In a world when screens dominate our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Be it for educational use as well as creative projects or simply adding an individual touch to the area, Child Tax Credit Form 8862 have become an invaluable resource. Through this post, we'll take a dive to the depths of "Child Tax Credit Form 8862," exploring what they are, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Child Tax Credit Form 8862 Below

Child Tax Credit Form 8862

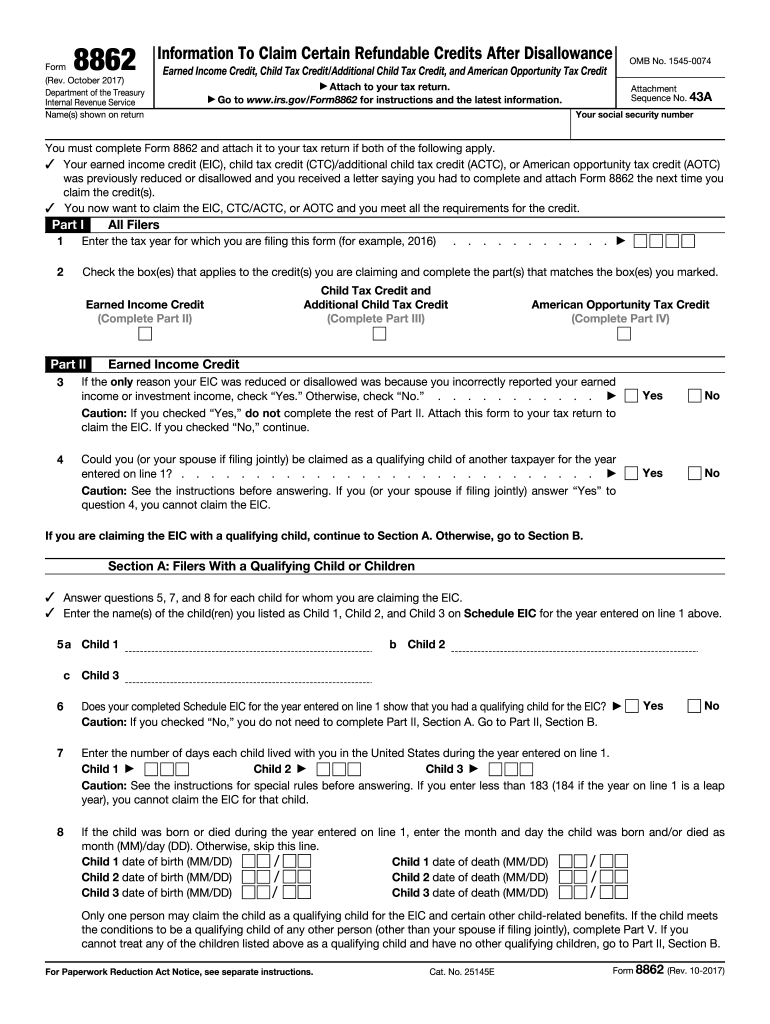

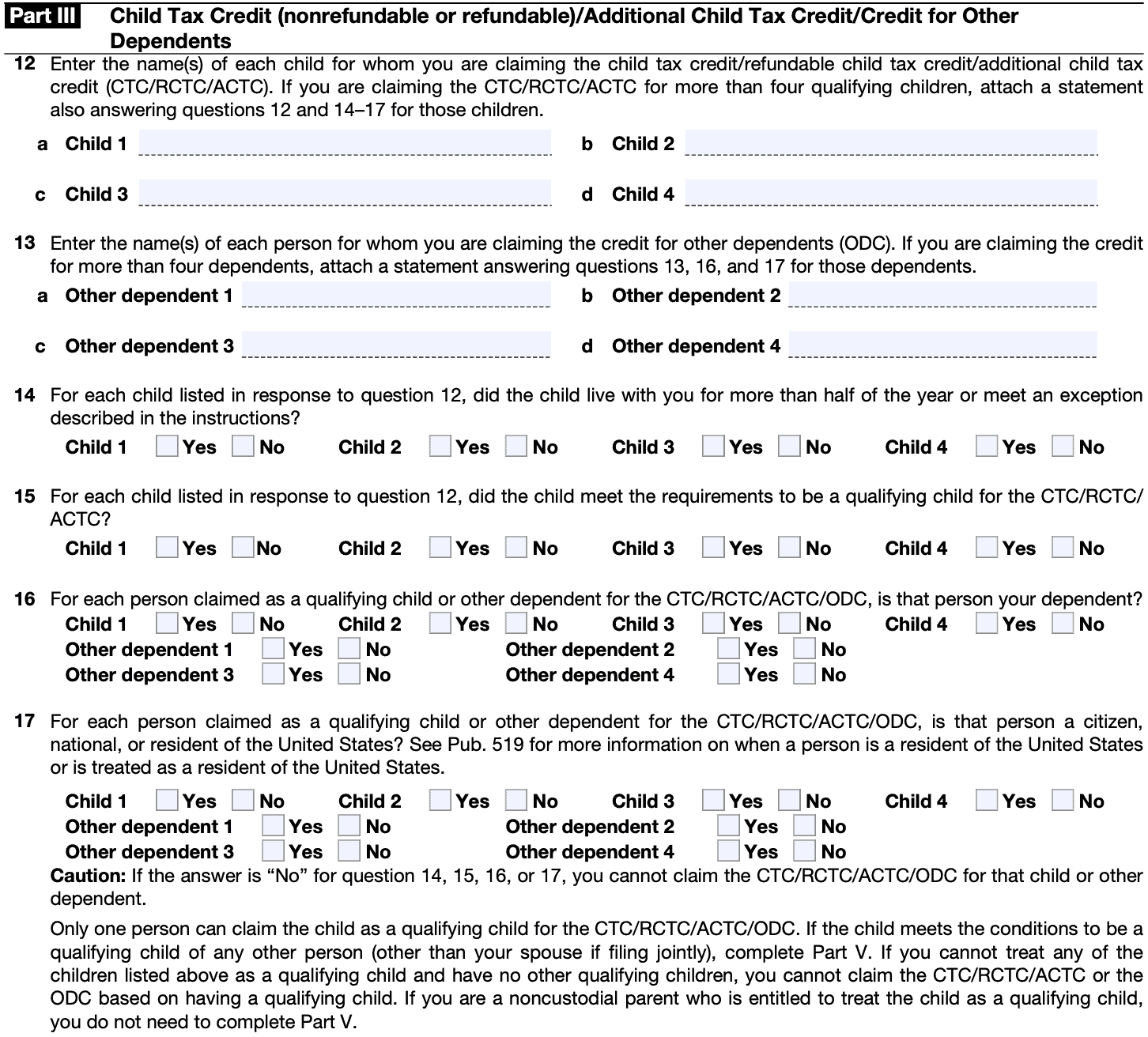

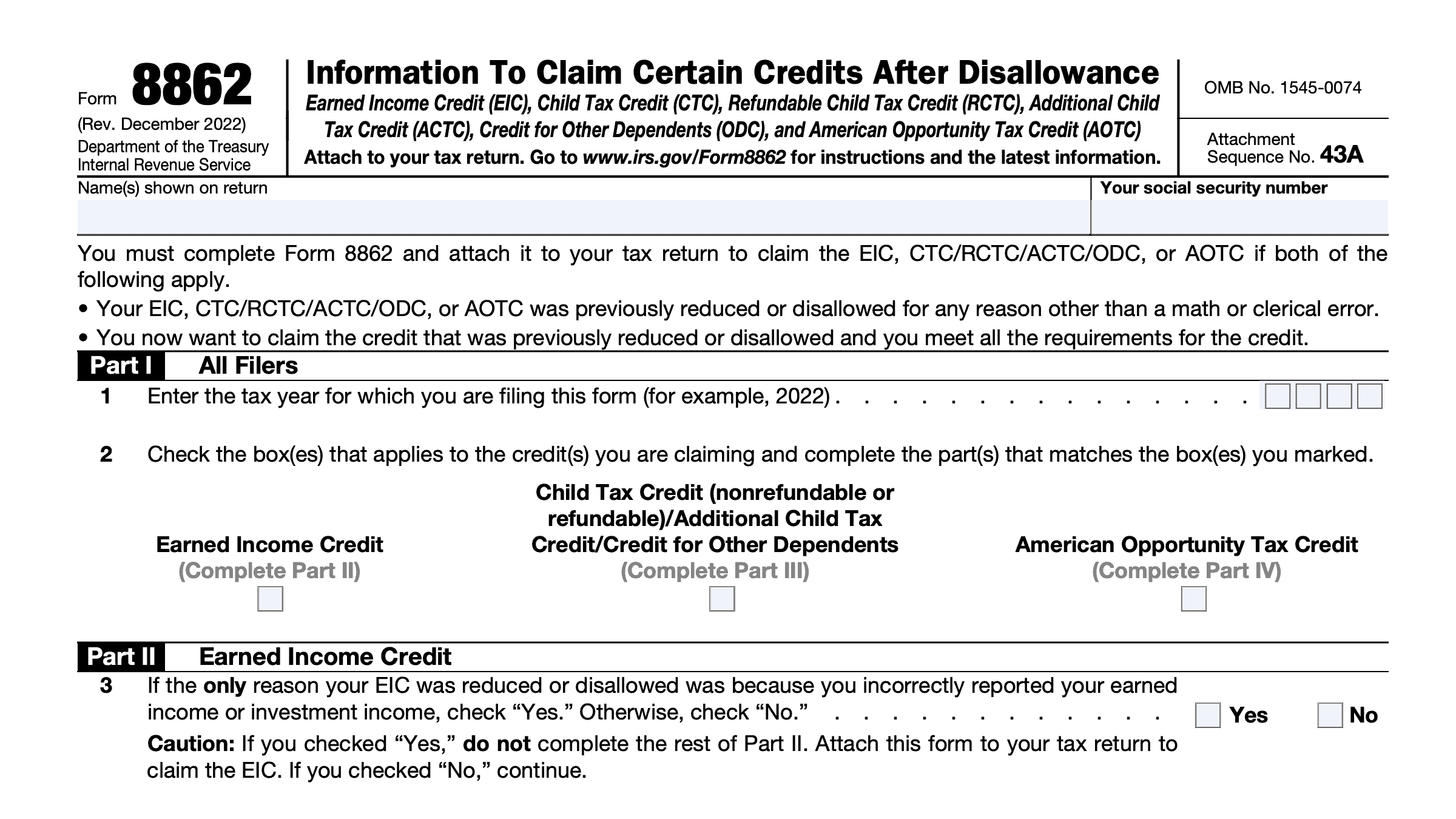

Child Tax Credit Form 8862 - Child Tax Credit Form 8862, Child And Other Dependent Tax Credit Form 8862, Form 8862 To Claim Child Tax Credit

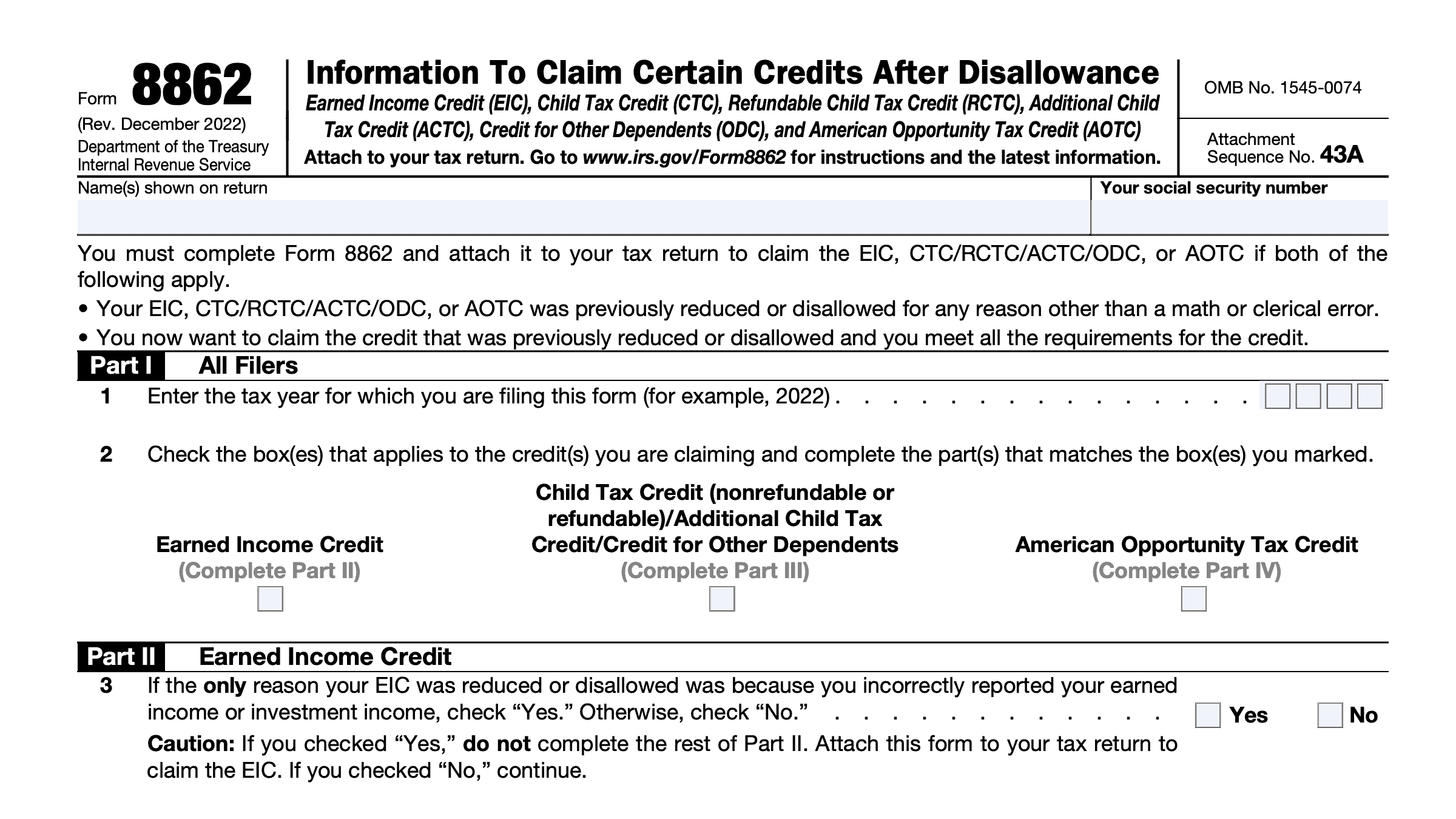

Learn about Form 8862 vital for reclaiming tax credits after disallowance Discover eligibility criteria and steps to maximize credit claims

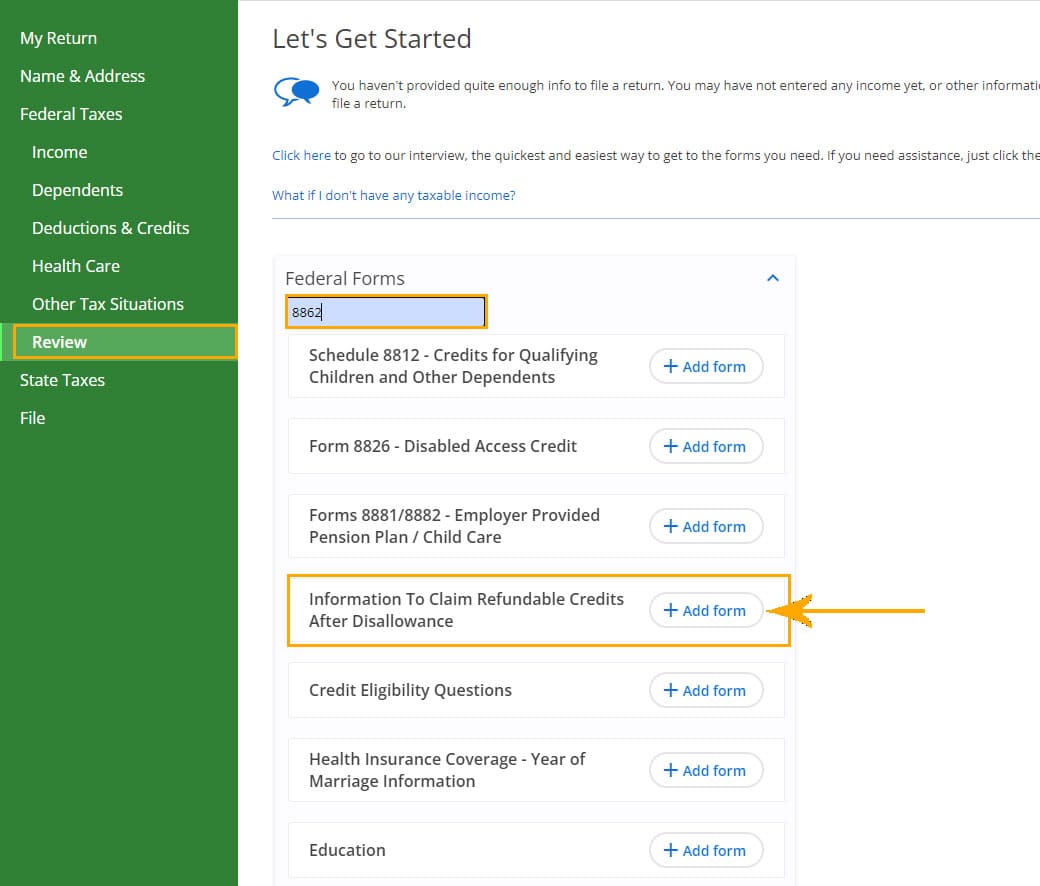

Here s how to file Form 8862 in TurboTax Open or continue your return in TurboTax by selecting the Continue or Start button on the Tax Home screen Select Search

Child Tax Credit Form 8862 offer a wide range of printable, free resources available online for download at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and much more. The appeal of printables for free is in their variety and accessibility.

More of Child Tax Credit Form 8862

Child Tax Credit 2022 What Will Be Different With Your Payments

Child Tax Credit 2022 What Will Be Different With Your Payments

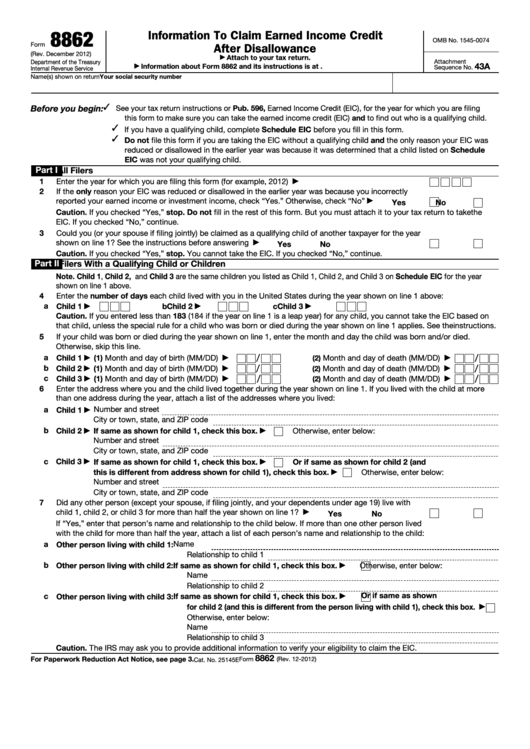

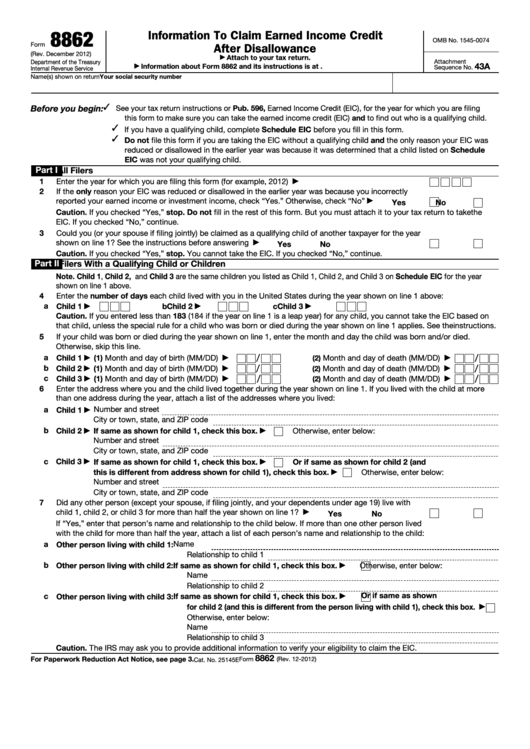

Tax form 8862 is an IRS attachment that must be filed to claim the Earned Income Credit the Child Tax Credit Additional Child Tax Credit Credit for Other Dependents or the

Form 8862 Information to claim Earned Income Credit EIC after Disallowance has been expanded to include the Child Tax Credit CTC Additional Child Tax Credit ACTC and the

The Child Tax Credit Form 8862 have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Individualization It is possible to tailor the design to meet your needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: Printing educational materials for no cost can be used by students of all ages. This makes these printables a powerful aid for parents as well as educators.

-

Convenience: Quick access to various designs and templates will save you time and effort.

Where to Find more Child Tax Credit Form 8862

IRS Form 8862 Fill Out And Sign Printable PDF Template SignNow

IRS Form 8862 Fill Out And Sign Printable PDF Template SignNow

You can apply for child benefit from Kela either via Kela s website or by a paper form The online service is available in Finnish and Swedish You can apply for child benefit

IRS Form 8862 is used by taxpayers to claim certain refundable credits after the IRS previously disallowed them This includes the Earned Income Tax Credit EITC Child Tax Credit CTC Additional Child Tax Credit ACTC Credit for

Now that we've piqued your interest in printables for free, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Child Tax Credit Form 8862 to suit a variety of uses.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Child Tax Credit Form 8862

Here are some inventive ways in order to maximize the use use of Child Tax Credit Form 8862:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Child Tax Credit Form 8862 are an abundance of useful and creative resources that cater to various needs and hobbies. Their accessibility and flexibility make them an essential part of the professional and personal lives of both. Explore the vast array that is Child Tax Credit Form 8862 today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these files for free.

-

Can I use the free printables in commercial projects?

- It is contingent on the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download Child Tax Credit Form 8862?

- Some printables may come with restrictions in use. Be sure to check the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home with your printer or visit a local print shop for more high-quality prints.

-

What software do I need to run printables free of charge?

- Most PDF-based printables are available in PDF format. These is open with no cost software such as Adobe Reader.

IRS Form 8862 Instructions

Form 8862 Information To Claim Earned Income Credit After

Check more sample of Child Tax Credit Form 8862 below

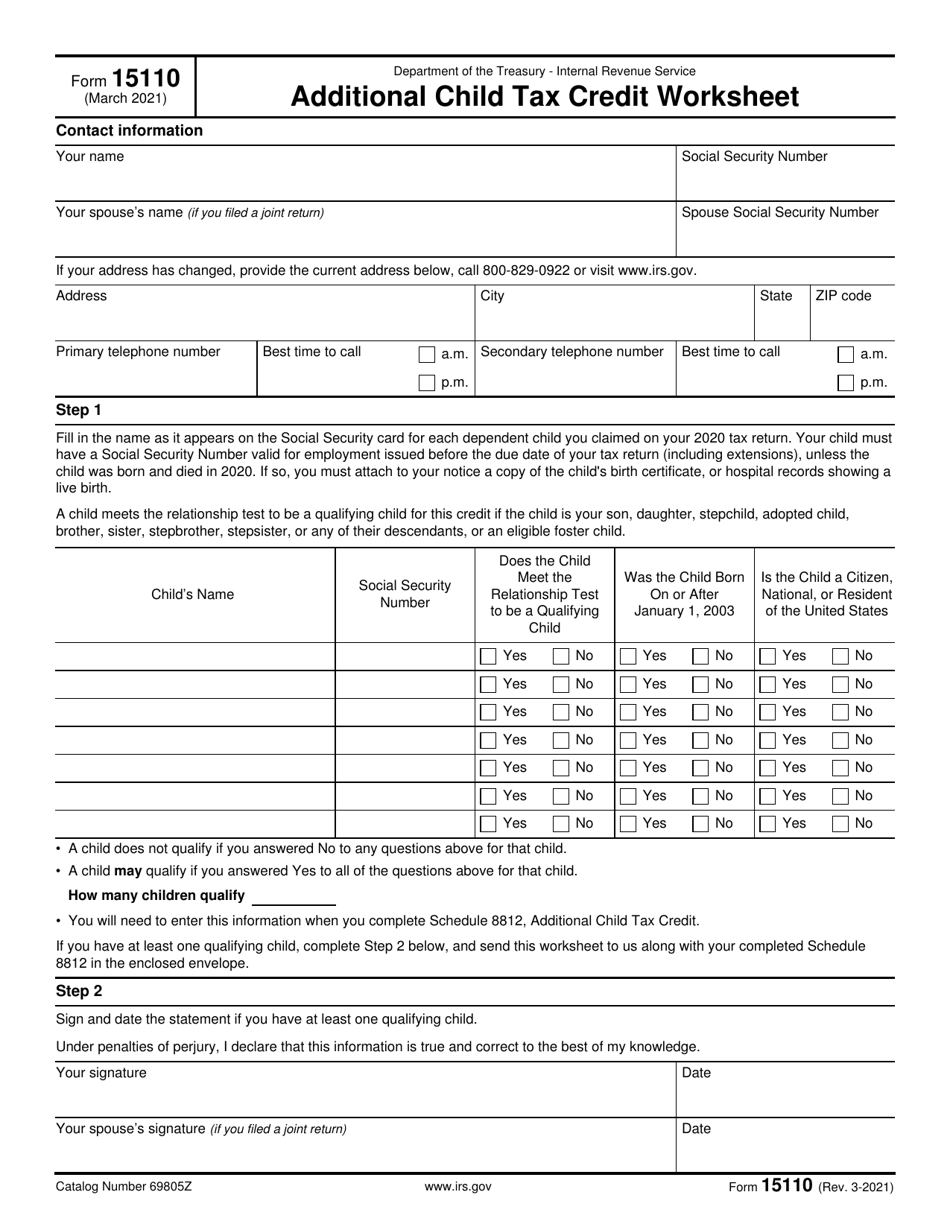

IRS Form 15110 Fill Out Sign Online And Download Fillable PDF

IRS Form 8862 Claiming Certain Tax Credits After Disallowance

Form 8862 Added To Your IRS Tax Return Instructions EFile

Fillable Form 8862 Information To Claim Earned Income Credit After

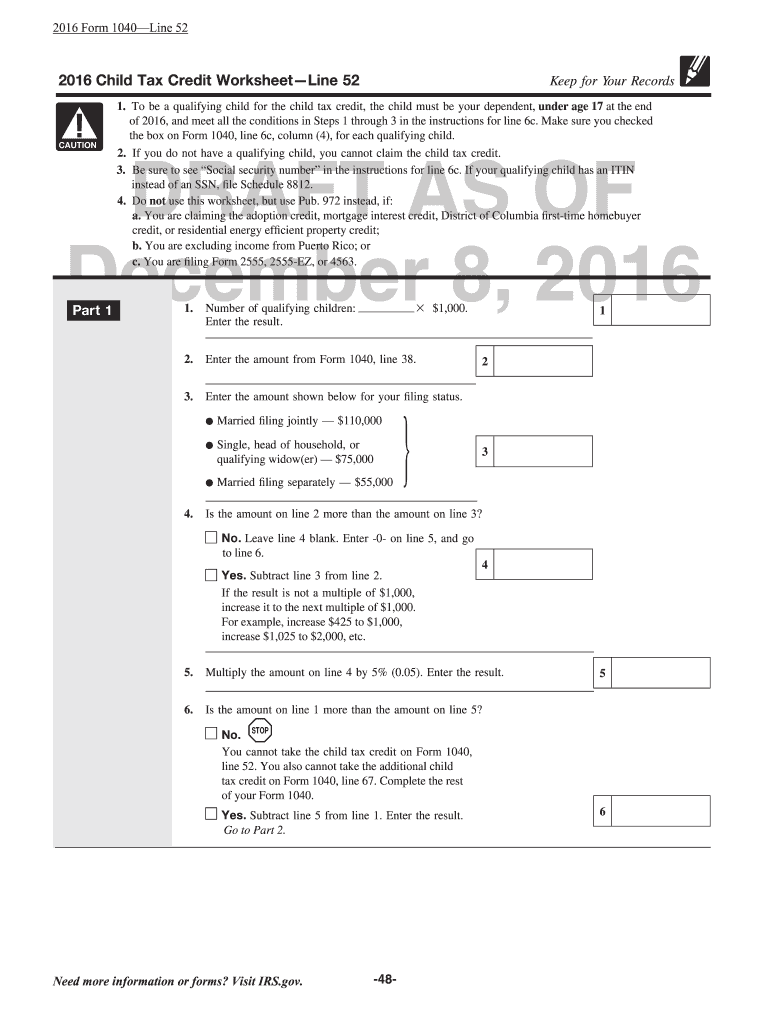

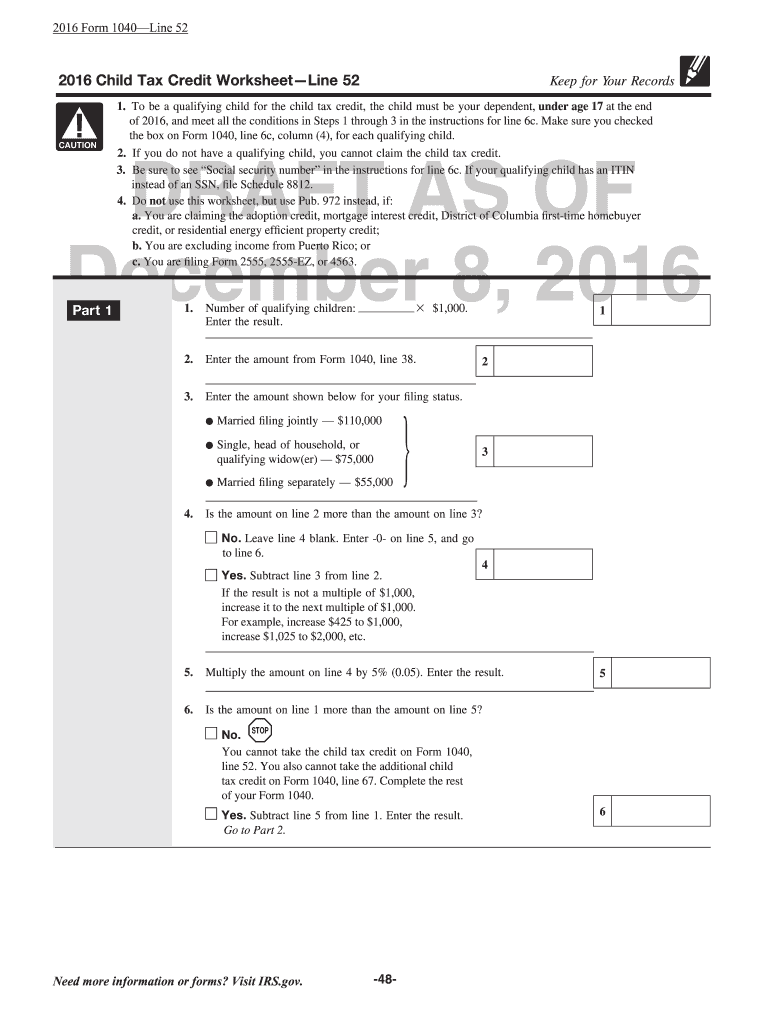

Child Tax Credit Worksheet 2014 Fill Online Printable Fillable

Form 8862 Information To Claim Earned Income Credit After

https://ttlc.intuit.com › turbotax-support › en-us › ...

Here s how to file Form 8862 in TurboTax Open or continue your return in TurboTax by selecting the Continue or Start button on the Tax Home screen Select Search

https://turbotax.intuit.com › tax-tips › ta…

Schedule EIC which is used to claim the Earned Income Credit with a qualifying child must be completed prior to filling out Form 8862 The IRS defines a qualifying child as the child an eligible foster child brother sister or

Here s how to file Form 8862 in TurboTax Open or continue your return in TurboTax by selecting the Continue or Start button on the Tax Home screen Select Search

Schedule EIC which is used to claim the Earned Income Credit with a qualifying child must be completed prior to filling out Form 8862 The IRS defines a qualifying child as the child an eligible foster child brother sister or

Fillable Form 8862 Information To Claim Earned Income Credit After

IRS Form 8862 Claiming Certain Tax Credits After Disallowance

Child Tax Credit Worksheet 2014 Fill Online Printable Fillable

Form 8862 Information To Claim Earned Income Credit After

How To Claim An Earned Income Credit By Electronically Filing IRS Form 8862

Form 8812 Additional Child Tax Credit

Form 8812 Additional Child Tax Credit

Publication 972 2020 Child Tax Credit And Credit For Other