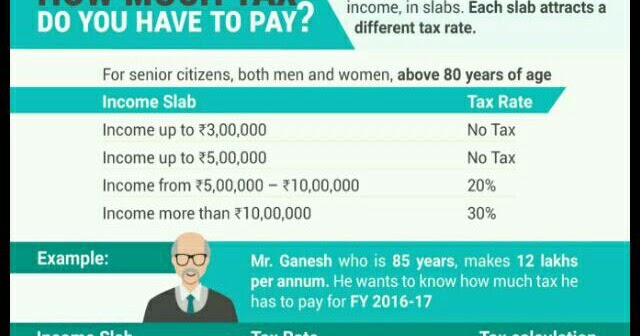

Nrinvestments How Much Tax Do You Have To Pay

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Pension Take A Lump Sum Or Monthly Payout Money

Lump Sum Pension Distribution Or Defined Benefit Plans Posts By

https://www.which.co.uk/.../pension-tax-calculator-avRmf8S2yxd1

Pension lump sum withdrawal tax calculator Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2024 25 2023 24 and 2022 23 tax years When you re 55 or older you can withdraw some or all of your pension pot even if you re not yet ready to retire

https://www.gov.uk/tax-on-pension/tax-free

Lump sums from your pension You can usually take up to 25 of the amount built up in any pension as a tax free lump sum The most you can take is 268 275

Pension lump sum withdrawal tax calculator Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2024 25 2023 24 and 2022 23 tax years When you re 55 or older you can withdraw some or all of your pension pot even if you re not yet ready to retire

Lump sums from your pension You can usually take up to 25 of the amount built up in any pension as a tax free lump sum The most you can take is 268 275

Comparing Lump Sum Versus Payments Personal Finance Advice For Real

Should You Take A Lump sum Pension Payout

Pension Take A Lump Sum Or Monthly Payout Money

Lump Sum Pension Distribution Or Defined Benefit Plans Posts By

Pension Mistakes Lump Sum Monthly Your Retirement Authority YouTube

Should You Take A Lump Sum Or Monthly Pension When You Retire

Should You Take A Lump Sum Or Monthly Pension When You Retire

How To Avoid Taxes On Lump Sum Pension Payout