In this age of electronic devices, in which screens are the norm but the value of tangible printed materials hasn't faded away. For educational purposes or creative projects, or simply to add an extra personal touch to your area, How Is A Lump Sum Severance Payment Taxed have become an invaluable source. Through this post, we'll take a dive into the sphere of "How Is A Lump Sum Severance Payment Taxed," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest How Is A Lump Sum Severance Payment Taxed Below

How Is A Lump Sum Severance Payment Taxed

How Is A Lump Sum Severance Payment Taxed - How Is A Lump Sum Severance Payment Taxed, How Is A Lump Sum Severance Payment Taxed In Ontario, How Is A Lump-sum Severance Payment Taxed In Canada, How Is Lump Sum Severance Pay Taxed, Are Lump Sum Severance Payments Taxed Higher, Is Lump Sum Severance Taxed, Do Severance Payments Get Taxed

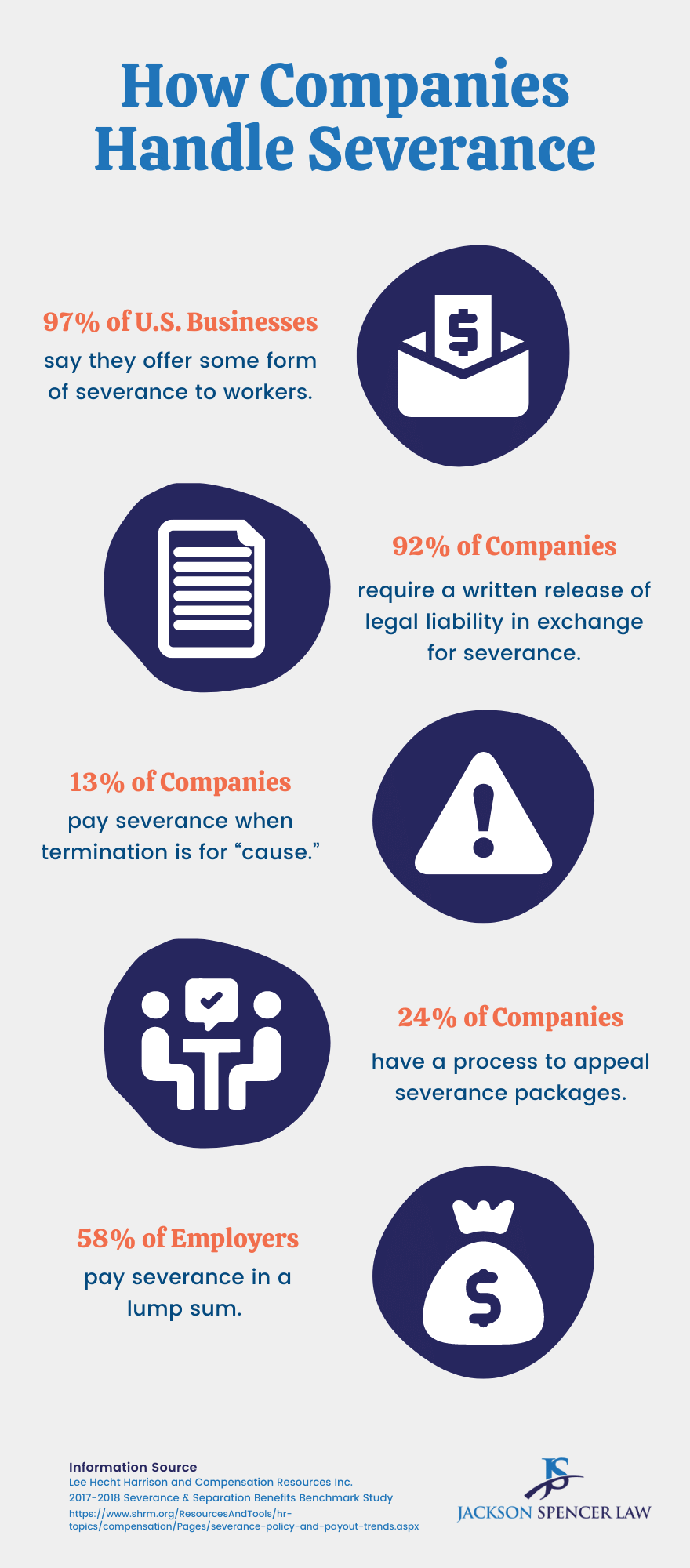

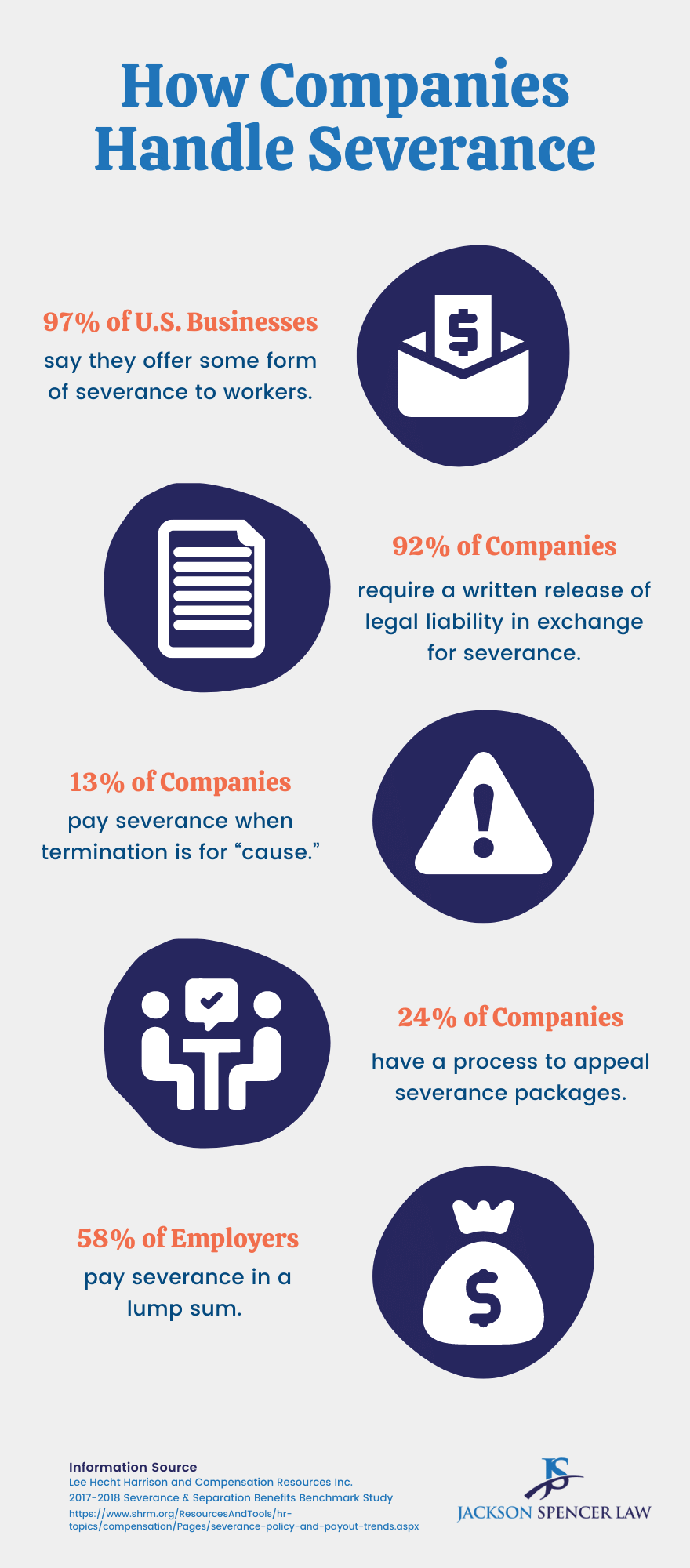

Paying income tax on lump sum severance payments If you get your severance pay as a lump sum payment your employer will deduct the income tax The amount of tax depends on the province or territory you live in and the total amount of severance pay

Is Severance Pay Taxable Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and sick time Employers usually simplify the tax payment process by including the amount on your Form W 2 and withholding the appropriate federal and state taxes

The How Is A Lump Sum Severance Payment Taxed are a huge selection of printable and downloadable documents that can be downloaded online at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and more. The benefit of How Is A Lump Sum Severance Payment Taxed is in their variety and accessibility.

More of How Is A Lump Sum Severance Payment Taxed

How A Lump Sum Payment For Unused Annual Leave Is Calculated And Taxed

How A Lump Sum Payment For Unused Annual Leave Is Calculated And Taxed

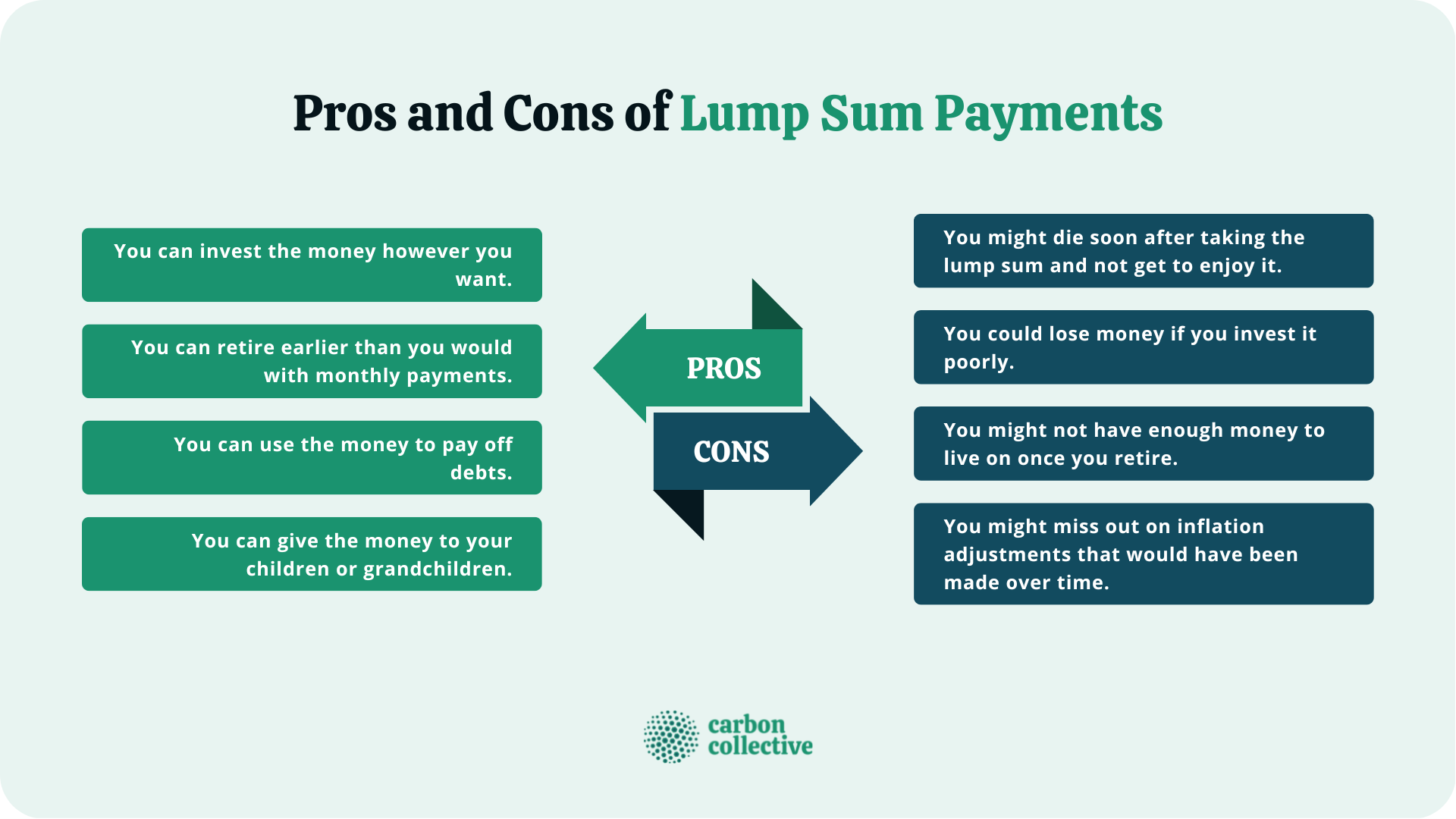

Lump Sum vs Installments Lump sum May push you into a higher tax bracket potentially increasing your tax burden Consider spreading out the payments over time if eligible Exceptions Disability severance Up to 5 250 may be

There are 4 main ways severance pay is distributed lump sum payment immediate transfer to an RRPS salary continuance and deferred payments Lump sum payment A lump sum payment is when you receive all of your severance pay

How Is A Lump Sum Severance Payment Taxed have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: There is the possibility of tailoring printables to your specific needs whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational Use: These How Is A Lump Sum Severance Payment Taxed are designed to appeal to students of all ages, making them a useful resource for educators and parents.

-

Convenience: Fast access a variety of designs and templates helps save time and effort.

Where to Find more How Is A Lump Sum Severance Payment Taxed

Lump Sum Payment Definition Finance Strategists

Lump Sum Payment Definition Finance Strategists

Summary Yes severance pay is taxable for the year that you receive it but there are ways to minimize those taxes put the money in a healthy savings account contribute to an individual retirement account spread out the severance payouts contribute to a 529 plan

There s a possibility when someone gets a lump sum severance payment and it s only withheld at 22 depending on how big that payment is they may be in a larger tax bracket than 22 and not be expecting to owe any taxes Michael Corrente managing director at CBIZ told Money Scoop So it s something that they should think about

In the event that we've stirred your curiosity about How Is A Lump Sum Severance Payment Taxed Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of How Is A Lump Sum Severance Payment Taxed for various reasons.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching materials.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide range of topics, including DIY projects to planning a party.

Maximizing How Is A Lump Sum Severance Payment Taxed

Here are some new ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Is A Lump Sum Severance Payment Taxed are an abundance of creative and practical resources that can meet the needs of a variety of people and hobbies. Their availability and versatility make them a great addition to each day life. Explore the wide world of How Is A Lump Sum Severance Payment Taxed right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Is A Lump Sum Severance Payment Taxed really absolutely free?

- Yes, they are! You can download and print these documents for free.

-

Can I utilize free printables for commercial use?

- It's based on specific usage guidelines. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download How Is A Lump Sum Severance Payment Taxed?

- Certain printables may be subject to restrictions in use. You should read the terms of service and conditions provided by the author.

-

How do I print How Is A Lump Sum Severance Payment Taxed?

- You can print them at home using printing equipment or visit an in-store print shop to get more high-quality prints.

-

What software must I use to open printables for free?

- The majority of printables are in the format PDF. This can be opened using free software, such as Adobe Reader.

Lump Sum Payment Meaning Examples Calculation Taxes

Lump Sum Payment What It Is How It Works Pros Cons

Check more sample of How Is A Lump Sum Severance Payment Taxed below

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money

Lump Sum Tax What Is It Formula Calculation Example

How Do I Minimize Taxes On Severance Payments YouTube

Lump Sum Payment Definition Example Tax Implications

Severance Pay Lump Sum Vs Salary Continuation YouTube

Should You Retire Early To Get A Larger Lump Sum On Your Pension WSJ

https://www.thebalancemoney.com/how-is-severance...

Is Severance Pay Taxable Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and sick time Employers usually simplify the tax payment process by including the amount on your Form W 2 and withholding the appropriate federal and state taxes

https://www.investopedia.com/articles/personal...

Severance is not taxed differently than income It s taxed at the ordinary income tax brackets but it may fall into a higher tax bracket if the severance pay is made as a lump sum

Is Severance Pay Taxable Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and sick time Employers usually simplify the tax payment process by including the amount on your Form W 2 and withholding the appropriate federal and state taxes

Severance is not taxed differently than income It s taxed at the ordinary income tax brackets but it may fall into a higher tax bracket if the severance pay is made as a lump sum

Lump Sum Payment Definition Example Tax Implications

Lump Sum Tax What Is It Formula Calculation Example

Severance Pay Lump Sum Vs Salary Continuation YouTube

Should You Retire Early To Get A Larger Lump Sum On Your Pension WSJ

7 Frequently Asked Questions About Severance Pay HRD Canada

Family Lump Sum Policy

Family Lump Sum Policy

How Severance Pay Is Taxed YouTube