In the digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Be it for educational use or creative projects, or simply to add a personal touch to your space, Do You Need Earned Income To Contribute To A Non Deductible Ira are a great source. This article will dive to the depths of "Do You Need Earned Income To Contribute To A Non Deductible Ira," exploring the benefits of them, where they are, and ways they can help you improve many aspects of your lives.

Get Latest Do You Need Earned Income To Contribute To A Non Deductible Ira Below

Do You Need Earned Income To Contribute To A Non Deductible Ira

Do You Need Earned Income To Contribute To A Non Deductible Ira - Do You Need Earned Income To Contribute To A Non Deductible Ira

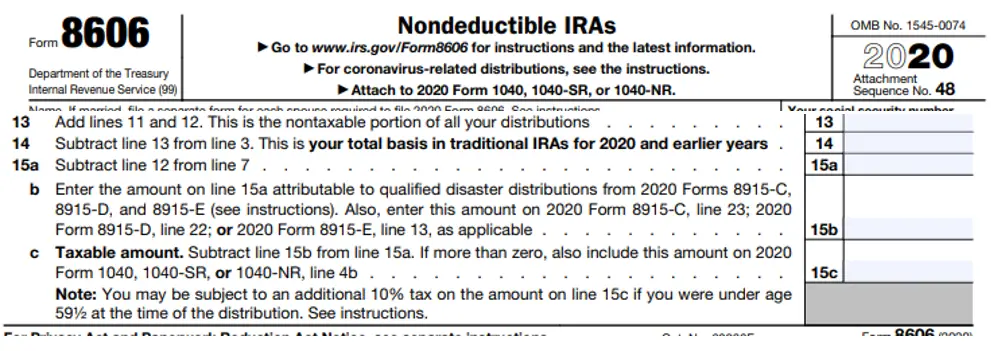

Withdrawing contributions You can withdraw money contributed to a nondeductible IRA in retirement without paying taxes on it though Otherwise you d be taxed twice on those contributions

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often overlooked

Do You Need Earned Income To Contribute To A Non Deductible Ira offer a wide variety of printable, downloadable materials online, at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and many more. One of the advantages of Do You Need Earned Income To Contribute To A Non Deductible Ira is in their variety and accessibility.

More of Do You Need Earned Income To Contribute To A Non Deductible Ira

What Is A Non deductible IRA Empower

What Is A Non deductible IRA Empower

It s important to note that to contribute to an IRA you must have earned income and your IRA contributions can t exceed your earned income for the year Since non deductible IRA contributions are primarily used by those whose income is too high to allow them to take advantage of deductible or Roth IRA

You can t deduct contributions from your income taxes as you would with a traditional IRA However your non deductible contributions grow tax free Many people turn to these options because their income is too high for the IRS to let them make tax deductible contributions to a regular IRA

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor the templates to meet your individual needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: Printing educational materials for no cost are designed to appeal to students from all ages, making the perfect tool for parents and educators.

-

The convenience of Quick access to the vast array of design and templates, which saves time as well as effort.

Where to Find more Do You Need Earned Income To Contribute To A Non Deductible Ira

Simple Ira Contribution Rules Choosing Your Gold IRA

Simple Ira Contribution Rules Choosing Your Gold IRA

Non deductible IRAs do not have a contribution limit and thus provide a way to add additional after tax dollars to a retirement plan How a Non Deductible IRA Works A traditional IRA

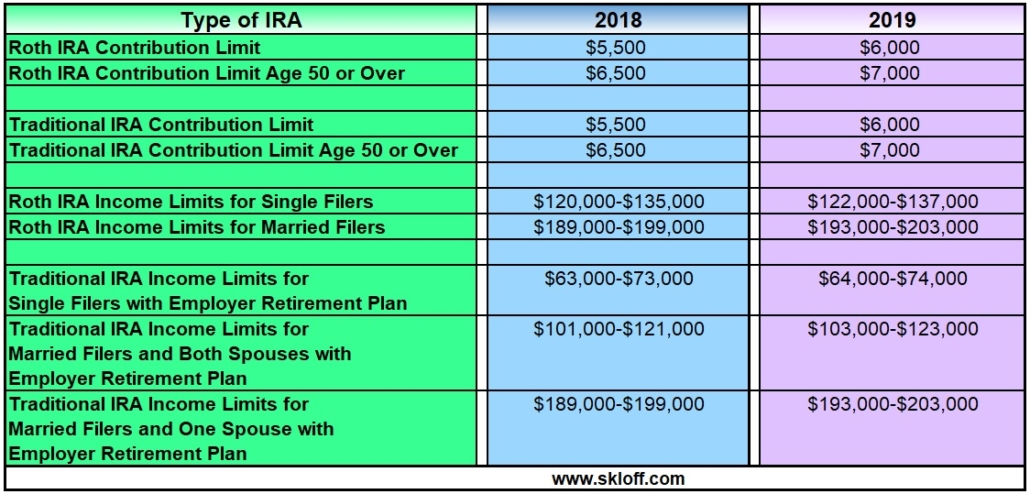

For 2023 the maximum contribution allowed is the lesser of 100 of your earned income for the year or 6 500 an increase of 1 000 from 2022 What s more if you re age 50 or older you

If we've already piqued your interest in printables for free we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Do You Need Earned Income To Contribute To A Non Deductible Ira for various purposes.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free, flashcards, and learning tools.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a wide variety of topics, including DIY projects to planning a party.

Maximizing Do You Need Earned Income To Contribute To A Non Deductible Ira

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Do You Need Earned Income To Contribute To A Non Deductible Ira are a treasure trove with useful and creative ideas that meet a variety of needs and desires. Their availability and versatility make them an essential part of your professional and personal life. Explore the world of Do You Need Earned Income To Contribute To A Non Deductible Ira right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can print and download these items for free.

-

Can I make use of free templates for commercial use?

- It is contingent on the specific terms of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download Do You Need Earned Income To Contribute To A Non Deductible Ira?

- Certain printables could be restricted on use. Be sure to check the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to the local print shops for superior prints.

-

What program do I need in order to open printables free of charge?

- The majority of PDF documents are provided in PDF format. These can be opened with free software, such as Adobe Reader.

What Is A Non deductible IRA Finance Strategists

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Check more sample of Do You Need Earned Income To Contribute To A Non Deductible Ira below

What Is A Non Deductible IRA SoFi

Excess Retirement Plan Contributions Can Be Taxing Coastal Tax Advisors

Saving To A Non deductible IRA Don t Forget This Step Planning

Should You Contribute To A Non Deductible IRA

/istock512752254.kroach.ira.cropped.lowercase-5bfc3077c9e77c0026b5e58b.jpg)

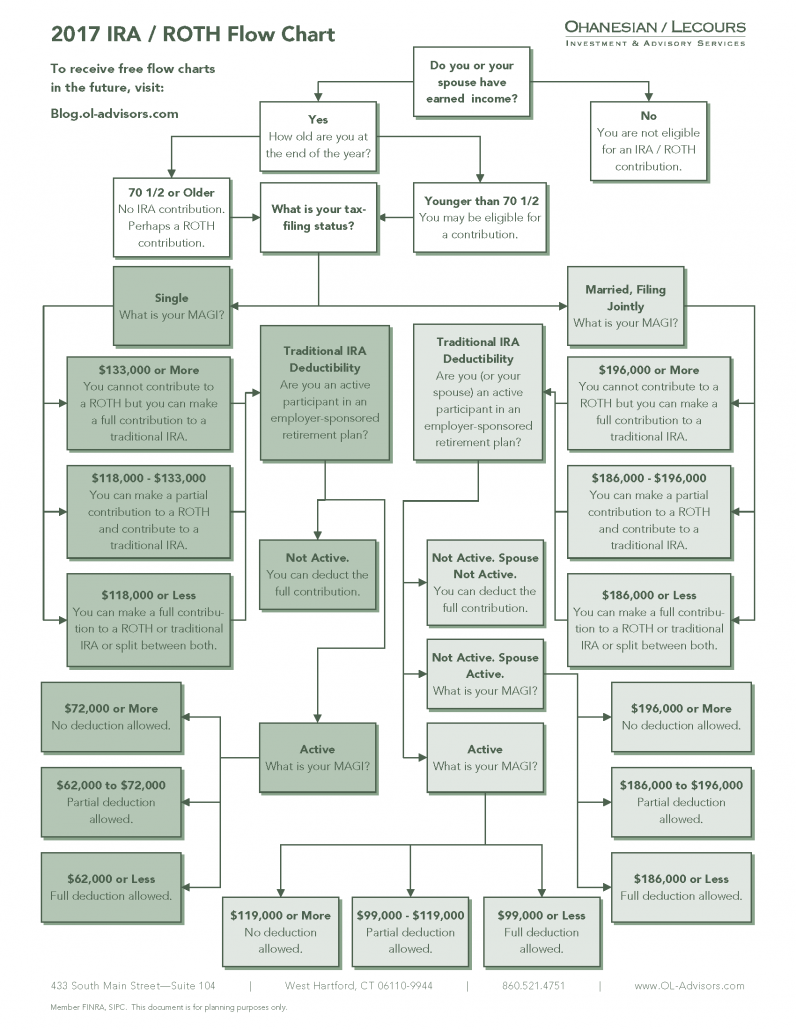

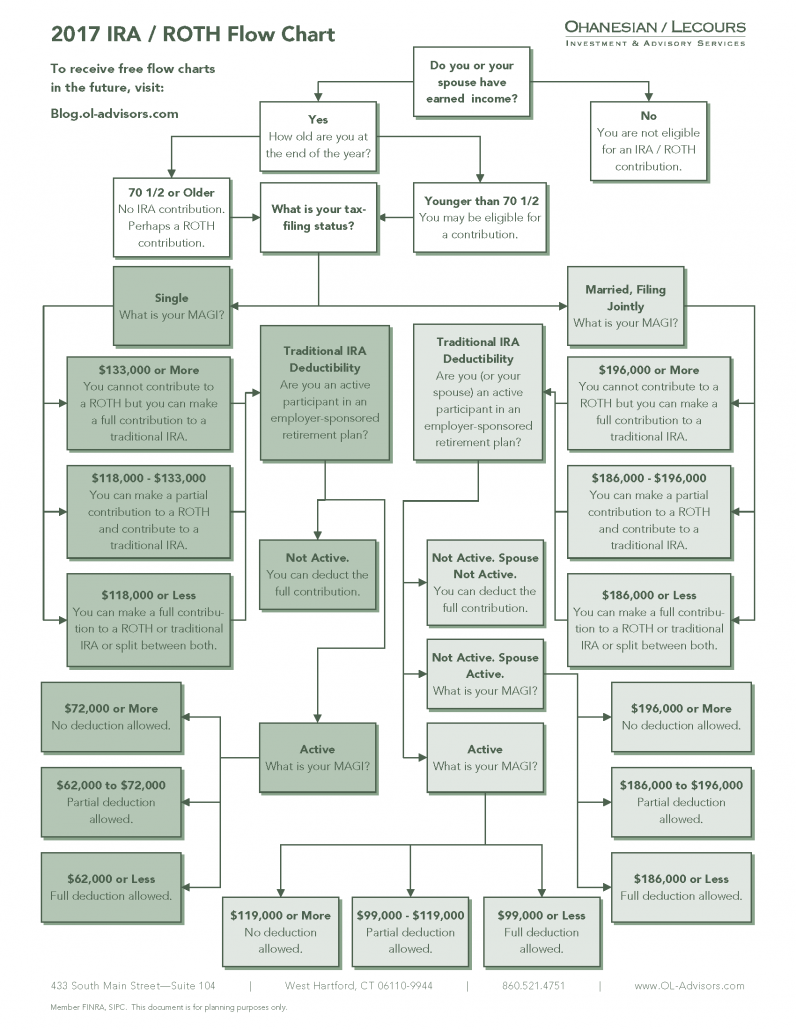

Visualizing IRA Rules Using Flowcharts

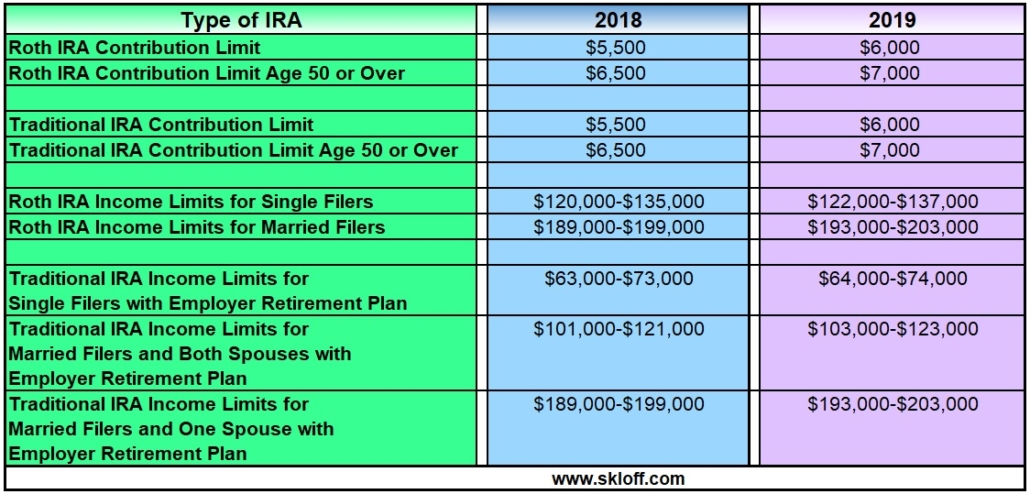

IRA Contribution And Income Limits For 2018 And 2019 Skloff Financial

https://www.forbes.com/sites/kristinmckenna/2021/...

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often overlooked

https://www.thebalancemoney.com/non-deductible-ira...

You might not be able to deduct contributions to your traditional IRA from your taxable income if your income exceeds certain levels The amount you can save may be limited as well but you can still save for your retirement with contributions that you don t deduct

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often overlooked

You might not be able to deduct contributions to your traditional IRA from your taxable income if your income exceeds certain levels The amount you can save may be limited as well but you can still save for your retirement with contributions that you don t deduct

/istock512752254.kroach.ira.cropped.lowercase-5bfc3077c9e77c0026b5e58b.jpg)

Should You Contribute To A Non Deductible IRA

Excess Retirement Plan Contributions Can Be Taxing Coastal Tax Advisors

Visualizing IRA Rules Using Flowcharts

IRA Contribution And Income Limits For 2018 And 2019 Skloff Financial

Retirement Portfolio Inflation Protection

Can I Contribute To My Roth IRA Marotta On Money

Can I Contribute To My Roth IRA Marotta On Money

What Is A Roth IRA The Fancy Accountant