In this digital age, in which screens are the norm The appeal of tangible printed objects isn't diminished. Be it for educational use for creative projects, simply to add an individual touch to the area, How Much Tax Can I Have Deducted From My Social Security Check are now an essential source. Here, we'll take a dive into the sphere of "How Much Tax Can I Have Deducted From My Social Security Check," exploring their purpose, where to get them, as well as how they can add value to various aspects of your life.

Get Latest How Much Tax Can I Have Deducted From My Social Security Check Below

How Much Tax Can I Have Deducted From My Social Security Check

How Much Tax Can I Have Deducted From My Social Security Check - How Much Tax Can I Have Deducted From My Social Security Check

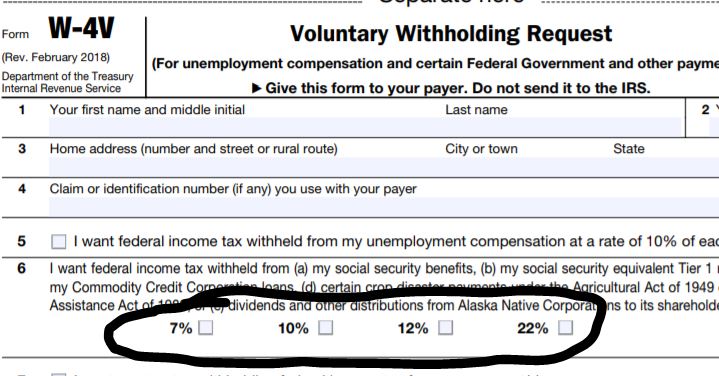

When you complete the form you will need to select the percentage of your monthly benefit amount you want withheld You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes Only these percentages can be withheld Flat dollar amounts are not accepted Sign the form and return it to your local Social Security office by

If you re single and the total comes to more than 25 000 part of your social security benefits may be taxable If you re married and filing jointly you should take half of your social

The How Much Tax Can I Have Deducted From My Social Security Check are a huge assortment of printable resources available online for download at no cost. They come in many designs, including worksheets templates, coloring pages and many more. The appealingness of How Much Tax Can I Have Deducted From My Social Security Check is their flexibility and accessibility.

More of How Much Tax Can I Have Deducted From My Social Security Check

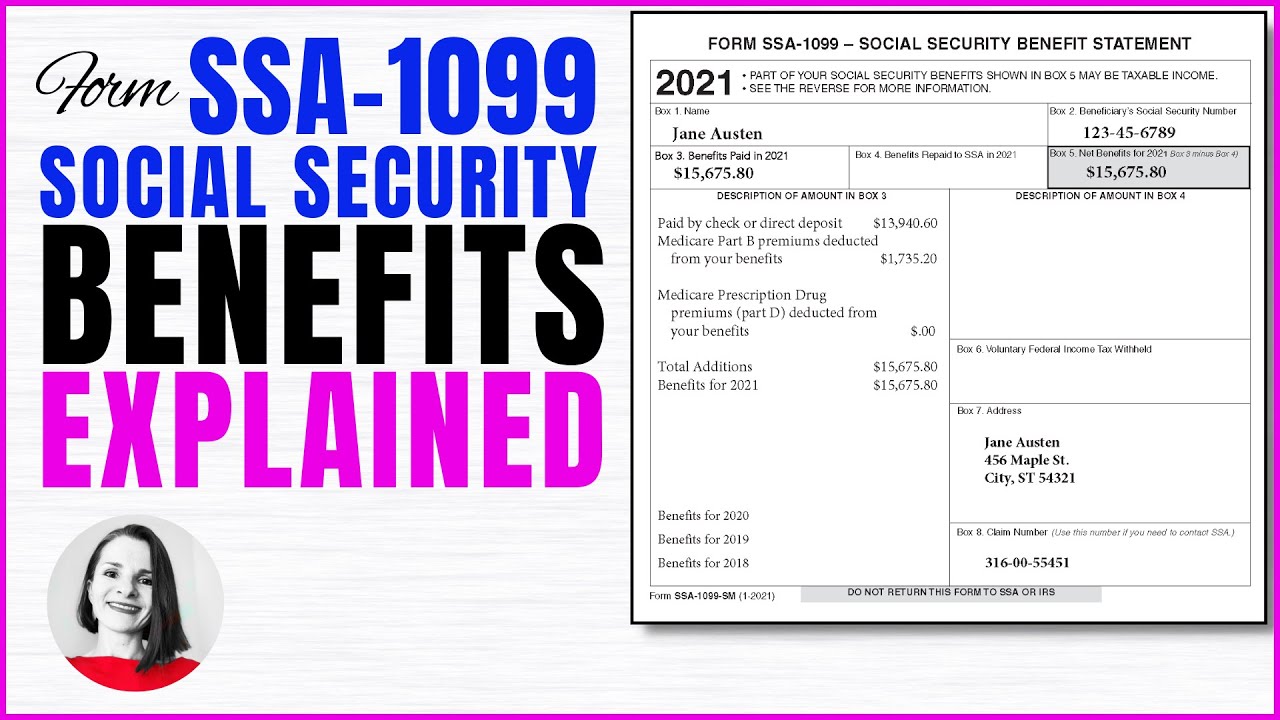

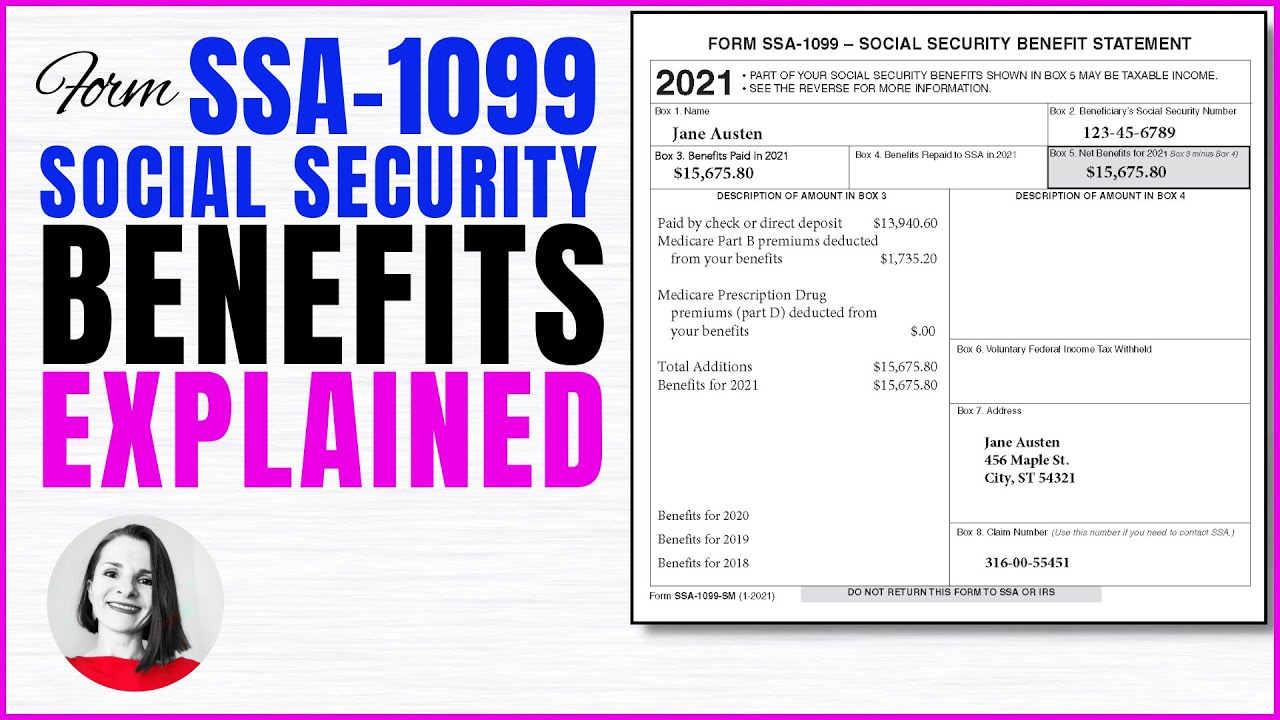

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits If your combined income is more than 34 000 you will pay taxes on up to

IR 2019 155 September 13 2019 WASHINGTON The new Tax Withholding Estimator launched last month on IRS gov includes user friendly features designed to help retirees quickly and easily figure the right amount of tax to be taken out of their pension payments The mobile friendly Tax Withholding Estimator replaces the Withholding Calculator

How Much Tax Can I Have Deducted From My Social Security Check have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: It is possible to tailor printed materials to meet your requirements be it designing invitations or arranging your schedule or decorating your home.

-

Educational Benefits: Downloads of educational content for free cater to learners of all ages, which makes them a great tool for parents and educators.

-

It's easy: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more How Much Tax Can I Have Deducted From My Social Security Check

Check For Errors In Your Social Security Statements

Check For Errors In Your Social Security Statements

When you calculate how much of your Social Security benefit is taxable use the 2 000 month number and multiply that by the number of months to get the annual Social Security benefits In other words add the Medicare Part B premium deducted from your Social Security to your net deposit

Social Security is taxed at the same rate for everyone 6 2 for employees and employers for a total of 12 4 If you are self employed you pay the entire 12 4 Social Security is only taxed up

Now that we've ignited your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of How Much Tax Can I Have Deducted From My Social Security Check designed for a variety purposes.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide range of interests, that includes DIY projects to party planning.

Maximizing How Much Tax Can I Have Deducted From My Social Security Check

Here are some fresh ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets for teaching at-home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

How Much Tax Can I Have Deducted From My Social Security Check are an abundance of useful and creative resources catering to different needs and passions. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the plethora of How Much Tax Can I Have Deducted From My Social Security Check right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can download and print these files for free.

-

Can I download free printables to make commercial products?

- It's based on the terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright violations with How Much Tax Can I Have Deducted From My Social Security Check?

- Some printables may come with restrictions regarding usage. Make sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with an printer, or go to any local print store for superior prints.

-

What software do I need in order to open printables at no cost?

- The majority are printed in PDF format. These is open with no cost software such as Adobe Reader.

Why Are Taxes And EI Being Deducted From My Pay MyOpenCourt

Should I Have Taxes Withheld From My Social Security Check

Check more sample of How Much Tax Can I Have Deducted From My Social Security Check below

Social Security Form W4v 2023 Printable Forms Free Online

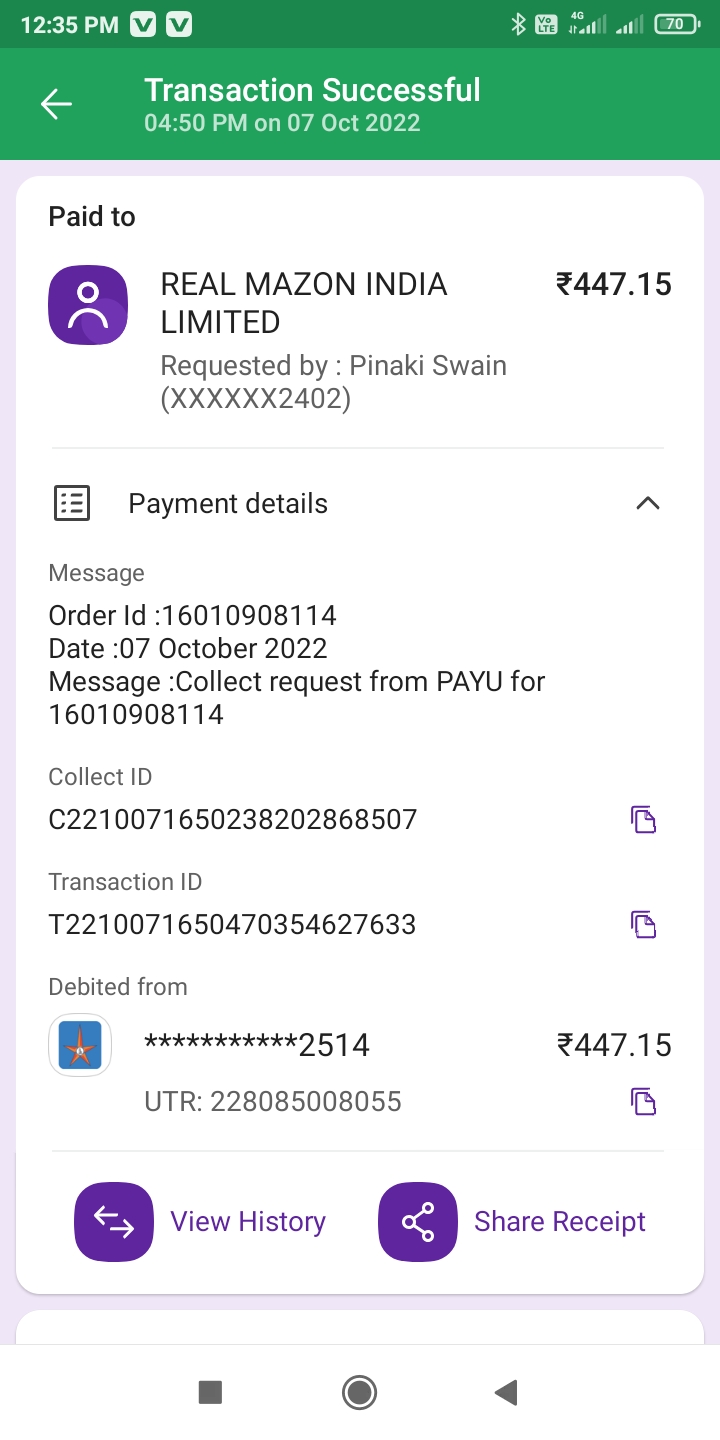

Money Deducted From My Account But HSRP Receipt Didn t Get Consumer

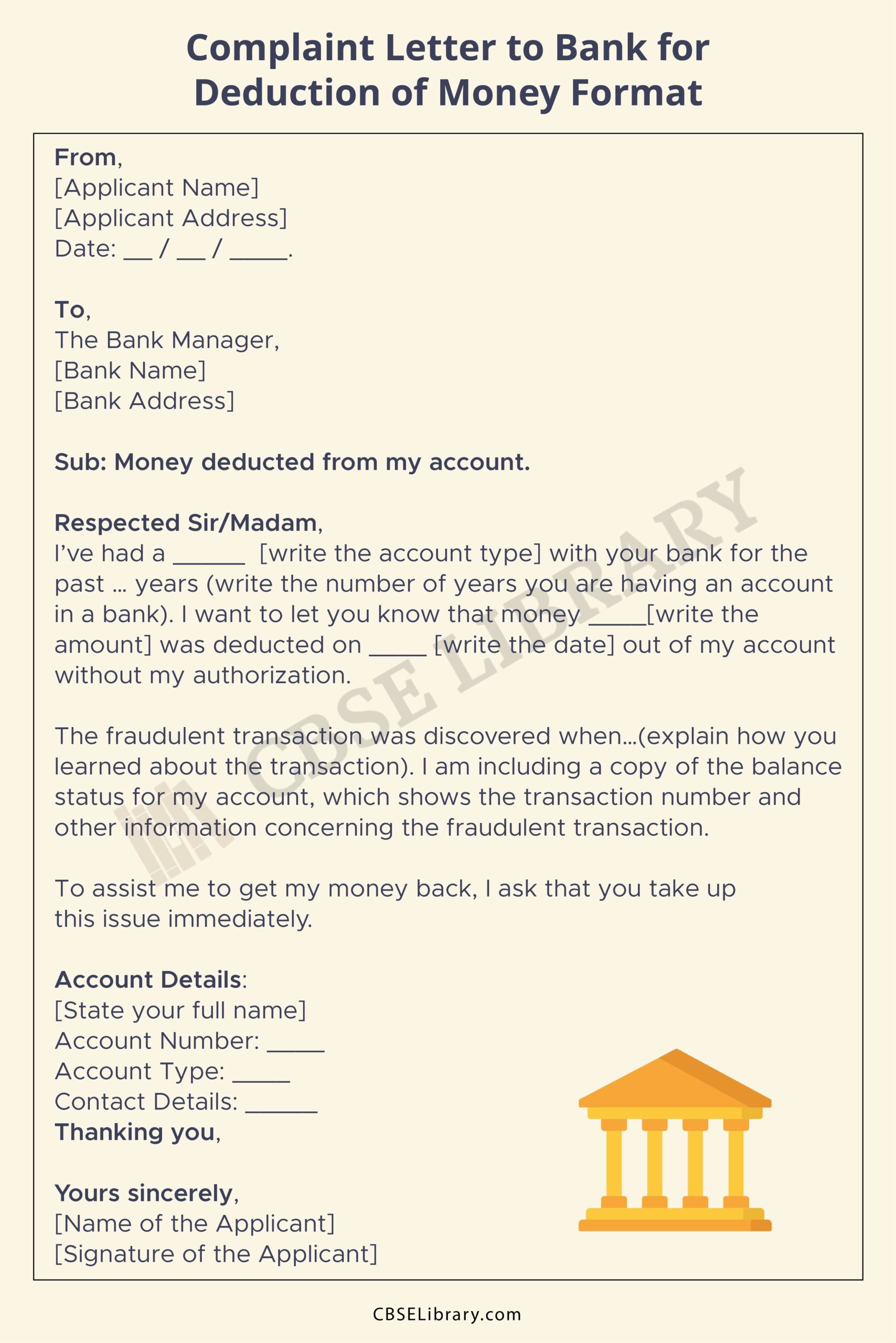

Complaint Letter To Bank For Deduction Of Money Application Letter

Can Mortgage Be Deducted From Rental Income Debt ca

Visualizing Taxes Deducted From Your Paycheck In Every State

What Can Be Deducted From Taxes H R Block

https://marketrealist.com/p/should-i-have-taxes...

If you re single and the total comes to more than 25 000 part of your social security benefits may be taxable If you re married and filing jointly you should take half of your social

https://www.aarp.org/retirement/social-security/...

Your Social Security benefits are taxable only if your overall income exceeds 25 000 for an individual or 32 000 for a married couple filing jointly If the income you report is above that threshold you could pay taxes on up to 85 percent of your benefits AARP NEWSLETTERS

If you re single and the total comes to more than 25 000 part of your social security benefits may be taxable If you re married and filing jointly you should take half of your social

Your Social Security benefits are taxable only if your overall income exceeds 25 000 for an individual or 32 000 for a married couple filing jointly If the income you report is above that threshold you could pay taxes on up to 85 percent of your benefits AARP NEWSLETTERS

Can Mortgage Be Deducted From Rental Income Debt ca

Money Deducted From My Account But HSRP Receipt Didn t Get Consumer

Visualizing Taxes Deducted From Your Paycheck In Every State

What Can Be Deducted From Taxes H R Block

What Is Deducted From My Security Deposit Cass Lake Front

Do Federal Employees Have To Pay State And Local Taxes List Foundation

Do Federal Employees Have To Pay State And Local Taxes List Foundation

Can I Deduct My Tax prep Fees Fox Business