In this digital age, with screens dominating our lives it's no wonder that the appeal of tangible printed objects hasn't waned. For educational purposes, creative projects, or just adding an element of personalization to your area, Does North Carolina Tax Federal Government Pensions can be an excellent source. For this piece, we'll dive to the depths of "Does North Carolina Tax Federal Government Pensions," exploring the benefits of them, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Does North Carolina Tax Federal Government Pensions Below

Does North Carolina Tax Federal Government Pensions

Does North Carolina Tax Federal Government Pensions - Does North Carolina Tax Federal Government Pensions, Does North Carolina Tax Federal Government Retirement, Does North Carolina Tax Government Pensions, Does North Carolina Tax Federal Retirement Income, Does Nc Tax Federal Pensions, Which States Do Not Tax Federal Government Pensions

As soon as you begin taking payments from your retirement accounts and pension funds the federal government will charge you an income tax Because this tax

Most standard 401 k IRA and other retirement account income is taxed at North Carolina s state income tax rate of 4 75 There are some exceptions to this rule though For instance the state s Bailey exemption allows

Printables for free cover a broad variety of printable, downloadable materials online, at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Does North Carolina Tax Federal Government Pensions

AskNC Why Does North Carolina Tax The Pensions Of Some Military

AskNC Why Does North Carolina Tax The Pensions Of Some Military

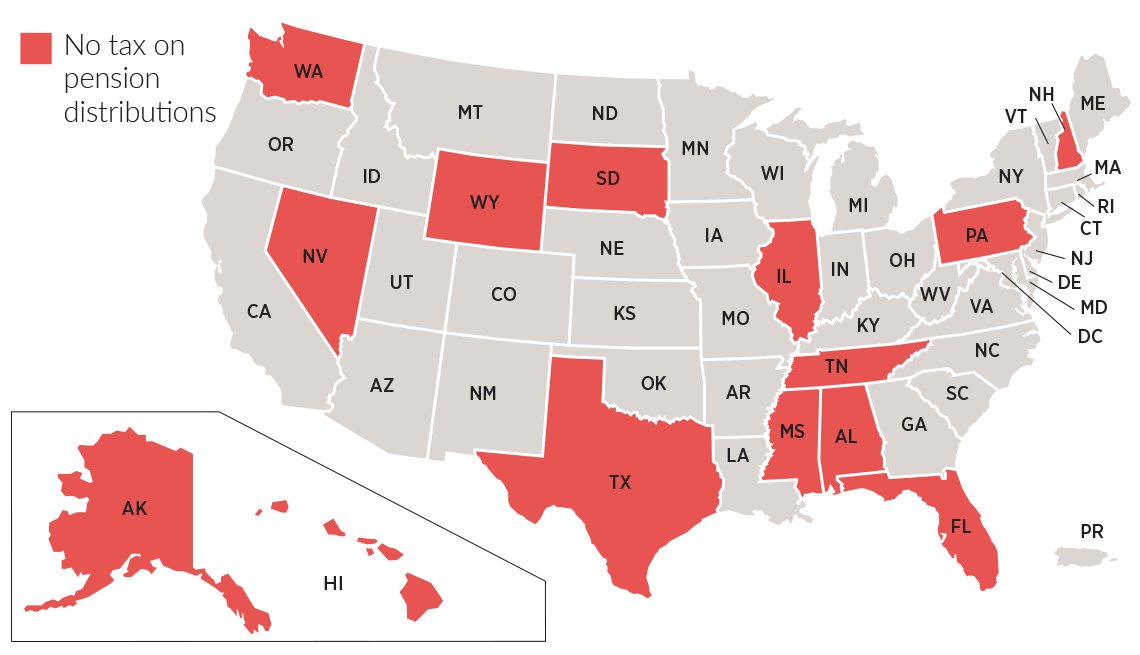

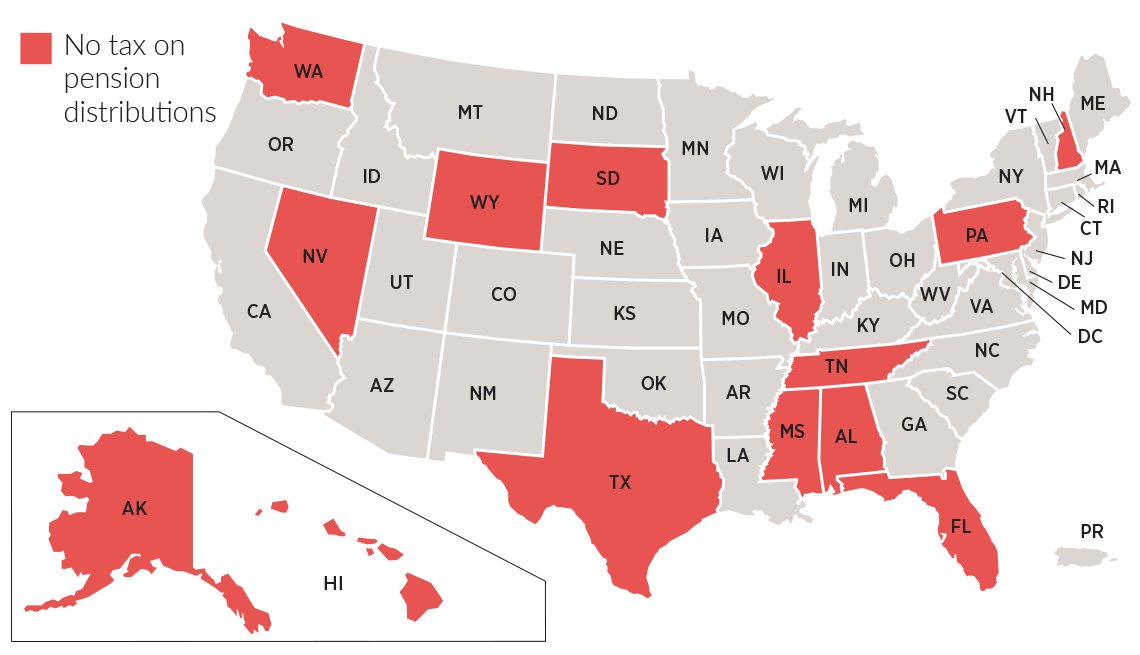

52 rowsHome Resources Retirement Information Pension Tax

In North Carolina all Social Security and Railroad Retirement benefits are exempt from state income taxes which is a great advantage for retirees relying on these sources of

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor printables to your specific needs whether you're designing invitations planning your schedule or decorating your home.

-

Educational Use: Free educational printables cater to learners of all ages, which makes them a great aid for parents as well as educators.

-

Convenience: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Does North Carolina Tax Federal Government Pensions

Government Pension Scheme Check Maximum Amount Limit Of Double Family

Government Pension Scheme Check Maximum Amount Limit Of Double Family

Federal Taxes Unless you specify a monthly withholding rate or amount for federal taxes your pension account will default to the rate of married with three allowances If you have already designated a withholding

Published 16 May 2017 Many states recognize federal retirees public service by specifically exempting federal government pensions from taxation or treating them more favorably than

We hope we've stimulated your interest in Does North Carolina Tax Federal Government Pensions Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Does North Carolina Tax Federal Government Pensions for all motives.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing Does North Carolina Tax Federal Government Pensions

Here are some unique ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Does North Carolina Tax Federal Government Pensions are an abundance of fun and practical tools for a variety of needs and hobbies. Their access and versatility makes these printables a useful addition to every aspect of your life, both professional and personal. Explore the wide world of Does North Carolina Tax Federal Government Pensions today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes they are! You can print and download these files for free.

-

Does it allow me to use free printables for commercial use?

- It's based on specific conditions of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may come with restrictions on usage. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print Does North Carolina Tax Federal Government Pensions?

- You can print them at home using either a printer or go to a print shop in your area for premium prints.

-

What software do I require to open printables at no cost?

- Many printables are offered in PDF format. These can be opened with free programs like Adobe Reader.

Federal Government Hotel Tax Exempt Form Virginia ExemptForm

Why The Federal Government Deficit Matters To You Abbotsford Today

Check more sample of Does North Carolina Tax Federal Government Pensions below

States That Tax Your Federal Government Pension Kiplinger

Which Of The Following Received Federal Government Pensions After The

Are North Carolina Retirement Taxes Affordable For Retirees

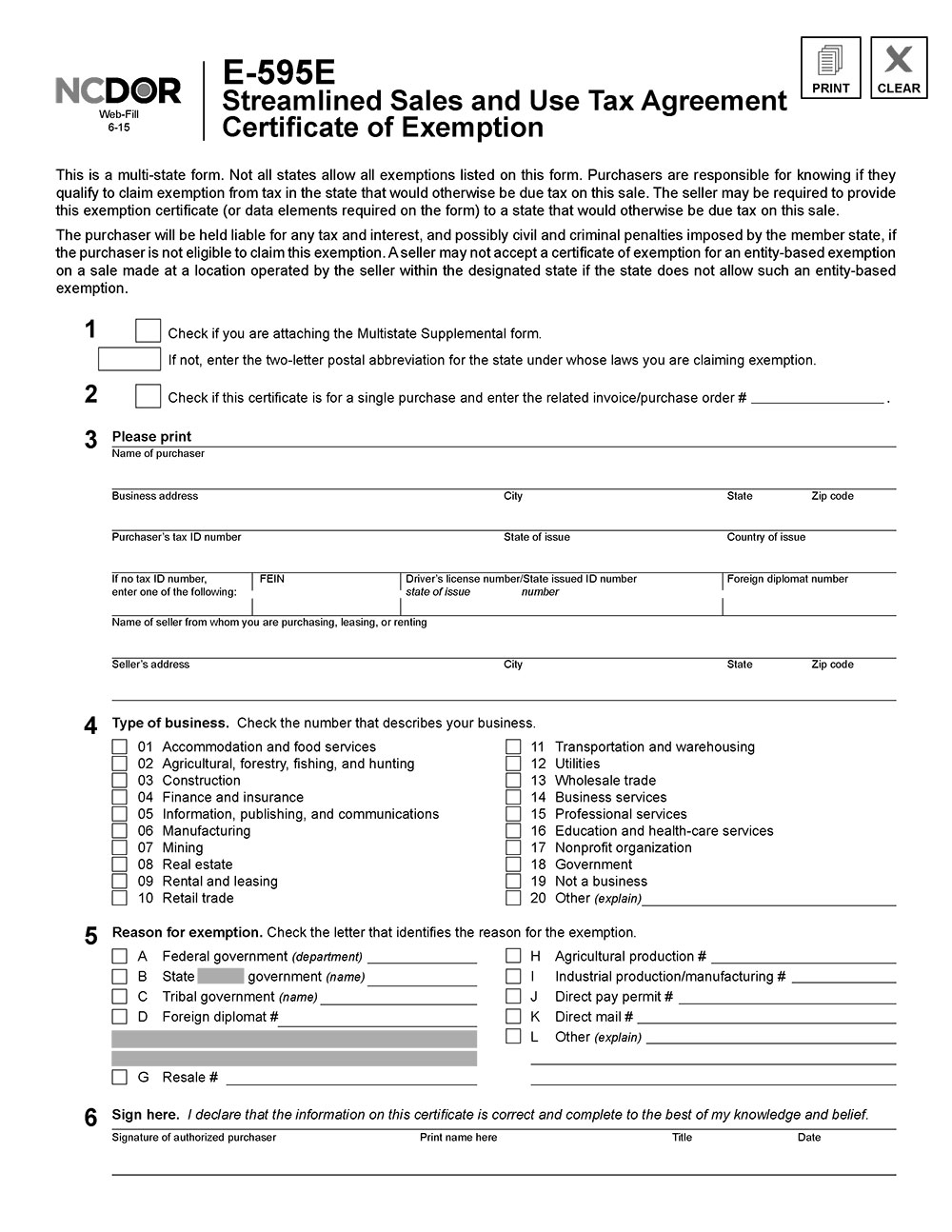

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

14 States Don t Tax Retirement Pension Payouts

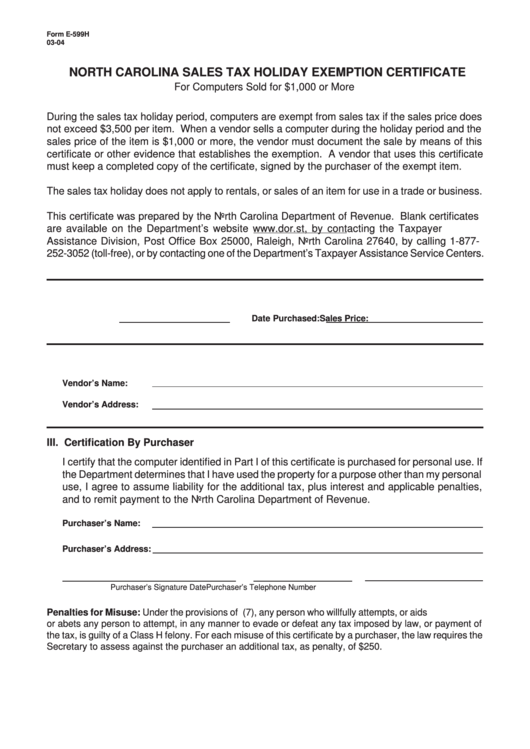

Form E 599h North Carolina Sales Tax Holiday Exemption Certificate

https://smartasset.com/retirement/north-carol…

Most standard 401 k IRA and other retirement account income is taxed at North Carolina s state income tax rate of 4 75 There are some exceptions to this rule though For instance the state s Bailey exemption allows

https://support.taxslayer.com/hc/en-us/articles/...

North Carolina cannot tax certain retirement benefits received by retirees or by

Most standard 401 k IRA and other retirement account income is taxed at North Carolina s state income tax rate of 4 75 There are some exceptions to this rule though For instance the state s Bailey exemption allows

North Carolina cannot tax certain retirement benefits received by retirees or by

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

Which Of The Following Received Federal Government Pensions After The

14 States Don t Tax Retirement Pension Payouts

Form E 599h North Carolina Sales Tax Holiday Exemption Certificate

Resale Certificate Nc Ten Quick Tips Regarding Resale

Exploring Diaper Production In North Carolina A Look At The Different

Exploring Diaper Production In North Carolina A Look At The Different

How Should North Carolina Slice The Tax Revenue Pie The Perfect And