In this age of electronic devices, when screens dominate our lives, the charm of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an individual touch to your space, Does Federal Tax Retirement Income are now a vital source. For this piece, we'll take a dive into the world of "Does Federal Tax Retirement Income," exploring what they are, where they can be found, and how they can enrich various aspects of your lives.

Get Latest Does Federal Tax Retirement Income Below

Does Federal Tax Retirement Income

Does Federal Tax Retirement Income - Does Federal Tax Retirement Income, Does Irs Tax Retirement Income, Does Federal Tax Pension Income, Does Federal Government Tax Retirement Income, Does Irs Tax Pension Income, Does Alabama Tax Federal Retirement Income, Does Louisiana Tax Federal Retirement Income, Does Missouri Tax Federal Retirement Income, Does Virginia Tax Federal Retirement Income, Does Hawaii Tax Federal Retirement Income

Report your pension and annuity income Report your civil service retirement income Are my wages exempt from federal income tax withholding

Interest Bearing Accounts Interest payments are taxed at ordinary income rates but municipal bond interest is exempt from federal tax and may be exempt from

The Does Federal Tax Retirement Income are a huge assortment of printable, downloadable documents that can be downloaded online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and much more. The appealingness of Does Federal Tax Retirement Income is their flexibility and accessibility.

More of Does Federal Tax Retirement Income

37 States That Don t Tax Social Security Benefits The Motley Fool

37 States That Don t Tax Social Security Benefits The Motley Fool

Retirees with high amounts of monthly pension income will likely pay taxes on 85 of their Social Security benefits and their total tax rate might run as high as 37 Retirees with almost no income other

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your depends on your income level If you have other sources of retirement income

Does Federal Tax Retirement Income have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization They can make print-ready templates to your specific requirements when it comes to designing invitations making your schedule, or decorating your home.

-

Educational Value: Downloads of educational content for free can be used by students of all ages, making them a vital device for teachers and parents.

-

Simple: Fast access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Does Federal Tax Retirement Income

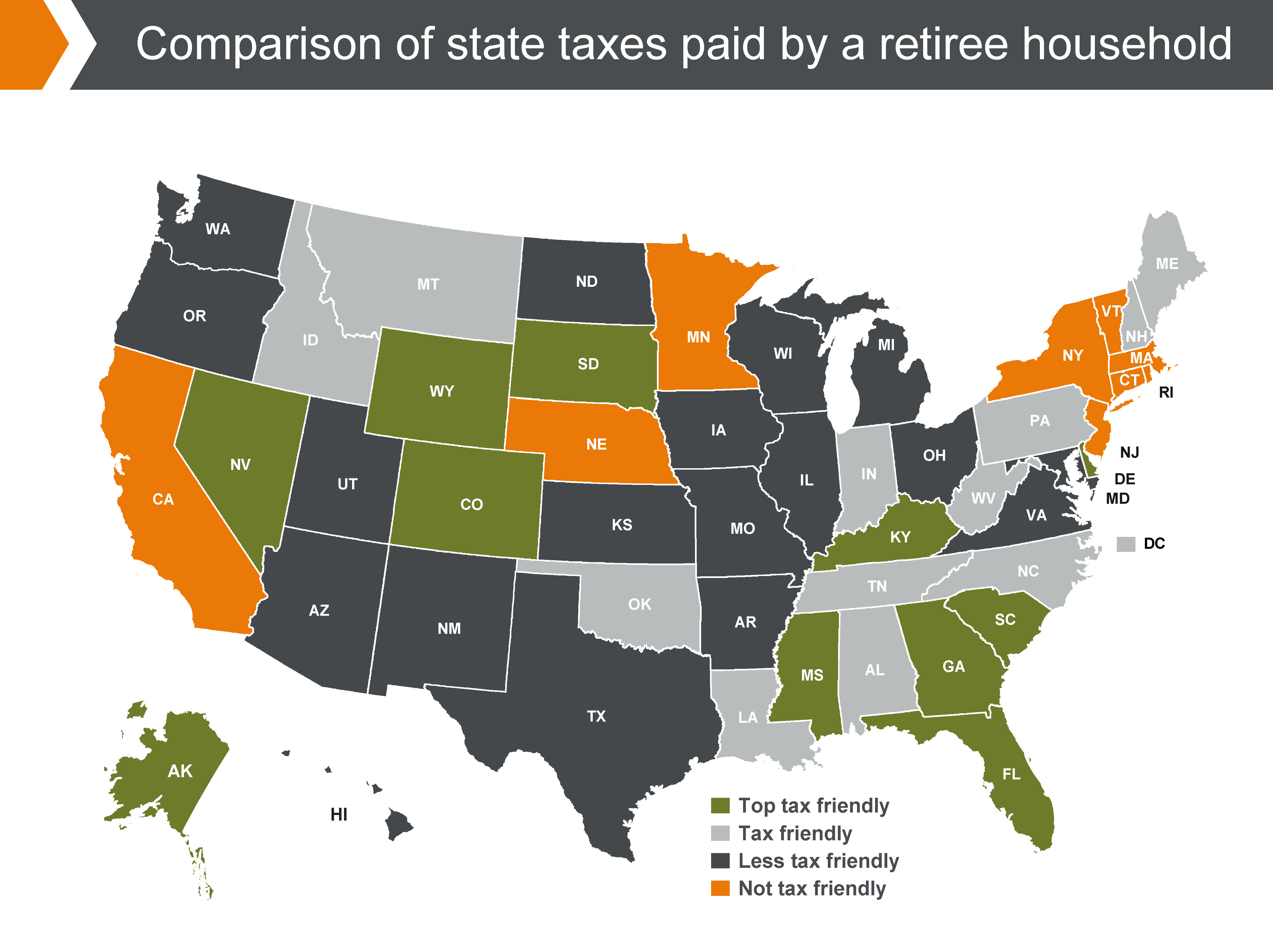

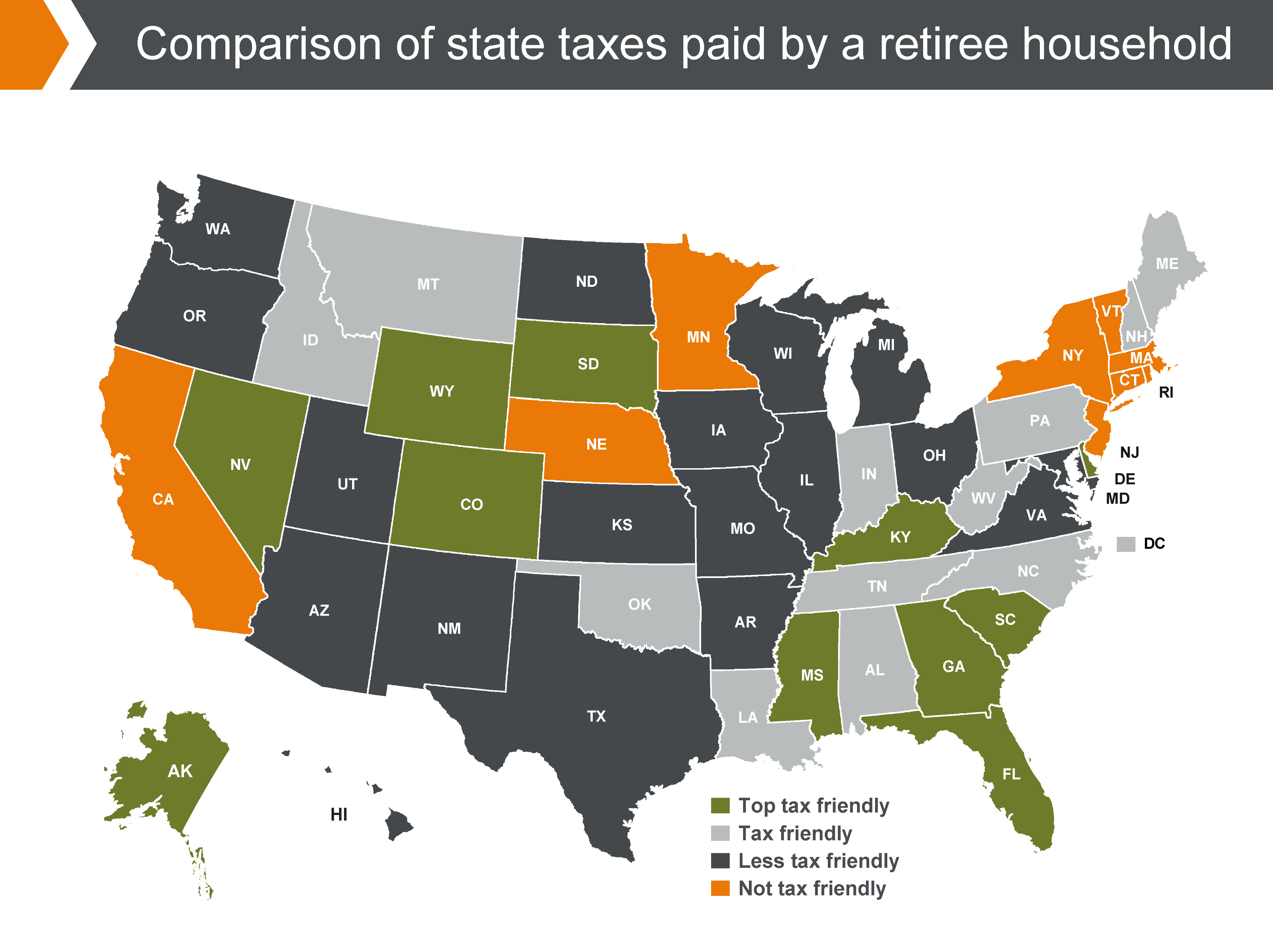

State by State Guide To Taxes On Retirees Retirement Retirement

State by State Guide To Taxes On Retirees Retirement Retirement

The types of income which are taxable include but are not limited to military retirement pay all or part of pensions and annuities all or part of Individual Retirement Accounts

Federal Tax Rates for Different Types of Retirement Income Federal tax rates vary by income type and level It s important to evaluate what each type of income

After we've peaked your curiosity about Does Federal Tax Retirement Income and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Does Federal Tax Retirement Income for different motives.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free including flashcards, learning tools.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide range of interests, that range from DIY projects to planning a party.

Maximizing Does Federal Tax Retirement Income

Here are some ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Does Federal Tax Retirement Income are a treasure trove of practical and innovative resources that meet a variety of needs and desires. Their accessibility and flexibility make them a fantastic addition to each day life. Explore the vast collection of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these resources at no cost.

-

Can I use free templates for commercial use?

- It's all dependent on the conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may contain restrictions in use. Always read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer at home or in the local print shop for higher quality prints.

-

What program do I need to run printables that are free?

- Most PDF-based printables are available in the format of PDF, which can be opened using free programs like Adobe Reader.

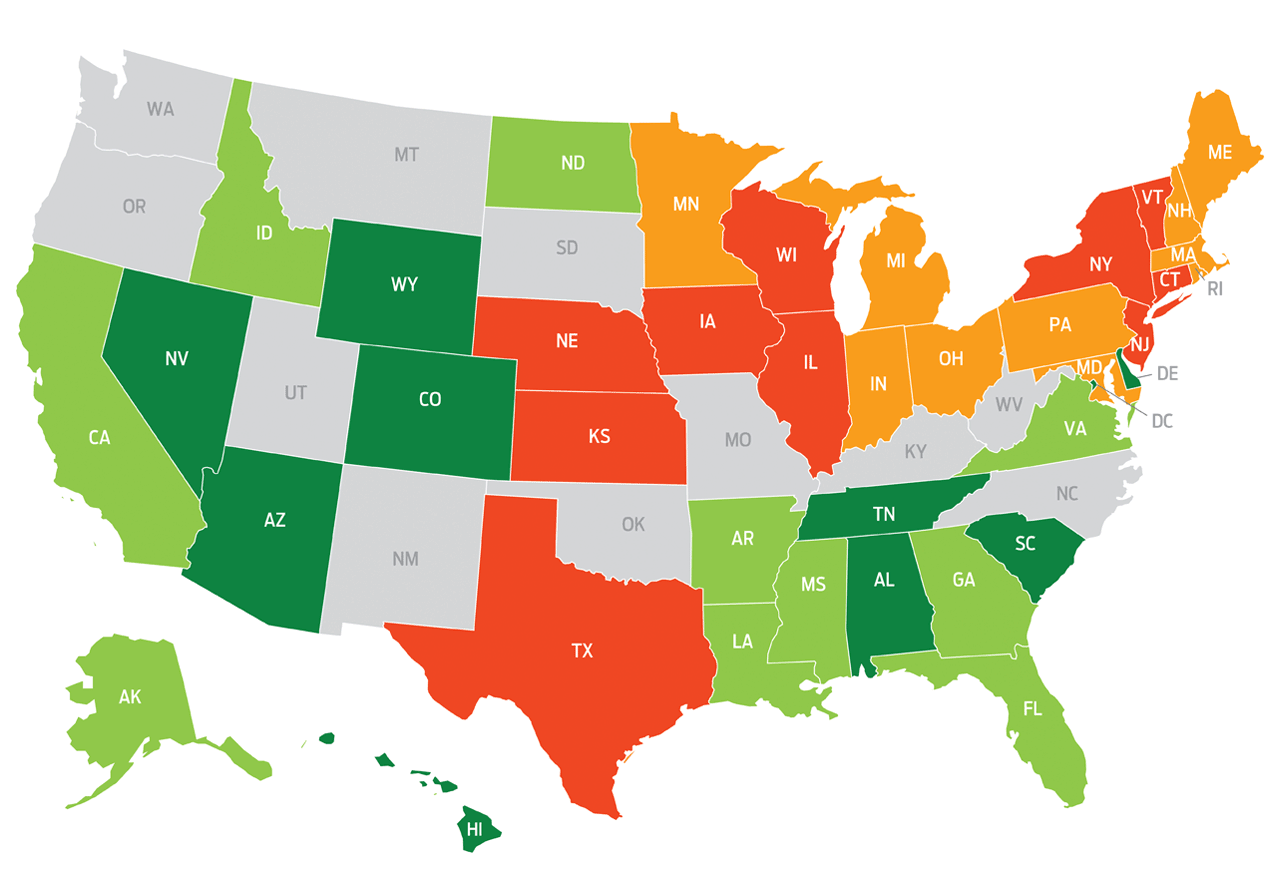

Every State With A Progressive Tax Also Taxes Retirement Income

7 States That Do Not Tax Retirement Income

Check more sample of Does Federal Tax Retirement Income below

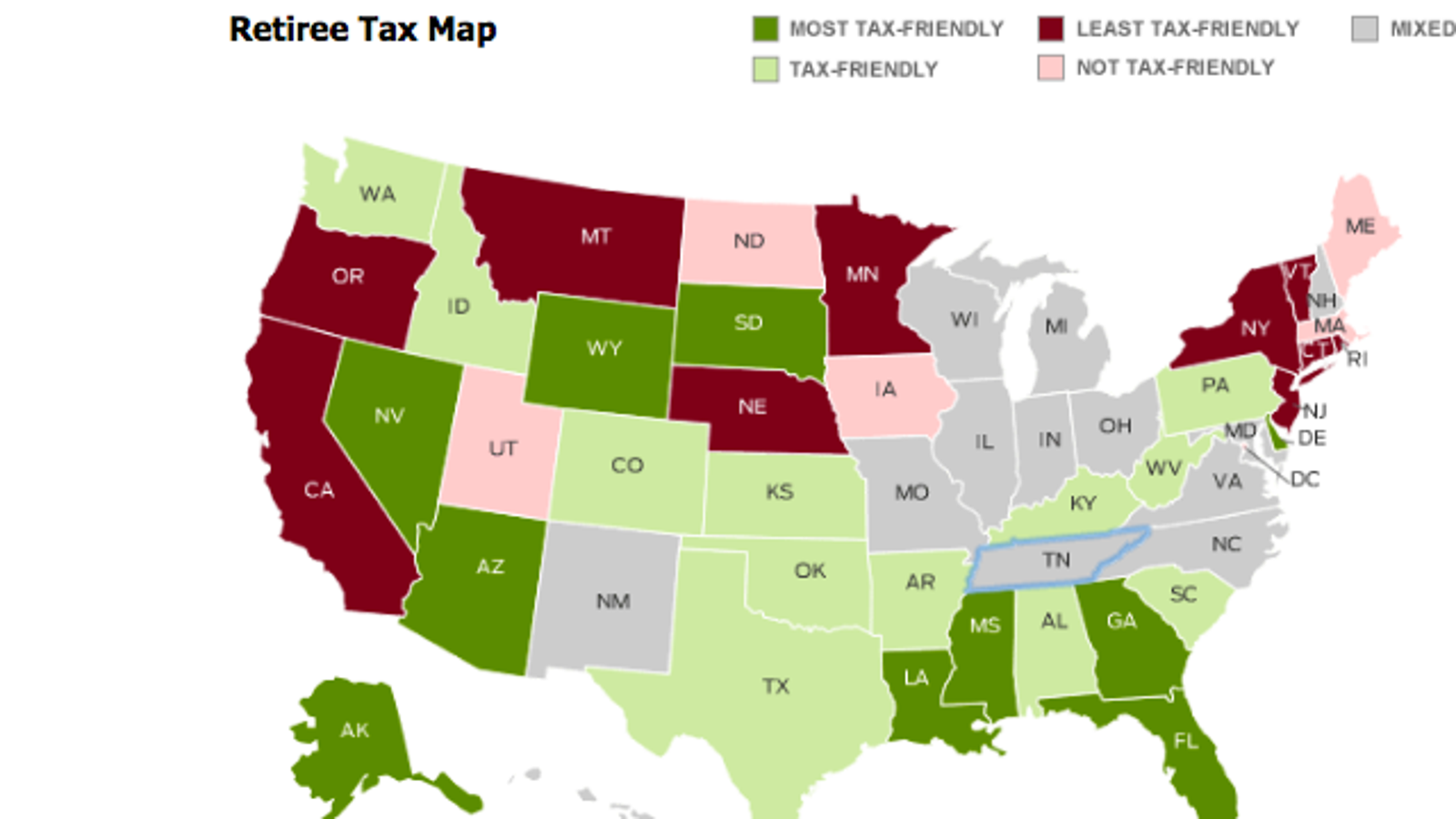

States That Won t Tax Your Retirement Distributions In 2021

States With The Highest and Lowest Taxes For Retirees Money

The Most Tax Friendly States For Retirement

Tax Information

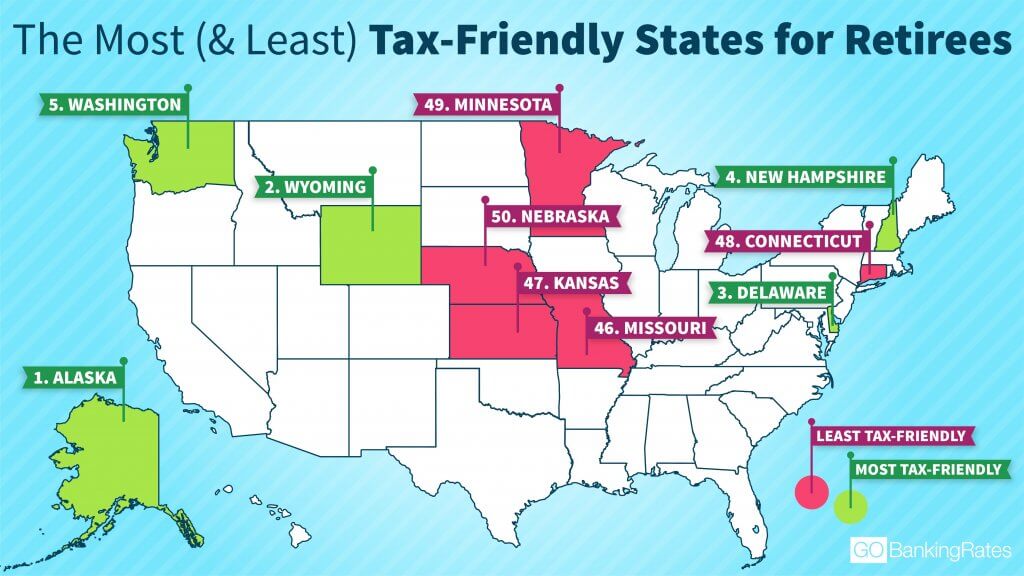

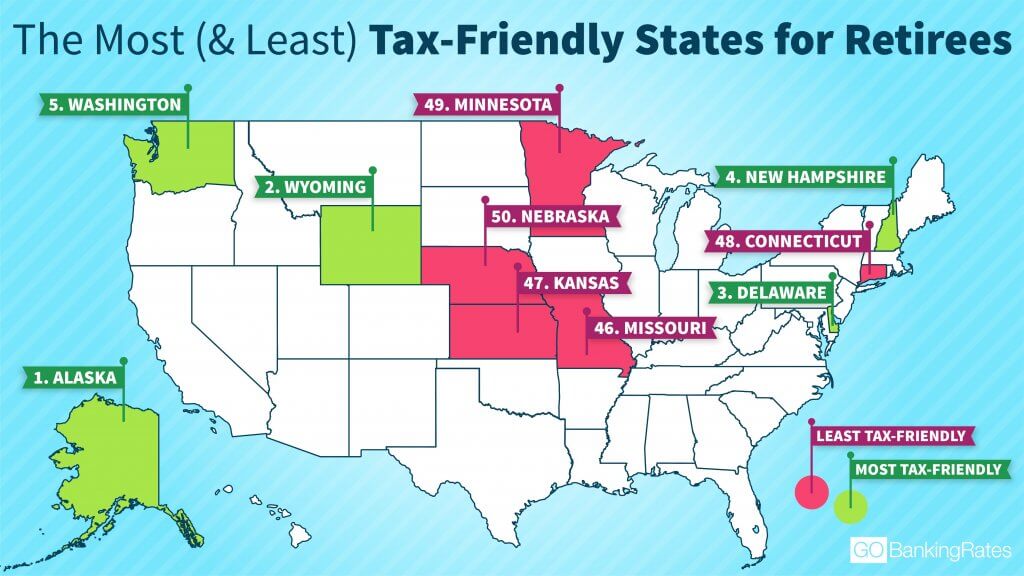

Want To Avoid High Taxes Retire In One Of These 10 States GOBankingRates

Pay Less Retirement Taxes

https://www.kiplinger.com/taxes/how-retirement-income-is-taxed

Interest Bearing Accounts Interest payments are taxed at ordinary income rates but municipal bond interest is exempt from federal tax and may be exempt from

https://www.kiplinger.com/taxes/how-is-retirement-income-taxed

The U S tax laws consider most forms of retirement income fair game including Social Security benefits pensions and withdrawals from your 401 k s and

Interest Bearing Accounts Interest payments are taxed at ordinary income rates but municipal bond interest is exempt from federal tax and may be exempt from

The U S tax laws consider most forms of retirement income fair game including Social Security benefits pensions and withdrawals from your 401 k s and

Tax Information

States With The Highest and Lowest Taxes For Retirees Money

Want To Avoid High Taxes Retire In One Of These 10 States GOBankingRates

Pay Less Retirement Taxes

This Map Shows The Best And Worst States For Retirement In 2019 Www

15 States That Don t Tax Retirement Income Pensions Social Security

15 States That Don t Tax Retirement Income Pensions Social Security

How Federal Income Tax Rates Work Full Report Tax Policy Center