In this age of technology, where screens have become the dominant feature of our lives, the charm of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or just adding an individual touch to your space, Do Ira Withdrawals Count As Earned Income have become an invaluable source. With this guide, you'll dive through the vast world of "Do Ira Withdrawals Count As Earned Income," exploring the benefits of them, where they are, and how they can improve various aspects of your daily life.

Get Latest Do Ira Withdrawals Count As Earned Income Below

Do Ira Withdrawals Count As Earned Income

Do Ira Withdrawals Count As Earned Income - Do Ira Withdrawals Count As Earned Income, Do Ira Withdrawals Count As Earned Income Against Social Security, Does Ira Withdrawals Count As Earned Income, Do Ira Distributions Count As Earned Income, Does Ira Distribution Count As Earned Income, Do Traditional Ira Withdrawals Count As Earned Income, Do Roth Ira Withdrawals Count As Earned Income, Do Inherited Ira Distributions Count As Earned Income, Are Withdrawals From An Ira Considered Earned Income, Are Ira Distributions Considered Earned Income

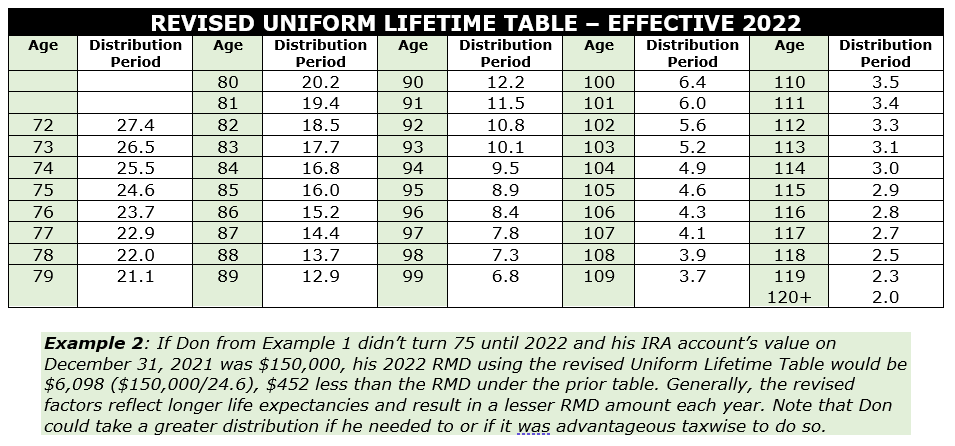

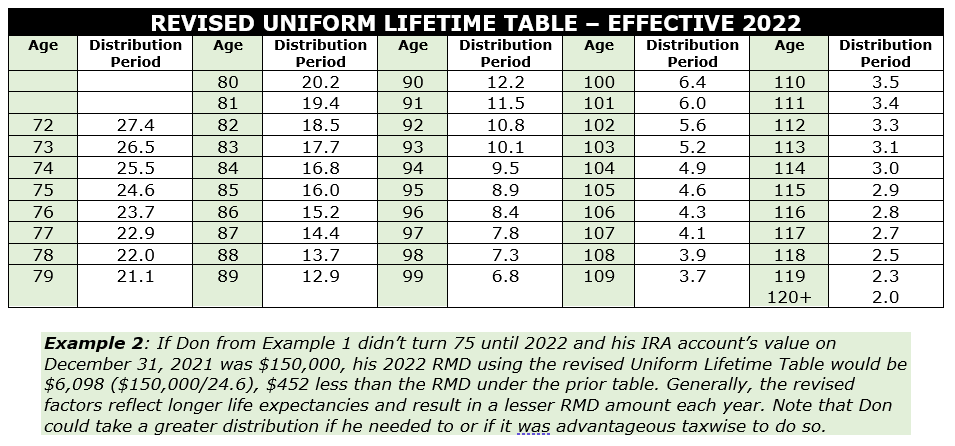

Do IRA withdrawals count toward your Social Security earnings limit Social Security only qualifies specific sources as earned income for the earnings limit Those sources are wages from a job or net earning if you are

The short answer is sometimes The question of whether IRA distributions are considered income depends on why you re asking The ability to collect Social Security benefits before reaching full

Do Ira Withdrawals Count As Earned Income provide a diverse assortment of printable, downloadable materials online, at no cost. They come in many types, such as worksheets coloring pages, templates and much more. The benefit of Do Ira Withdrawals Count As Earned Income lies in their versatility and accessibility.

More of Do Ira Withdrawals Count As Earned Income

Do Roth Withdrawals Count As Senior Freeze Income NJMoneyHelp

Do Roth Withdrawals Count As Senior Freeze Income NJMoneyHelp

If all your contributions to your traditional IRA were tax deductible the calculation is simple All of your IRA withdrawals will be counted as taxable income If you had any

Distributions of Roth IRA assets from regular participant contributions and from nontaxable conversions of a traditional IRA can be taken at any time tax and penalty free

Do Ira Withdrawals Count As Earned Income have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization Your HTML0 customization options allow you to customize printables to fit your particular needs be it designing invitations and schedules, or decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages, making them a valuable resource for educators and parents.

-

Accessibility: Quick access to an array of designs and templates helps save time and effort.

Where to Find more Do Ira Withdrawals Count As Earned Income

How To Make Penalty Free Pre Age 59 5 Traditional IRA Withdrawals

How To Make Penalty Free Pre Age 59 5 Traditional IRA Withdrawals

Traditional IRAs impact Social Security in certain cases Some IRA distributions count as income that could lower your benefits

IRA distributions do not count as income as far as the Social Security Administration is concerned however the IRS uses these distributions to determine your tax

We've now piqued your interest in Do Ira Withdrawals Count As Earned Income Let's look into where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Do Ira Withdrawals Count As Earned Income designed for a variety objectives.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to planning a party.

Maximizing Do Ira Withdrawals Count As Earned Income

Here are some ideas for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to enhance learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Do Ira Withdrawals Count As Earned Income are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and passions. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the plethora of Do Ira Withdrawals Count As Earned Income to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I use free printables for commercial purposes?

- It is contingent on the specific conditions of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables might have limitations regarding usage. Be sure to check the terms and regulations provided by the creator.

-

How do I print Do Ira Withdrawals Count As Earned Income?

- Print them at home using any printer or head to the local print shops for top quality prints.

-

What software will I need to access printables free of charge?

- Many printables are offered in PDF format, which is open with no cost software like Adobe Reader.

Traditional IRA Withdrawal Rules Blue Co LLC

7 RRSP Withdrawal Rules Truth About RRSP Withholding Tax Simplified

Check more sample of Do Ira Withdrawals Count As Earned Income below

Do Gambling Winnings Count As Earned Income In 2022

Early IRA Withdrawals Can Be Penalty Free WSJ

How Are IRA Withdrawals Taxed YouTube

IRA Withdrawal Rules

Do You Pay State Income Tax On Ira Withdrawals Tax Walls

9 Circumstances That Allow Penalty Free IRA Withdrawals 59 1 2

https://www.fool.com › retirement › plan…

The short answer is sometimes The question of whether IRA distributions are considered income depends on why you re asking The ability to collect Social Security benefits before reaching full

https://www.investopedia.com › ask › answers › iraearningsmagi.asp

Earnings that you withdraw from a Roth IRA don t count as income as long as you meet the rules for qualified distributions Typically you will need to have had a Roth IRA

The short answer is sometimes The question of whether IRA distributions are considered income depends on why you re asking The ability to collect Social Security benefits before reaching full

Earnings that you withdraw from a Roth IRA don t count as income as long as you meet the rules for qualified distributions Typically you will need to have had a Roth IRA

IRA Withdrawal Rules

Early IRA Withdrawals Can Be Penalty Free WSJ

Do You Pay State Income Tax On Ira Withdrawals Tax Walls

9 Circumstances That Allow Penalty Free IRA Withdrawals 59 1 2

How To Cut Taxes On Your IRA Withdrawals Marotta On Money

IRA Withdrawal Planning Can Save On Taxes The Wealth Guardians

IRA Withdrawal Planning Can Save On Taxes The Wealth Guardians

IRA Withdrawals That Escape The 10 Penalty Scarlet Oak Financial