In this day and age where screens rule our lives and the appeal of physical printed materials isn't diminishing. For educational purposes such as creative projects or simply to add personal touches to your area, Does Indiana Tax 401k Distributions are now an essential resource. The following article is a take a dive deep into the realm of "Does Indiana Tax 401k Distributions," exploring what they are, how you can find them, and how they can improve various aspects of your lives.

Get Latest Does Indiana Tax 401k Distributions Below

Does Indiana Tax 401k Distributions

Does Indiana Tax 401k Distributions - Does Indiana Tax 401k Distributions, Do You Pay Taxes On 401k Distributions, Indiana Tax Rate On 401k Withdrawal, Which States Tax 401k Distributions

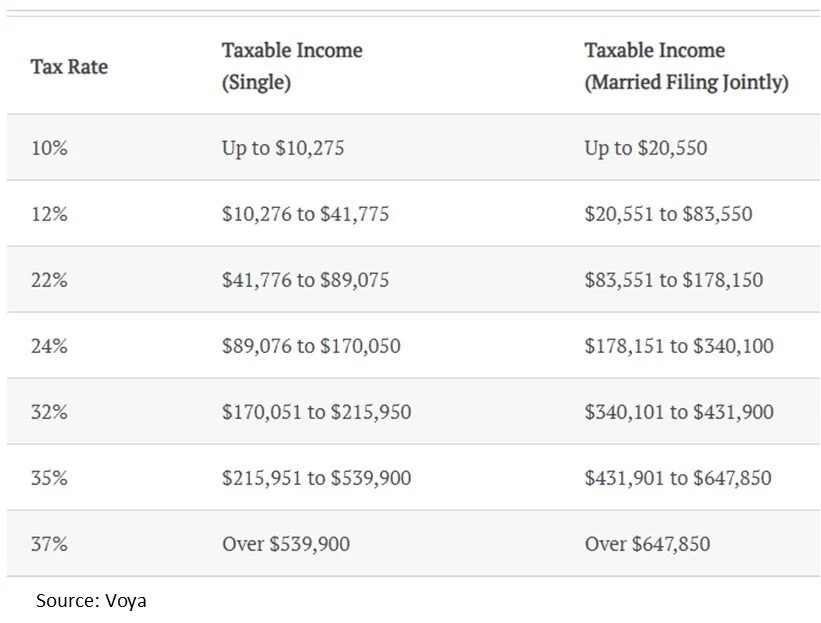

As detailed in our thorough Indiana Retirement Tax Friendliness Guide the state of Indiana is moderately tax friendly toward its retirees Indiana doesn t tax Social Security But it does fully tax

Pension income 401 k income IRA income and income from any other retirement

Printables for free cover a broad array of printable material that is available online at no cost. These resources come in many types, like worksheets, coloring pages, templates and much more. The benefit of Does Indiana Tax 401k Distributions is their flexibility and accessibility.

More of Does Indiana Tax 401k Distributions

Tax Credits StateImpact Idaho

Tax Credits StateImpact Idaho

This general information is provided to help you understand state income tax withholding

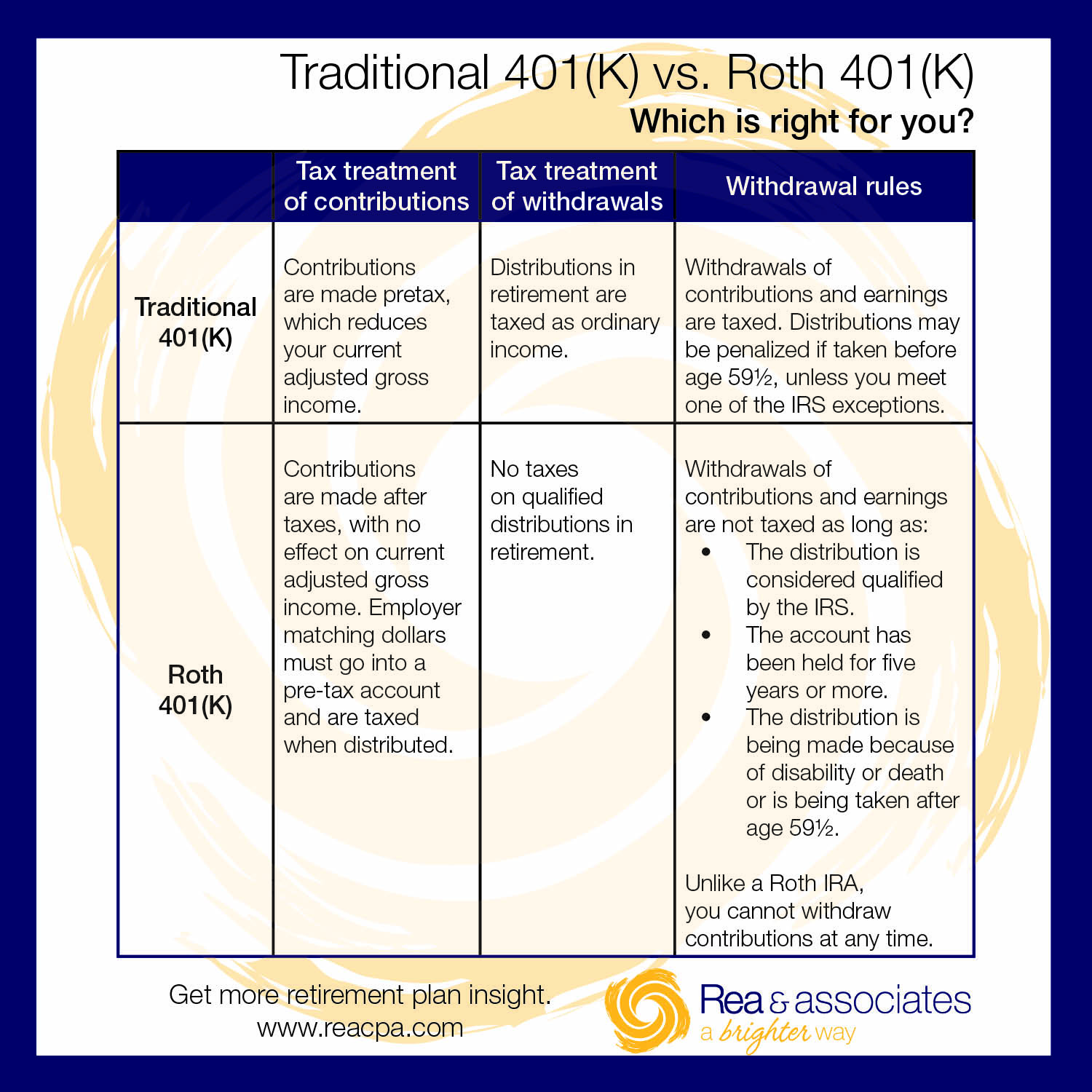

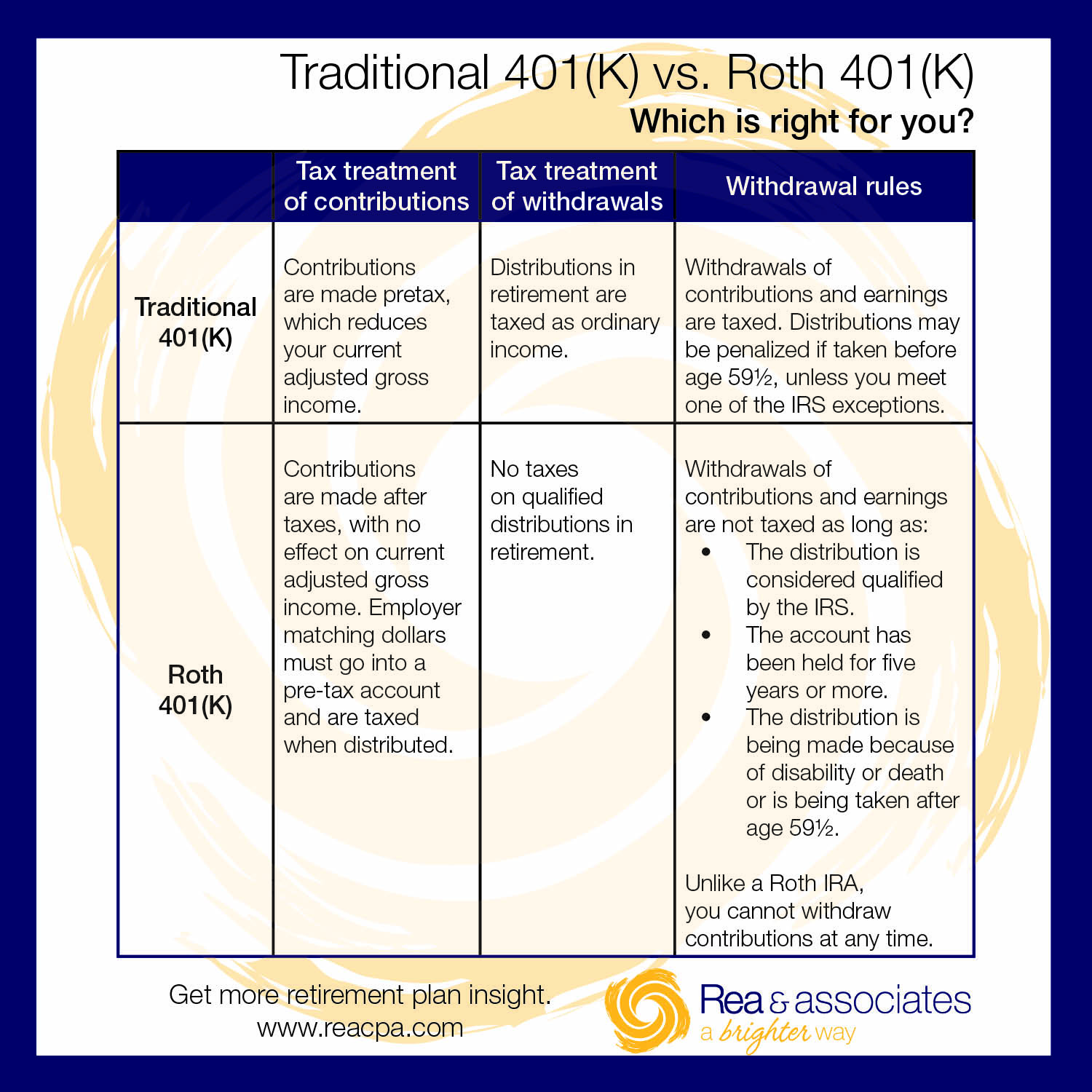

Withdrawals of contributions and earnings are taxed Distributions may be penalized if taken before age 59 unless you meet one of the IRS exceptions

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: We can customize the design to meet your needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Impact: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a great aid for parents as well as educators.

-

Simple: Instant access to the vast array of design and templates can save you time and energy.

Where to Find more Does Indiana Tax 401k Distributions

What You Need To Know About After Tax 401K Contributions Fleishel

What You Need To Know About After Tax 401K Contributions Fleishel

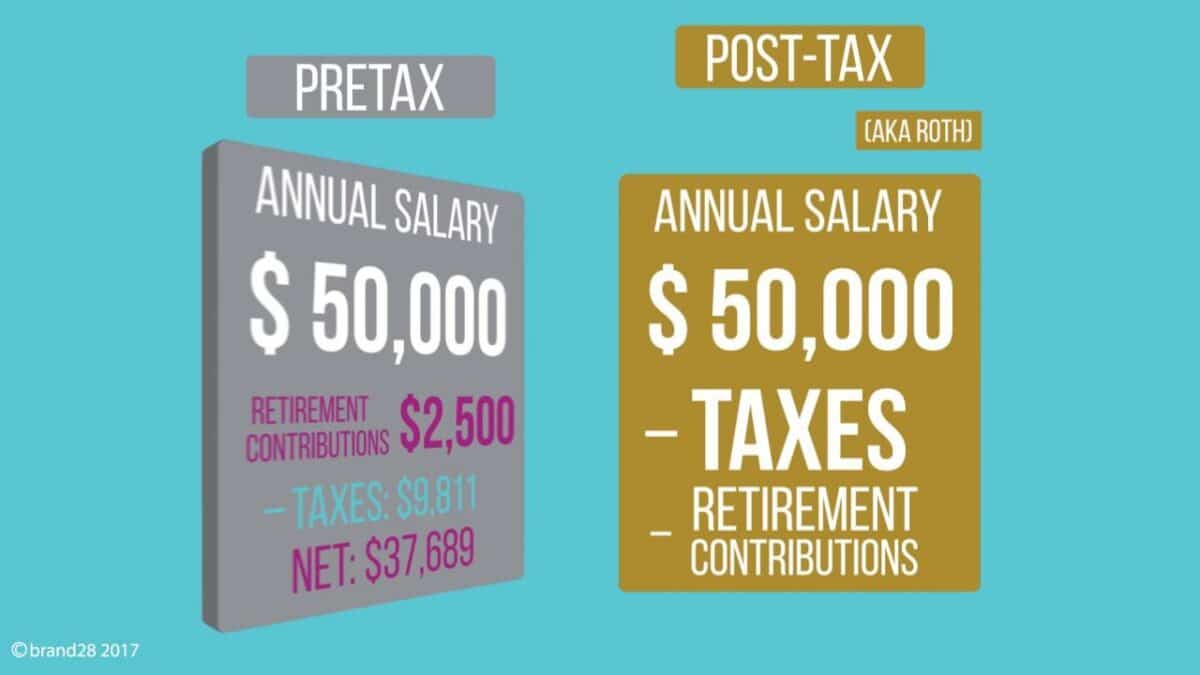

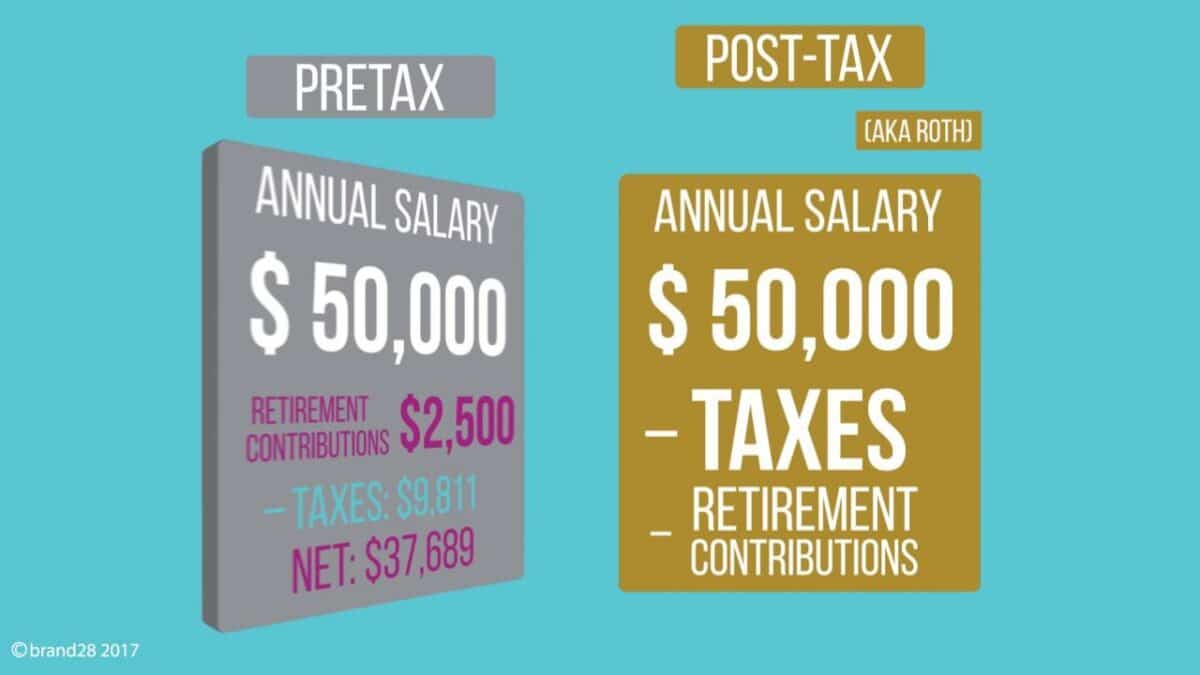

So if these deductions aren t taxed at the time of entering your 401 k

Taxes in Retirement How All 50 States Tax Retirees Provides an overview of how income from employment investments a pension retirement distributions and Social Security are taxed in

We've now piqued your interest in printables for free Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Does Indiana Tax 401k Distributions suitable for many applications.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Does Indiana Tax 401k Distributions

Here are some ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Does Indiana Tax 401k Distributions are an abundance of innovative and useful resources that satisfy a wide range of requirements and interests. Their access and versatility makes them a wonderful addition to both professional and personal lives. Explore the vast collection of Does Indiana Tax 401k Distributions today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these tools for free.

-

Does it allow me to use free printables for commercial use?

- It is contingent on the specific terms of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables might have limitations on use. Check the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using printing equipment or visit an in-store print shop to get more high-quality prints.

-

What software do I need to run printables free of charge?

- The majority of printables are as PDF files, which is open with no cost software like Adobe Reader.

After Tax 401 k Contribution Definition Pros Cons Rollover

AFTER TAX 401K EXPLAINED How Roth And After tax 401 K Retirement

Check more sample of Does Indiana Tax 401k Distributions below

Difference Between Before Tax And After Tax 401K Difference Guru

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

Neat What Is Non Standard 1099 r A Chronological Report About Tigers

Pre Tax Vs After Tax 401k Roth Or Traditional Investdale

Roth Vs Traditional 401 K Retirement Ohio CPA Firm Rea CPA

The Complete Guide To 401 k Corrective Distributions

https://smartasset.com/retirement/indiana-retirement-taxes

Pension income 401 k income IRA income and income from any other retirement

https://personal.vanguard.com/pdf/sarpsc.pdf

All rights reserved SARPSC 102023 Vermont Virginia Eligible rollover distributions 30

Pension income 401 k income IRA income and income from any other retirement

All rights reserved SARPSC 102023 Vermont Virginia Eligible rollover distributions 30

Pre Tax Vs After Tax 401k Roth Or Traditional Investdale

Cares Act 401k Withdrawal Taxes Calculator FayezTarran

Roth Vs Traditional 401 K Retirement Ohio CPA Firm Rea CPA

The Complete Guide To 401 k Corrective Distributions

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k

After Tax 401K Rollover To Roth Ira Oncom Id Project

After Tax 401K Rollover To Roth Ira Oncom Id Project

The MAGIC Of Pre tax Dollars BRIO Financial Planning