In this age of electronic devices, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. No matter whether it's for educational uses project ideas, artistic or simply to add an extra personal touch to your home, printables for free are a great resource. This article will take a dive through the vast world of "Do You Pay Social Security Tax On 401k Withdrawals," exploring the benefits of them, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Do You Pay Social Security Tax On 401k Withdrawals Below

Do You Pay Social Security Tax On 401k Withdrawals

Do You Pay Social Security Tax On 401k Withdrawals - Do You Pay Social Security Tax On 401k Withdrawals, Do You Pay Social Security Tax On 401k Distributions, Do You Have To Pay Social Security Tax On 401k Withdrawals, Do You Pay Social Security And Medicare Tax On 401k Withdrawals, Do You Pay Social Security And Medicare Tax On 401k Distributions, Do I Need To Pay Social Security Tax On 401k Withdrawal

Financial Advisors Banking How to Avoid Taxes on Your 401 k Withdrawals A 401 k plan is a powerful tax advantaged tool for retirement savers Employer matches offered by some plans make them

So no you don t have to pay payroll FICA Social Security taxes on your early withdrawal As for the penalty that is basically an extra tax so if you withdraw

Do You Pay Social Security Tax On 401k Withdrawals offer a wide collection of printable documents that can be downloaded online at no cost. They come in many types, like worksheets, coloring pages, templates and more. The value of Do You Pay Social Security Tax On 401k Withdrawals is their flexibility and accessibility.

More of Do You Pay Social Security Tax On 401k Withdrawals

13 Things You Need To Know About Social Security Vision Retirement

13 Things You Need To Know About Social Security Vision Retirement

You still have to pay some FICA taxes Medicare and Social Security on your payroll contributions to a 401 k

One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert those funds to a Roth 401 k or a Roth individual

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: It is possible to tailor designs to suit your personal needs whether it's making invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Printables for education that are free can be used by students of all ages, making these printables a powerful tool for parents and teachers.

-

It's easy: Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Do You Pay Social Security Tax On 401k Withdrawals

Social Security Benefit Taxes By State 13 States Might Tax Benefits

Social Security Benefit Taxes By State 13 States Might Tax Benefits

But no you don t pay taxes twice on 401 k withdrawals With the 20 withholding on your distribution you re essentially paying part of your taxes upfront Depending on your tax situation the amount withheld might not

401 k s offer an upfront tax break or a tax break in retirement depending on whether you have a traditional 401 k or a Roth 401 k Under the Secure Act 2 0 rules

Now that we've ignited your interest in Do You Pay Social Security Tax On 401k Withdrawals, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Do You Pay Social Security Tax On 401k Withdrawals designed for a variety purposes.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- The blogs are a vast range of interests, everything from DIY projects to planning a party.

Maximizing Do You Pay Social Security Tax On 401k Withdrawals

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Do You Pay Social Security Tax On 401k Withdrawals are a treasure trove of fun and practical tools designed to meet a range of needs and desires. Their accessibility and flexibility make these printables a useful addition to any professional or personal life. Explore the many options of Do You Pay Social Security Tax On 401k Withdrawals today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes they are! You can print and download these items for free.

-

Can I utilize free printables in commercial projects?

- It's based on specific rules of usage. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright violations with Do You Pay Social Security Tax On 401k Withdrawals?

- Some printables may have restrictions on usage. Be sure to review the terms and conditions offered by the creator.

-

How do I print Do You Pay Social Security Tax On 401k Withdrawals?

- You can print them at home with either a printer at home or in a local print shop to purchase better quality prints.

-

What program do I need in order to open printables for free?

- A majority of printed materials are in the PDF format, and can be opened using free programs like Adobe Reader.

Tax Payment Which States Have No Income Tax Marca

Social Security GuangGurpage

Check more sample of Do You Pay Social Security Tax On 401k Withdrawals below

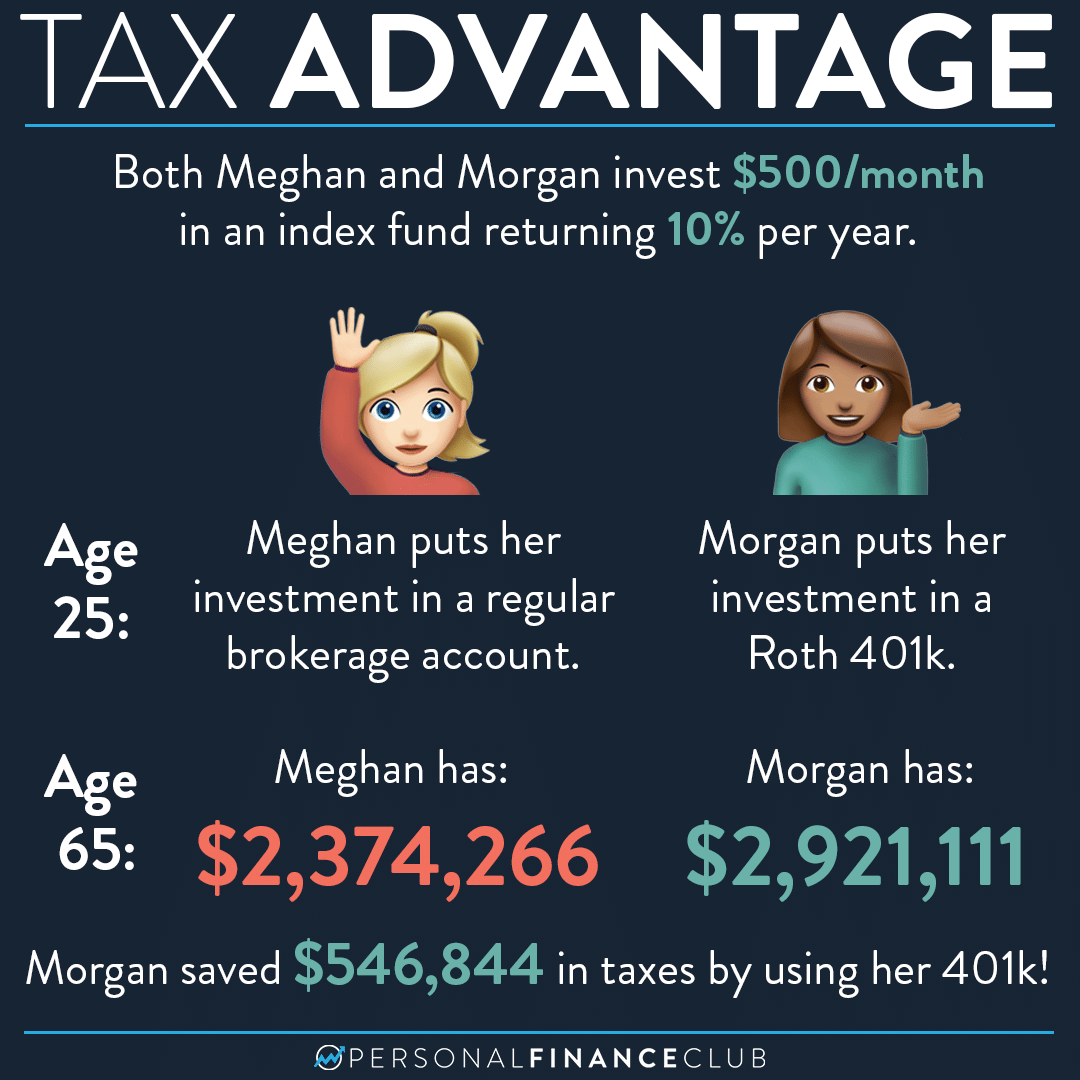

Here s How Much Money You Can Save On Taxes With A Roth 401k Personal

Pay Social Security Contributions Via E payment Of GSB Mekha News

Social Security Tax Increase In 2023 City Of Loogootee

Social Security s Never Beneficiaries Social Security Intelligence

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

Social Security Cost Of Living Adjustments 2023

https://money.stackexchange.com/questions/55170

So no you don t have to pay payroll FICA Social Security taxes on your early withdrawal As for the penalty that is basically an extra tax so if you withdraw

https://smartasset.com/retirement/401k-tax

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay

So no you don t have to pay payroll FICA Social Security taxes on your early withdrawal As for the penalty that is basically an extra tax so if you withdraw

Traditional 401 k plans are tax deferred You don t have to pay income taxes on your contributions though you will have to pay other payroll taxes like Social Security and Medicare taxes You won t pay

Social Security s Never Beneficiaries Social Security Intelligence

Pay Social Security Contributions Via E payment Of GSB Mekha News

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

Social Security Cost Of Living Adjustments 2023

You May Have To Pay Tax On Social Security Benefits Boris Benic And

Social Security Tax Withholding What Do YOU Pay YouTube

Social Security Tax Withholding What Do YOU Pay YouTube

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

401k Withdrawal Strategy For Early Retirement Early Retirement