In the age of digital, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses in creative or artistic projects, or simply adding an extra personal touch to your home, printables for free are now a useful source. The following article is a dive into the sphere of "Does 401k Contribution Reduce Federal Taxable Income," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your lives.

Get Latest Does 401k Contribution Reduce Federal Taxable Income Below

Does 401k Contribution Reduce Federal Taxable Income

Does 401k Contribution Reduce Federal Taxable Income - Does 401k Contribution Reduce Federal Taxable Income, How Much Does 401k Contribution Reduce Taxes, Does 401k Reduce Taxable Income, What Taxes Are Reduced By 401k Contributions

As a result a 401 k contribution of 5 of your salary lowers your taxable income by 2 000 to 38 000 In turn you ll owe only 4 340 in federal income tax compared to the 4 580 you d owe if you didn t contribute anything to your 401 k and paid taxes on your full salary That equates to a tax savings of 240

For example if your annual salary is 50 000 and you contribute 5 000 to your 401 k your taxable income will be reduced to 45 000 This means you will owe less in income taxes potentially putting you in a lower tax

Printables for free cover a broad range of downloadable, printable resources available online for download at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and more. The benefit of Does 401k Contribution Reduce Federal Taxable Income is in their variety and accessibility.

More of Does 401k Contribution Reduce Federal Taxable Income

Gross Income Vs Federal Taxable Gross Finance Zacks

Gross Income Vs Federal Taxable Gross Finance Zacks

Bottom Line When it comes to tax planning understanding how 401 k contributions impact AGI is essential Lowering your AGI may reduce your tax bill and could increase your eligibility for various tax benefits

Do You Pay Tax on 401 k Contributions A 401 k is a tax deferred account That means you do not pay income taxes when you contribute money Instead your employer withholds your contribution from your paycheck before the money can be subjected to income tax

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Individualization We can customize printing templates to your own specific requirements be it designing invitations or arranging your schedule or even decorating your house.

-

Educational Use: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a vital source for educators and parents.

-

Simple: Instant access to a variety of designs and templates reduces time and effort.

Where to Find more Does 401k Contribution Reduce Federal Taxable Income

How Much Does 401k Contribution Reduce Taxes Calculator The Tech Edvocate

How Much Does 401k Contribution Reduce Taxes Calculator The Tech Edvocate

Boosting your 401 k contributions lowers your adjusted gross income while padding your retirement savings You can funnel 20 500 into your 401 k for 2022 up from 19 500 in 2021 and

Since 401 k contributions are pre tax the more money you put into your 401 k the more you can reduce your taxable income By increasing your contributions by just 1 you can reduce your overall taxable income all while building your retirement savings even more

In the event that we've stirred your interest in Does 401k Contribution Reduce Federal Taxable Income we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Does 401k Contribution Reduce Federal Taxable Income for all motives.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets with flashcards and other teaching tools.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing Does 401k Contribution Reduce Federal Taxable Income

Here are some inventive ways for you to get the best use of Does 401k Contribution Reduce Federal Taxable Income:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Does 401k Contribution Reduce Federal Taxable Income are a treasure trove with useful and creative ideas that cater to various needs and passions. Their access and versatility makes them an essential part of each day life. Explore the many options of Does 401k Contribution Reduce Federal Taxable Income today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Does 401k Contribution Reduce Federal Taxable Income really absolutely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use free printables in commercial projects?

- It's based on the conditions of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted concerning their use. Check the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using any printer or head to any local print store for more high-quality prints.

-

What program do I need to run printables free of charge?

- The majority are printed in the format of PDF, which is open with no cost software like Adobe Reader.

Max Tsp Contribution 2020 2020 401 k Contribution Limits 2019 12 15

Do RRSP Contributions Reduce Taxable Income

Check more sample of Does 401k Contribution Reduce Federal Taxable Income below

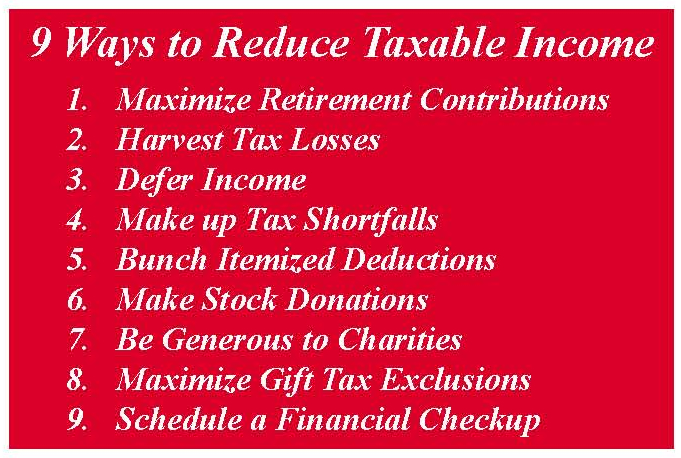

9 Ways To Reduce Taxable Income This Year Smedley Financial Blog

401k Reduce Taxable Income Calculator ArmaanHakeem

When You Contribute To A Roth 401 k The Contribution Won t Lower Your

Social Security Cost Of Living Adjustments 2023

Simulador De Taxes 2023 Irs 401k IMAGESEE

How To Reduce Your Taxable Income Pay 0 In Taxes Millers On Fire

https://livewell.com/finance/how-much-does...

For example if your annual salary is 50 000 and you contribute 5 000 to your 401 k your taxable income will be reduced to 45 000 This means you will owe less in income taxes potentially putting you in a lower tax

https://turbotax.intuit.com/tax-tips/investments...

Money pulled from your take home pay and put into a 401 k lowers your taxable income so you pay less income tax now For example let s assume your salary is 35 000 and your tax bracket is 25 When you contribute 6 of your salary into a tax deferred 401 k 2 100 your taxable income is reduced to 32 900

For example if your annual salary is 50 000 and you contribute 5 000 to your 401 k your taxable income will be reduced to 45 000 This means you will owe less in income taxes potentially putting you in a lower tax

Money pulled from your take home pay and put into a 401 k lowers your taxable income so you pay less income tax now For example let s assume your salary is 35 000 and your tax bracket is 25 When you contribute 6 of your salary into a tax deferred 401 k 2 100 your taxable income is reduced to 32 900

Social Security Cost Of Living Adjustments 2023

401k Reduce Taxable Income Calculator ArmaanHakeem

Simulador De Taxes 2023 Irs 401k IMAGESEE

How To Reduce Your Taxable Income Pay 0 In Taxes Millers On Fire

How Does 401k Work 401k Plan 401k Login Www 401k Fidelity 401k

2018 Vs 2017 Roth IRA Contribution And Income Limits Plus Conversion

2018 Vs 2017 Roth IRA Contribution And Income Limits Plus Conversion

2012 401K IRA And Roth IRA Contribution And Income Deduction Limits