In a world where screens dominate our lives and the appeal of physical printed materials isn't diminishing. In the case of educational materials project ideas, artistic or just adding personal touches to your space, Donation To Political Party Income Tax Rebate are a great resource. Here, we'll take a dive into the world of "Donation To Political Party Income Tax Rebate," exploring the different types of printables, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest Donation To Political Party Income Tax Rebate Below

Donation To Political Party Income Tax Rebate

Donation To Political Party Income Tax Rebate - Donation To Political Party Income Tax Rebate, Are Donations To Political Parties Tax Deductible, Is Donation To Political Party Tax Deductible In India

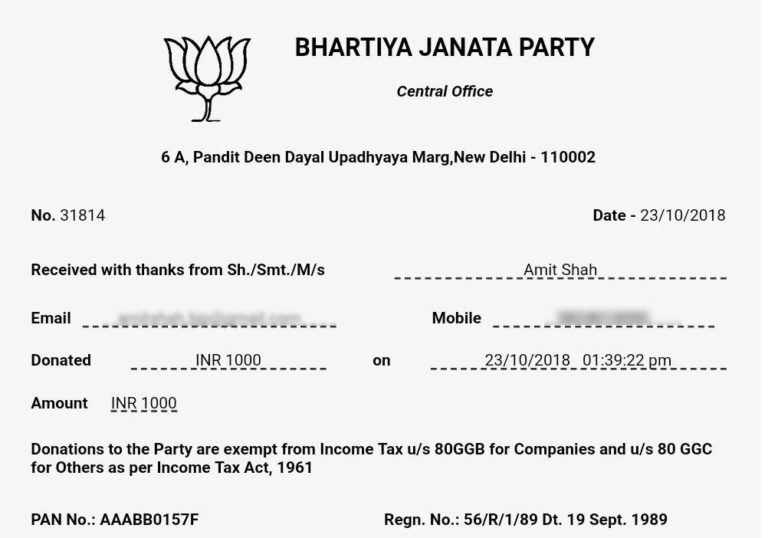

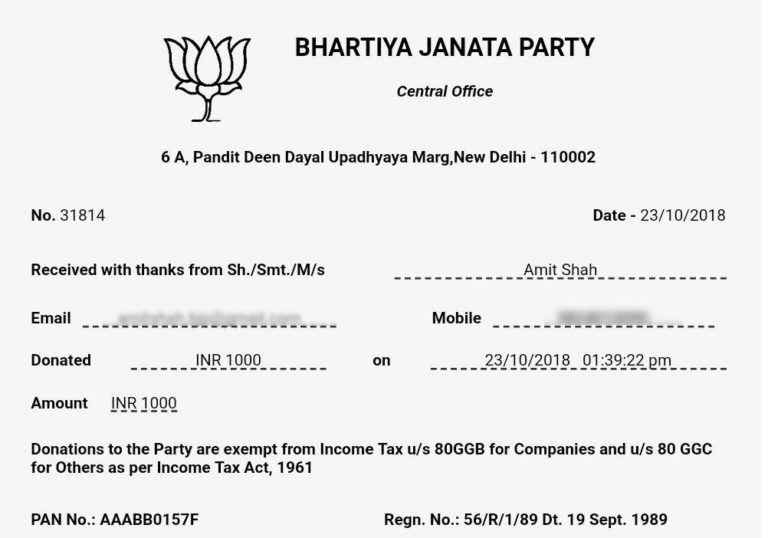

Web 30 d 233 c 2022 nbsp 0183 32 Section 80GGC under the Income Tax Act 1961 provides tax deduction benefits on donations made by any individual to political parties subject to certain

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

Donation To Political Party Income Tax Rebate provide a diverse selection of printable and downloadable resources available online for download at no cost. These resources come in various designs, including worksheets coloring pages, templates and much more. The appeal of printables for free is their flexibility and accessibility.

More of Donation To Political Party Income Tax Rebate

Income Tax Notice For 80ggc Donation To Political Party Political

Income Tax Notice For 80ggc Donation To Political Party Political

Web 28 f 233 vr 2023 nbsp 0183 32 Section 80GGC of Income Tax Act allows taxpayers to avail of tax benefits for their contributions to political parties Hence if you meet certain eligibility criteria

Web You can claim a credit for the amount of contributions that you or your spouse or common law partner made in the year to a registered federal political party a registered

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: There is the possibility of tailoring printed materials to meet your requirements whether it's making invitations and schedules, or decorating your home.

-

Educational Use: Education-related printables at no charge can be used by students of all ages, which makes them an invaluable aid for parents as well as educators.

-

Affordability: immediate access various designs and templates reduces time and effort.

Where to Find more Donation To Political Party Income Tax Rebate

Political Party Contributions

Political Party Contributions

Web 12 avr 2023 nbsp 0183 32 Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

Web 27 f 233 vr 2020 nbsp 0183 32 Section 80GGB of the Income Tax Act 1961 deals in any Indian company or enterprise that donates to a political party or an electoral trust registered in India can

In the event that we've stirred your interest in Donation To Political Party Income Tax Rebate, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Donation To Political Party Income Tax Rebate designed for a variety motives.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning materials.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Donation To Political Party Income Tax Rebate

Here are some unique ways ensure you get the very most use of Donation To Political Party Income Tax Rebate:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Donation To Political Party Income Tax Rebate are an abundance of creative and practical resources that meet a variety of needs and interests. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the plethora of Donation To Political Party Income Tax Rebate today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Donation To Political Party Income Tax Rebate really for free?

- Yes they are! You can print and download these items for free.

-

Are there any free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Donation To Political Party Income Tax Rebate?

- Some printables may come with restrictions regarding their use. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to a print shop in your area for top quality prints.

-

What program do I need to run printables free of charge?

- A majority of printed materials are with PDF formats, which can be opened with free software like Adobe Reader.

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

80ggc Donation To Political Party Donation To Political Party Limit

Check more sample of Donation To Political Party Income Tax Rebate below

Donation To Political Party Get Deduction Under Income Tax 80GGB

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

Donation To Political Party IncomeTax Planning Goes Wrong shorts

Donation To Political Party Or Electrol Trust Limits Process Income

Deduction For Donation To Political Party Section 80GGC YouTube

Deduction For Donations Given To Political Parties FinancePost

https://tax2win.in/guide/section-80ggc

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

https://cleartax.in/s/section-80ggb

Web 8 f 233 vr 2019 nbsp 0183 32 As per Section 80GGB of the Income Tax Act 1961 any Indian company or enterprise that donates to a political party or an electoral trust registered in India can

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

Web 8 f 233 vr 2019 nbsp 0183 32 As per Section 80GGB of the Income Tax Act 1961 any Indian company or enterprise that donates to a political party or an electoral trust registered in India can

Donation To Political Party Or Electrol Trust Limits Process Income

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

Deduction For Donation To Political Party Section 80GGC YouTube

Deduction For Donations Given To Political Parties FinancePost

Donate Us 80g Tipslopez

Sample Official Donation Receipts Canada ca Donate Receipts

Sample Official Donation Receipts Canada ca Donate Receipts

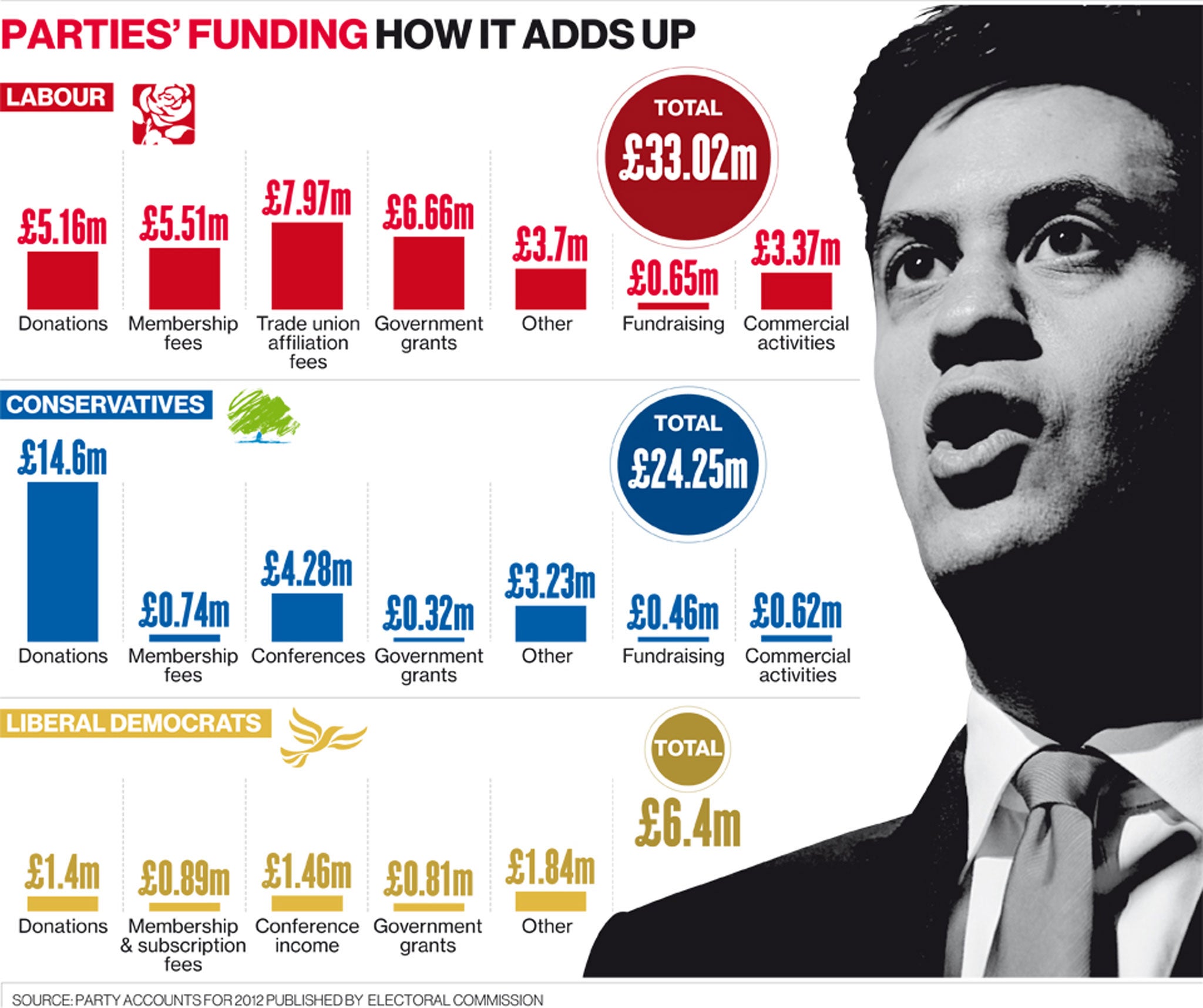

A 5 000 Cap On Donations Debt laden Labour Call For State Funding Of