In this age of technology, with screens dominating our lives however, the attraction of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons as well as creative projects or just adding an element of personalization to your space, How Much Is State Tax On 401k Withdrawal have become a valuable source. For this piece, we'll dive in the world of "How Much Is State Tax On 401k Withdrawal," exploring what they are, how to find them, and how they can add value to various aspects of your daily life.

Get Latest How Much Is State Tax On 401k Withdrawal Below

How Much Is State Tax On 401k Withdrawal

How Much Is State Tax On 401k Withdrawal - How Much Is State Tax On 401k Withdrawal, How Much Is Income Tax On 401k Withdrawal, How Much Is California State Tax On 401k Withdrawal, How Much Is Ohio State Tax On 401k Withdrawal, How Much Is Illinois State Tax On 401k Withdrawal, How Much Is Wisconsin State Tax On 401k Withdrawal, How Much Is State Income Tax On 401k Withdrawal, How Much Is California State Tax On 401k Withdrawal Calculator, How Much Is Federal Income Tax On 401k Withdrawal, How Much State Tax On 401k Early Withdrawal

Key Takeaways The tax treatment of 401 k distributions depends on the type of plan traditional or Roth Traditional 401 k withdrawals are taxed at an individual s current income tax

When you make a withdrawal from a 401 k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59

Printables for free include a vast array of printable materials available online at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and more. The appeal of printables for free is in their variety and accessibility.

More of How Much Is State Tax On 401k Withdrawal

Pin On Retirement

Pin On Retirement

Taxes will be withheld The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes 0

Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b All Fields Required How much are you considering taking as an early distribution from your QRP What is your Federal income tax rate

How Much Is State Tax On 401k Withdrawal have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization You can tailor the templates to meet your individual needs be it designing invitations or arranging your schedule or decorating your home.

-

Educational Use: Printables for education that are free are designed to appeal to students from all ages, making them an invaluable instrument for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to an array of designs and templates reduces time and effort.

Where to Find more How Much Is State Tax On 401k Withdrawal

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

State Income Tax Rate The percentage of taxes an individual has to pay on their income according to the laws of their state Lump sum Distribution The withdrawal of funds from a 401k Rollover Moving the 401k contribution to another retirement fund option often an IRA Penalties The payment demanded for not adhering to set rules

If you withdraw money from your 401 k before you re 59 the IRS usually assesses a 10 tax as an early distribution penalty

After we've peaked your interest in printables for free Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of How Much Is State Tax On 401k Withdrawal suitable for many reasons.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free with flashcards and other teaching tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a broad variety of topics, that includes DIY projects to planning a party.

Maximizing How Much Is State Tax On 401k Withdrawal

Here are some creative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Is State Tax On 401k Withdrawal are a treasure trove filled with creative and practical information designed to meet a range of needs and hobbies. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the endless world of How Much Is State Tax On 401k Withdrawal today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Much Is State Tax On 401k Withdrawal really absolutely free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I download free printing templates for commercial purposes?

- It's based on specific rules of usage. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted regarding usage. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer or go to the local print shop for high-quality prints.

-

What program is required to open printables at no cost?

- The majority of printables are in PDF format, which is open with no cost software like Adobe Reader.

401k Vs Roth Ira Calculator Choosing Your Gold IRA

Here Are The Tax Penalties For 401k Early Withdrawal Video

Check more sample of How Much Is State Tax On 401k Withdrawal below

Tax Payment Which States Have No Income Tax Marca

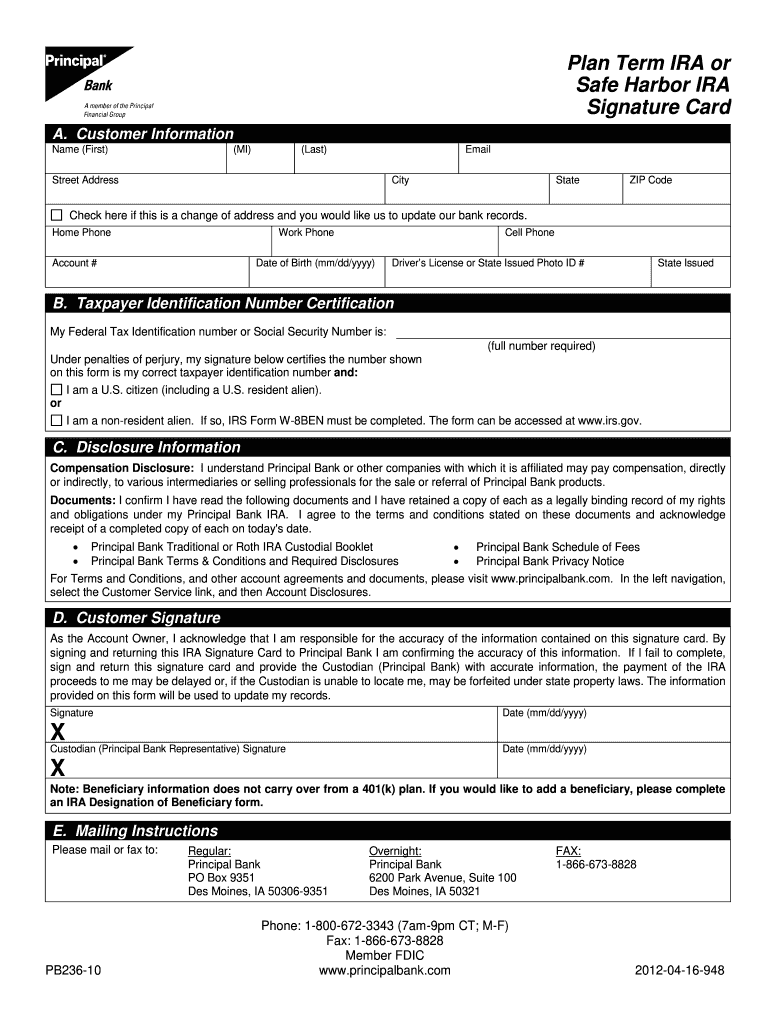

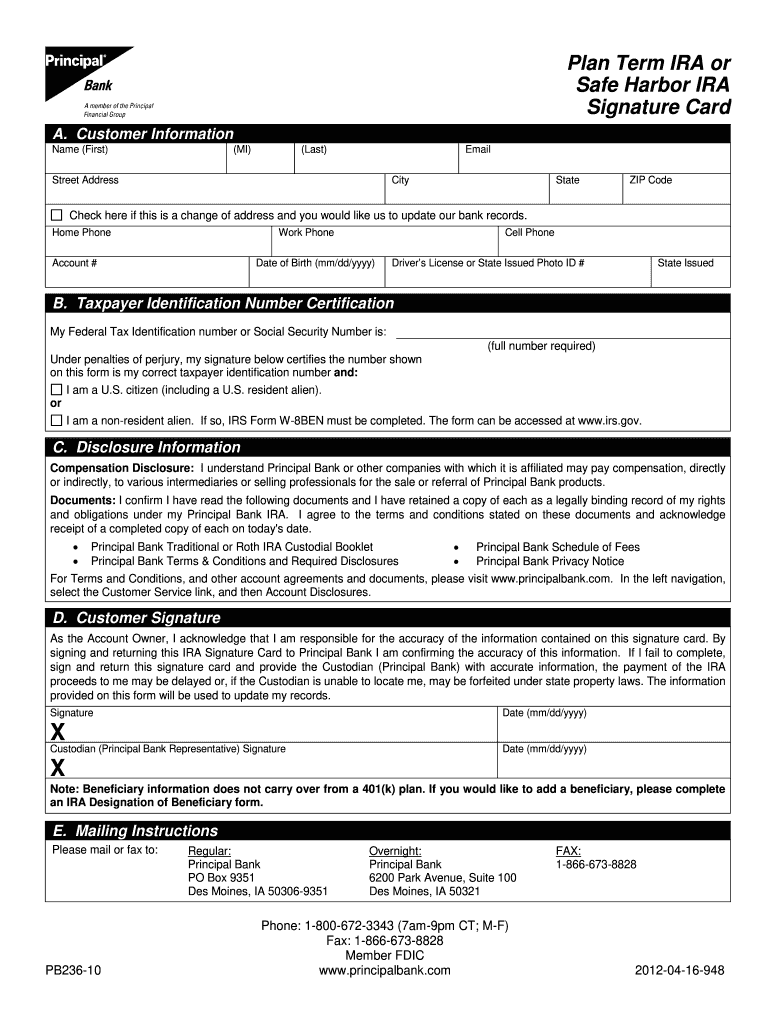

Principal 401k Withdrawal Fill Out Sign Online DocHub

2021 Nc Standard Deduction Standard Deduction 2021

The Union Role In Our Growing Taxocracy California Policy Center

What Is The 401 k Tax Rate For Withdrawals SmartAsset 401k

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

https://meetbeagle.com/resources/post/how-much-tax...

When you make a withdrawal from a 401 k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59

https://finance.zacks.com/pay-state-taxes-401k-withdrawals-2040.html

Penalties If you do not wait until the age of 59 1 2 to withdraw your 401 k funds you may pay a penalty tax in addition to federal state and local taxes In most circumstances an

When you make a withdrawal from a 401 k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59

Penalties If you do not wait until the age of 59 1 2 to withdraw your 401 k funds you may pay a penalty tax in addition to federal state and local taxes In most circumstances an

The Union Role In Our Growing Taxocracy California Policy Center

Principal 401k Withdrawal Fill Out Sign Online DocHub

What Is The 401 k Tax Rate For Withdrawals SmartAsset 401k

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

One Of The BEST Way To Save On Taxes What Is A 401k YouTube

401k Early Withdrawal Tax Calculator AndrenaCarla

401k Early Withdrawal Tax Calculator AndrenaCarla

Should I Cash Out My 401k To Pay Off Debt Bariatrx