In the age of digital, when screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education for creative projects, simply adding a personal touch to your area, Does Virginia Tax Military Retirement And Social Security are a great resource. Through this post, we'll take a dive through the vast world of "Does Virginia Tax Military Retirement And Social Security," exploring what they are, where to find them and how they can add value to various aspects of your life.

Get Latest Does Virginia Tax Military Retirement And Social Security Below

Does Virginia Tax Military Retirement And Social Security

Does Virginia Tax Military Retirement And Social Security - Does Virginia Tax Military Retirement And Social Security, Does Virginia Tax Military Retirement, How Much Does Virginia Tax Military Retirement

As a veteran over 55 you can deduct up to 40 000 of your retired military pay from Virginia taxable income This Virginia veteran tax credit phases in over four

After enacting a state tax exemption for military retirement pay in 2022 this expanded benefit will apply to all military retirees regardless of age and takes effect in the taxable

The Does Virginia Tax Military Retirement And Social Security are a huge assortment of printable, downloadable documents that can be downloaded online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and much more. The benefit of Does Virginia Tax Military Retirement And Social Security is in their versatility and accessibility.

More of Does Virginia Tax Military Retirement And Social Security

Petition Make Military Retirement Tax EXEMPT Virginia Change

Petition Make Military Retirement Tax EXEMPT Virginia Change

These nine states have no state income tax which means no tax on military retirement income Alaska Florida Nevada New Hampshire institutes tax on interest

Published February 23 2022 Some states don t charge income tax on military retired pay In all states U S Department of Veterans Affairs disability payments are tax free If you

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: This allows you to modify printed materials to meet your requirements whether you're designing invitations to organize your schedule or even decorating your home.

-

Education Value Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them an essential source for educators and parents.

-

It's easy: Access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Does Virginia Tax Military Retirement And Social Security

Average Federal Tax Rate On Military Retirement Pay Military Pay

Average Federal Tax Rate On Military Retirement Pay Military Pay

Virginia Retirees age 55 and over can deduct up to 20 000 in military benefits from their 2023 state income taxes The deduction increases to 30 000 for the

Military Benefits Prior to 2022 Military Retirement is taxable and is included in gross income on the return This applies to a military pension received while the retiree is a

We hope we've stimulated your curiosity about Does Virginia Tax Military Retirement And Social Security Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Does Virginia Tax Military Retirement And Social Security to suit a variety of applications.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Does Virginia Tax Military Retirement And Social Security

Here are some unique ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Does Virginia Tax Military Retirement And Social Security are an abundance of practical and imaginative resources which cater to a wide range of needs and interest. Their accessibility and versatility make these printables a useful addition to each day life. Explore the many options of Does Virginia Tax Military Retirement And Social Security now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations in use. Make sure to read the conditions and terms of use provided by the creator.

-

How do I print Does Virginia Tax Military Retirement And Social Security?

- You can print them at home using an printer, or go to an in-store print shop to get the highest quality prints.

-

What program do I need in order to open printables at no cost?

- The majority of printables are in the PDF format, and can be opened using free software like Adobe Reader.

Retiring These States Won t Tax Your Distributions

States That Don t Tax Military Retirement Pay Discover Here

Check more sample of Does Virginia Tax Military Retirement And Social Security below

NC Gives Veterans Tax Credits On Income And Property Taxes Wfmynews2

States That Don t Tax Military Retirement 2023 Wisevoter

States That Won t Tax Your Retirement Distributions In 2021

States That Don t Tax Military Retirement A Detailed List

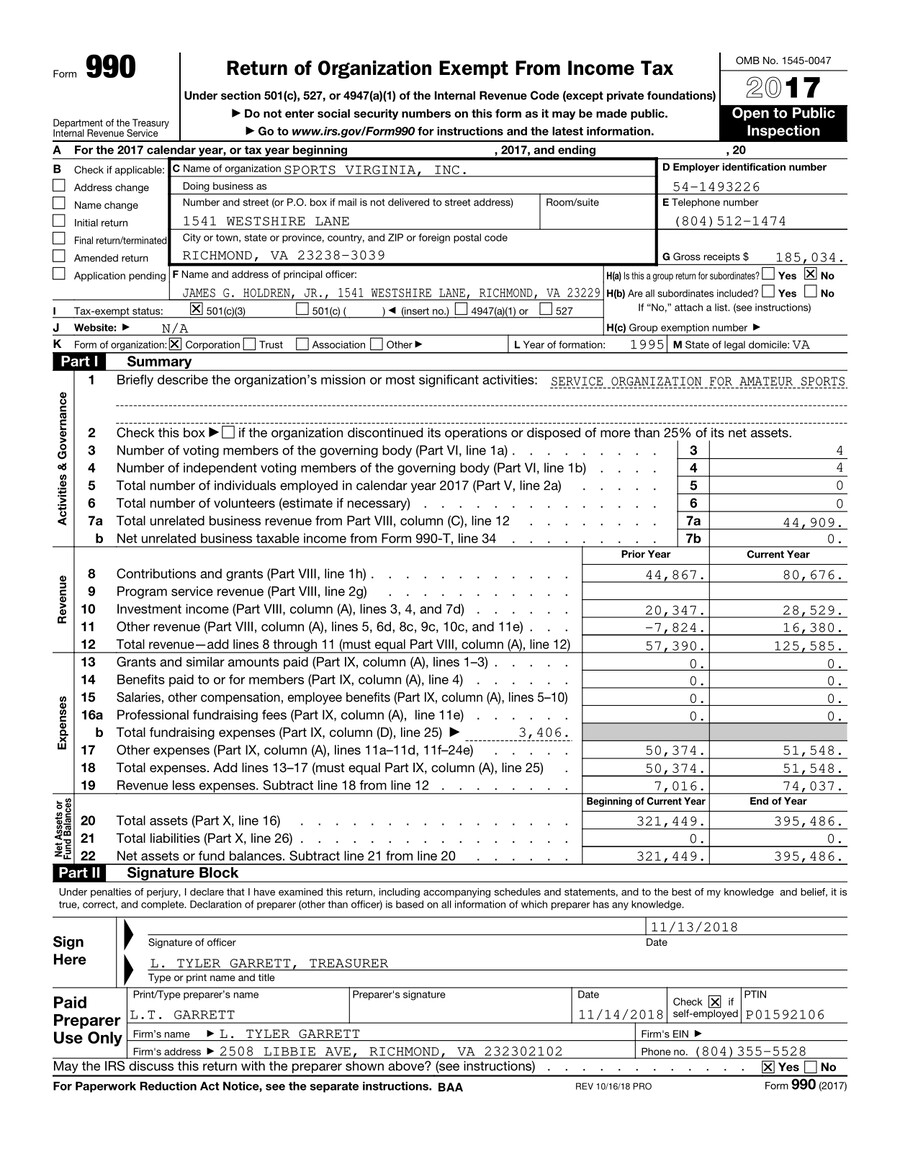

2017 USATF Virginia Tax Return By Sarah linehan Flipsnack

States That Tax Social Security Benefits Tax Foundation

https://www.msn.com/en-us/news/politics/gov-glenn...

After enacting a state tax exemption for military retirement pay in 2022 this expanded benefit will apply to all military retirees regardless of age and takes effect in the taxable

https://myarmybenefits.us.army.mil/.../Virgi…

For the 2023 tax year resident Veterans aged 55 and over who are receiving military retired pay can deduct 20 000 from their Virginia taxable income This subtraction will increase each year

After enacting a state tax exemption for military retirement pay in 2022 this expanded benefit will apply to all military retirees regardless of age and takes effect in the taxable

For the 2023 tax year resident Veterans aged 55 and over who are receiving military retired pay can deduct 20 000 from their Virginia taxable income This subtraction will increase each year

States That Don t Tax Military Retirement A Detailed List

States That Don t Tax Military Retirement 2023 Wisevoter

2017 USATF Virginia Tax Return By Sarah linehan Flipsnack

States That Tax Social Security Benefits Tax Foundation

15 States That Don t Tax Retirement Income Pensions Social Security

56 Of Social Security Households Pay Tax On Their Benefits Will You

56 Of Social Security Households Pay Tax On Their Benefits Will You

States That Won t Tax Your Retirement Distributions Retirement Budget