Today, with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Be it for educational use and creative work, or simply to add an individual touch to the area, Do I Have To File My Social Security Benefits On My Taxes have proven to be a valuable resource. Here, we'll take a dive in the world of "Do I Have To File My Social Security Benefits On My Taxes," exploring what they are, where they are available, and what they can do to improve different aspects of your lives.

Get Latest Do I Have To File My Social Security Benefits On My Taxes Below

Do I Have To File My Social Security Benefits On My Taxes

Do I Have To File My Social Security Benefits On My Taxes - Do I Have To File My Social Security Benefits On My Taxes, Do I Need To Claim Social Security Benefits On My Taxes, Do You Have To Claim Social Security On Taxes, Do You Claim Social Security Benefits On Taxes

Published October 10 2018 Updated December 21 2022 If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits

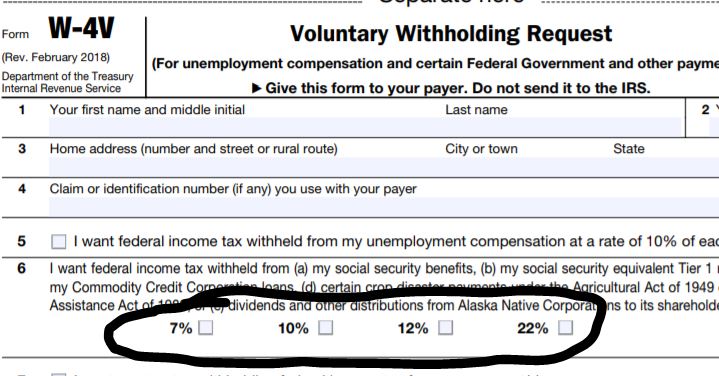

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest

Printables for free include a vast selection of printable and downloadable items that are available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and more. The appealingness of Do I Have To File My Social Security Benefits On My Taxes is in their variety and accessibility.

More of Do I Have To File My Social Security Benefits On My Taxes

What Happens If You Don t Pay Your Taxes A Complete Guide All

What Happens If You Don t Pay Your Taxes A Complete Guide All

Ti ng Vi t Krey l ayisyen IRS Tax Tip 2022 22 February 9 2022 A new tax season has arrived The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and

If you are a single tax filer and your combined income is more than 34 000 you may have to pay income tax on up to 85 of your benefits If you are filing a joint return and your combined income

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: This allows you to modify printables to fit your particular needs for invitations, whether that's creating them, organizing your schedule, or even decorating your home.

-

Educational Benefits: These Do I Have To File My Social Security Benefits On My Taxes can be used by students of all ages, making the perfect aid for parents as well as educators.

-

Simple: Quick access to an array of designs and templates reduces time and effort.

Where to Find more Do I Have To File My Social Security Benefits On My Taxes

How To Receive Medicare Benefits

How To Receive Medicare Benefits

As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your Social Security income remains tax free This taxable portion goes up as your income rises but it will never exceed 85 Even if your annual income is 1 million at least 15 of your Social Security benefits will stay tax free

Under 25 000 single or 32 000 joint filing No tax on your Social Security benefits Between 25 000 and 34 000 single or 32 000 and 44 000 joint filing Up to 50 of Social Security

In the event that we've stirred your interest in printables for free Let's take a look at where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Do I Have To File My Social Security Benefits On My Taxes to suit a variety of uses.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs are a vast range of interests, that includes DIY projects to planning a party.

Maximizing Do I Have To File My Social Security Benefits On My Taxes

Here are some innovative ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Do I Have To File My Social Security Benefits On My Taxes are an abundance with useful and creative ideas that satisfy a wide range of requirements and passions. Their access and versatility makes them an essential part of any professional or personal life. Explore the vast collection that is Do I Have To File My Social Security Benefits On My Taxes today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can print and download these free resources for no cost.

-

Can I make use of free printables for commercial uses?

- It's based on the terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Do I Have To File My Social Security Benefits On My Taxes?

- Some printables may have restrictions in their usage. You should read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home using your printer or visit a local print shop for top quality prints.

-

What software is required to open printables for free?

- The majority of PDF documents are provided in PDF format. They is open with no cost software such as Adobe Reader.

Foreign Social Security Taxable In Us TaxableSocialSecurity

Fillable Social Security Benefits Worksheet 2022 Fillable Form 2023

Check more sample of Do I Have To File My Social Security Benefits On My Taxes below

Social Security Form W4v 2023 Printable Forms Free Online

How To File Back Taxes SDG Accountants

Taxes On Social Security Benefits YouTube

A my Social Security Account Puts Your Info At Your Fingertips Www

Social Security Benefit Calendar 2023 Best Latest List Of Seaside

Do ESports Players Pay Taxes US Nonresident Alien Guide

https://www.ssa.gov/benefits/retirement/planner/...

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest

https://faq.ssa.gov/en-US/Topic/article/KA-02471

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000 If you are married and file a separate return you probably will have to pay taxes on your benefits

A my Social Security Account Puts Your Info At Your Fingertips Www

How To File Back Taxes SDG Accountants

Social Security Benefit Calendar 2023 Best Latest List Of Seaside

Do ESports Players Pay Taxes US Nonresident Alien Guide

Social Security Cost Of Living Adjustments 2023

Social Security Benefits Quotes QuotesGram

Social Security Benefits Quotes QuotesGram

States That Tax Social Security Benefits Tax Foundation