In this age of technology, when screens dominate our lives The appeal of tangible printed material hasn't diminished. For educational purposes and creative work, or simply to add an individual touch to the area, How Are Annuity Payouts Taxed have become a valuable resource. For this piece, we'll dive into the sphere of "How Are Annuity Payouts Taxed," exploring what they are, where to find them and what they can do to improve different aspects of your lives.

Get Latest How Are Annuity Payouts Taxed Below

How Are Annuity Payouts Taxed

How Are Annuity Payouts Taxed - How Are Annuity Payouts Taxed, How Are Annuity Payments Taxed In Canada, How Are Lottery Annuity Payments Taxed, How Are Pension Annuity Payments Taxed, How Are Immediate Annuity Payments Taxed, How Are Variable Annuity Payments Taxed, How Are Qualified Annuity Payments Taxed, How Are Grat Annuity Payments Taxed, How Are Income Annuity Payments Taxed, How Are Charitable Gift Annuity Payments Taxed

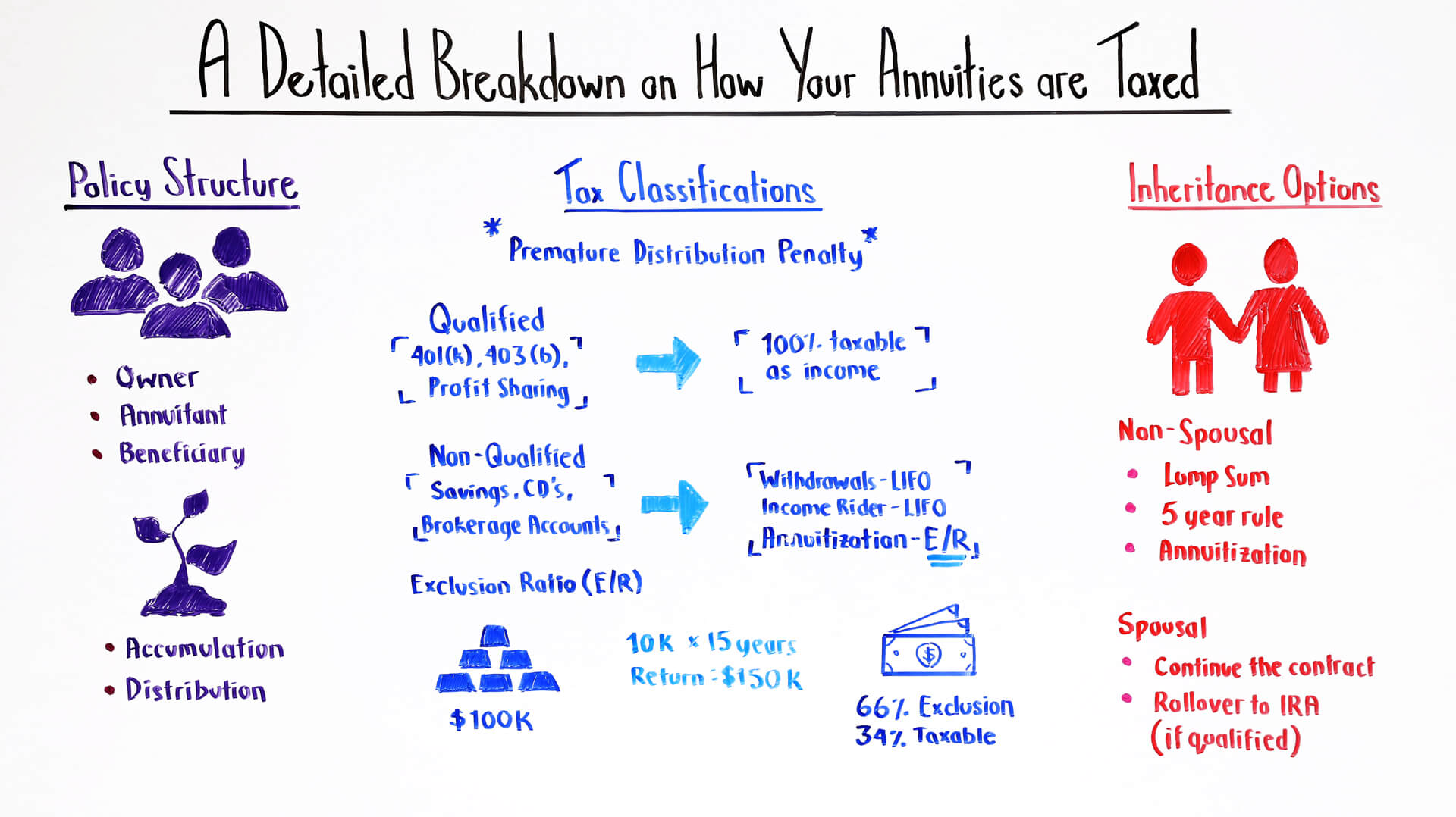

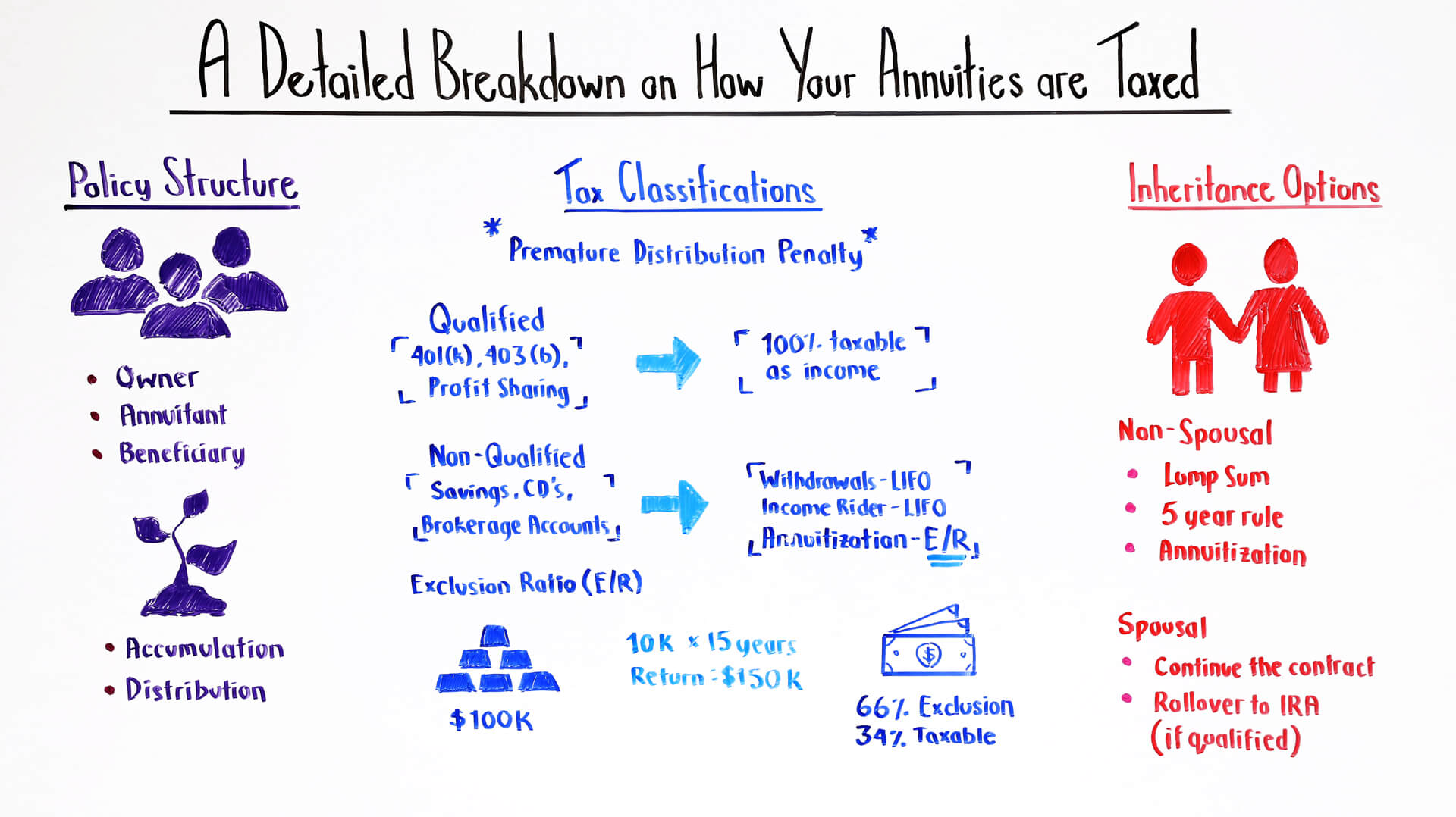

Christian Worstell March 16 2023 In this article Learn how qualified and non qualified annuities are taxed Explore the exclusion ratio Form 1099 R and more in this guide to understanding annuity taxation Understanding annuity taxation is essential in order to make smart financial decisions and to get the best out of your investment

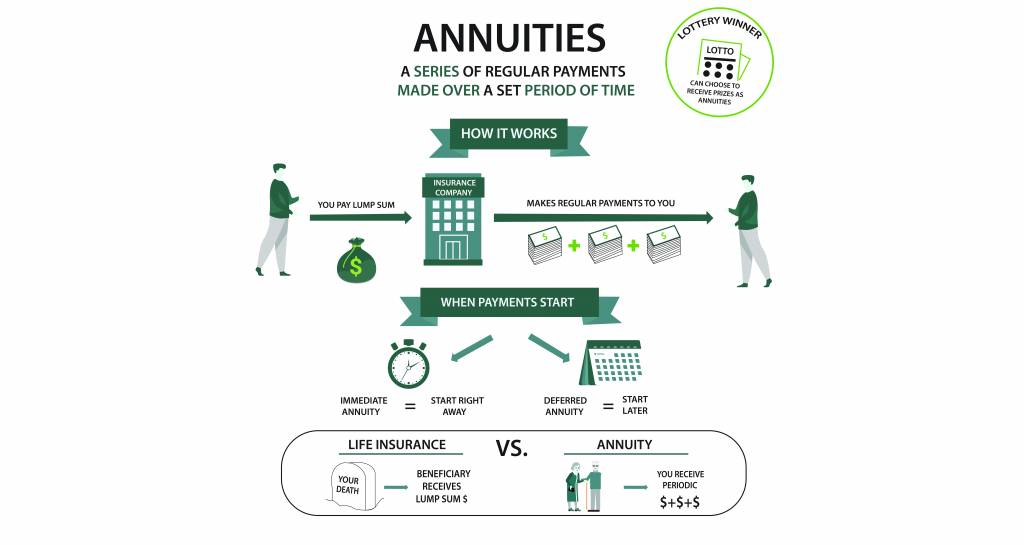

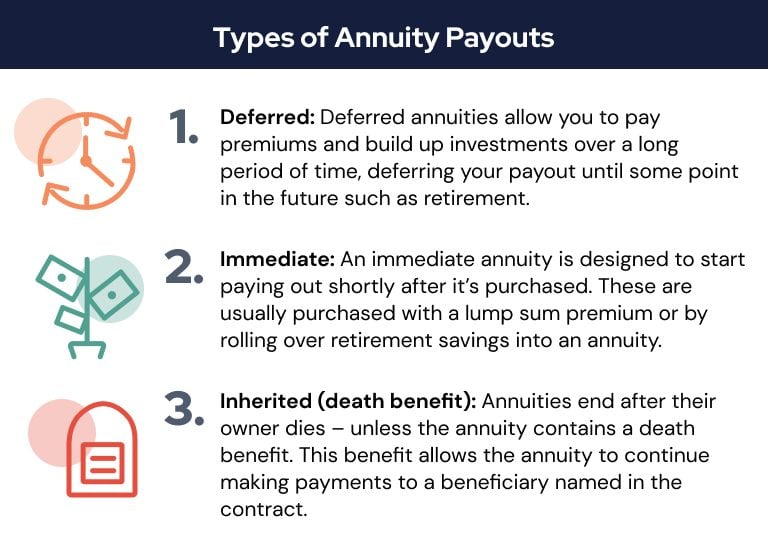

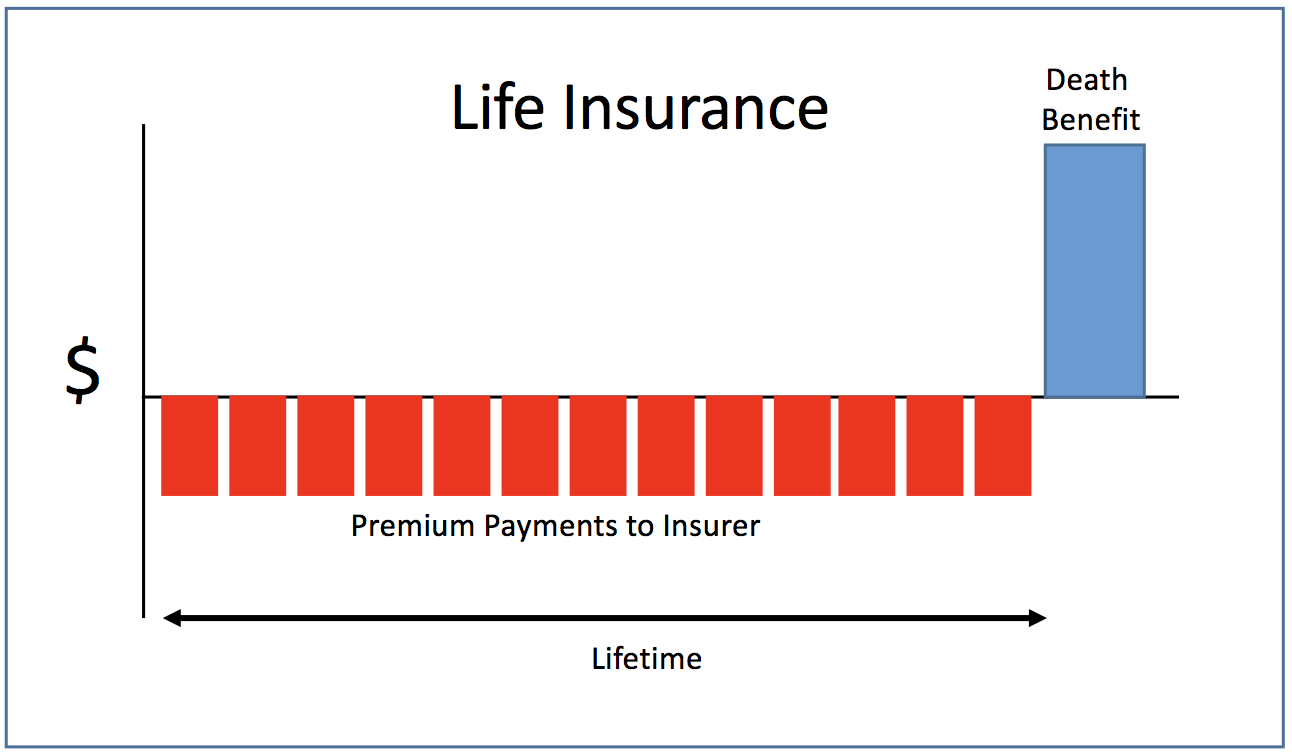

How are annuities taxed Annuities are taxed when you withdraw money or receive payments If the annuity was purchased with pre tax funds the entire amount of withdrawal is taxed as ordinary income You are only taxed on the annuity s earnings if you purchased it with after tax money

How Are Annuity Payouts Taxed offer a wide array of printable resources available online for download at no cost. They come in many styles, from worksheets to coloring pages, templates and more. The value of How Are Annuity Payouts Taxed lies in their versatility as well as accessibility.

More of How Are Annuity Payouts Taxed

Is Insurance Payout Taxable

Is Insurance Payout Taxable

How Are Annuities Taxed It depends on your contributions By Justin Pritchard Updated on November 27 2021 Reviewed by Chip Stapleton Photo Richard Drury Getty Images Annuity taxation depends on the type of annuity you have qualified vs non qualified and how you take distributions Learn what to expect when receiving

Annuity Payout Tax Once you select your payout method you should ask for your exclusion ratio which tells you how much of your payment is excluded from being taxed

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor designs to suit your personal needs such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: Printing educational materials for no cost are designed to appeal to students from all ages, making the perfect tool for teachers and parents.

-

An easy way to access HTML0: instant access various designs and templates can save you time and energy.

Where to Find more How Are Annuity Payouts Taxed

Annuity Payout Choices Explained The Annuity Consultants

Annuity Payout Choices Explained The Annuity Consultants

The principal or basis the money you put in will be returned to you tax free while the earnings growth will be taxed as ordinary income But how does the IRS determine what portion of your payout will be taxed The answer to this depends on whether payments are being made from an income annuity or from an accumulation annuity

Payouts The interest or earnings are taxed as ordinary income but you won t pay taxes on the premium or principal you initially deposited Annuity early withdrawal penalties

We've now piqued your interest in How Are Annuity Payouts Taxed Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of How Are Annuity Payouts Taxed suitable for many needs.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad range of topics, from DIY projects to party planning.

Maximizing How Are Annuity Payouts Taxed

Here are some new ways that you can make use of How Are Annuity Payouts Taxed:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free for teaching at-home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

How Are Annuity Payouts Taxed are an abundance of practical and imaginative resources that satisfy a wide range of requirements and needs and. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast array of How Are Annuity Payouts Taxed today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes they are! You can download and print these resources at no cost.

-

Do I have the right to use free printables for commercial uses?

- It's based on the rules of usage. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright issues with How Are Annuity Payouts Taxed?

- Some printables may come with restrictions in their usage. You should read the terms and conditions offered by the designer.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in the local print shop for better quality prints.

-

What software is required to open printables free of charge?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software like Adobe Reader.

Calculating Annuity Payments For An Annuity YouTube

Qualified Vs Non Qualified Annuities Taxation And Distribution

Check more sample of How Are Annuity Payouts Taxed below

What Are Your Annuity Payout Options Due

Annuities Information Types Features Payouts

What Is The Employee Retention Credit Retirement Daily On TheStreet

Best Single Premium Annuity Payouts YouTube

Annuity Payout Options Selecting The Right One For You

Income Annuities Immediate And Deferred Seeking Alpha

https://www.annuity.org/annuities/taxation

How are annuities taxed Annuities are taxed when you withdraw money or receive payments If the annuity was purchased with pre tax funds the entire amount of withdrawal is taxed as ordinary income You are only taxed on the annuity s earnings if you purchased it with after tax money

https://smartasset.com/taxes/how-are-annuities-taxed

Written by Mark Henricks An annuity can provide you with income that is guaranteed for as long as you live These retirement savings vehicles do provide some tax benefits by letting earnings grow tax deferred However at least part of your annuity payments may be subject to federal income taxes

How are annuities taxed Annuities are taxed when you withdraw money or receive payments If the annuity was purchased with pre tax funds the entire amount of withdrawal is taxed as ordinary income You are only taxed on the annuity s earnings if you purchased it with after tax money

Written by Mark Henricks An annuity can provide you with income that is guaranteed for as long as you live These retirement savings vehicles do provide some tax benefits by letting earnings grow tax deferred However at least part of your annuity payments may be subject to federal income taxes

Best Single Premium Annuity Payouts YouTube

Annuities Information Types Features Payouts

Annuity Payout Options Selecting The Right One For You

Income Annuities Immediate And Deferred Seeking Alpha

Joint And Survivor Annuity Calculator

Episode 125 A Detailed Breakdown On How Your Annuities Are Taxe

Episode 125 A Detailed Breakdown On How Your Annuities Are Taxe

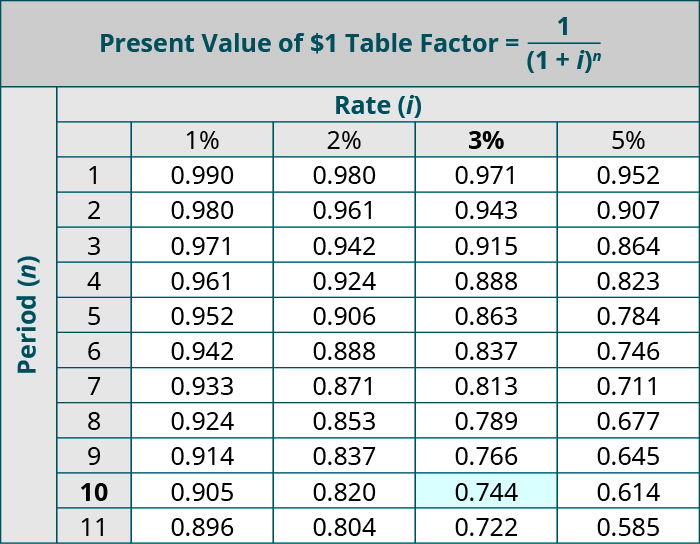

What Is The Present Value Of Annuity Business Accounting