Today, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. For educational purposes or creative projects, or simply to add an individual touch to your area, How Much Tax Do I Pay On My Pension In Ireland are now a vital source. Through this post, we'll dive in the world of "How Much Tax Do I Pay On My Pension In Ireland," exploring what they are, how to find them, and how they can enhance various aspects of your daily life.

Get Latest How Much Tax Do I Pay On My Pension In Ireland Below

How Much Tax Do I Pay On My Pension In Ireland

How Much Tax Do I Pay On My Pension In Ireland - How Much Tax Do I Pay On My Pension In Ireland, How Much Tax Will I Pay On My Pension In Ireland, Do You Pay Tax On Your Pension In Ireland, How Much Tax Do You Pay On Your Pensions

You pay tax in a lump sum on your pension when you receive it however up to 200 000 of this is tax free If the lump sum is over 200 000 and under 500 000 the maximum allowable the income tax rate is 20

Personal pensions and occupational pensions are taxable sources of income They are liable to Income Tax and Universal Social Charge USC They may also be liable to Pay Related Social Insurance PRSI in the same way as employment income Your pension provider will deduct the tax from each payment it makes to you

How Much Tax Do I Pay On My Pension In Ireland encompass a wide array of printable resources available online for download at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and much more. The appealingness of How Much Tax Do I Pay On My Pension In Ireland is their flexibility and accessibility.

More of How Much Tax Do I Pay On My Pension In Ireland

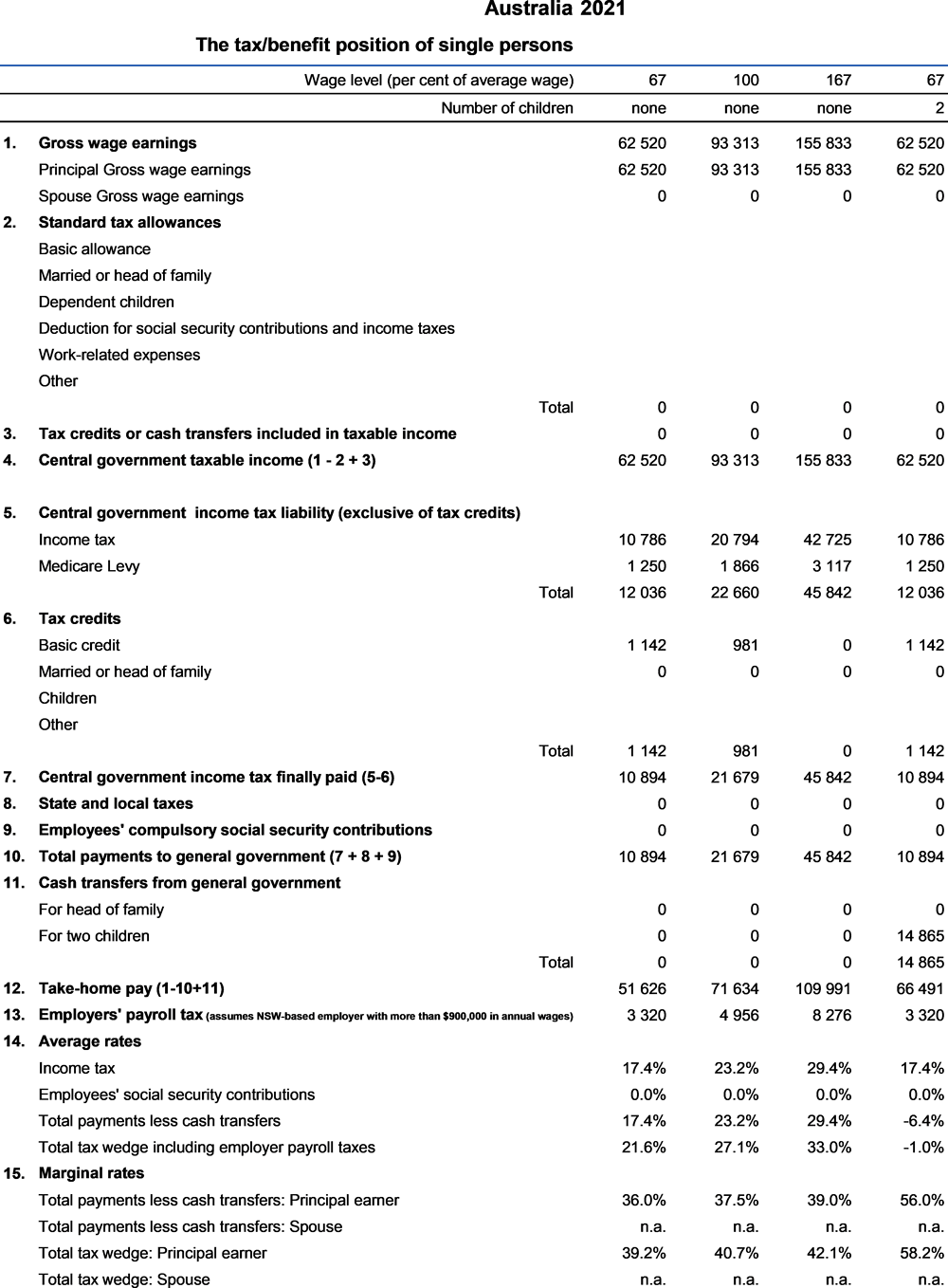

Australia 2020 2021 Income Tax Year Taxing Wages 2022 Impact Of

Australia 2020 2021 Income Tax Year Taxing Wages 2022 Impact Of

Employees in Ireland are entitled to income tax relief on contributions made to a pension scheme each year whether it is an occupation scheme set up with their employer or a self administered pension

You should choose the tax reference number below for the type of pension benefit you have Taxable Cash Trivial Payment For a once of taxable cash or trivial payment subject to certain criteria tax credits should be allocated to Irish Life ARF Payments under tax reference number 4820009C

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: It is possible to tailor designs to suit your personal needs in designing invitations planning your schedule or even decorating your house.

-

Educational value: The free educational worksheets cater to learners from all ages, making them a valuable aid for parents as well as educators.

-

An easy way to access HTML0: immediate access many designs and templates, which saves time as well as effort.

Where to Find more How Much Tax Do I Pay On My Pension In Ireland

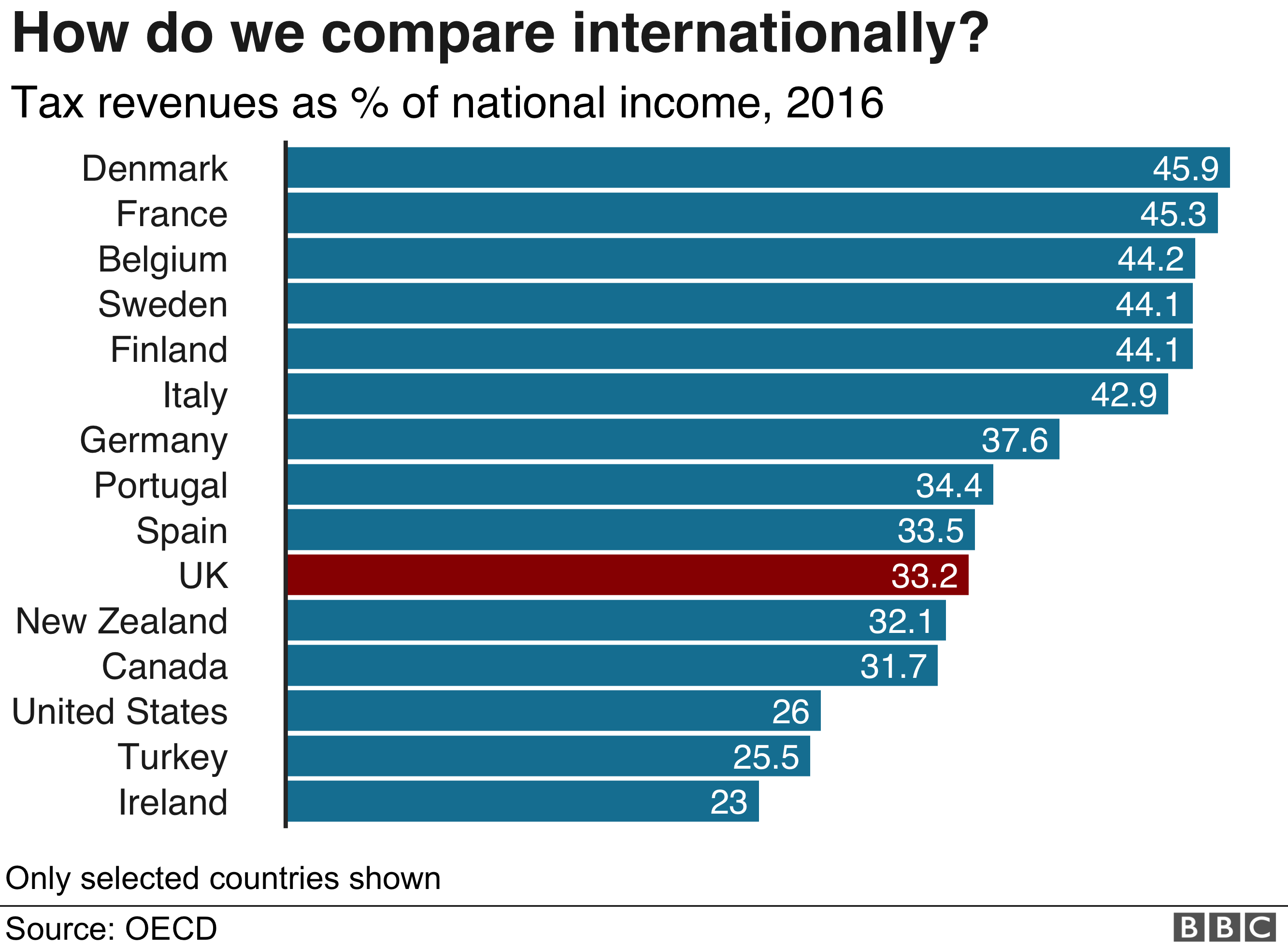

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

How your Income Tax is calculated If you are paid weekly your Income Tax is calculated by applying the standard rate of 20 to the income in your weekly rate band applying the higher rate of 40 to any income above your weekly rate band adding the two amounts above together

There is pension tax relief on pension contributions and retirement lump sums If you are getting a pension or social welfare payment you can read about how pensions are taxed and how social welfare payments are taxed

Now that we've ignited your curiosity about How Much Tax Do I Pay On My Pension In Ireland we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of How Much Tax Do I Pay On My Pension In Ireland designed for a variety objectives.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad range of interests, starting from DIY projects to planning a party.

Maximizing How Much Tax Do I Pay On My Pension In Ireland

Here are some inventive ways ensure you get the very most use of How Much Tax Do I Pay On My Pension In Ireland:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home and in class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

How Much Tax Do I Pay On My Pension In Ireland are an abundance of innovative and useful resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can print and download these tools for free.

-

Can I use the free printables for commercial uses?

- It's based on specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables might have limitations concerning their use. Make sure you read these terms and conditions as set out by the designer.

-

How can I print How Much Tax Do I Pay On My Pension In Ireland?

- You can print them at home with your printer or visit an in-store print shop to get more high-quality prints.

-

What program do I require to open How Much Tax Do I Pay On My Pension In Ireland?

- The majority of printables are with PDF formats, which is open with no cost software such as Adobe Reader.

Age Pension Income Test Rules from September 2023

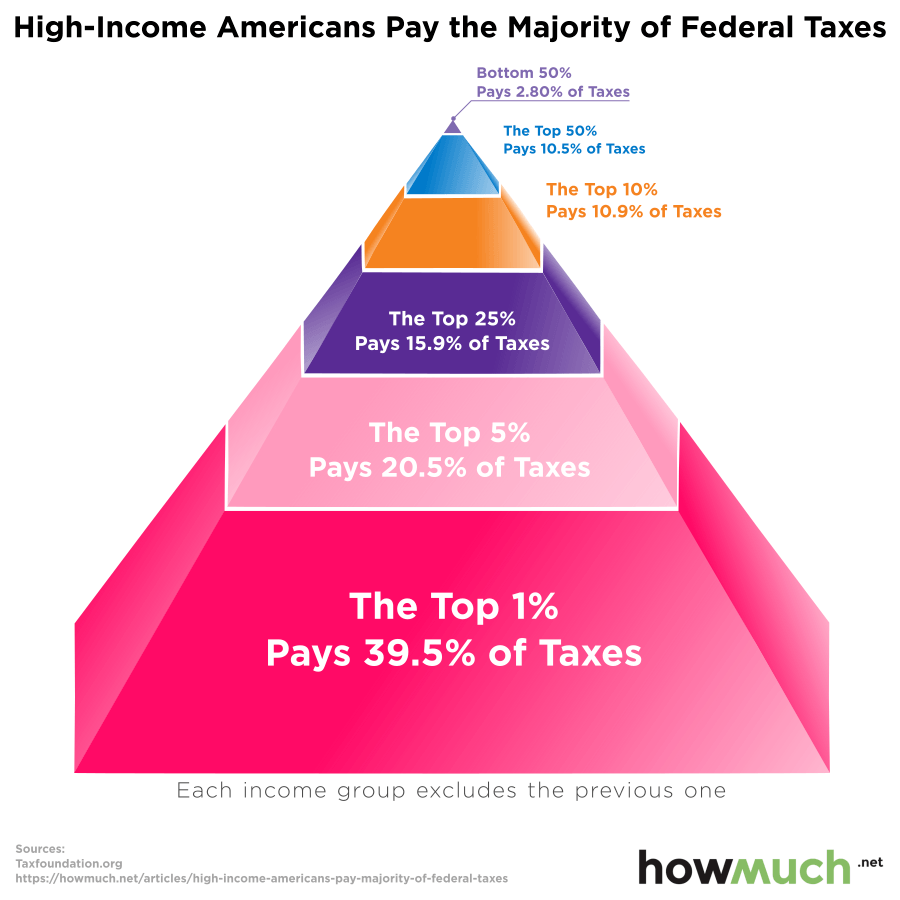

In 1 Chart How Much The Rich Pay In Taxes 19FortyFive

Check more sample of How Much Tax Do I Pay On My Pension In Ireland below

Mn Tax Tables 2017 M1 Elcho Table

How Much Tax Do I Pay In Australia Rask Finance HD YouTube

CI Post 2 Do Immigrants Pay Taxes

Does The Uk Do Tax Returns Filling In The Inland Revenue Self

20192019 Tax

What Do You Think Would Be A Fair Tax Rate Percentage For Different

https://www.revenue.ie/en/jobs-and-pensions/...

Personal pensions and occupational pensions are taxable sources of income They are liable to Income Tax and Universal Social Charge USC They may also be liable to Pay Related Social Insurance PRSI in the same way as employment income Your pension provider will deduct the tax from each payment it makes to you

https://nationalpensionhelpline.ie/pension...

How can I calculate my income tax By inputting some brief details about yourself in our easy to use calculator you will receive instant results on your predicted income tax return payment

Personal pensions and occupational pensions are taxable sources of income They are liable to Income Tax and Universal Social Charge USC They may also be liable to Pay Related Social Insurance PRSI in the same way as employment income Your pension provider will deduct the tax from each payment it makes to you

How can I calculate my income tax By inputting some brief details about yourself in our easy to use calculator you will receive instant results on your predicted income tax return payment

Does The Uk Do Tax Returns Filling In The Inland Revenue Self

How Much Tax Do I Pay In Australia Rask Finance HD YouTube

20192019 Tax

What Do You Think Would Be A Fair Tax Rate Percentage For Different

How Much Income Before You Have To Pay Taxes Tax Walls

/https://blogs-images.forbes.com/kellyphillipserb/files/2014/10/Single_rates.png)

IRS Announces 2015 Tax Brackets Standard Deduction Amounts And More

/https://blogs-images.forbes.com/kellyphillipserb/files/2014/10/Single_rates.png)

IRS Announces 2015 Tax Brackets Standard Deduction Amounts And More

Centrelink Payment Rates 2023 Atotaxrates info