In this age of technology, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials for creative projects, simply adding an individual touch to your space, Do I Need To Include Social Security Income On My Taxes have proven to be a valuable source. We'll take a dive deeper into "Do I Need To Include Social Security Income On My Taxes," exploring the different types of printables, where to find them and what they can do to improve different aspects of your lives.

Get Latest Do I Need To Include Social Security Income On My Taxes Below

Do I Need To Include Social Security Income On My Taxes

Do I Need To Include Social Security Income On My Taxes - Do I Need To Include Social Security Income On My Taxes, Do I Include My Social Security Income On My Taxes, Do You Include Social Security As Income, Do I Have To Report My Social Security Income On My Taxes

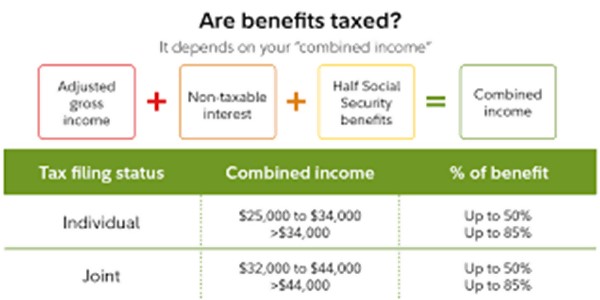

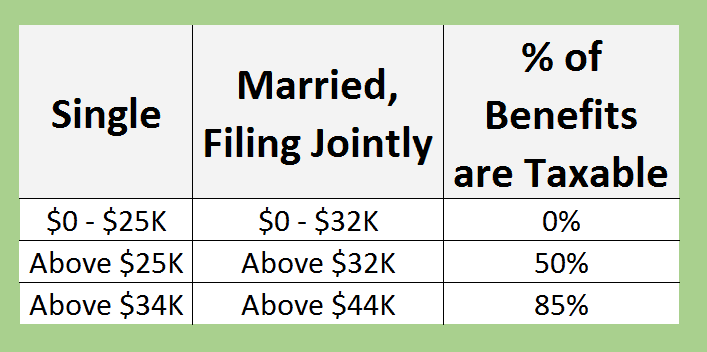

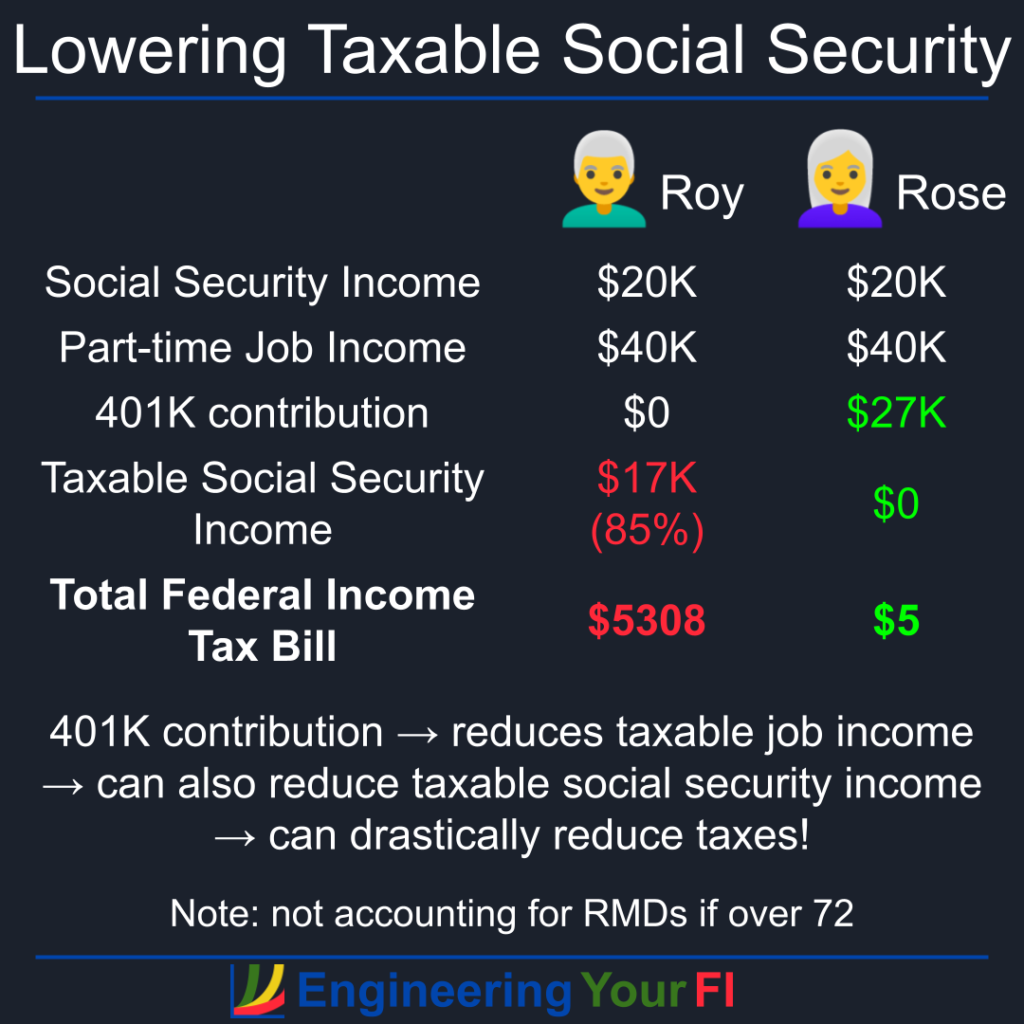

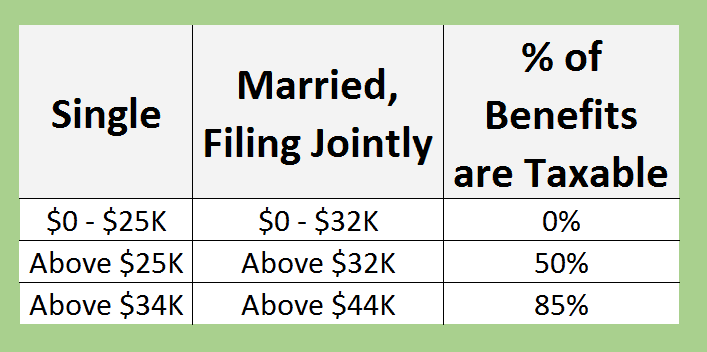

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

Do I Need To Include Social Security Income On My Taxes provide a diverse variety of printable, downloadable materials online, at no cost. These resources come in many forms, including worksheets, coloring pages, templates and more. The value of Do I Need To Include Social Security Income On My Taxes is in their variety and accessibility.

More of Do I Need To Include Social Security Income On My Taxes

How Do I Estimate Social Security Benefits

How Do I Estimate Social Security Benefits

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

You are at least 65 years of age and Your gross income for tax is 15 700 or more However if your only income is from Social Security benefits and the amount that you receive is less than 50 000 per year you don t

Do I Need To Include Social Security Income On My Taxes have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize the design to meet your needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Printables for education that are free are designed to appeal to students of all ages, making the perfect resource for educators and parents.

-

The convenience of immediate access a myriad of designs as well as templates will save you time and effort.

Where to Find more Do I Need To Include Social Security Income On My Taxes

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

No tax on your Social Security benefits Between 25 000 and 34 000 single or 32 000 and 44 000 joint filing Up to 50 of Social Security benefits can be taxed

Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable The portion of benefits that are taxable depends on

We've now piqued your interest in Do I Need To Include Social Security Income On My Taxes Let's see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Do I Need To Include Social Security Income On My Taxes suitable for many objectives.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Do I Need To Include Social Security Income On My Taxes

Here are some ideas of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Do I Need To Include Social Security Income On My Taxes are a treasure trove with useful and creative ideas that meet a variety of needs and hobbies. Their accessibility and versatility make them a great addition to each day life. Explore the wide world of Do I Need To Include Social Security Income On My Taxes now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can download and print the resources for free.

-

Can I use free printables for commercial use?

- It's all dependent on the terms of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may have restrictions regarding their use. Be sure to read the terms of service and conditions provided by the author.

-

How do I print Do I Need To Include Social Security Income On My Taxes?

- Print them at home with either a printer at home or in any local print store for more high-quality prints.

-

What program is required to open printables that are free?

- The majority of printables are as PDF files, which is open with no cost software, such as Adobe Reader.

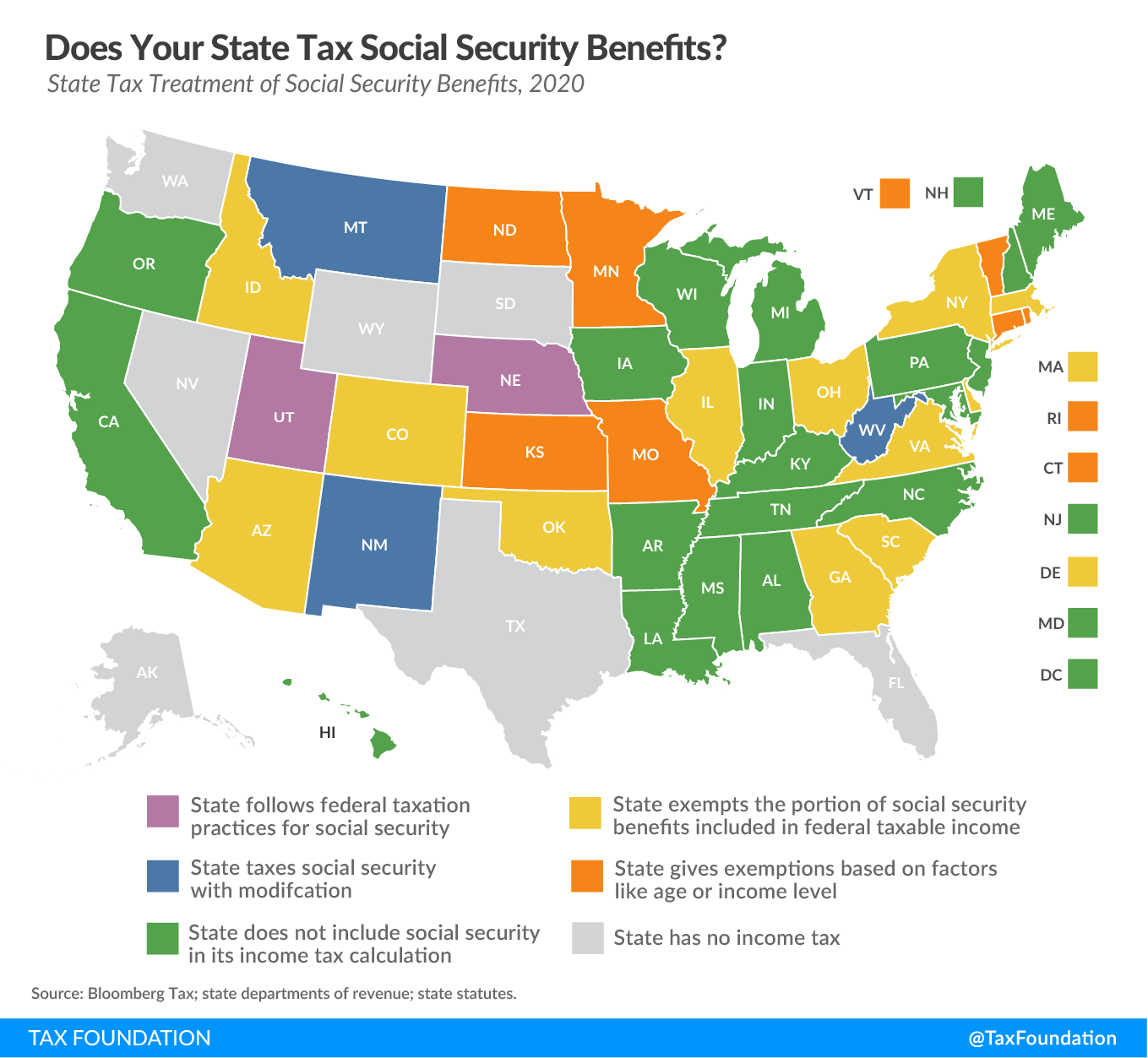

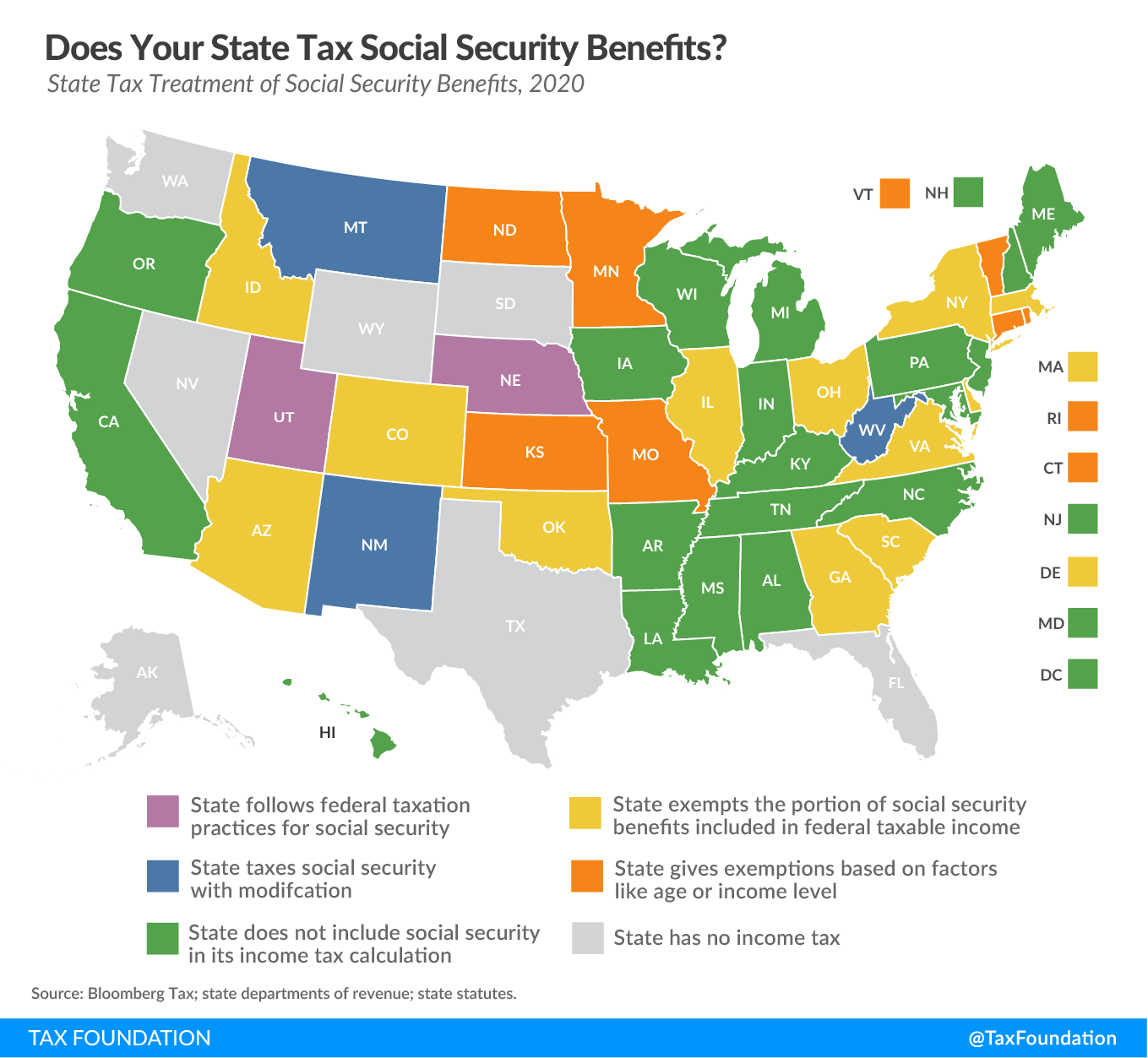

States That Tax Social Security Benefits Tax Foundation

Do This During Tax Season To Maximize Your Social Security Benefits

Check more sample of Do I Need To Include Social Security Income On My Taxes below

13 States That Tax Social Security Benefits Tax Foundation

Understanding How Social Security Benefits Are Taxed

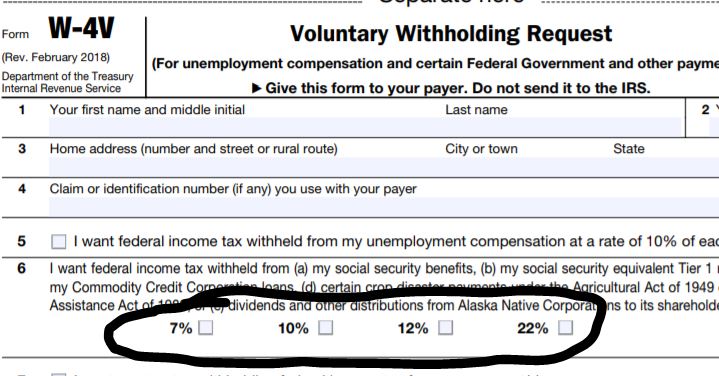

Withholding Federal Taxes From Your Social Security Benefits MTA TMBA

Paying Social Security Taxes On Earnings After Full Retirement Age

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

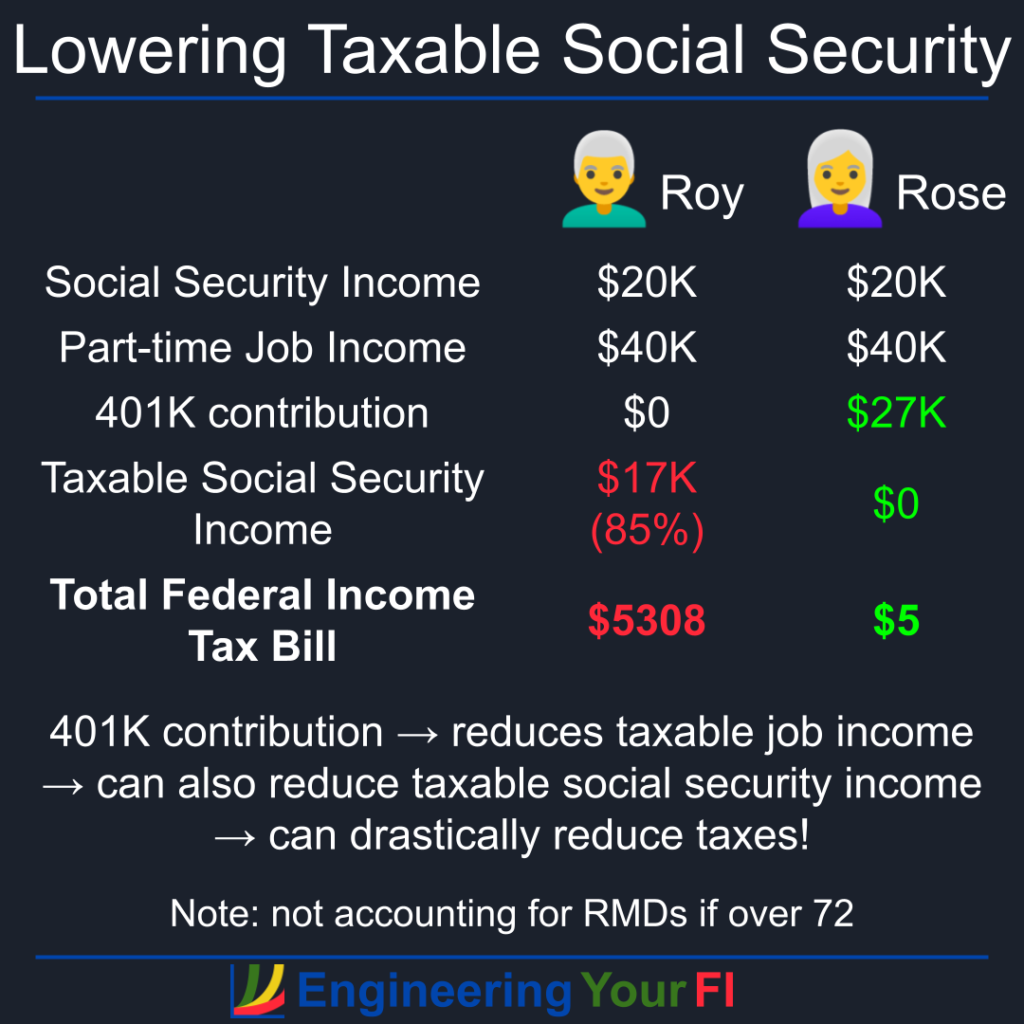

How Much Of My Social Security Income Will Be Taxed Engineering Your FI

Are Social Security Benefits Taxable Social Security Intelligence

https://smartasset.com/retirement/is-social-security-income-taxable

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

https://www.fool.com/taxes/2019/01/19/do-i-have-to...

So if you re single and your combined income was 25 100 in 2018 then the most you ll have to include as taxable Social Security benefits is half of the 100 amount by which 25 100 is

If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

So if you re single and your combined income was 25 100 in 2018 then the most you ll have to include as taxable Social Security benefits is half of the 100 amount by which 25 100 is

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding How Social Security Benefits Are Taxed

How Much Of My Social Security Income Will Be Taxed Engineering Your FI

Are Social Security Benefits Taxable Social Security Intelligence

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

Does Your State Tax Social Security Benefits Upstate Tax Professionals

Does Your State Tax Social Security Benefits Upstate Tax Professionals

How To Calculate Federal Income Taxes Social Security Medicare