In a world where screens dominate our lives The appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes, creative projects, or just adding an individual touch to the home, printables for free have become a valuable resource. In this article, we'll dive deep into the realm of "Do They Tax Social Security In Michigan," exploring the different types of printables, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Do They Tax Social Security In Michigan Below

Do They Tax Social Security In Michigan

Do They Tax Social Security In Michigan - Do They Tax Social Security In Michigan, Do I Have To Pay Taxes On Social Security In Michigan, How Is Social Security Taxed In Michigan, Does Michigan Tax Social Security Benefits

Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits If your combined income is more than 34 000 you will pay taxes on up to 85 of your Social Security benefits

The Lowering MI Costs Plan Public Act 4 of 2023 was signed into law on March 7 2023 and will amend Michigan s current Income Tax Act to provide a substantial tax deduction on retirement and pension benefits The law will take effect in March 2024 and will be phased in over the 2023 2026 tax years

Printables for free include a vast collection of printable documents that can be downloaded online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and more. One of the advantages of Do They Tax Social Security In Michigan is in their versatility and accessibility.

More of Do They Tax Social Security In Michigan

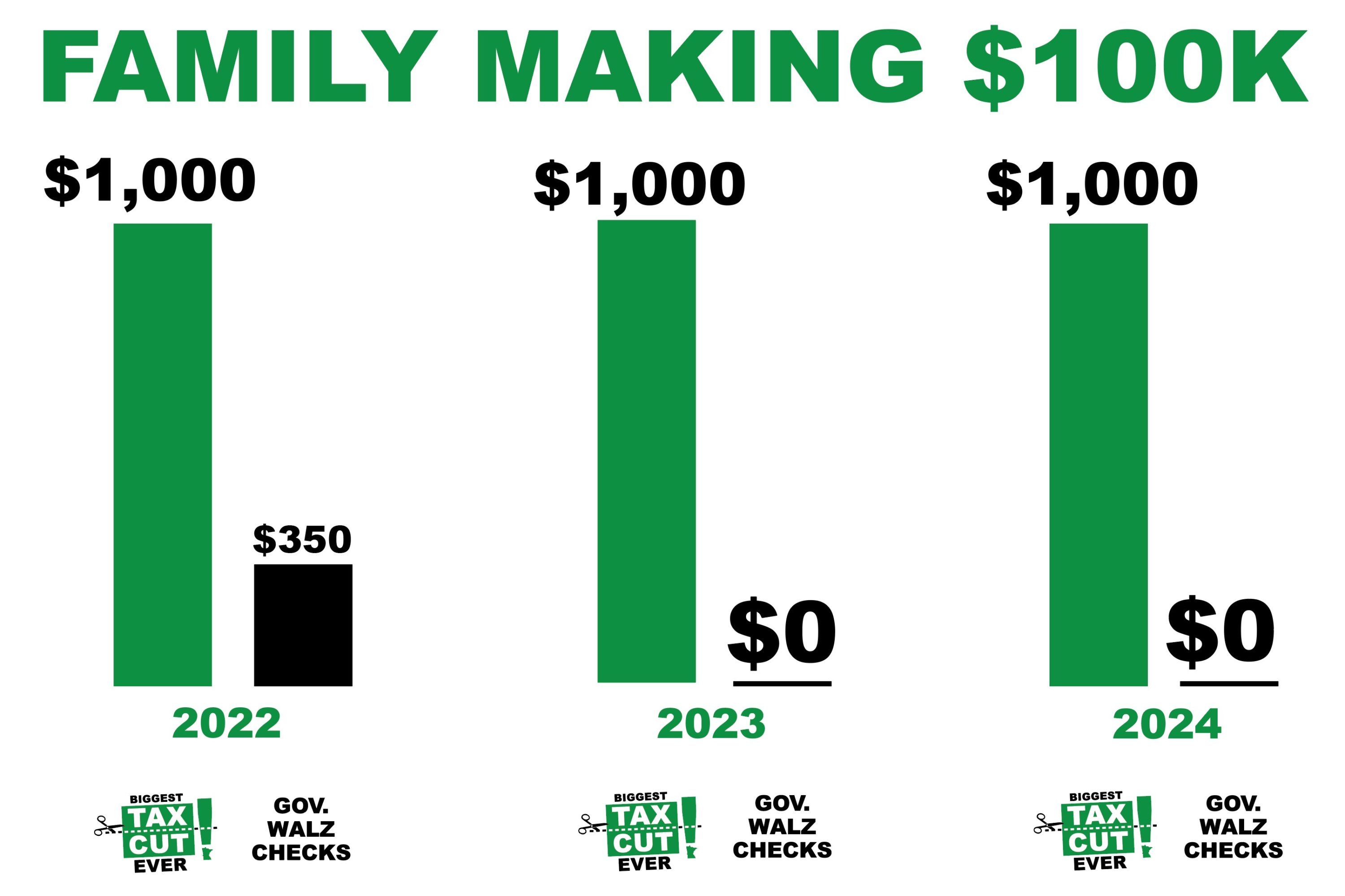

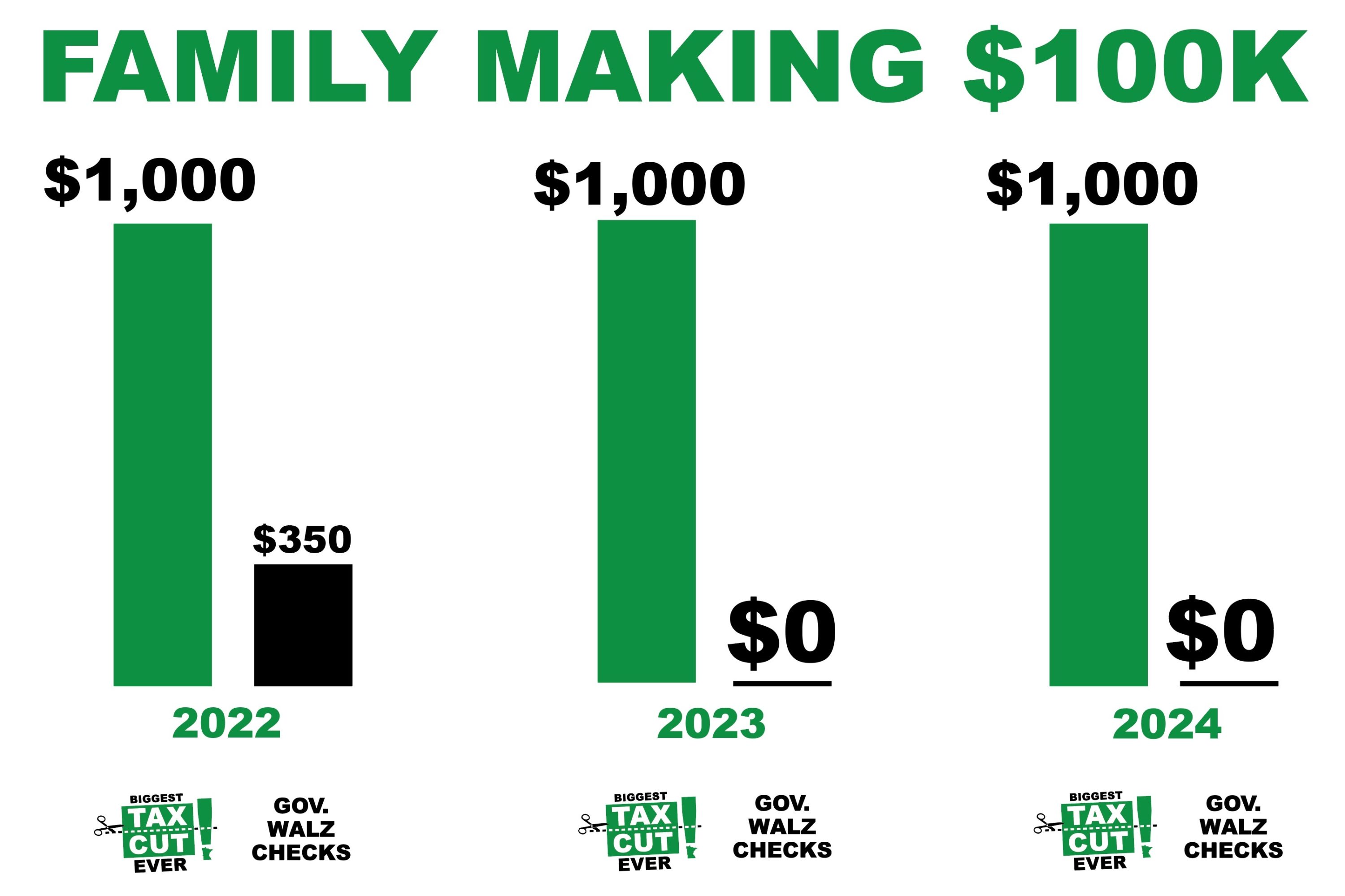

The Biggest Tax Cut Ever Minnesota Senate Republicans

The Biggest Tax Cut Ever Minnesota Senate Republicans

The taxpayer may also deduct eligible retirement and pension benefits from a Federal or State public retirement system Social Security benefits and the max of 56 961 for a single return and

As a reminder Michigan state tax rate is 4 25 In 2019 as a single individual you are exempt from the first 4 400 of income for Michigan state taxes and if married you are exempt from the first 8 800 I have used average social security benefits and yours could vary significantly

Do They Tax Social Security In Michigan have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Flexible: They can make the templates to meet your individual needs whether it's making invitations planning your schedule or even decorating your house.

-

Educational value: Free educational printables provide for students of all ages. This makes these printables a powerful tool for teachers and parents.

-

The convenience of immediate access a myriad of designs as well as templates reduces time and effort.

Where to Find more Do They Tax Social Security In Michigan

Pin On Retiement saving Money

Pin On Retiement saving Money

Out of all 50 states in the U S 38 states and the District of Columbia do not levy a tax on Social Security benefits Nine of those states don t collect state income tax at all They are Alaska

What are Retirement and Pension Benefits Retirement and pension benefits include most income that is reported on Form 1099 R for federal tax purposes This includes defined benefit pensions IRA distributions and most payments from defined contribution plans

We've now piqued your curiosity about Do They Tax Social Security In Michigan, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a broad range of interests, starting from DIY projects to party planning.

Maximizing Do They Tax Social Security In Michigan

Here are some inventive ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Do They Tax Social Security In Michigan are a treasure trove filled with creative and practical information catering to different needs and desires. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the endless world of Do They Tax Social Security In Michigan today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can download and print these free resources for no cost.

-

Does it allow me to use free printables to make commercial products?

- It's dependent on the particular terms of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with Do They Tax Social Security In Michigan?

- Certain printables could be restricted regarding their use. Be sure to check the terms and condition of use as provided by the author.

-

How do I print Do They Tax Social Security In Michigan?

- You can print them at home using either a printer or go to a local print shop for premium prints.

-

What program do I require to view Do They Tax Social Security In Michigan?

- The majority of printables are in the PDF format, and is open with no cost programs like Adobe Reader.

Meet The 38 States That Do Not Tax Social Security Do You Live In One

The Most And Least Tax friendly States For Retirees copy Lovemoney

Check more sample of Do They Tax Social Security In Michigan below

TAX TIP An ITIN Is A 9 digit Number Issued By The IRS To A Person Who

7 States That Do NOT Tax Retirement Income Easy Seniors Club

37 States That Don t Tax Social Security Benefits Social Security

How Government Pension Can Affect Social Security

PDF Social Security In United States Treaties And Executive Agreements

Taxes On Social Security Benefits Inflation Protection

https://www.mersofmich.com/retiree/resources/...

The Lowering MI Costs Plan Public Act 4 of 2023 was signed into law on March 7 2023 and will amend Michigan s current Income Tax Act to provide a substantial tax deduction on retirement and pension benefits The law will take effect in March 2024 and will be phased in over the 2023 2026 tax years

https://smartasset.com/retirement/michigan-retirement-taxes

Is Social Security taxable in Michigan Social Security payments are not taxed in Michigan Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income AGI when filing your state taxes in Michigan

The Lowering MI Costs Plan Public Act 4 of 2023 was signed into law on March 7 2023 and will amend Michigan s current Income Tax Act to provide a substantial tax deduction on retirement and pension benefits The law will take effect in March 2024 and will be phased in over the 2023 2026 tax years

Is Social Security taxable in Michigan Social Security payments are not taxed in Michigan Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income AGI when filing your state taxes in Michigan

How Government Pension Can Affect Social Security

7 States That Do NOT Tax Retirement Income Easy Seniors Club

PDF Social Security In United States Treaties And Executive Agreements

Taxes On Social Security Benefits Inflation Protection

37 States That Don t Tax Social Security Benefits

PDF POOR HOUSEHOLDS AND SOCIAL SECURITY IN INDIA AN INVESTIGATION

PDF POOR HOUSEHOLDS AND SOCIAL SECURITY IN INDIA AN INVESTIGATION

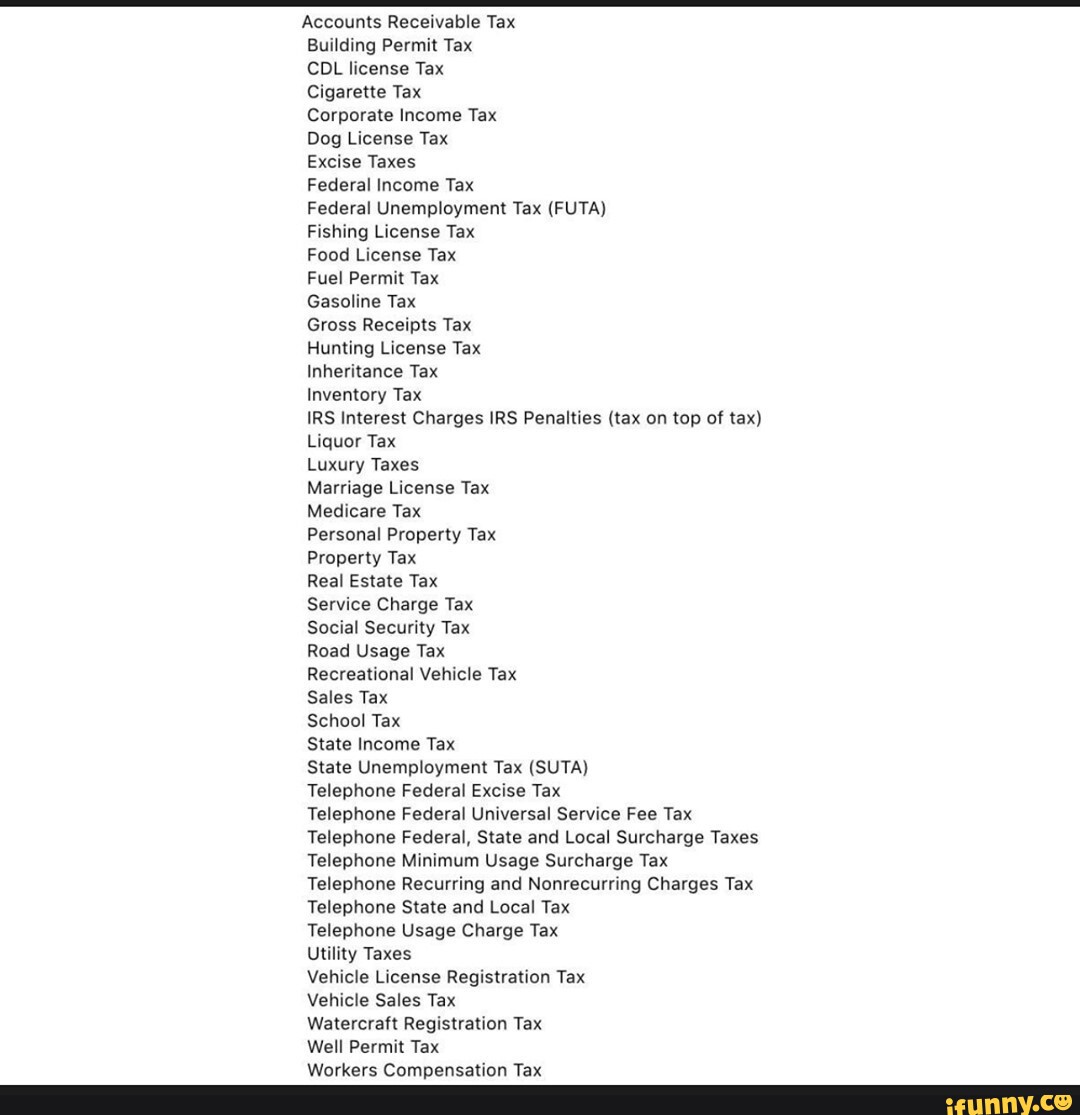

Receivable Memes Best Collection Of Funny Receivable Pictures On