In this age of technology, with screens dominating our lives The appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes project ideas, artistic or simply to add an individual touch to the area, Do I Have To Pay Tax On My State Pension Lump Sum are a great resource. With this guide, you'll dive into the world of "Do I Have To Pay Tax On My State Pension Lump Sum," exploring what they are, how they are available, and how they can enhance various aspects of your daily life.

Get Latest Do I Have To Pay Tax On My State Pension Lump Sum Below

Do I Have To Pay Tax On My State Pension Lump Sum

Do I Have To Pay Tax On My State Pension Lump Sum - Do I Have To Pay Tax On My State Pension Lump Sum, Do You Pay Taxes On Lump Sum Pension, Is State Pension Lump Sum Taxable

If you take an uncrystallised pension fund lump tax should be automatically deducted from your lump sum by your pension company through the Pay As You Earn system or PAYE If you take a lump sum from your state pension tax should be deducted from it by the Department for Work and Pensions

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax if

Do I Have To Pay Tax On My State Pension Lump Sum provide a diverse variety of printable, downloadable content that can be downloaded from the internet at no cost. They are available in numerous forms, like worksheets templates, coloring pages and much more. One of the advantages of Do I Have To Pay Tax On My State Pension Lump Sum is in their variety and accessibility.

More of Do I Have To Pay Tax On My State Pension Lump Sum

State Pension LissaTahlia

State Pension LissaTahlia

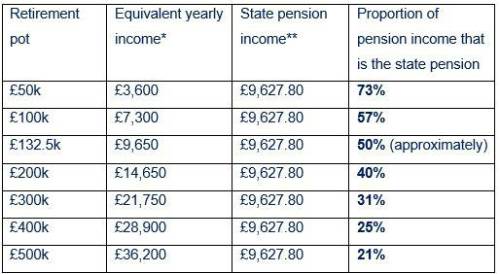

How much tax do I pay on a pension lump sum From age 55 if you have a defined contribution DC pension where you ve built up pension savings over your working life you can take a 25 lump sum tax free you can take more but you ll pay income tax on anything above 25

Do I pay tax on my state pension State pension is taxable but the amount you pay will depend upon your income for the tax year Your tax free personal income allowance is 12 570

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: We can customize printing templates to your own specific requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational Use: Education-related printables at no charge provide for students of all ages. This makes these printables a powerful resource for educators and parents.

-

Accessibility: The instant accessibility to many designs and templates reduces time and effort.

Where to Find more Do I Have To Pay Tax On My State Pension Lump Sum

Do You Have To Pay Tax On Your Social Security Benefits YouTube

Do You Have To Pay Tax On Your Social Security Benefits YouTube

Do I pay tax on deferred state pension If you decide to take an extra pension you ll simply pay income tax on the total amount of income you have from all of your pensions If you decide to take the deferred pension as a lump sum it is taxable at your current rate you won t be pushed into a higher tax rate because you received a lump

If you get the State Pension and a private pension Your pension provider will usually take off any tax you owe before they pay you They ll also take off any tax you owe on your State

Now that we've ignited your interest in Do I Have To Pay Tax On My State Pension Lump Sum Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of objectives.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning materials.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast range of interests, that includes DIY projects to party planning.

Maximizing Do I Have To Pay Tax On My State Pension Lump Sum

Here are some innovative ways ensure you get the very most of Do I Have To Pay Tax On My State Pension Lump Sum:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Do I Have To Pay Tax On My State Pension Lump Sum are a treasure trove filled with creative and practical information for a variety of needs and needs and. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the vast collection of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can download and print these files for free.

-

Can I use the free printables for commercial uses?

- It's based on the rules of usage. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables could be restricted concerning their use. Check the terms and regulations provided by the creator.

-

How do I print Do I Have To Pay Tax On My State Pension Lump Sum?

- Print them at home with either a printer or go to a print shop in your area for higher quality prints.

-

What program is required to open printables for free?

- The majority of printables are in the format of PDF, which can be opened with free programs like Adobe Reader.

State Pension MbarakDaeney

Pension Tax Refund Claiming Back AccountingFirms

Check more sample of Do I Have To Pay Tax On My State Pension Lump Sum below

Your Pension Lump Sum Or Monthly Payments

I m Retired Do I Have To Pay Tax On My Retirement Income Nj

Is My Pension Lump Sum Tax free Nuts About Money

State Pension DainRithvi

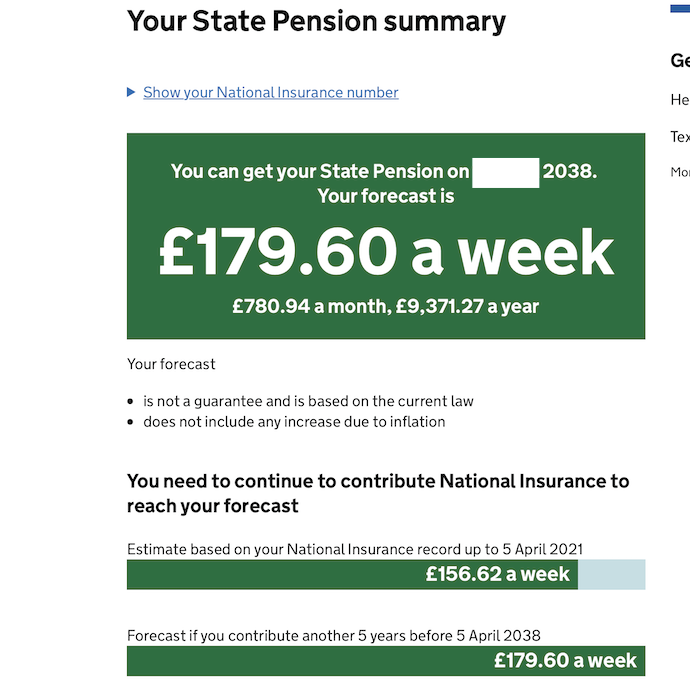

Your State Pension Forecast Explained Which

State Pension Pensioners Demand Lump Sum Increase After Triple Lock

https://www.gov.uk/tax-on-pension

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax if

https://smartasset.com/retirement/how-to-avoid...

While you may pay taxes on the conversion all future earnings and withdrawals are tax free Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account IRA or other eligible retirement accounts

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax if

While you may pay taxes on the conversion all future earnings and withdrawals are tax free Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account IRA or other eligible retirement accounts

State Pension DainRithvi

I m Retired Do I Have To Pay Tax On My Retirement Income Nj

Your State Pension Forecast Explained Which

State Pension Pensioners Demand Lump Sum Increase After Triple Lock

Do I Have To Pay Tax On My Rental Income

Did You Miss Out On A State Pension Lump Sum When You Were Widowed

Did You Miss Out On A State Pension Lump Sum When You Were Widowed

Getting Tax Back On Your Pension Lump Sum ITAS Accounting