In this day and age in which screens are the norm The appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education in creative or artistic projects, or just adding an individual touch to the area, Ct Tax On Pensions And Social Security have proven to be a valuable source. The following article is a take a dive into the world of "Ct Tax On Pensions And Social Security," exploring their purpose, where you can find them, and how they can enhance various aspects of your lives.

Get Latest Ct Tax On Pensions And Social Security Below

Ct Tax On Pensions And Social Security

Ct Tax On Pensions And Social Security - Ct Tax On Pensions And Social Security, Ct Income Tax On Pensions And Social Security, Does Ct Tax Pensions And Social Security, Does Connecticut Tax Pensions And Social Security, Does Ct Tax Social Security Income, What Is The Tax Rate On Pensions In Ct, Are Pensions And Social Security Taxable, Does Ct Tax Social Security

By law Connecticut exempts from its income tax 1 Social Security income the federal government exempts from the federal income tax and 2 depending on a taxpayer s filing status and AGI some or all of the Social Security income the federal government taxes CGS 12 701 20 B x

November 12 2021 2021 R 0168 Issue Explain the state tax deductions for Social Security income pension and annuity income and individual retirement account IRA income This report updates OLR Report 2019 R 0098 This report has been updated by OLR Report 2022 R 0099 Social Security Income

Ct Tax On Pensions And Social Security provide a diverse variety of printable, downloadable items that are available online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages, and more. The great thing about Ct Tax On Pensions And Social Security lies in their versatility as well as accessibility.

More of Ct Tax On Pensions And Social Security

Family Pension Know How To Claim Family Pension After Death Of

Family Pension Know How To Claim Family Pension After Death Of

Taxpayers may deduct 100 of their federally taxable Social Security income if their AGI is below 1 75 000 for single filers and married people filing separately or 2 100 000 for joint filers and heads of household

Connecticut currently exempts from the state income tax all pension and annuity earnings but only for individuals whose overall income from all sources is less than 75 000 per year

The Ct Tax On Pensions And Social Security have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: It is possible to tailor printing templates to your own specific requirements be it designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge are designed to appeal to students of all ages, which makes the perfect source for educators and parents.

-

Convenience: You have instant access an array of designs and templates helps save time and effort.

Where to Find more Ct Tax On Pensions And Social Security

Income Limits Social Security Vets Disability Guide

Income Limits Social Security Vets Disability Guide

Connecticut also shields 50 of pension earnings for retired teachers and 100 of federally taxable military retirement pay according to the state s Tax Expenditure Report The exemption for

SUMMARY Connecticut s income tax excludes 1 75 or 100 of federally taxable Social Security income depending on the taxpayer s federal adjusted gross income AGI 2 100 of railroad retirement benefits and 3 50 of federally taxable military retirement benefits Connecticut has no exemptions for other types of

After we've peaked your curiosity about Ct Tax On Pensions And Social Security we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Ct Tax On Pensions And Social Security designed for a variety needs.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs are a vast variety of topics, starting from DIY projects to planning a party.

Maximizing Ct Tax On Pensions And Social Security

Here are some unique ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Ct Tax On Pensions And Social Security are a treasure trove of useful and creative resources that can meet the needs of a variety of people and interest. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the world of Ct Tax On Pensions And Social Security today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can download and print the resources for free.

-

Can I download free printables to make commercial products?

- It depends on the specific terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Ct Tax On Pensions And Social Security?

- Some printables may have restrictions on usage. Always read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer or go to an area print shop for more high-quality prints.

-

What program is required to open Ct Tax On Pensions And Social Security?

- The majority are printed in PDF format. They is open with no cost software such as Adobe Reader.

Are You Due A Huge Pension Tax Refund Which News

State by State Guide To Taxes On Retirees Flagel Huber Flagel

Check more sample of Ct Tax On Pensions And Social Security below

Want To Retire In Arizona Here s What You Need To Know Vision

12 401 Ok IRA

Social Security Income Inflation Protection

Tax On Pensions Beware The Tax Trap GBM Accounts

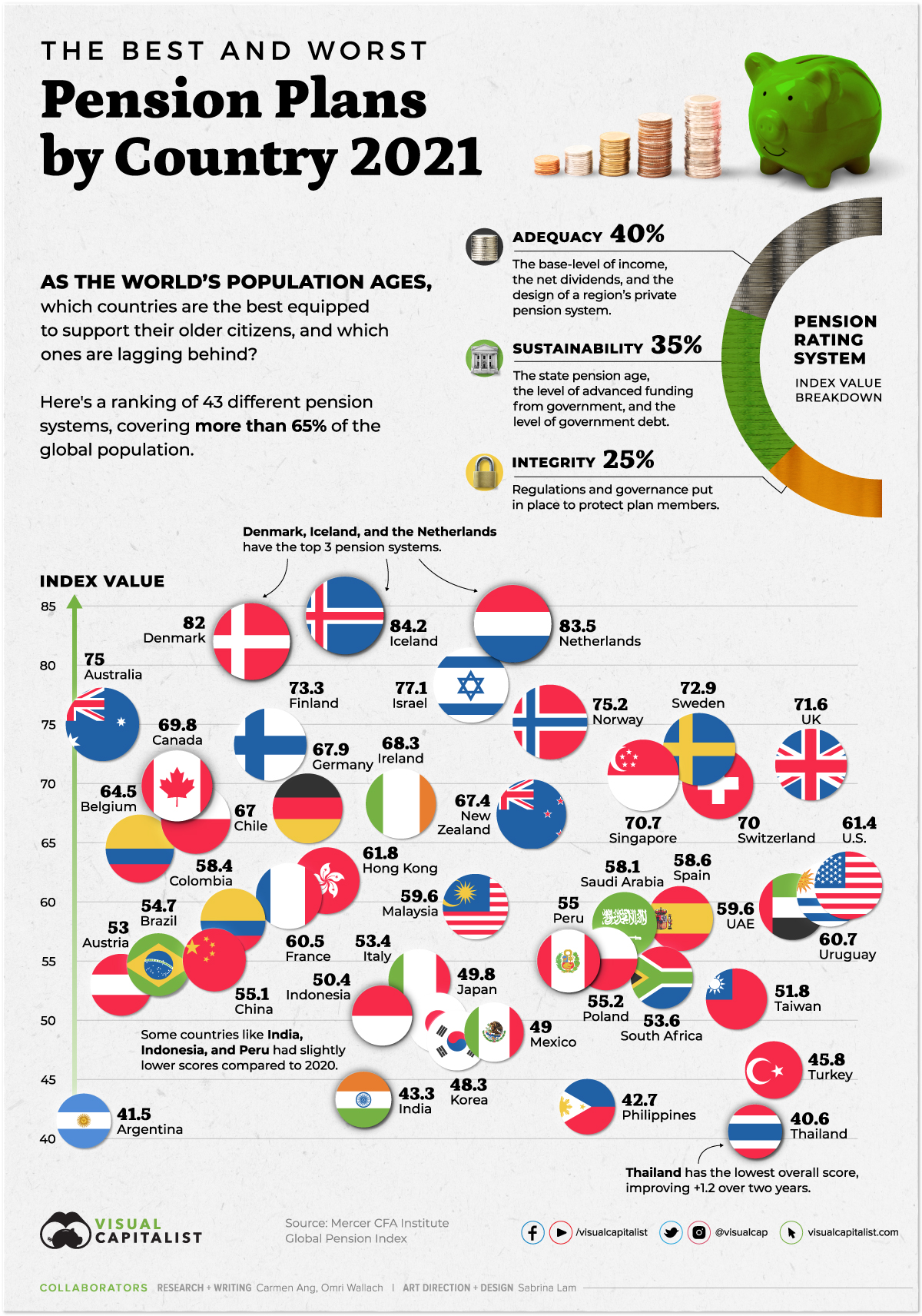

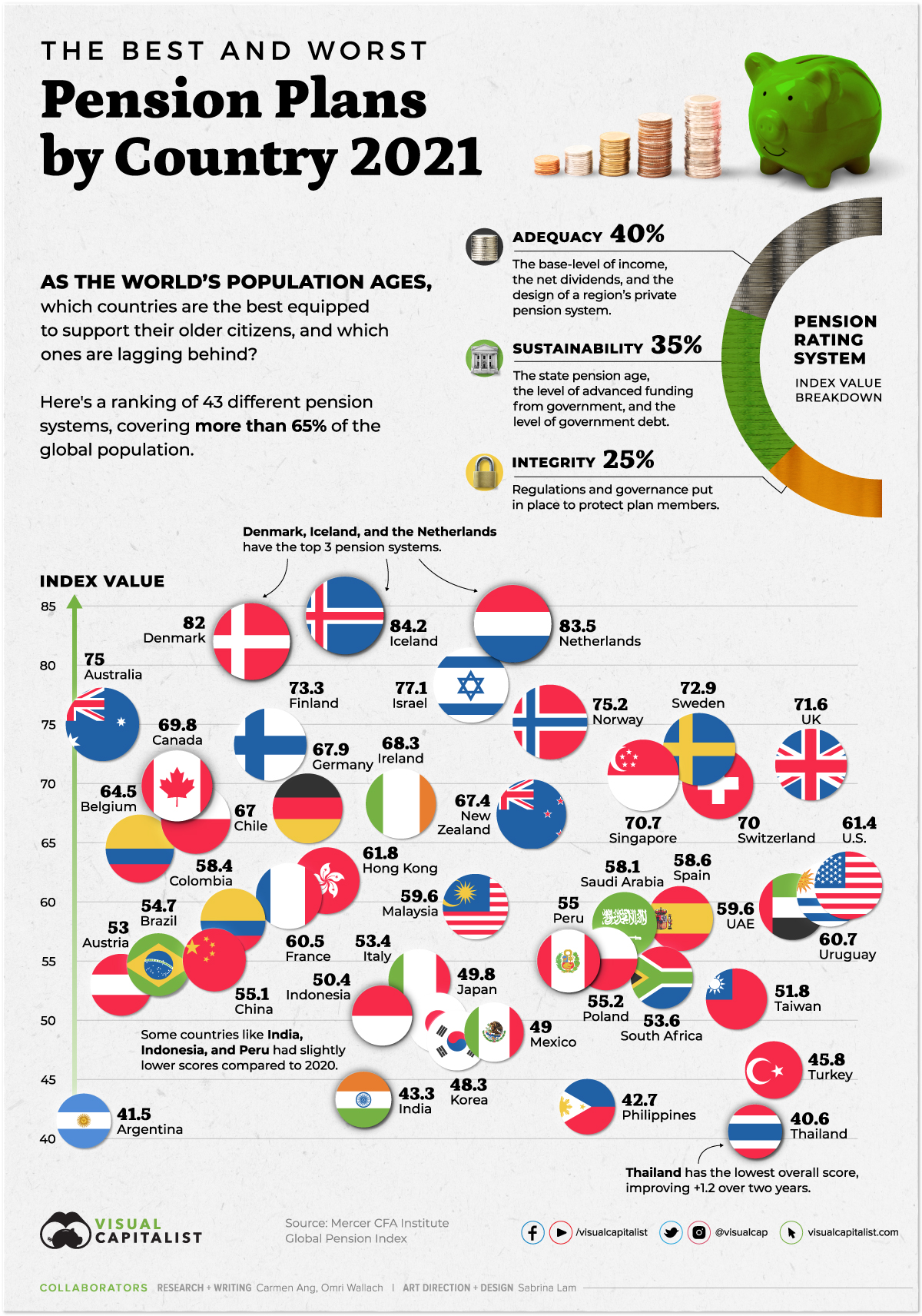

Ranked The Best And Worst Pension Plans By Country

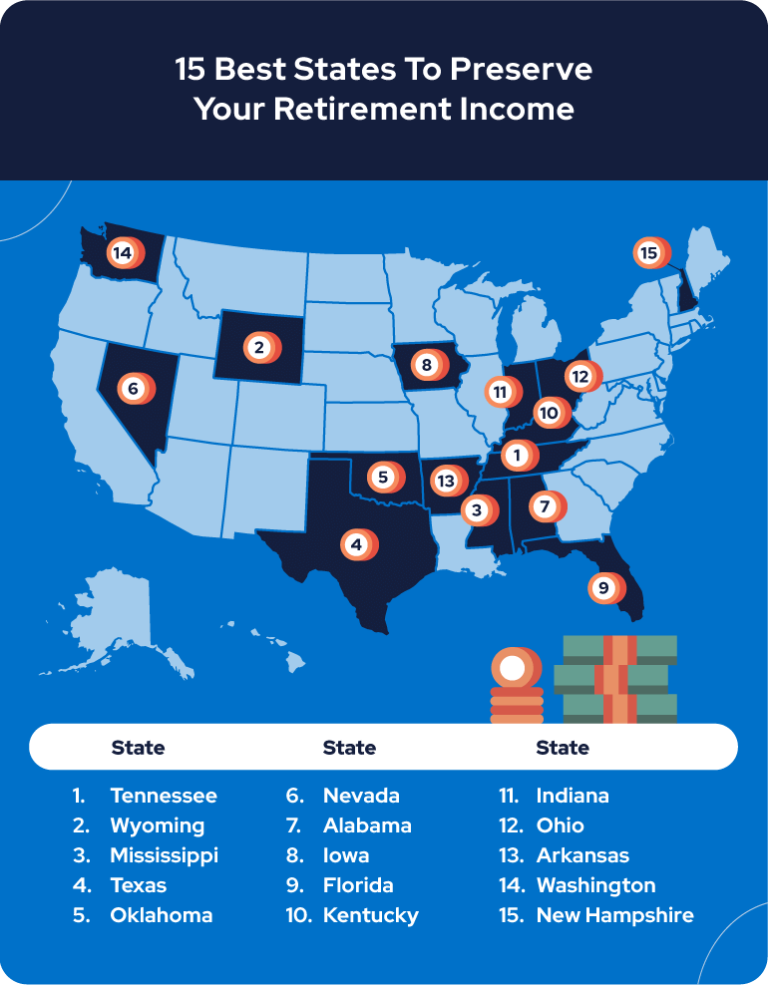

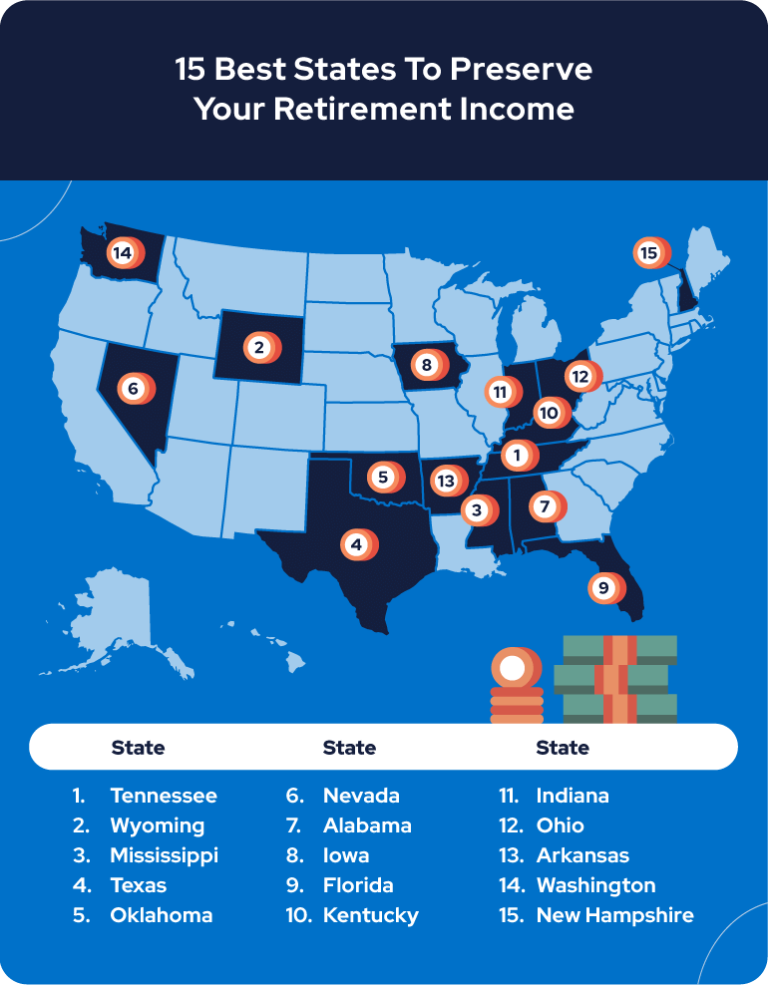

STATES THAT DON T TAX PENSIONS AND SOCIAL SECURITY

https://www.cga.ct.gov/2021/rpt/pdf/2021-R-0168.pdf

November 12 2021 2021 R 0168 Issue Explain the state tax deductions for Social Security income pension and annuity income and individual retirement account IRA income This report updates OLR Report 2019 R 0098 This report has been updated by OLR Report 2022 R 0099 Social Security Income

https://portal.ct.gov/-/media/DRS/Publications/...

Your Social Security benefits are fully exempt from Connecticut income tax if your federal filing status is Single or married filing separately and your federal adjusted gross income as reported on Line 1 of your Connecticut

November 12 2021 2021 R 0168 Issue Explain the state tax deductions for Social Security income pension and annuity income and individual retirement account IRA income This report updates OLR Report 2019 R 0098 This report has been updated by OLR Report 2022 R 0099 Social Security Income

Your Social Security benefits are fully exempt from Connecticut income tax if your federal filing status is Single or married filing separately and your federal adjusted gross income as reported on Line 1 of your Connecticut

Tax On Pensions Beware The Tax Trap GBM Accounts

12 401 Ok IRA

Ranked The Best And Worst Pension Plans By Country

STATES THAT DON T TAX PENSIONS AND SOCIAL SECURITY

Jamel Doan

States That Don t Tax Social Security Retiree Friendly States

States That Don t Tax Social Security Retiree Friendly States

Pensions More Than Just A Tax efficient Way To Save For Retirement