In the age of digital, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. Be it for educational use and creative work, or simply to add an individual touch to the home, printables for free can be an excellent resource. This article will dive into the sphere of "Earned Income Tax Credit Ireland," exploring what they are, how they are, and how they can improve various aspects of your daily life.

Get Latest Earned Income Tax Credit Ireland Below

Earned Income Tax Credit Ireland

Earned Income Tax Credit Ireland - Earned Income Tax Credit Ireland, Do I Qualify For The Earned Income Tax Credit, How Much Do You Have To Earn To Get The Earned Income Tax Credit, Who Qualifies For The Earned Income Tax Credit

The updated guidance includes 1 the increase in the credit for 2024 to 1 875 euros US 2 050 from 1 775 euros US 1 941 as provided for in Finance No 2 Act of 2023 2 interaction with the employee pay as you earn PAYE tax credit and 3 considerations for those taxed under joint assessment

Section 472AB provides for the Earned Income Tax Credit EIC This tax credit is computed by reference to the standard rate of income tax in respect of an individual s earned income The credit is equal to the lower of 20 of an individual s qualified earned income and a specified amount Broadly this means that the maximum credit

Earned Income Tax Credit Ireland include a broad assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, templates, coloring pages and many more. The value of Earned Income Tax Credit Ireland is their flexibility and accessibility.

More of Earned Income Tax Credit Ireland

Claiming The Earned Income Tax Credit Be Prepared To Substantiate

Claiming The Earned Income Tax Credit Be Prepared To Substantiate

All PAYE taxpayers are entitled to a tax credit known as the Employee Tax Credit formerly known as the PAYE tax credit This is worth 1 875 in 2024 1 775 in 2023 If you are married and taxed under joint assessment then you and your spouse may both claim an Employee Tax Credit Benefits from employment

The current rate of Earned Income Tax Credit credit available as of 2024 is the lower of 1 875 or 20 of your qualifying earned income Frequently Asked Questions on EITC Addressing common queries about the Earned Income Tax Credit can provide further clarity Let s explore some of the most frequently asked questions

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization This allows you to modify designs to suit your personal needs whether it's making invitations or arranging your schedule or decorating your home.

-

Educational Benefits: Printables for education that are free cater to learners from all ages, making them an invaluable tool for teachers and parents.

-

Easy to use: The instant accessibility to a plethora of designs and templates helps save time and effort.

Where to Find more Earned Income Tax Credit Ireland

Earned Income Tax Credit EITC Erfahren Sie Wie Sie Sich

Earned Income Tax Credit EITC Erfahren Sie Wie Sie Sich

Employee credit 1 650 Earned income credit increased 1 150 Home carer credit increased 1 200 Applies to self employed income and certain PAYE employments not subject to the PAYE credit Help to Buy Scheme unchanged Income tax rebate capped at 20 000 for first time buyers of a principal private residence

You are also entitled to the Employee Tax Credit if you are Still working Getting a pension Getting a taxable social welfare payment If you are self employed you get the Earned Income Tax Credit The amount of each tax credit

Now that we've piqued your interest in printables for free Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Earned Income Tax Credit Ireland for various needs.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free, flashcards, and learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad range of topics, ranging from DIY projects to planning a party.

Maximizing Earned Income Tax Credit Ireland

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home also in the classes.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Earned Income Tax Credit Ireland are an abundance of fun and practical tools that can meet the needs of a variety of people and needs and. Their accessibility and versatility make them a wonderful addition to any professional or personal life. Explore the vast world of Earned Income Tax Credit Ireland today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can print and download these items for free.

-

Do I have the right to use free printables for commercial purposes?

- It's determined by the specific conditions of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables might have limitations concerning their use. Be sure to read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home with your printer or visit a local print shop for higher quality prints.

-

What software do I require to view printables that are free?

- A majority of printed materials are in PDF format, which can be opened using free programs like Adobe Reader.

This Is Earned Income Tax Credit Awareness Day

EARNED INCOME TAX CREDIT

Check more sample of Earned Income Tax Credit Ireland below

Free Tax Assistance At New Bedford City Hall On February 19th New

Basic Facts And FAQs About The Earned Income Tax Credit EIC Or EITC

Earned Income Credit Eligibility Fluctuates H R Block Newsroom

The Success Of The Earned Income Tax Credit Econofact

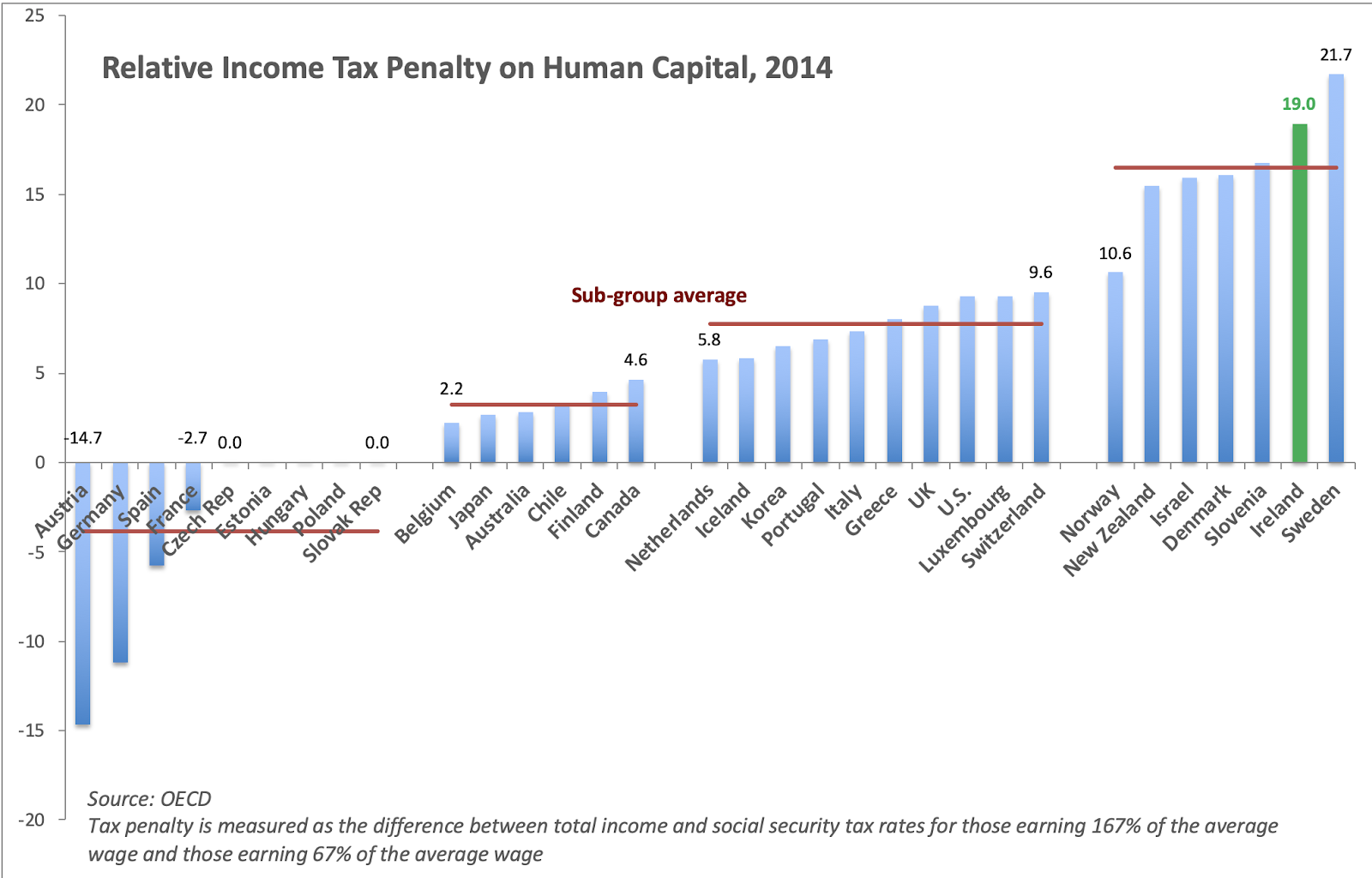

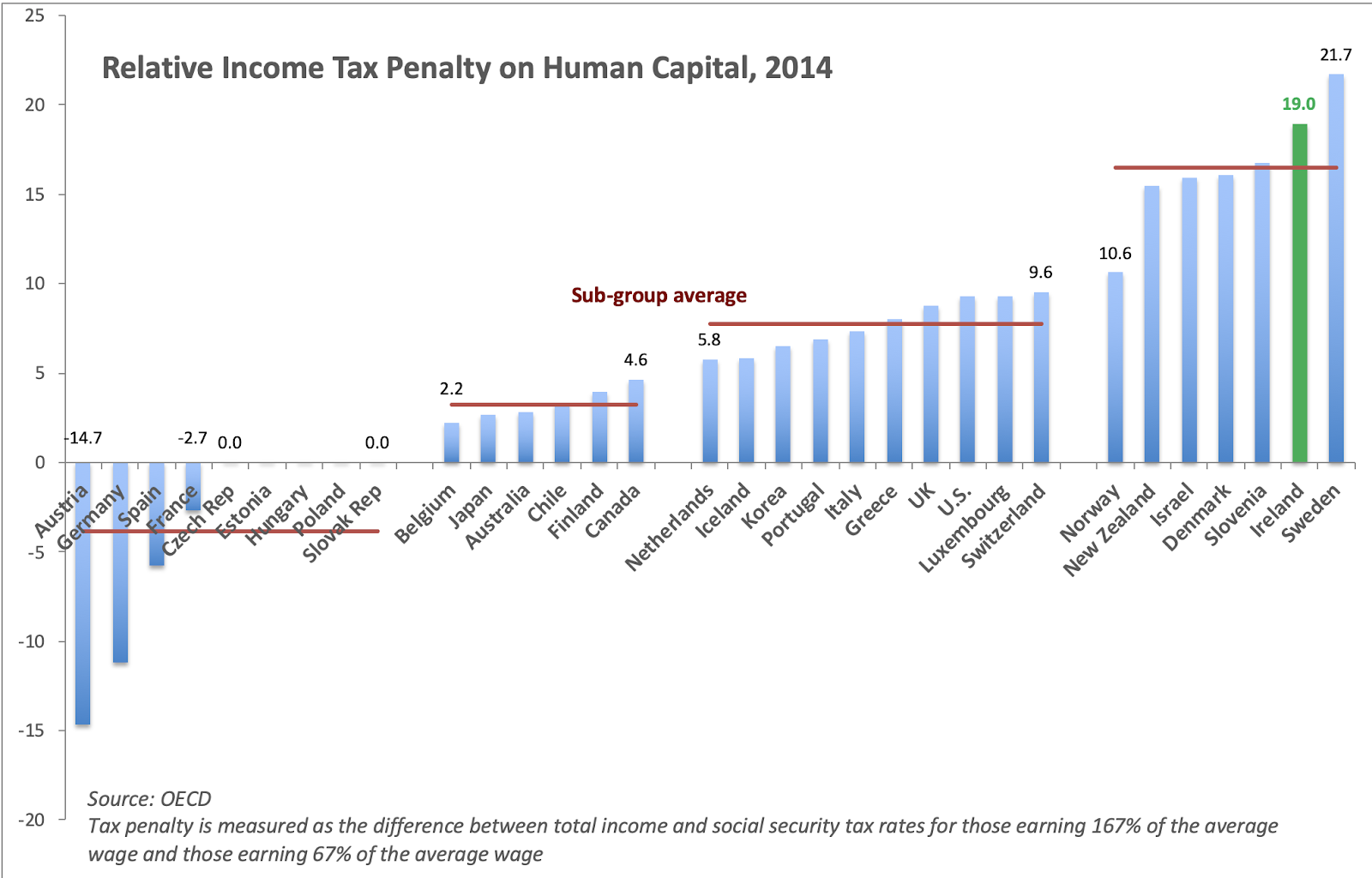

True Economics 9 9 19 Ireland And OECD Income Tax Rates Comparatives

Earned Income Tax Credit Alchetron The Free Social Encyclopedia

https://www.revenue.ie/en/tax-professionals/tdm/...

Section 472AB provides for the Earned Income Tax Credit EIC This tax credit is computed by reference to the standard rate of income tax in respect of an individual s earned income The credit is equal to the lower of 20 of an individual s qualified earned income and a specified amount Broadly this means that the maximum credit

https://www.revenue.ie/en/tax-professionals/tdm/...

Section 472AB of the Taxes Consolidation Act 1997 TCA 1997 was inserted by Finance Act 2015 and applies for the tax year 2016 and subsequent years It provides for a tax credit computed by reference to the standard rate of income tax in respect of an individual s earned income

Section 472AB provides for the Earned Income Tax Credit EIC This tax credit is computed by reference to the standard rate of income tax in respect of an individual s earned income The credit is equal to the lower of 20 of an individual s qualified earned income and a specified amount Broadly this means that the maximum credit

Section 472AB of the Taxes Consolidation Act 1997 TCA 1997 was inserted by Finance Act 2015 and applies for the tax year 2016 and subsequent years It provides for a tax credit computed by reference to the standard rate of income tax in respect of an individual s earned income

The Success Of The Earned Income Tax Credit Econofact

Basic Facts And FAQs About The Earned Income Tax Credit EIC Or EITC

True Economics 9 9 19 Ireland And OECD Income Tax Rates Comparatives

Earned Income Tax Credit Alchetron The Free Social Encyclopedia

Paying Tax In Ireland What You Need To Know

The Earned Income Tax Credit EITC Gives A Tax Break To Workers In The

The Earned Income Tax Credit EITC Gives A Tax Break To Workers In The

What Is The Earned Income Tax Credit Do I Qualify SFS Tax