Today, in which screens are the norm however, the attraction of tangible printed objects isn't diminished. Whether it's for educational purposes such as creative projects or simply to add an element of personalization to your space, Income Tax Rebate On Saving Account are now a vital resource. Here, we'll dive into the sphere of "Income Tax Rebate On Saving Account," exploring the different types of printables, where to find them, and how they can add value to various aspects of your life.

Get Latest Income Tax Rebate On Saving Account Below

Income Tax Rebate On Saving Account

Income Tax Rebate On Saving Account - Income Tax Rebate On Saving Account Interest, Income Tax Exemption On Interest On Savings Account, Income Tax Exemption For Saving Account, Income Tax Return In Saving Account, Income Tax Rebate On Bank Interest, How Much Saving Account Interest Is Tax Free, How Much Savings Interest Is Tax Free

Web 10 mars 2022 nbsp 0183 32 The interest you earn from the money in a savings account is taxable In the U S the principal balance in your savings account is not taxable Your interest

Web 3 janv 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a

Income Tax Rebate On Saving Account encompass a wide range of printable, free resources available online for download at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Rebate On Saving Account

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Web 26 avr 2023 nbsp 0183 32 Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even if it s

Web 22 oct 2022 nbsp 0183 32 You can avail deduction of up to Rs 10 000 on the total savings account interest income earned This deduction can be availed under Section 80TTA of the Income Tax Act and is available to an

Income Tax Rebate On Saving Account have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: This allows you to modify printables to your specific needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Educational Value: Downloads of educational content for free cater to learners of all ages. This makes them a great instrument for parents and teachers.

-

An easy way to access HTML0: Access to an array of designs and templates saves time and effort.

Where to Find more Income Tax Rebate On Saving Account

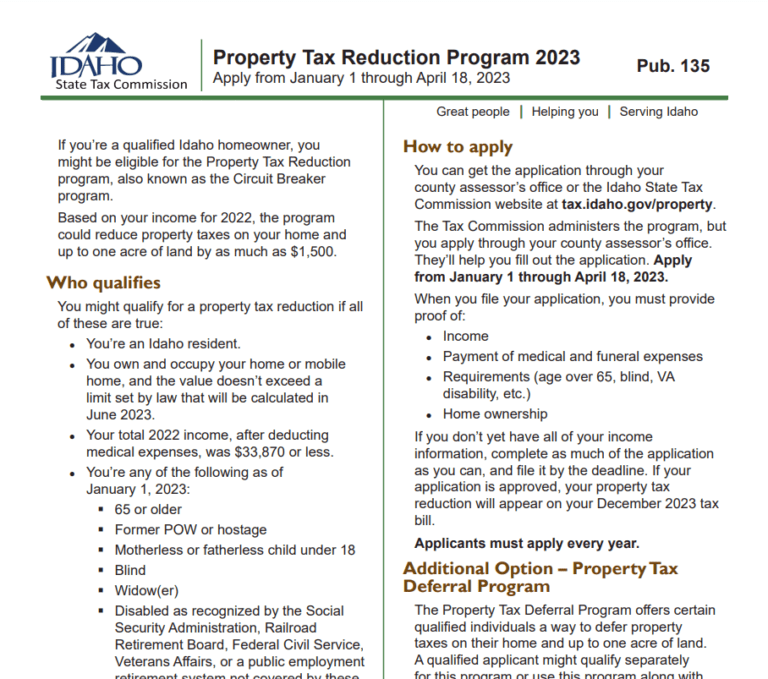

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money

Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return From HM Revenue amp Customs Published

Web 6 avr 2023 nbsp 0183 32 This 163 5 000 starting rate for savings means anyone with total taxable income under the personal income tax allowance plus 163 5 000 will not pay any tax on your savings This means if your total taxable

Now that we've piqued your interest in Income Tax Rebate On Saving Account, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Income Tax Rebate On Saving Account suitable for many goals.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets including flashcards, learning materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging that range from DIY projects to party planning.

Maximizing Income Tax Rebate On Saving Account

Here are some ways of making the most of Income Tax Rebate On Saving Account:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Saving Account are an abundance with useful and creative ideas that cater to various needs and pursuits. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast collection that is Income Tax Rebate On Saving Account today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can download and print the resources for free.

-

Can I utilize free printables for commercial uses?

- It's contingent upon the specific terms of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations in use. Always read the terms and conditions provided by the creator.

-

How can I print Income Tax Rebate On Saving Account?

- Print them at home using any printer or head to a local print shop for better quality prints.

-

What program do I need to run Income Tax Rebate On Saving Account?

- The majority are printed in the format of PDF, which can be opened with free software like Adobe Reader.

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

10 Savings Accounts That Come With Sweet Tax Breaks

Check more sample of Income Tax Rebate On Saving Account below

Income Tax And Rebate For Apartment Owners Association

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Individual Income Tax Rebate

https://www.fincash.com/l/tax/income-tax-on-savings-bank-interest

Web 3 janv 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a

https://www.bankbazaar.com/tax/tax-rebate.html

Web You can now avail tax rebate on interest on savings up to Rs 10 000 from 1 st April 2013 under Section 80TTA provided the interest is lesser than the amount Individuals and

Web 3 janv 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a

Web You can now avail tax rebate on interest on savings up to Rs 10 000 from 1 st April 2013 under Section 80TTA provided the interest is lesser than the amount Individuals and

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Individual Income Tax Rebate

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

Section 87A Tax Rebate Under Section 87A