In a world where screens rule our lives however, the attraction of tangible, printed materials hasn't diminished. Whatever the reason, whether for education such as creative projects or simply adding an individual touch to your area, Claim A Tax Deduction have become a valuable source. This article will take a dive into the world "Claim A Tax Deduction," exploring the benefits of them, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Claim A Tax Deduction Below

Claim A Tax Deduction

Claim A Tax Deduction - Claim A Tax Deduction For Personal Super Contributions, Claim A Tax Deduction, Claim A Tax Deduction Qsuper, Claim A Tax Deduction Australian Super, Hostplus Claim A Tax Deduction, Claim A Tax Rebate, Claim A Tax Credit, Claim A Tax Rebate For Uniform, Claim A Tax Relief, Claim A Tax Rebate For Working From Home

To claim a dependent for tax credits or deductions the dependent must meet specific requirements Answer questions to see if you can claim someone as a dependent on your tax return See the full rules for dependents General rules for dependents These rules generally apply to all dependents

A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them

Claim A Tax Deduction encompass a wide variety of printable, downloadable items that are available online at no cost. They come in many styles, from worksheets to coloring pages, templates and much more. One of the advantages of Claim A Tax Deduction lies in their versatility as well as accessibility.

More of Claim A Tax Deduction

Record Of Charitable Contribution Is A Must For Claiming Deduction

Record Of Charitable Contribution Is A Must For Claiming Deduction

You may be able to claim the following 15 common write offs which include both tax credits and deductions Additionally you m

The Standard Deduction for tax year 2023 is 13 850 for single taxpayers 20 800 for those who file as Head of Household and 27 700 for Married Filing Jointly Additional deductions you can take without itemizing are known as above the line deductions These deductions help determine your adjusted gross income AGI

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Flexible: This allows you to modify the templates to meet your individual needs whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: These Claim A Tax Deduction provide for students of all ages, which makes these printables a powerful tool for parents and educators.

-

The convenience of The instant accessibility to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Claim A Tax Deduction

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Should You Take The Standard Deduction On Your 2021 2022 Taxes

What Is a Tax Deduction A tax deduction is an amount you can subtract from your gross income before calculating your tax liability For example if a single taxpayer

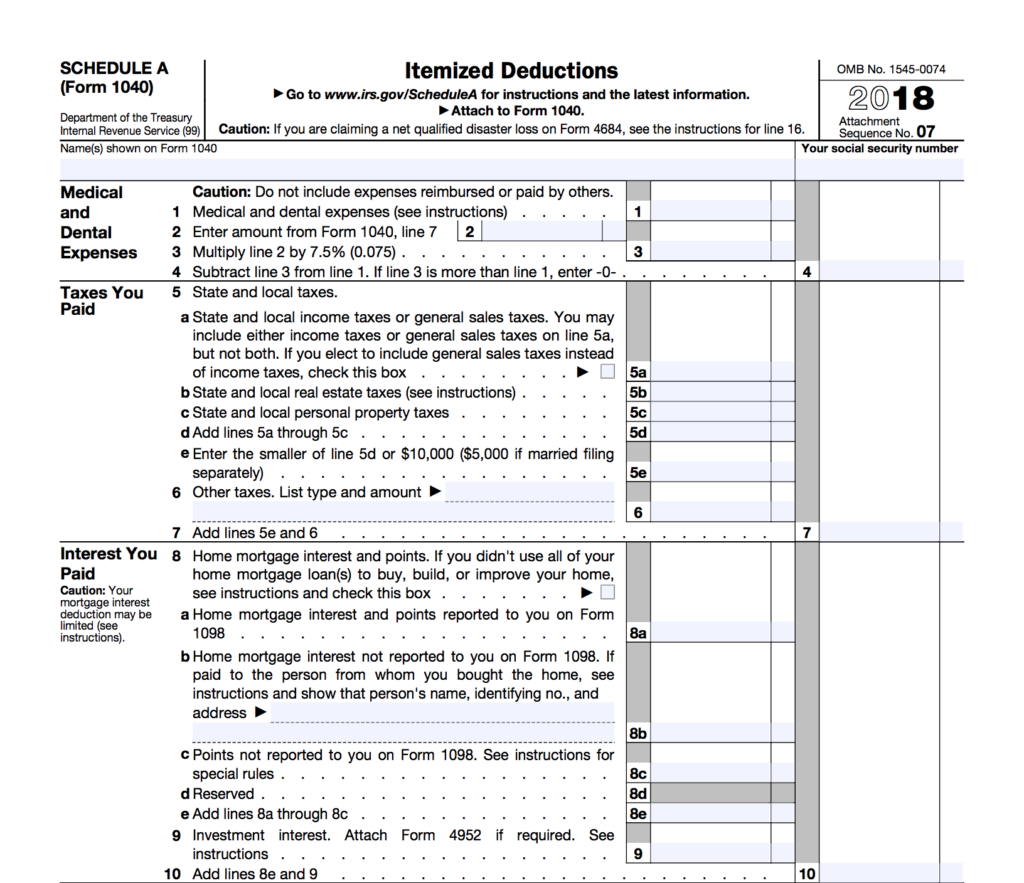

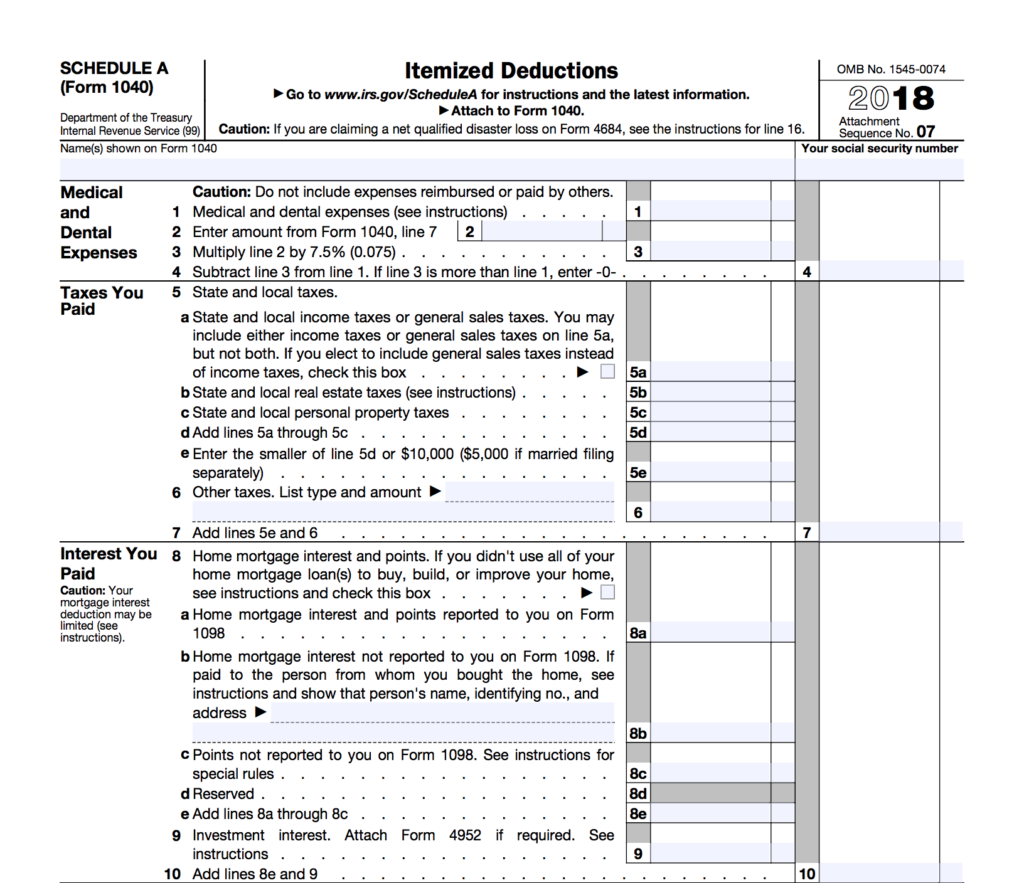

When you re filling out your tax return there are two ways to claim tax deductions Take the standard deduction or itemize your deductions You have to pick one The standard deduction is an amount set by the IRS each year and it is the easy option it s like an automatic tax freebie

After we've peaked your curiosity about Claim A Tax Deduction Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of goals.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Claim A Tax Deduction

Here are some inventive ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Claim A Tax Deduction are an abundance with useful and creative ideas that can meet the needs of a variety of people and needs and. Their availability and versatility make them an invaluable addition to each day life. Explore the world of Claim A Tax Deduction and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Claim A Tax Deduction truly cost-free?

- Yes you can! You can download and print these documents for free.

-

Do I have the right to use free printables to make commercial products?

- It's dependent on the particular terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions concerning their use. Make sure you read the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home using any printer or head to the local print shop for higher quality prints.

-

What program do I require to view printables that are free?

- Many printables are offered in PDF format, which is open with no cost software, such as Adobe Reader.

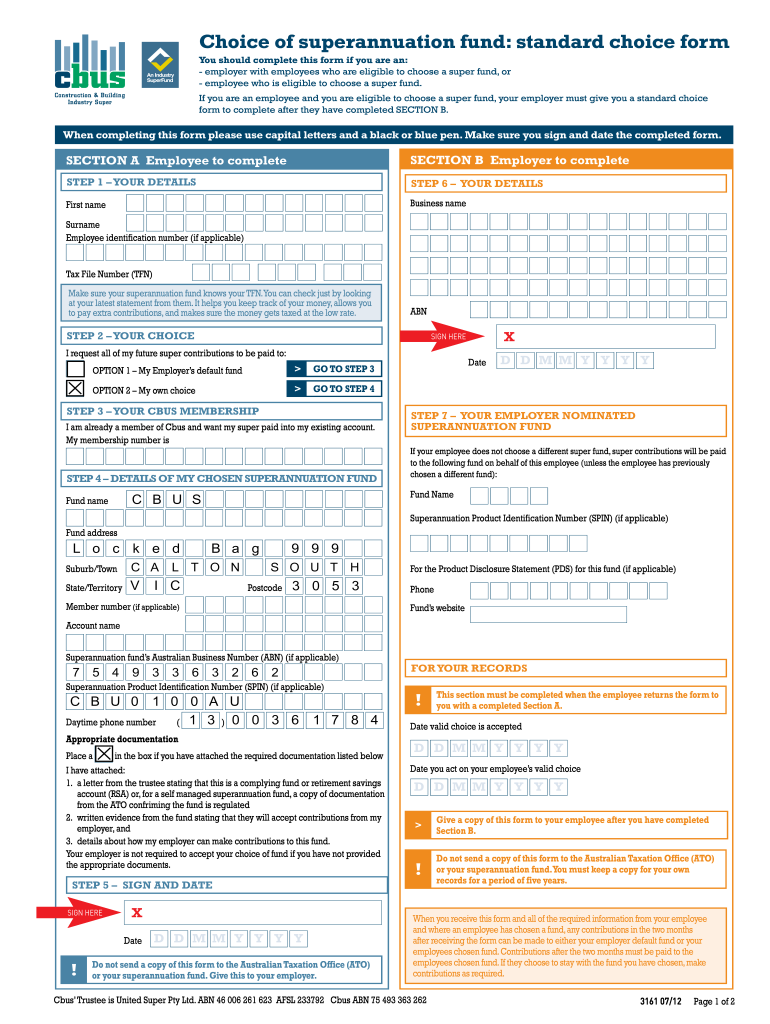

AU Cbus 3161 Fill And Sign Printable Template Online US Legal Forms

What Is A Tax Deduction Definition Examples Calculation

Check more sample of Claim A Tax Deduction below

Tax Deductions You Can Deduct What Napkin Finance

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

Tax Deduction Letter Sign Templates Jotform

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Tax Deductions Write Offs To Save You Money Financial Gym

https://www.nerdwallet.com/article/taxes/tax-deductions-tax-breaks

A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them

https://www.irs.gov/credits

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions Claim credits A credit is an amount you subtract from the tax you owe

A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions Claim credits A credit is an amount you subtract from the tax you owe

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Tax Deductions Write Offs To Save You Money Financial Gym

10 2014 Itemized Deductions Worksheet Worksheeto

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

How To claim A Tax Deduction For Work Uniforms YouTube