In the age of digital, where screens dominate our lives but the value of tangible printed material hasn't diminished. If it's to aid in education project ideas, artistic or simply to add an individual touch to your home, printables for free have become a valuable source. The following article is a dive to the depths of "Home Loan Interest And Principal Tax Rebate," exploring their purpose, where they are available, and how they can add value to various aspects of your lives.

Get Latest Home Loan Interest And Principal Tax Rebate Below

Home Loan Interest And Principal Tax Rebate

Home Loan Interest And Principal Tax Rebate - Home Loan Interest And Principal Tax Rebate, Income Tax Rebate On Home Loan Interest And Principal, Is Home Loan Interest Tax Deductible, Is Principal Amount Of Home Loan Tax Deductible, Income Tax Benefit On Home Loan Interest, How Much Home Loan Principal Is Exempt From Tax

Web 31 mai 2022 nbsp 0183 32 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan you can claim home loan

Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that

Home Loan Interest And Principal Tax Rebate include a broad assortment of printable, downloadable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and many more. The value of Home Loan Interest And Principal Tax Rebate is in their versatility and accessibility.

More of Home Loan Interest And Principal Tax Rebate

How To Lower Loan Interest Rates

How To Lower Loan Interest Rates

Web 9 f 233 vr 2018 nbsp 0183 32 Tax benefits of a Home Loan Section 80C Home Loan principal For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: The Customization feature lets you tailor printables to fit your particular needs be it designing invitations planning your schedule or decorating your home.

-

Educational Benefits: Education-related printables at no charge provide for students of all ages, making them a valuable resource for educators and parents.

-

Accessibility: Access to numerous designs and templates cuts down on time and efforts.

Where to Find more Home Loan Interest And Principal Tax Rebate

Home Loan EMI Calculator Free Excel Sheet Stable Investor

Home Loan EMI Calculator Free Excel Sheet Stable Investor

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income

In the event that we've stirred your interest in printables for free Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of uses.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad variety of topics, that includes DIY projects to planning a party.

Maximizing Home Loan Interest And Principal Tax Rebate

Here are some inventive ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free for teaching at-home as well as in the class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Home Loan Interest And Principal Tax Rebate are an abundance of innovative and useful resources designed to meet a range of needs and preferences. Their access and versatility makes them a great addition to your professional and personal life. Explore the endless world of Home Loan Interest And Principal Tax Rebate right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Home Loan Interest And Principal Tax Rebate really are they free?

- Yes you can! You can download and print the resources for free.

-

Can I make use of free printing templates for commercial purposes?

- It's based on the conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may contain restrictions regarding usage. You should read the terms and conditions set forth by the author.

-

How do I print Home Loan Interest And Principal Tax Rebate?

- Print them at home with either a printer at home or in an area print shop for higher quality prints.

-

What program do I need to run printables that are free?

- The majority of printed documents are as PDF files, which can be opened with free software, such as Adobe Reader.

Home Loan Repayments Principal And Interest Or Interest Only

The Five Year Rule For Buying A House

Check more sample of Home Loan Interest And Principal Tax Rebate below

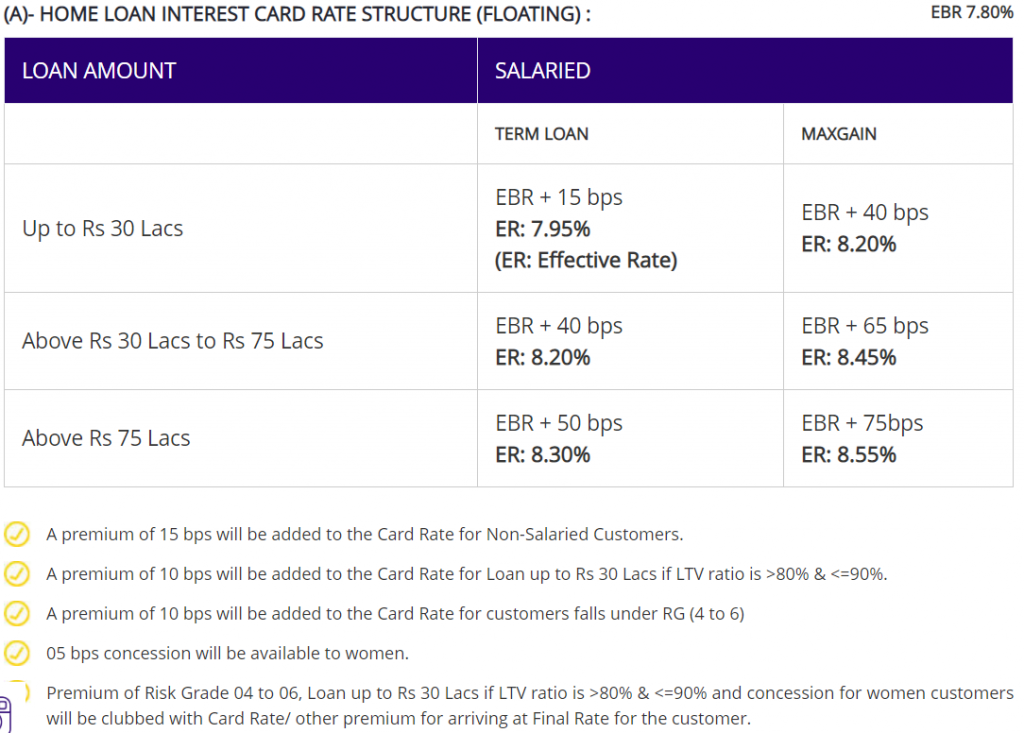

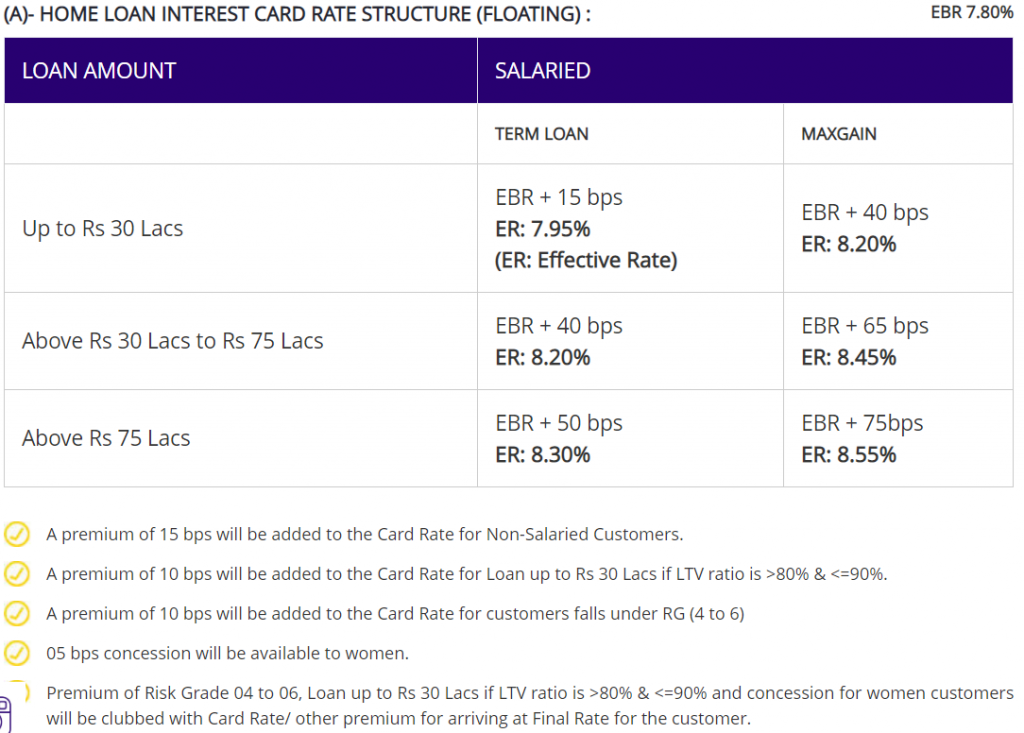

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Home Loan Tax Benefit Calculator FrankiSoumya

Understanding Home Loan Refinance Interest Rates In 2023 Money

Rising Home Loan Interests Have Begun To Impact Homebuyers

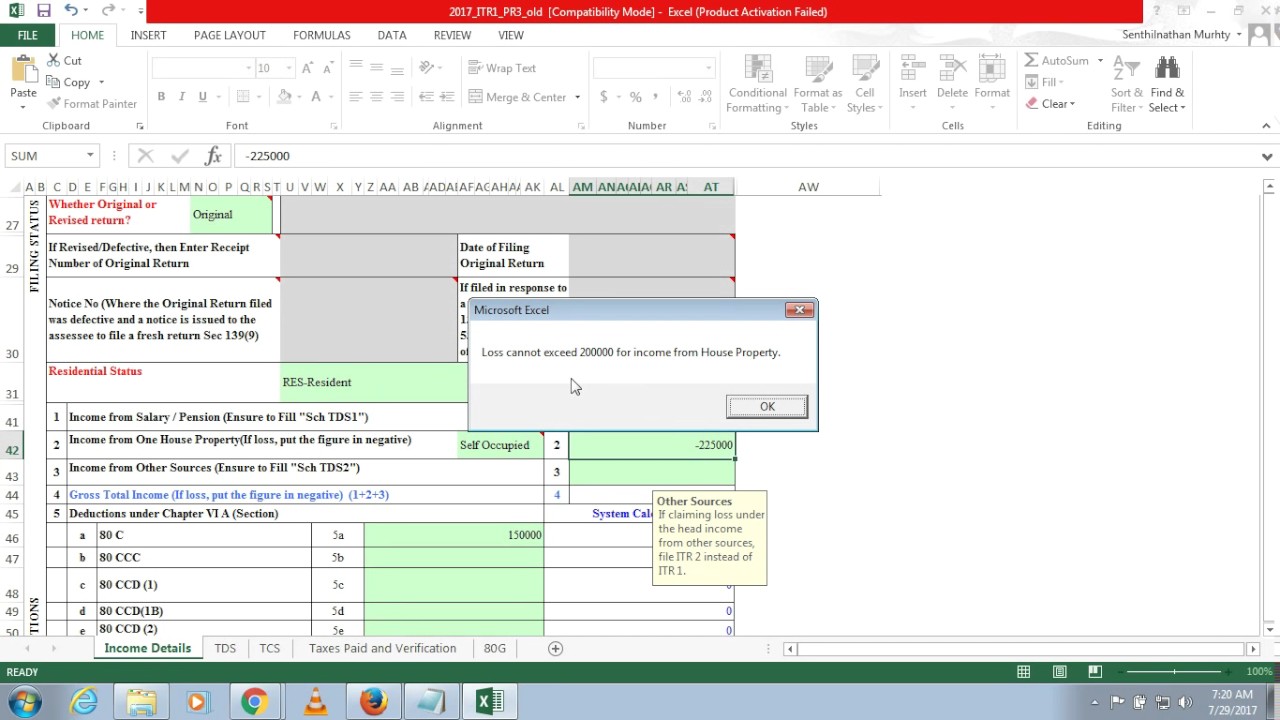

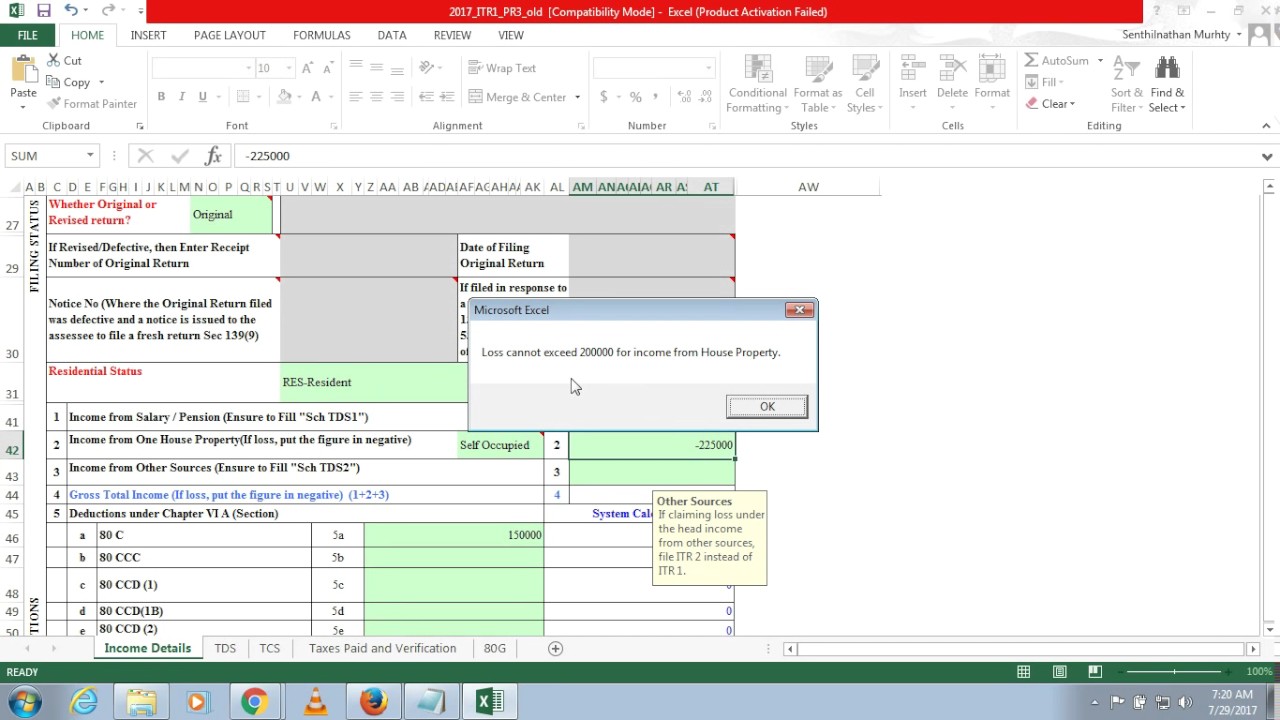

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

Essential Design Smartphone Apps

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Rising Home Loan Interests Have Begun To Impact Homebuyers

Home Loan Tax Benefit Calculator FrankiSoumya

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

Essential Design Smartphone Apps

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

Loan Principal Definition Deltapart

Loan Principal Definition Deltapart

Best Home Loan Interest Rate Comparison