In this day and age where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed material hasn't diminished. In the case of educational materials or creative projects, or simply to add an individual touch to the space, Do You Pay Mn State Tax On Social Security are now a vital resource. In this article, we'll take a dive deep into the realm of "Do You Pay Mn State Tax On Social Security," exploring what they are, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Do You Pay Mn State Tax On Social Security Below

Do You Pay Mn State Tax On Social Security

Do You Pay Mn State Tax On Social Security - Do You Pay Mn State Tax On Social Security, Do You Pay State Taxes On Social Security In Minnesota, Is Social Security Income Taxable In Mn, Do You Have To Pay Taxes On Social Security Income In Minnesota, Do You Have To Pay Taxes On Social Security In Minnesota, What Is The Tax Rate On Social Security In Minnesota, Do You Pay State Taxes On Social Security

Under the DFL proposals from the House and Senate married filers earning up to 100 000 and individuals with up to 78 000 in adjusted gross income would pay no state tax on

The simplified method allows taxpayers with adjusted gross income below 100 000 for Married Filing Jointly or below 78 000 for Single or Head of Household to subtract all

Do You Pay Mn State Tax On Social Security encompass a wide collection of printable materials that are accessible online for free cost. They come in many types, such as worksheets coloring pages, templates and more. The value of Do You Pay Mn State Tax On Social Security is in their versatility and accessibility.

More of Do You Pay Mn State Tax On Social Security

Social Security Benefit Taxes By State 13 States Might Tax Benefits

Social Security Benefit Taxes By State 13 States Might Tax Benefits

According to the nonpartisan Minnesota House Research Department when non filers are counted only about a third of all Social Security benefits paid to Minnesota residents are

Only a portion of a taxpayer s Social Security income is subject to Minnesota s income tax There are two separate tax policies that result in Social Security income being

The Do You Pay Mn State Tax On Social Security have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: This allows you to modify printables to fit your particular needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational value: Free educational printables provide for students of all ages, which makes these printables a powerful tool for teachers and parents.

-

An easy way to access HTML0: immediate access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Do You Pay Mn State Tax On Social Security

Social Security Tax Deferment ArmyReenlistment

Social Security Tax Deferment ArmyReenlistment

Only a portion of Social Security benefits is subject to Minnesota income taxes The exclusion from tax is the result of two separate policies the federal exclusion from

The Minnesota Senate passed a plan Tuesday that expands a state tax exemption for Social Security benefits without eliminating the tax after maneuvering around a version

After we've peaked your interest in printables for free Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Do You Pay Mn State Tax On Social Security for all reasons.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing Do You Pay Mn State Tax On Social Security

Here are some ideas create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Do You Pay Mn State Tax On Social Security are an abundance filled with creative and practical information for a variety of needs and interest. Their accessibility and versatility make them a valuable addition to your professional and personal life. Explore the vast world of Do You Pay Mn State Tax On Social Security to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print these materials for free.

-

Do I have the right to use free templates for commercial use?

- It's determined by the specific terms of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues with Do You Pay Mn State Tax On Social Security?

- Certain printables could be restricted on usage. Be sure to read these terms and conditions as set out by the creator.

-

How can I print Do You Pay Mn State Tax On Social Security?

- Print them at home with your printer or visit any local print store for more high-quality prints.

-

What program will I need to access printables free of charge?

- Most PDF-based printables are available as PDF files, which can be opened with free software such as Adobe Reader.

Map Of The Day State Highway Taxes Vs State Highway Spending Streets mn

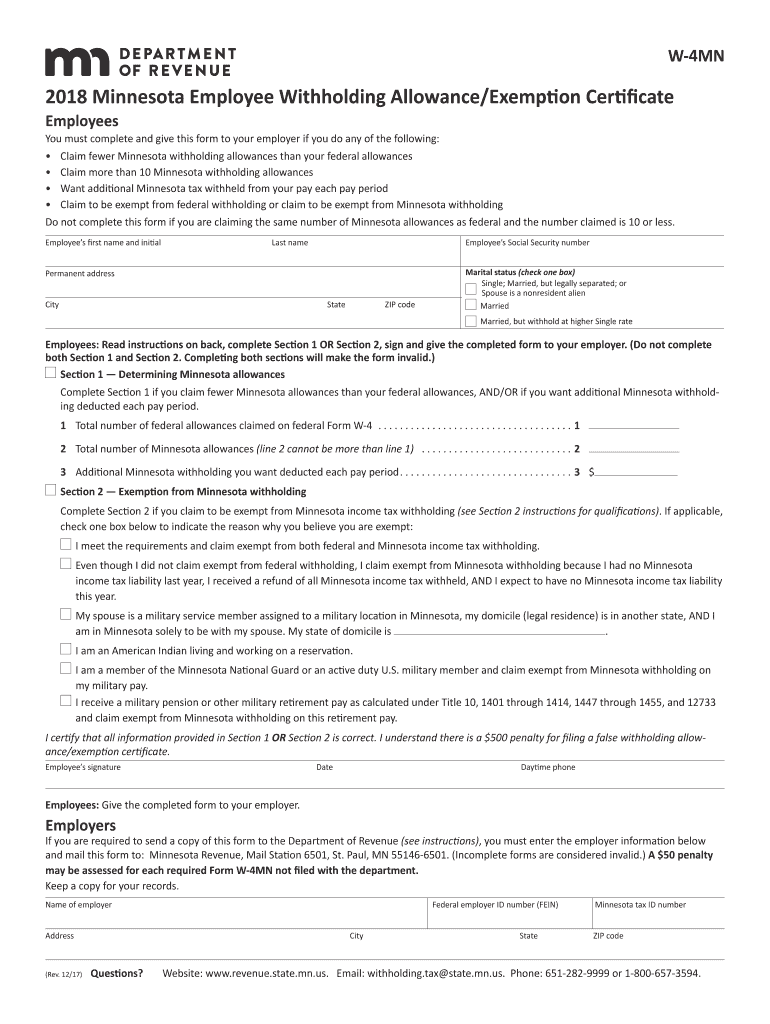

Form W 4 MN Minnesota Employee Withholding Allowance Fill Out And

Check more sample of Do You Pay Mn State Tax On Social Security below

13 States That Tax Social Security Benefits

Taxes On Social Security Benefits Inflation Protection

56 Of Social Security Households Pay Tax On Their Benefits Will You

37 States That Don t Tax Social Security Benefits

States That Tax Social Security Benefits Tax Foundation

2022 Federal Effective Tax Rate Calculator Printable Form Templates

https://www.revenue.state.mn.us/social-security-benefit-subtraction

The simplified method allows taxpayers with adjusted gross income below 100 000 for Married Filing Jointly or below 78 000 for Single or Head of Household to subtract all

https://www.house.mn.gov/hrd/issinfo/sstaxes.aspx

Only a portion of Social Security benefits is subject to Minnesota income taxes The exclusion from tax is the result of two separate policies the federal exclusion from

The simplified method allows taxpayers with adjusted gross income below 100 000 for Married Filing Jointly or below 78 000 for Single or Head of Household to subtract all

Only a portion of Social Security benefits is subject to Minnesota income taxes The exclusion from tax is the result of two separate policies the federal exclusion from

37 States That Don t Tax Social Security Benefits

Taxes On Social Security Benefits Inflation Protection

States That Tax Social Security Benefits Tax Foundation

2022 Federal Effective Tax Rate Calculator Printable Form Templates

A Way To Cut Tax On Social Security Benefits

Social Security Cost Of Living Adjustments 2023

Social Security Cost Of Living Adjustments 2023

Maximize Your Paycheck Understanding FICA Tax In 2023