In this day and age where screens have become the dominant feature of our lives however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education such as creative projects or simply to add personal touches to your space, Federal Government Tax Incentives For Homeowners have proven to be a valuable resource. The following article is a dive into the world "Federal Government Tax Incentives For Homeowners," exploring their purpose, where they are, and how they can enhance various aspects of your daily life.

Get Latest Federal Government Tax Incentives For Homeowners Below

Federal Government Tax Incentives For Homeowners

Federal Government Tax Incentives For Homeowners -

Incentives for Homeowners Learn more about the tax credits and rebates available to homeowners through President Biden s Investing in America plan Visit the ENERGYSTAR tax credit information page for information on tax credits for work undertaken in 2022 or before Pick one Appliances Home Improvement Still have questions

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Federal Government Tax Incentives For Homeowners cover a large range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and much more. The beauty of Federal Government Tax Incentives For Homeowners lies in their versatility as well as accessibility.

More of Federal Government Tax Incentives For Homeowners

Senate Democrats Would Take Some Small Steps To Clean Up Energy Tax

Senate Democrats Would Take Some Small Steps To Clean Up Energy Tax

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving money on home energy upgrades clean vehicles and more

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: You can tailor printed materials to meet your requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational value: Free educational printables can be used by students from all ages, making them an invaluable device for teachers and parents.

-

Affordability: instant access the vast array of design and templates can save you time and energy.

Where to Find more Federal Government Tax Incentives For Homeowners

Tax Incentives For Historic Preservation YouTube

Tax Incentives For Historic Preservation YouTube

If you re looking to upgrade your home to be cleaner and more energy efficient the federal government is offering some massive discounts thanks to the now enacted Inflation Reduction Act And more money is expected to become available in 2024 The IRA s numerous tax incentives cover a lot of ground

The legislation is designed to Expand Medicare benefits Lower healthcare costs Lower energy bills Reduce carbon emissions by about 40 by 2030 Create clean manufacturing jobs Invest in

We hope we've stimulated your interest in printables for free Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Federal Government Tax Incentives For Homeowners designed for a variety goals.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing Federal Government Tax Incentives For Homeowners

Here are some inventive ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Federal Government Tax Incentives For Homeowners are an abundance of practical and innovative resources for a variety of needs and interests. Their accessibility and versatility make them an invaluable addition to each day life. Explore the many options that is Federal Government Tax Incentives For Homeowners today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Federal Government Tax Incentives For Homeowners really completely free?

- Yes you can! You can print and download these items for free.

-

Can I download free printables for commercial use?

- It's all dependent on the rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables could be restricted in their usage. Make sure to read the terms and condition of use as provided by the author.

-

How do I print Federal Government Tax Incentives For Homeowners?

- Print them at home using any printer or head to a print shop in your area for the highest quality prints.

-

What software do I require to view printables at no cost?

- Most printables come with PDF formats, which is open with no cost software, such as Adobe Reader.

Guide To Film Tax Incentives By State Blue Fox Financing

Tax Incentives Cyworld Wealth

Check more sample of Federal Government Tax Incentives For Homeowners below

Tax Incentives For Foreign Direct Investment By A J Easson

TAX INCENTIVES SA EMPLOYERS NA TATANGGAP NG K 12 GRADUATES The POST

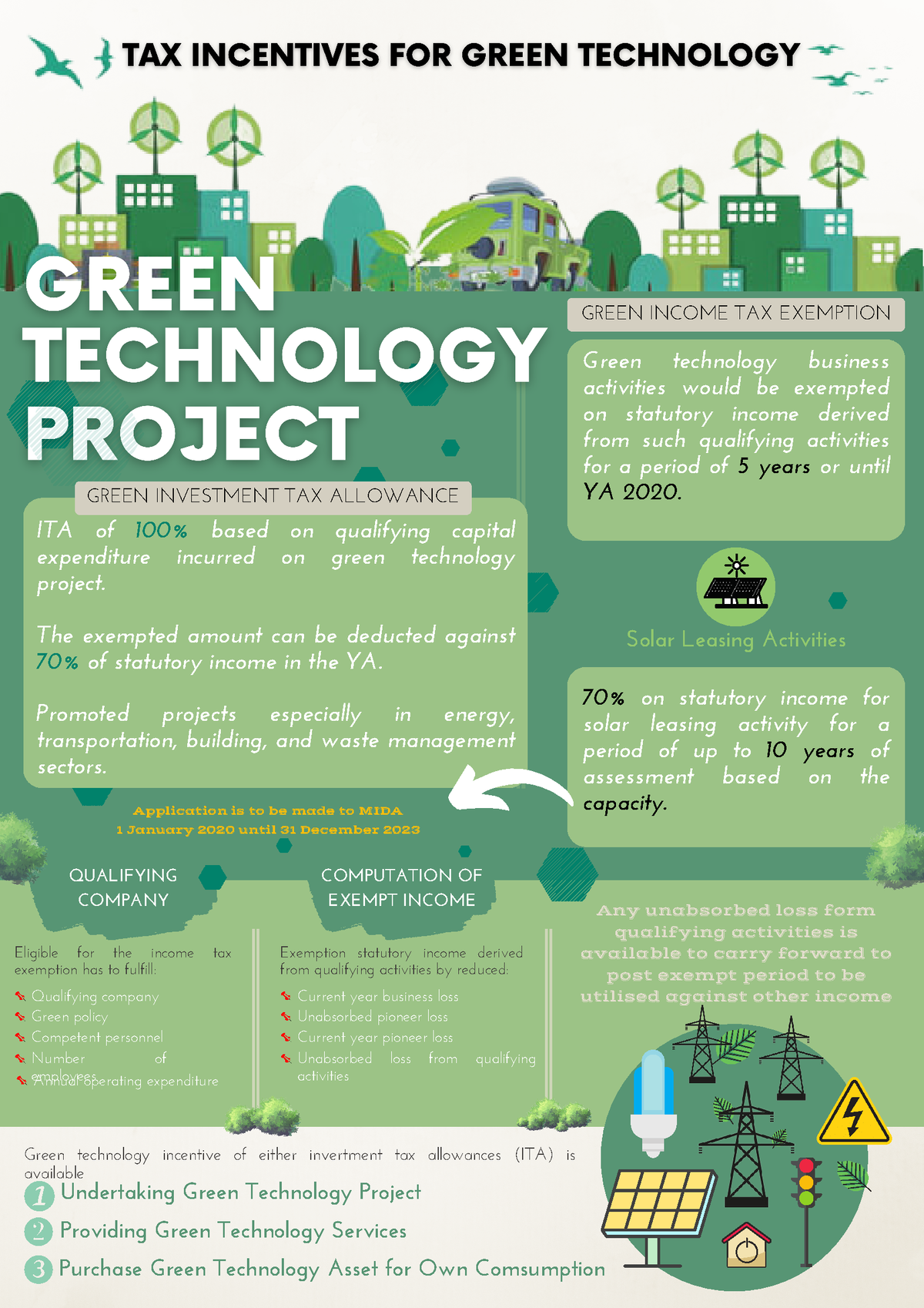

TAX Incentives FOR Green Technology Wan Sharmirizal GREEN INCOME

The Power Of Government Support 5 Funding Schemes For Indian Startup

Federal Solar Tax Credit What It Is How To Claim It For 2024

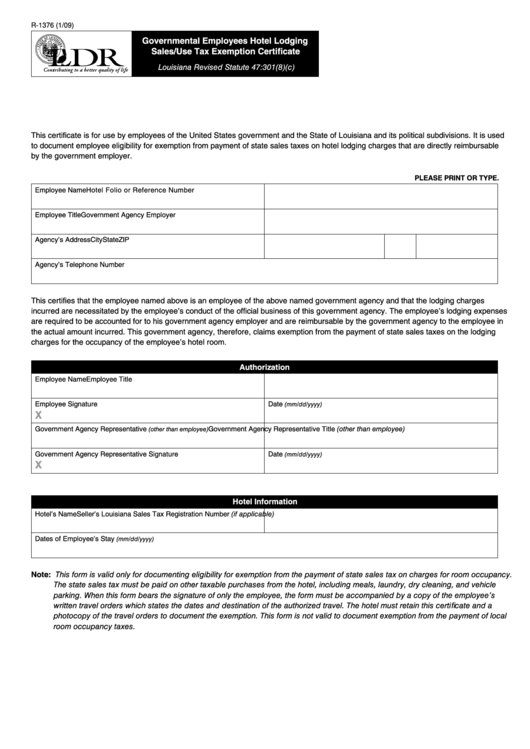

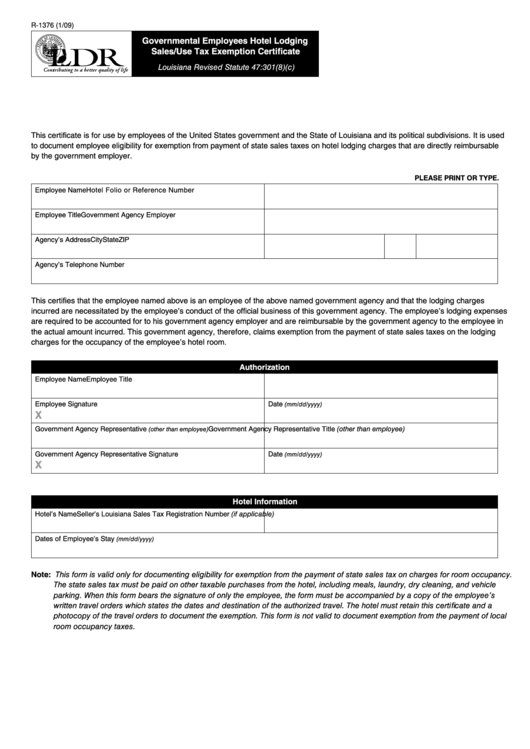

Federal Government Hotel Tax Exempt Form Virginia ExemptForm

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

https://www.irs.gov/newsroom/energy-incentives-for...

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero Page Last Reviewed or Updated 30 Jan 2024 Updated questions and answers on the residential energy property credit

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero Page Last Reviewed or Updated 30 Jan 2024 Updated questions and answers on the residential energy property credit

The Power Of Government Support 5 Funding Schemes For Indian Startup

TAX INCENTIVES SA EMPLOYERS NA TATANGGAP NG K 12 GRADUATES The POST

Federal Solar Tax Credit What It Is How To Claim It For 2024

Federal Government Hotel Tax Exempt Form Virginia ExemptForm

IRS Tax Charts 2021 Federal Withholding Tables 2021

Tax Incentives For Employers

Tax Incentives For Employers

11 Types Of Tax Incentives How They Differ In Their Functionality