In the digital age, in which screens are the norm, the charm of tangible printed products hasn't decreased. Whether it's for educational purposes or creative projects, or simply to add an individual touch to the area, Do You Have To Pay Federal Income Tax On Railroad Retirement are now a useful source. The following article is a dive deep into the realm of "Do You Have To Pay Federal Income Tax On Railroad Retirement," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your daily life.

Get Latest Do You Have To Pay Federal Income Tax On Railroad Retirement Below

Do You Have To Pay Federal Income Tax On Railroad Retirement

Do You Have To Pay Federal Income Tax On Railroad Retirement - Do You Have To Pay Federal Income Tax On Railroad Retirement, Do You Pay Taxes On Railroad Retirement, Do You Pay State Taxes On Railroad Retirement

If you re a retiree enjoying the benefits of the Railroad Retirement Act RRA or soon to be retired you may have questions about how your annuities are taxed under federal income tax laws The RRA has specific rules regarding the

Well now that you have paid taxes your whole career for the Railroad Retirement Annuity it is only right that the federal government has decided it will also tax your benefits you will be receiving in retirement The

Do You Have To Pay Federal Income Tax On Railroad Retirement cover a large selection of printable and downloadable items that are available online at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and more. The appeal of printables for free is their versatility and accessibility.

More of Do You Have To Pay Federal Income Tax On Railroad Retirement

Ca Tax Brackets Chart Jokeragri

Ca Tax Brackets Chart Jokeragri

In most cases part of a railroad retirement annuity is treated like a social security benefit for Federal income tax purposes while other parts of the annuity are treated like private pensions

The Tier 1 Tier 2 and vested dual benefit components of regular annuity payments and special guaranty overall minimum formula payments have been subject to Federal income tax

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization You can tailor the design to meet your needs in designing invitations and schedules, or decorating your home.

-

Educational Value: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them an essential source for educators and parents.

-

Simple: The instant accessibility to a myriad of designs as well as templates helps save time and effort.

Where to Find more Do You Have To Pay Federal Income Tax On Railroad Retirement

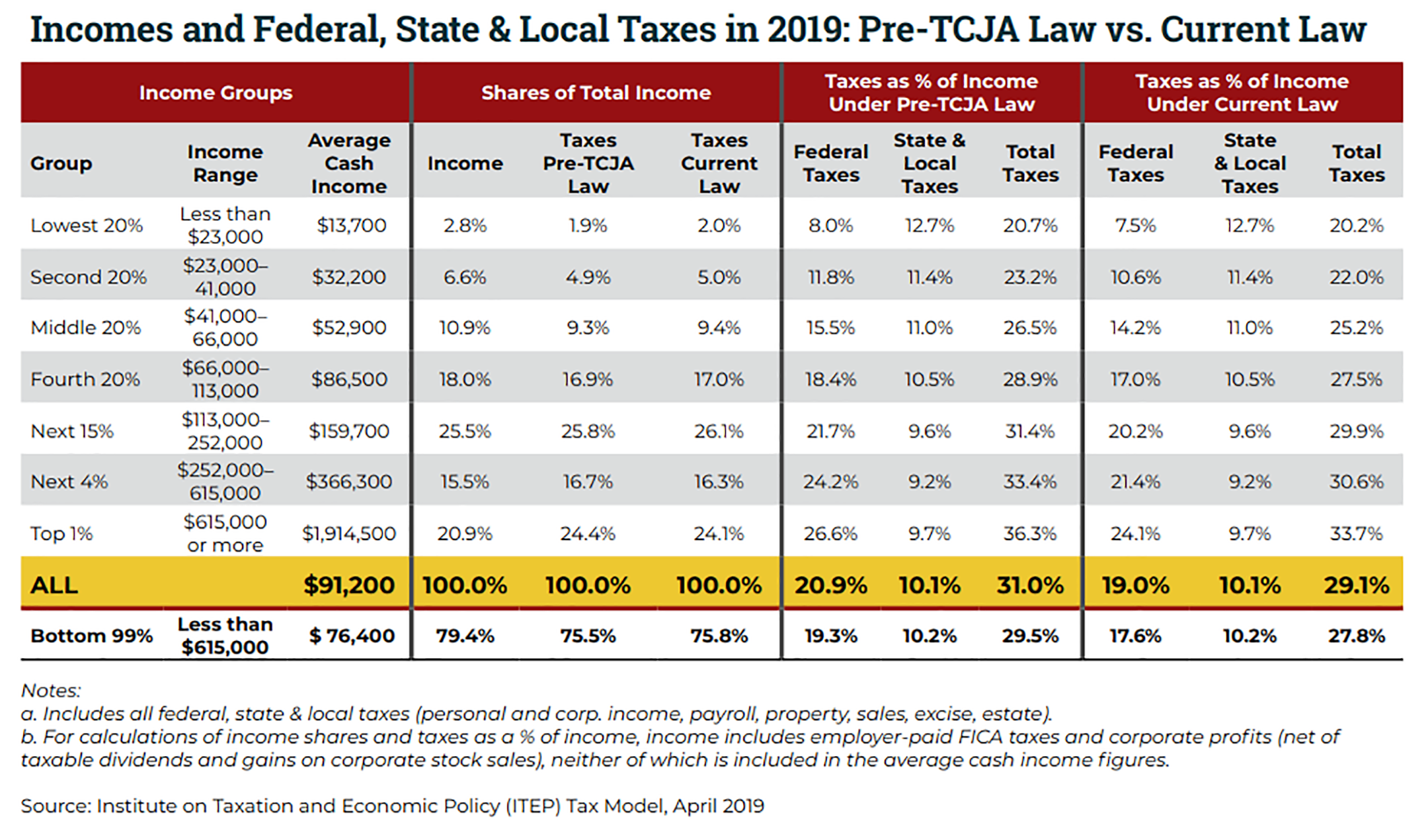

Top 1 Pay Nearly Half Of Federal Income Taxes

Top 1 Pay Nearly Half Of Federal Income Taxes

The legislation passed but again faced legal challenges as a federal district court declared that neither railroad employees nor employers could be compelled to pay industry specific

With tax time rapidly approaching the U S Railroad Retirement Board RRB wants to remind its customers that the best source of information pertaining to Federal income tax

In the event that we've stirred your interest in Do You Have To Pay Federal Income Tax On Railroad Retirement Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Do You Have To Pay Federal Income Tax On Railroad Retirement suitable for many objectives.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing Do You Have To Pay Federal Income Tax On Railroad Retirement

Here are some innovative ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Do You Have To Pay Federal Income Tax On Railroad Retirement are an abundance of practical and innovative resources for a variety of needs and pursuits. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the endless world of Do You Have To Pay Federal Income Tax On Railroad Retirement and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Do You Have To Pay Federal Income Tax On Railroad Retirement really for free?

- Yes, they are! You can print and download these tools for free.

-

Do I have the right to use free printables in commercial projects?

- It's determined by the specific terms of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables could have limitations regarding usage. Check the conditions and terms of use provided by the designer.

-

How can I print Do You Have To Pay Federal Income Tax On Railroad Retirement?

- Print them at home with the printer, or go to the local print shop for superior prints.

-

What software do I need in order to open printables for free?

- Most printables come in PDF format, which is open with no cost software like Adobe Reader.

Is Railroad Retirement Exempt From State Income Tax JacAnswers

Do You Have To Pay Federal Taxes On Your Disability Benefits

Check more sample of Do You Have To Pay Federal Income Tax On Railroad Retirement below

The Union Role In Our Growing Taxocracy California Policy Center

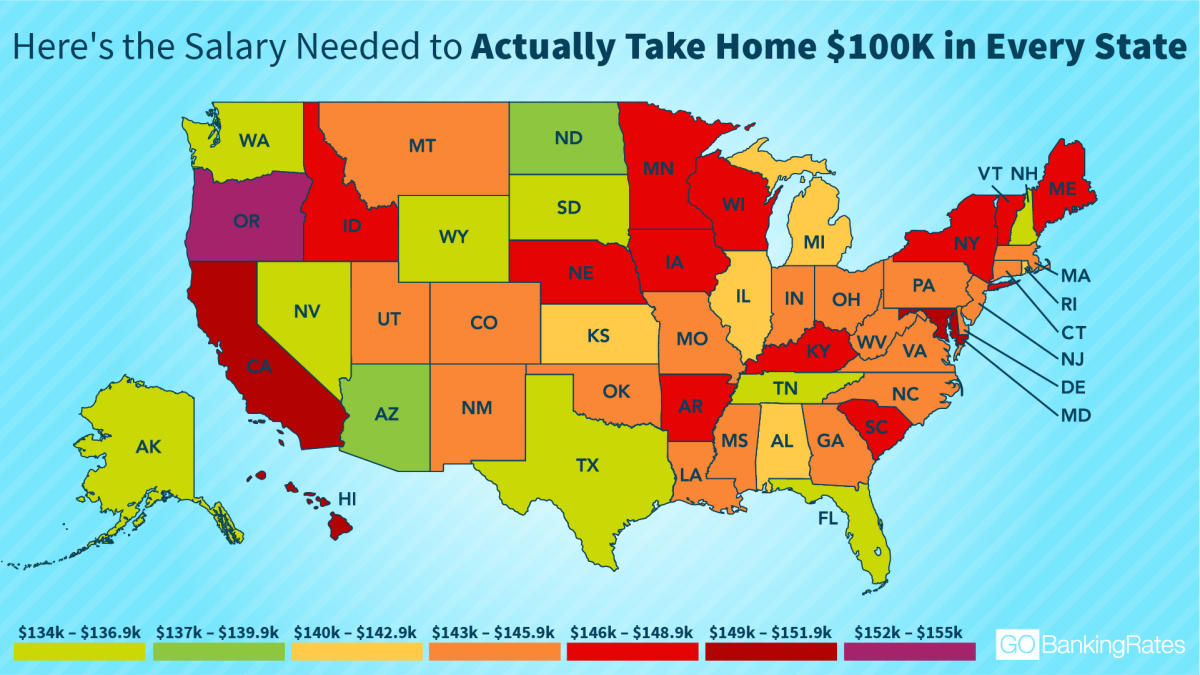

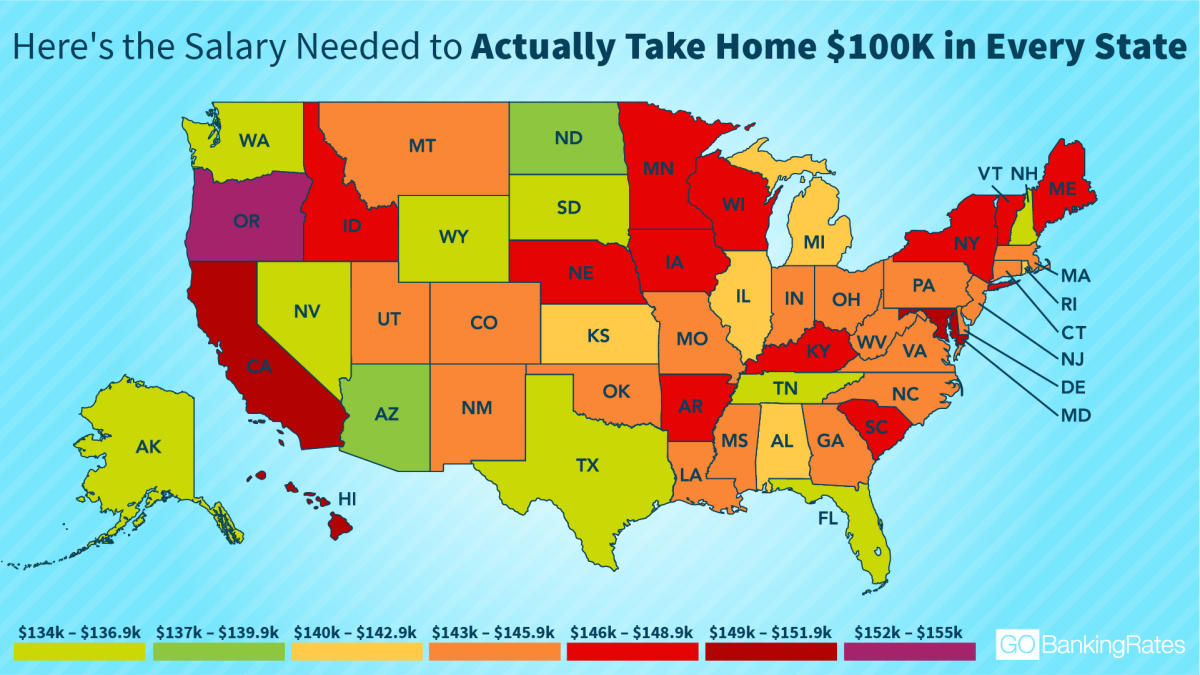

This Is The Ideal Salary You Need To Take Home 100K In Your State

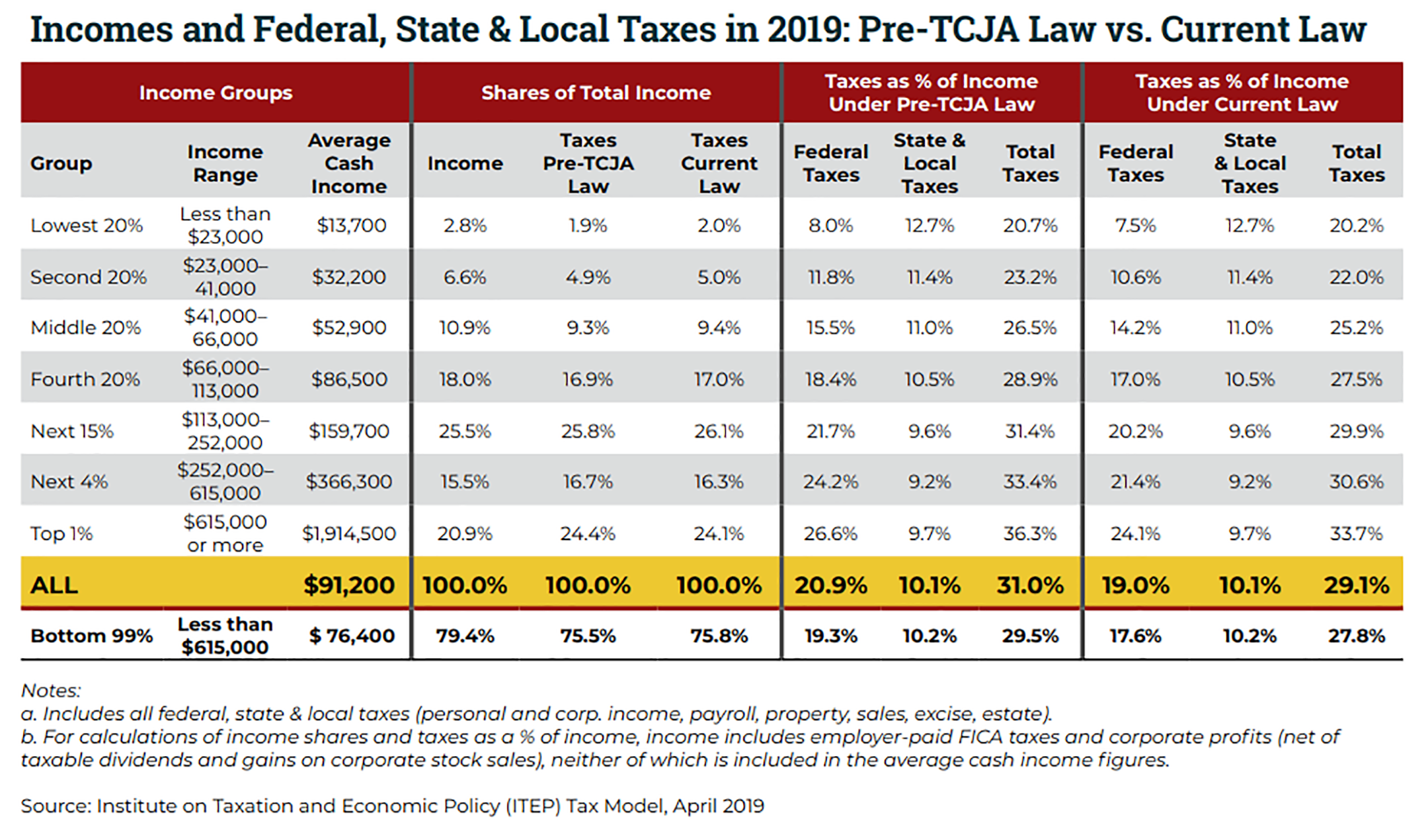

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

2021 Nc Standard Deduction Standard Deduction 2021

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Much Gift Tax Do I Pay In Australia Tax 27950 Hot Sex Picture

https://highballadvisors.com/blog/what-e…

Well now that you have paid taxes your whole career for the Railroad Retirement Annuity it is only right that the federal government has decided it will also tax your benefits you will be receiving in retirement The

https://www.rrb.gov/sites/default/files/2018-02/QA1802.pdf

In most cases part of a railroad retirement annuity is treated like a social security benefit for Federal income tax purposes while other parts of the annuity are treated like private pensions

Well now that you have paid taxes your whole career for the Railroad Retirement Annuity it is only right that the federal government has decided it will also tax your benefits you will be receiving in retirement The

In most cases part of a railroad retirement annuity is treated like a social security benefit for Federal income tax purposes while other parts of the annuity are treated like private pensions

2021 Nc Standard Deduction Standard Deduction 2021

This Is The Ideal Salary You Need To Take Home 100K In Your State

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Much Gift Tax Do I Pay In Australia Tax 27950 Hot Sex Picture

You Don t Have To Pay Federal Income Tax If You Make This Much Money

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

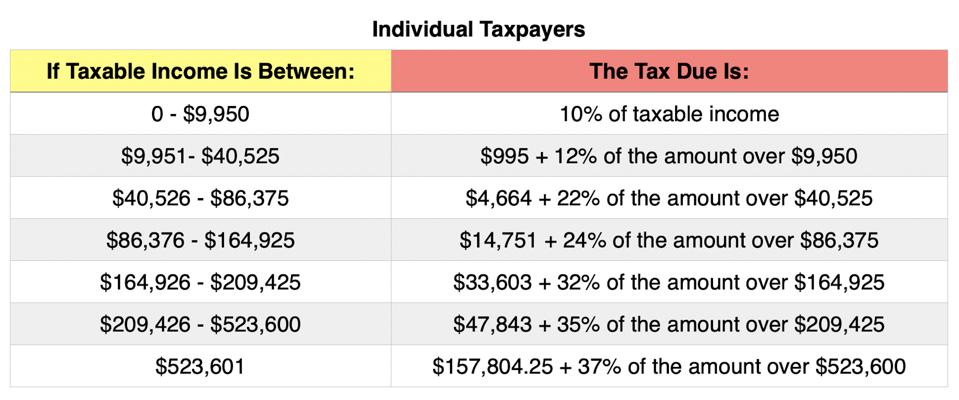

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The