In this day and age with screens dominating our lives however, the attraction of tangible printed objects hasn't waned. In the case of educational materials for creative projects, simply adding an extra personal touch to your area, Does Ohio Tax Roth Ira Distributions are now an essential resource. With this guide, you'll take a dive to the depths of "Does Ohio Tax Roth Ira Distributions," exploring what they are, where they are, and what they can do to improve different aspects of your life.

Get Latest Does Ohio Tax Roth Ira Distributions Below

Does Ohio Tax Roth Ira Distributions

Does Ohio Tax Roth Ira Distributions - Does Ohio Tax Roth Ira Distributions, Does Ohio Tax Ira Distributions, Which States Tax Roth Ira Distributions, Does Maryland Tax Roth Ira Distributions

Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and

If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio However if your rollover results in recognizing income that is included

Does Ohio Tax Roth Ira Distributions encompass a wide selection of printable and downloadable materials available online at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages, and more. The value of Does Ohio Tax Roth Ira Distributions is their versatility and accessibility.

More of Does Ohio Tax Roth Ira Distributions

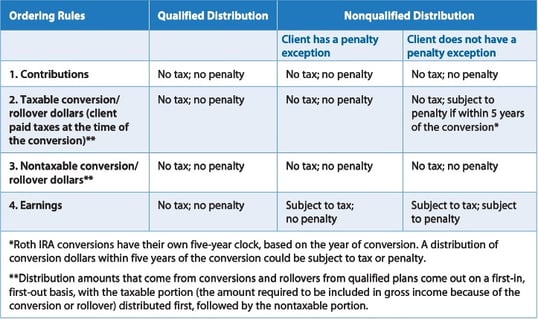

Roth IRA Distribution Rules Taxation Tax Diversification

Roth IRA Distribution Rules Taxation Tax Diversification

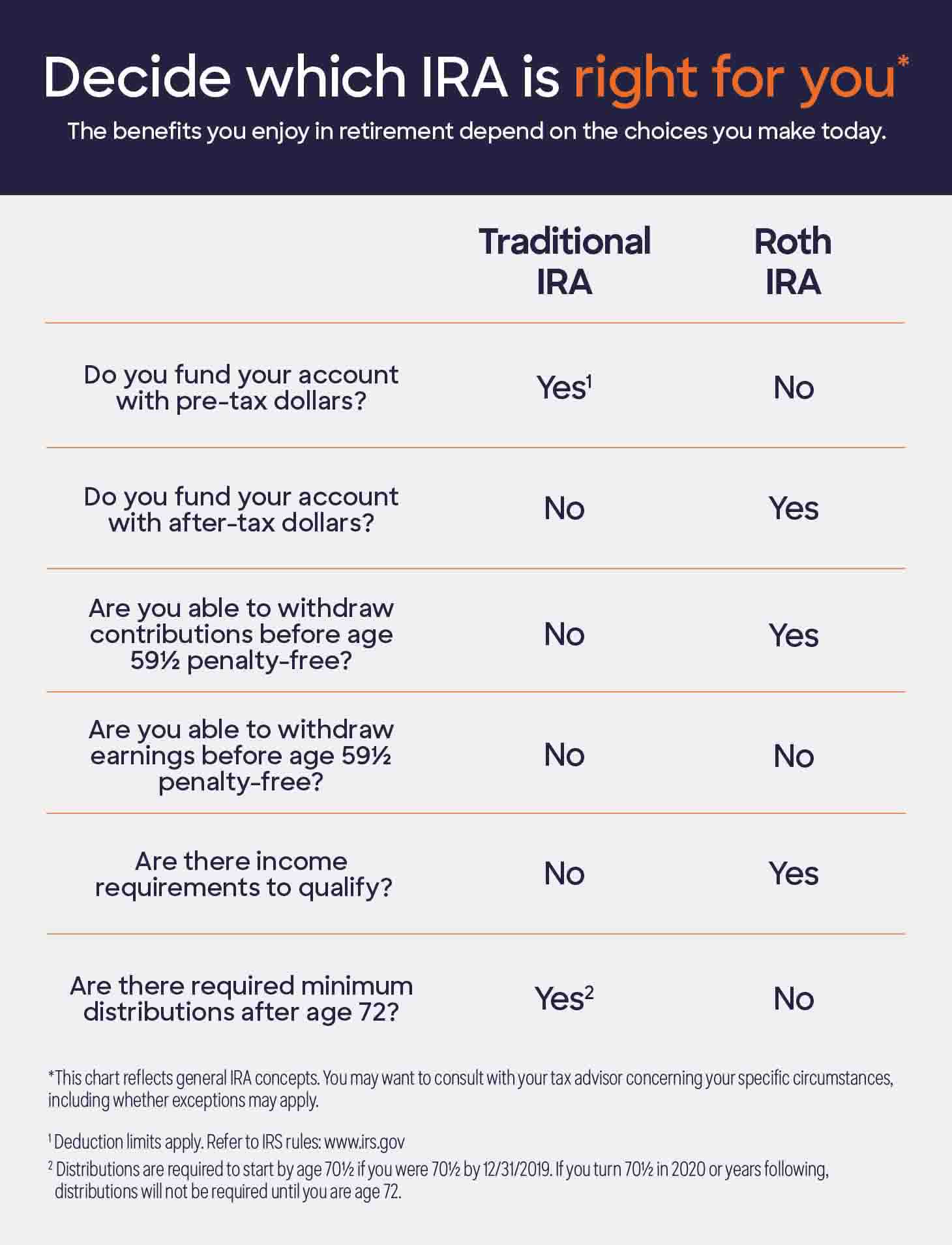

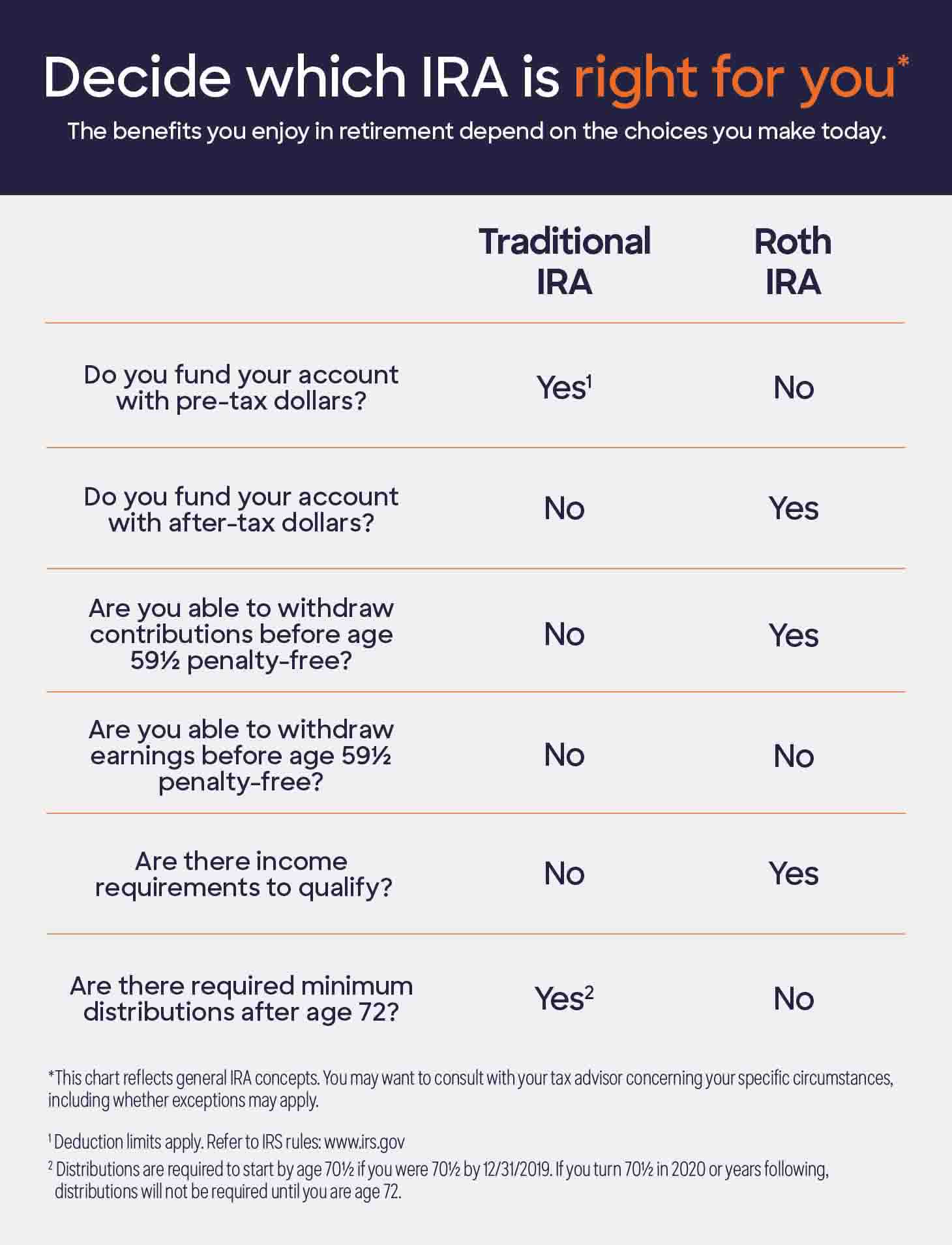

Overview of Ohio Retirement Tax Friendliness Social Security retirement benefits are fully exempt from state income taxes in Ohio Certain income from pensions or retirement accounts like a 401 k or an IRA is taxed

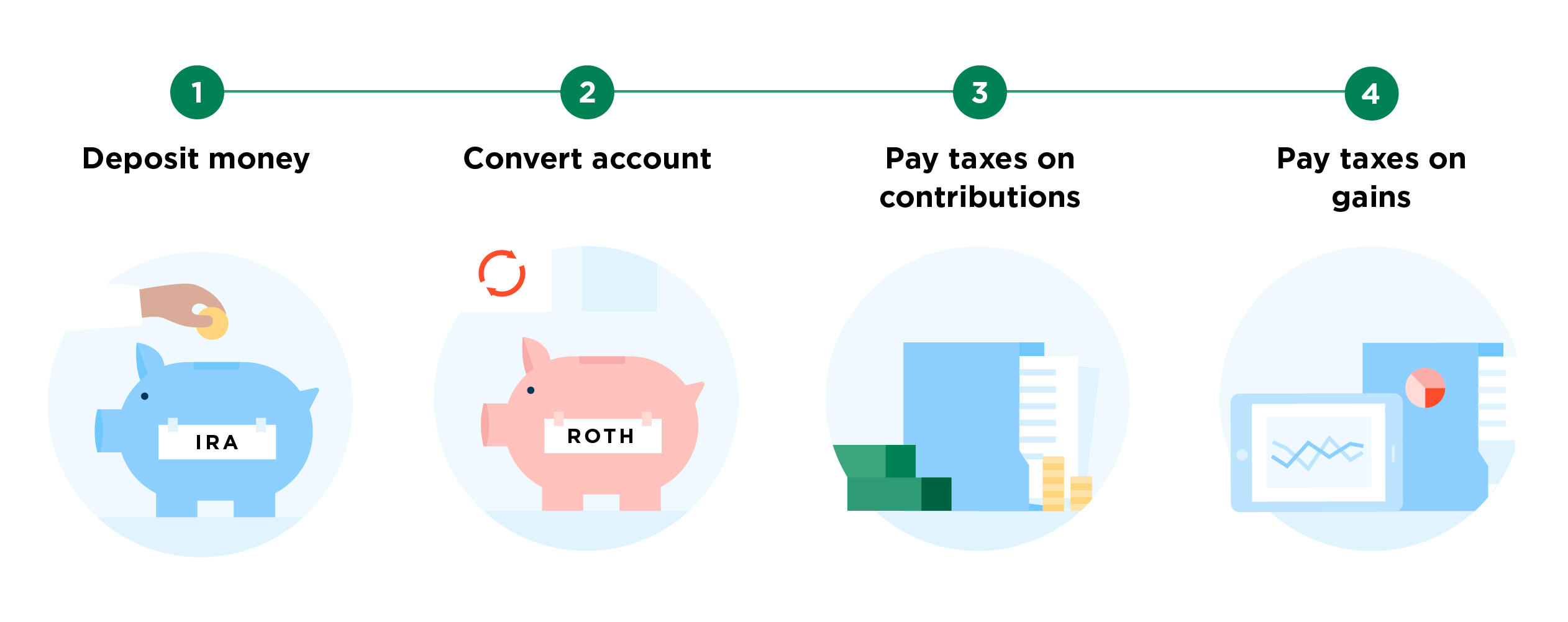

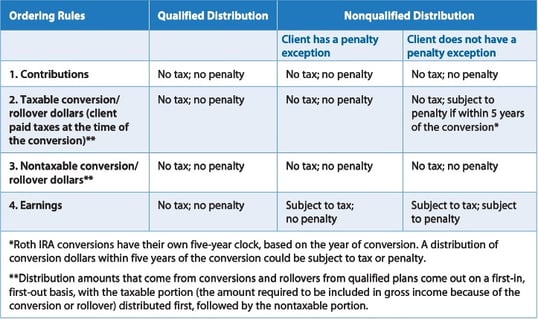

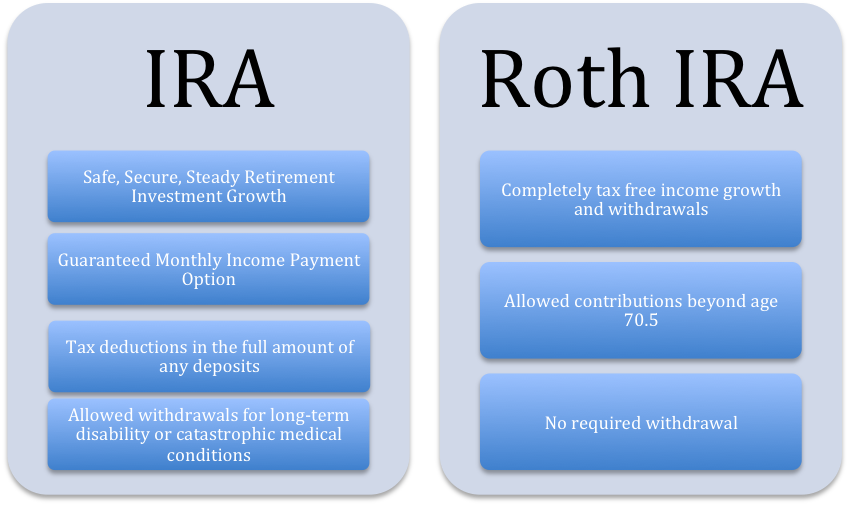

While there s no deduction for Roth IRA contributions qualified distributions from a Roth account are tax free Savers can also withdraw their original contributions on a tax free

The Does Ohio Tax Roth Ira Distributions have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: You can tailor printables to your specific needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: Printables for education that are free are designed to appeal to students of all ages, making them a valuable tool for parents and teachers.

-

An easy way to access HTML0: Access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Does Ohio Tax Roth Ira Distributions

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

But Roth IRA earnings are tax free only if they are part of a qualified distribution For interested parties the question becomes How does one know if a Roth

Since we've got your interest in Does Ohio Tax Roth Ira Distributions we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Does Ohio Tax Roth Ira Distributions to suit a variety of purposes.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs are a vast variety of topics, from DIY projects to planning a party.

Maximizing Does Ohio Tax Roth Ira Distributions

Here are some inventive ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Does Ohio Tax Roth Ira Distributions are a treasure trove of innovative and useful resources that cater to various needs and desires. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the vast array of Does Ohio Tax Roth Ira Distributions to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free printouts for commercial usage?

- It's determined by the specific terms of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables could be restricted regarding usage. Check the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home with an printer, or go to an in-store print shop to get higher quality prints.

-

What software must I use to open printables that are free?

- Most PDF-based printables are available in the PDF format, and is open with no cost software, such as Adobe Reader.

Roth IRA Withdrawal Rules Oblivious Investor

Are Roth Contributions Right For Me

Check more sample of Does Ohio Tax Roth Ira Distributions below

Qualified Vs Non Qualified Roth IRA Distributions

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Roth Ira Which Term Is Best Whats Apy

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

When Are Roth IRA Distributions Tax Free

https://tax.ohio.gov/wps/portal/gov/tax/help...

If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio However if your rollover results in recognizing income that is included

https://financeband.com/are-roth-ira-distributions-taxable-by-states

Roth IRA contributions aren t taxed because the contributions you make to them are usually made with after tax money and you can t deduct them Earnings in a

If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio However if your rollover results in recognizing income that is included

Roth IRA contributions aren t taxed because the contributions you make to them are usually made with after tax money and you can t deduct them Earnings in a

Roth Ira Which Term Is Best Whats Apy

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

When Are Roth IRA Distributions Tax Free

What Is A Roth IRA The Fancy Accountant

The Basics About The Roth IRA Blog hubcfo

The Basics About The Roth IRA Blog hubcfo

IRA And Roth IRA