In this age of technology, with screens dominating our lives yet the appeal of tangible printed materials isn't diminishing. If it's to aid in education project ideas, artistic or simply to add an element of personalization to your home, printables for free are now a useful source. In this article, we'll dive deeper into "How Are 401k Distributions Taxed," exploring what they are, how they are available, and how they can improve various aspects of your life.

Get Latest How Are 401k Distributions Taxed Below

How Are 401k Distributions Taxed

How Are 401k Distributions Taxed - How Are 401k Distributions Taxed, How Are 401 K Distributions Taxed In Retirement, How Are 401k Distributions Taxed After Death, How Are 401 K Distributions Taxed In Nj, How Are 401k Withdrawals Taxed In Puerto Rico, How Are 401k Withdrawals Taxed In Retirement, Are 401 K Contributions Taxed, How Are 401k Dividends Taxed, How Are 401k Withdrawals Taxed In California, How Are 401k Withdrawals Taxed In Canada

Your 401 k distributions are taxed as ordinary income All that means is the government treats it the same as money you earned from a job The good news for most people is that incomes

The tax treatment of 401 k distributions depends on the type of account traditional or Roth Traditional 401 k withdrawals are taxed at the account owner s

How Are 401k Distributions Taxed provide a diverse selection of printable and downloadable materials online, at no cost. They are available in a variety of types, like worksheets, templates, coloring pages and more. The benefit of How Are 401k Distributions Taxed lies in their versatility as well as accessibility.

More of How Are 401k Distributions Taxed

How Will My Roth 401k Distributions Be Taxed YouTube

How Will My Roth 401k Distributions Be Taxed YouTube

When funds are withdrawn they are typically subject to income taxes However an exception applies to qualified distributions from Roth 401 k accounts where withdrawals can be tax free due to post tax contributions Understanding the rules that regulate 401 k withdrawals is crucial for efficient retirement planning

What do you do Here are several ways to minimize taxes on withdrawals Key Takeaways One of the easiest ways to lower the amount of taxes you have to pay

How Are 401k Distributions Taxed have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor printing templates to your own specific requirements whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Printables for education that are free provide for students of all ages, making them an essential tool for parents and teachers.

-

It's easy: immediate access various designs and templates saves time and effort.

Where to Find more How Are 401k Distributions Taxed

What Are The Benefits Of Having 401 k Plan

What Are The Benefits Of Having 401 k Plan

All traditional 401 k plan withdrawals are considered income and subject to income tax as 401 k contributions are made with pretax dollars As a result

Taxes on 401 k Distributions If you take qualified distributions from a traditional 401 k all distributions are subject to ordinary income tax

Now that we've piqued your interest in printables for free We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in How Are 401k Distributions Taxed for different motives.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a broad selection of subjects, from DIY projects to planning a party.

Maximizing How Are 401k Distributions Taxed

Here are some innovative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Are 401k Distributions Taxed are a treasure trove of fun and practical tools which cater to a wide range of needs and pursuits. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the wide world that is How Are 401k Distributions Taxed today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Are 401k Distributions Taxed truly are they free?

- Yes they are! You can print and download these materials for free.

-

Are there any free printing templates for commercial purposes?

- It's dependent on the particular rules of usage. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions concerning their use. Make sure to read these terms and conditions as set out by the creator.

-

How do I print How Are 401k Distributions Taxed?

- You can print them at home with either a printer at home or in an in-store print shop to get better quality prints.

-

What program must I use to open printables for free?

- Most printables come in PDF format. They can be opened with free software, such as Adobe Reader.

401k Minimum Distribution Table 2017 Www microfinanceindia

Brief About 401 k Plan In US Payroll Using The OpenHRMS

Check more sample of How Are 401k Distributions Taxed below

Roth IRA Vs 401 k Which Is Better For You Ira Investment Roth

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Indexed Universal Life IUL Vs 401 k Finance Strategists

401 k Loan What To Know Before Borrowing From Your 401 k

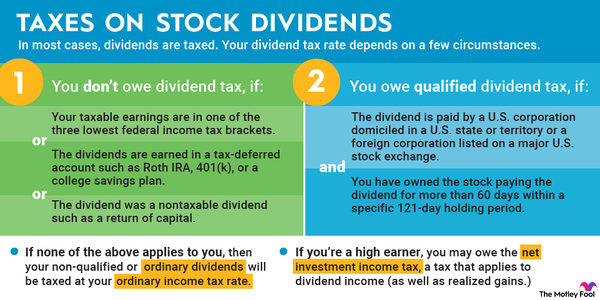

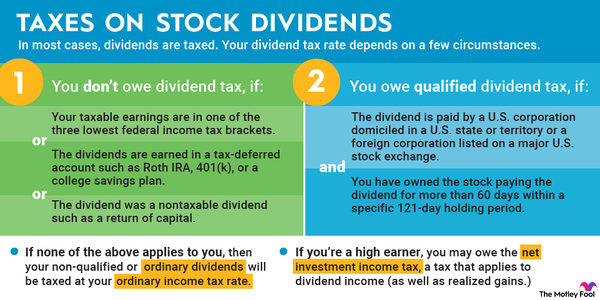

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

https://www.investopedia.com/articles/personal...

The tax treatment of 401 k distributions depends on the type of account traditional or Roth Traditional 401 k withdrawals are taxed at the account owner s

https://www.nerdwallet.com/article/taxes/401k-taxes

Contributions to a traditional 401 k plan as well as any employer matches and earnings in the account such as gains interest or dividends are considered tax deferred This means you

The tax treatment of 401 k distributions depends on the type of account traditional or Roth Traditional 401 k withdrawals are taxed at the account owner s

Contributions to a traditional 401 k plan as well as any employer matches and earnings in the account such as gains interest or dividends are considered tax deferred This means you

401 k Loan What To Know Before Borrowing From Your 401 k

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

The Maximum 401k Contribution Limit Harry Point

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog