In this age of technology, in which screens are the norm but the value of tangible printed objects hasn't waned. Whether it's for educational purposes such as creative projects or simply adding an individual touch to your space, How Are Lump Sum Severance Payments Taxed can be an excellent source. The following article is a dive deep into the realm of "How Are Lump Sum Severance Payments Taxed," exploring the benefits of them, where to find them, and ways they can help you improve many aspects of your daily life.

Get Latest How Are Lump Sum Severance Payments Taxed Below

How Are Lump Sum Severance Payments Taxed

How Are Lump Sum Severance Payments Taxed - How Are Lump Sum Severance Payments Taxed, How Are Lump Sum Severance Packages Taxed, How Is Lump Sum Severance Pay Taxed, How Is A Lump Sum Severance Payment Taxed In Ontario, How Is A Lump-sum Severance Payment Taxed In Canada, Are Lump Sum Severance Payments Taxed Higher, Is Lump Sum Severance Taxed, Do Severance Payments Get Taxed

Severance pay and unemployment compensation are taxable Payments for any accumulated vacation or sick time are also taxable You should ensure that enough

Severance is not taxed differently than income It s taxed at the ordinary income tax brackets but it may fall into a higher tax bracket if the severance pay is

Printables for free cover a broad collection of printable documents that can be downloaded online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and more. The beauty of How Are Lump Sum Severance Payments Taxed lies in their versatility and accessibility.

More of How Are Lump Sum Severance Payments Taxed

Lump Sum Payment Definition Finance Strategists

Lump Sum Payment Definition Finance Strategists

Is Severance Pay Taxable One of the unfortunate realities about severance pay is that it is fully taxable In the eyes of the IRS severance pay is the same as your

When severance comes as supplemental wages 22 of your pay is withheld regardless of whether you receive a lump sum or periodic payments How will severance

How Are Lump Sum Severance Payments Taxed have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring the templates to meet your individual needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational value: These How Are Lump Sum Severance Payments Taxed provide for students of all ages, which makes them a great source for educators and parents.

-

The convenience of You have instant access an array of designs and templates cuts down on time and efforts.

Where to Find more How Are Lump Sum Severance Payments Taxed

Defined Benefit Pension Plans Lump Sum Severance Packages

Defined Benefit Pension Plans Lump Sum Severance Packages

The severance pay is subject to withholding and employment taxes The rest would be paid on a gross check with no withholding and reported on a Form 1099

According to the IRS severance pay is taxed in the year it was received Your former employer would likely automatically withhold those taxes and your severance pay would

Now that we've ignited your interest in How Are Lump Sum Severance Payments Taxed Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of How Are Lump Sum Severance Payments Taxed to suit a variety of goals.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning materials.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing How Are Lump Sum Severance Payments Taxed

Here are some innovative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to enhance learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Are Lump Sum Severance Payments Taxed are a treasure trove of practical and innovative resources for a variety of needs and desires. Their accessibility and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the plethora of How Are Lump Sum Severance Payments Taxed today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Are Lump Sum Severance Payments Taxed truly available for download?

- Yes you can! You can download and print these materials for free.

-

Are there any free printing templates for commercial purposes?

- It depends on the specific usage guidelines. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright concerns with How Are Lump Sum Severance Payments Taxed?

- Some printables may have restrictions on usage. Be sure to read the terms and conditions set forth by the author.

-

How do I print How Are Lump Sum Severance Payments Taxed?

- Print them at home with either a printer or go to the local print shop for top quality prints.

-

What software do I require to view printables that are free?

- The majority of printables are with PDF formats, which is open with no cost software such as Adobe Reader.

Lump Sum Payment What It Is How It Works Pros Cons

How Do I Minimize Taxes On Severance Payments YouTube

Check more sample of How Are Lump Sum Severance Payments Taxed below

Lump Sum Vs Payments Personal Finance Advice For Real People

Find The Lump Sum Deposited Today That Will Yield The Same Total Amount

When Paying Severance Which Is Better One Lump Sum Or Monthly

Severance Package Lump Sum And Invest Or Payments To Lower Taxes

Sell Your Items With A Lump Sum Personal Finance Advice For Real People

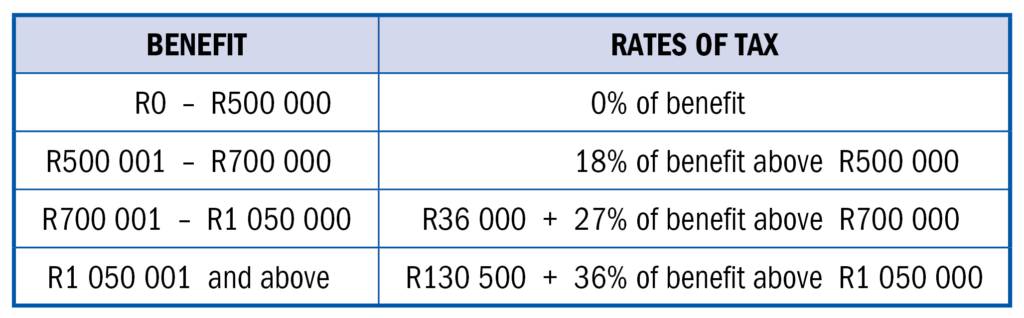

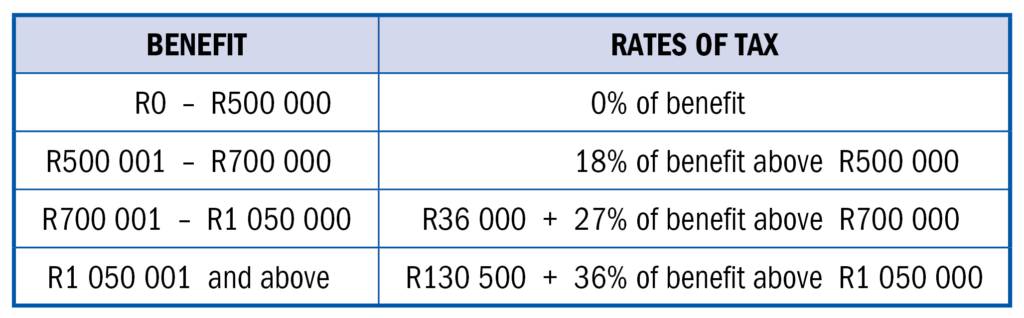

Lump Sum Benefits Retirement Fund Lump Sum Benefits Or Severance Benefits

https://www.investopedia.com/articles/personal...

Severance is not taxed differently than income It s taxed at the ordinary income tax brackets but it may fall into a higher tax bracket if the severance pay is

https://www.thebalancemoney.com/how-is-severance-pay-taxed-5188192

Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and

Severance is not taxed differently than income It s taxed at the ordinary income tax brackets but it may fall into a higher tax bracket if the severance pay is

Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and

Severance Package Lump Sum And Invest Or Payments To Lower Taxes

Find The Lump Sum Deposited Today That Will Yield The Same Total Amount

Sell Your Items With A Lump Sum Personal Finance Advice For Real People

Lump Sum Benefits Retirement Fund Lump Sum Benefits Or Severance Benefits

How Retirement And Severance Lump Sum Benefits Are Taxed Tax Breaks

Lump Sum Payments Reverse Mortgage

Lump Sum Payments Reverse Mortgage

Comparing Lump Sum Versus Payments Personal Finance Advice For Real