In this digital age, where screens rule our lives, the charm of tangible, printed materials hasn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply adding an element of personalization to your home, printables for free can be an excellent source. We'll dive into the world of "Do Employer Pension Contributions Count Towards Taxable Income," exploring their purpose, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Do Employer Pension Contributions Count Towards Taxable Income Below

Do Employer Pension Contributions Count Towards Taxable Income

Do Employer Pension Contributions Count Towards Taxable Income - Do Employer Pension Contributions Count Towards Taxable Income, Do Employer Pension Contributions Count As Taxable Income

The short answer is no in order to contribute to a UK pension they ll usually need to have relevant UK earnings But what does this term actually mean And can an individual contribute to a pension without any relevant UK earnings In this article we look at making personal contributions to a registered pension scheme

What type of pension contribution do you intend making One that reduces your taxable income such as a net pay contribution to your employers scheme or a relief at source contribution to a personal pension or SIPP which doesn t reduce your taxable income but does increase your basic rate tax band

Do Employer Pension Contributions Count Towards Taxable Income encompass a wide array of printable content that can be downloaded from the internet at no cost. These resources come in many kinds, including worksheets templates, coloring pages and more. The appealingness of Do Employer Pension Contributions Count Towards Taxable Income is in their variety and accessibility.

More of Do Employer Pension Contributions Count Towards Taxable Income

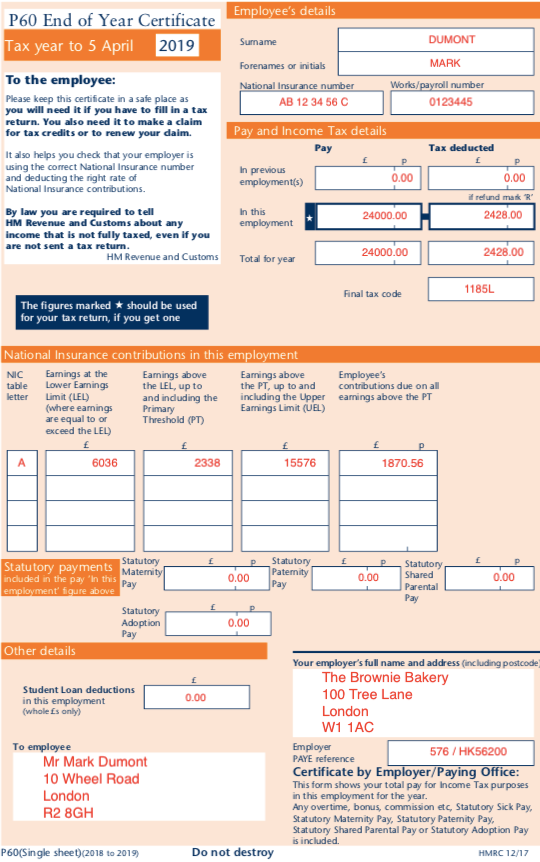

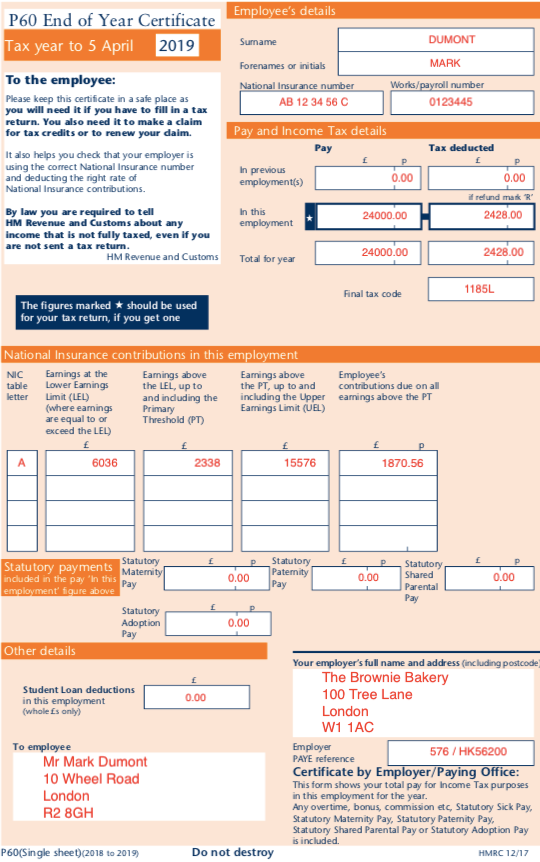

OS Payroll Your P60 Document Explained

OS Payroll Your P60 Document Explained

Making contributions into an employer s pension scheme Earnings that attract tax relief Tax relief on contributions into a personal pension arrangement Tax relief on contributions into a

A basic rate taxpayer will pay income tax of 20 and National Insurance of 8 on their salary So for every 1 000 they receive 280 is deducted They can add the 720 they re left with to a

Do Employer Pension Contributions Count Towards Taxable Income have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring printables to fit your particular needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost provide for students from all ages, making them a vital instrument for parents and teachers.

-

Simple: instant access numerous designs and templates can save you time and energy.

Where to Find more Do Employer Pension Contributions Count Towards Taxable Income

Mac Financial Making Pension Contributions Before The End Of The Tax

Mac Financial Making Pension Contributions Before The End Of The Tax

There are two ways you can get tax relief on your pension contributions If you re in a workplace pension scheme your employer chooses which method to use and must apply it to all staff Find out how tax relief works here

You contribute 3 to your company pension and your employer contributes 5 You also have a personal pension into which you pay a 10 000 lump sum You would personally pay in a net amount

We've now piqued your curiosity about Do Employer Pension Contributions Count Towards Taxable Income Let's look into where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Do Employer Pension Contributions Count Towards Taxable Income for a variety purposes.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast variety of topics, from DIY projects to party planning.

Maximizing Do Employer Pension Contributions Count Towards Taxable Income

Here are some new ways that you can make use of Do Employer Pension Contributions Count Towards Taxable Income:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Do Employer Pension Contributions Count Towards Taxable Income are an abundance of useful and creative resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make them a valuable addition to each day life. Explore the vast world of Do Employer Pension Contributions Count Towards Taxable Income right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print the resources for free.

-

Can I use free printing templates for commercial purposes?

- It's all dependent on the usage guidelines. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables could be restricted on usage. Check the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home with either a printer at home or in any local print store for the highest quality prints.

-

What software do I need in order to open printables at no cost?

- The majority of printables are as PDF files, which can be opened using free software such as Adobe Reader.

National Insurance Contributions Explained IFS Taxlab

National Insurance contribution rates%2C 2021–22.png?itok=iGs8c8Ix)

NHS Pension Scheme member contribution rates 2022 23 PDF

Check more sample of Do Employer Pension Contributions Count Towards Taxable Income below

Employer Pension Contributions Calculator Factorial

P60 Www gorgas gob pa

Hunter Gee Holroyd Changes To Pension Contributions From 6 April 2018

Changes In NHS Pension Contributions Are You A Winner Or Loser

Social Security Cost Of Living Adjustments 2023

How Pension Contributions Work

https://forums.moneysavingexpert.com/discussion/...

What type of pension contribution do you intend making One that reduces your taxable income such as a net pay contribution to your employers scheme or a relief at source contribution to a personal pension or SIPP which doesn t reduce your taxable income but does increase your basic rate tax band

https://www.gov.uk/guidance/adjusted-net-income

Pension contributions paid gross before tax relief pension contributions where your pension provider has already given you tax relief at the basic rate take off the grossed up

What type of pension contribution do you intend making One that reduces your taxable income such as a net pay contribution to your employers scheme or a relief at source contribution to a personal pension or SIPP which doesn t reduce your taxable income but does increase your basic rate tax band

Pension contributions paid gross before tax relief pension contributions where your pension provider has already given you tax relief at the basic rate take off the grossed up

Changes In NHS Pension Contributions Are You A Winner Or Loser

P60 Www gorgas gob pa

Social Security Cost Of Living Adjustments 2023

How Pension Contributions Work

Crazy Monday Achieve Financial Freedom Fitness Goals Employer

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund