Today, with screens dominating our lives, the charm of tangible printed products hasn't decreased. For educational purposes for creative projects, simply to add personal touches to your space, Child Care Tax Credit Calculator Ontario have become a valuable resource. This article will dive deeper into "Child Care Tax Credit Calculator Ontario," exploring the benefits of them, where they can be found, and how they can improve various aspects of your life.

Get Latest Child Care Tax Credit Calculator Ontario Below

Child Care Tax Credit Calculator Ontario

Child Care Tax Credit Calculator Ontario - Child Care Tax Credit Calculator Ontario, How Much Child Care Tax Credit Calculator, How To Calculate Child Care Tax Credit, What Is The Maximum For Child Care Tax Credit

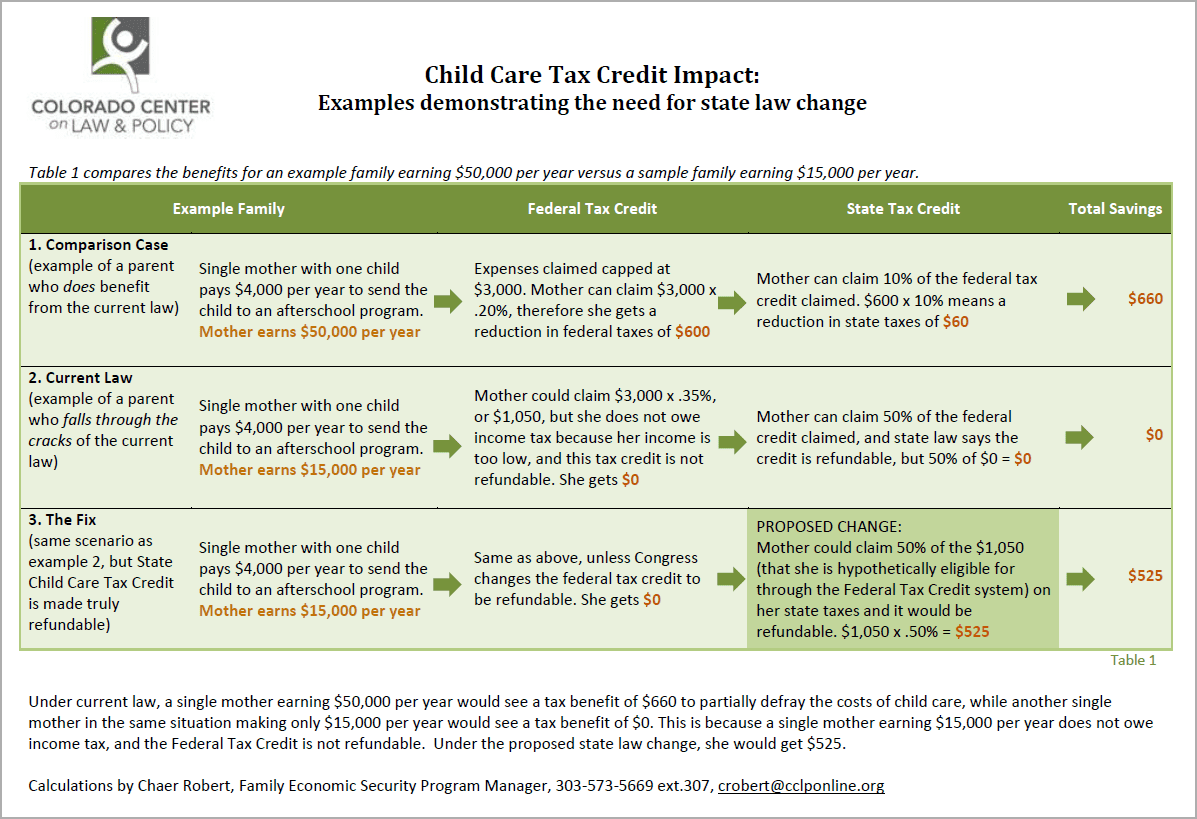

59 2 x 3 59 6 53 tax credit rate The tax credit rate is multiplied by the allowable child care expense deduction If actual expenses incurred totalled 9 600 but the maximum allowable deduction is 8 000 the refundable tax credit would be 53 x 8 000 4 240 For 2021 only the credit would be 4 240 x 1 2 5 088

Ontario Child Care Tax Credit rate calculation Family income Rate calculation Up to 20 000 75 Greater than 20 000 and up to 40 000 75 minus 2 percentage points for each 2 500 or part of above 20 000 Greater than 40 000 and up to 60 000 59 minus 2 percentage points for each 5 000 or part of above 40 000 Greater than

Child Care Tax Credit Calculator Ontario provide a diverse array of printable materials online, at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The value of Child Care Tax Credit Calculator Ontario is in their variety and accessibility.

More of Child Care Tax Credit Calculator Ontario

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

2023 11 20 Information about Canada child benefit CCB who can apply how to apply how much you get payment dates how to keep getting your payments and related provincial and territorial benefits

The amount you pay for child care depends on your family s adjusted net income To calculate your net income take your net income amount on line 236 of the Canada Revenue Agency personal income tax form Then subtract any federal Universal Child Care Benefit UCCB payments the UCCB is not considered in determining a family s

The Child Care Tax Credit Calculator Ontario have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization: We can customize the templates to meet your individual needs, whether it's designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Value Downloads of educational content for free can be used by students of all ages, making them a great tool for parents and educators.

-

Accessibility: Access to numerous designs and templates will save you time and effort.

Where to Find more Child Care Tax Credit Calculator Ontario

Child Care Tax Credit Calculator Paradox

Child Care Tax Credit Calculator Paradox

October 18 2024 November 20 2024 December 13 2024 Here s How Much Ontario Child Benefit You Will Receive You will get up to a maximum of 1 607 per child per year or 133 91 per month per child under 18 You may receive a partial benefit if your family s net income exceeds 24 542

Canada Child Benefit Calculator 2021 2022 This Page s Content Was Last Updated September 29 2022 WOWA Trusted and Transparent Inputs 1 Select Province BC AB SK MB ON QC NB NS PE NL YU NT NU 2 Select Status Single Parent Joint Custody of Children 3 Select Year Choose the year to calculate Child Care

If we've already piqued your curiosity about Child Care Tax Credit Calculator Ontario and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of purposes.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Child Care Tax Credit Calculator Ontario

Here are some creative ways for you to get the best of Child Care Tax Credit Calculator Ontario:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Child Care Tax Credit Calculator Ontario are an abundance with useful and creative ideas that can meet the needs of a variety of people and interest. Their availability and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast world of Child Care Tax Credit Calculator Ontario today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Child Care Tax Credit Calculator Ontario really completely free?

- Yes they are! You can print and download these files for free.

-

Can I make use of free printables in commercial projects?

- It's dependent on the particular terms of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright concerns when using Child Care Tax Credit Calculator Ontario?

- Some printables may contain restrictions regarding their use. Be sure to read the terms and conditions provided by the designer.

-

How can I print Child Care Tax Credit Calculator Ontario?

- You can print them at home with either a printer or go to the local print shop for better quality prints.

-

What software do I require to view Child Care Tax Credit Calculator Ontario?

- The majority are printed with PDF formats, which can be opened using free software, such as Adobe Reader.

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Fixing The Child Care Tax Credit EOPRTF CCLP

Check more sample of Child Care Tax Credit Calculator Ontario below

The Child Tax Credit ZOBUZ

Tax Credit Or FSA For Child Care Expenses Which Is Better

Can I Opt Out Of The Child Tax Credit Payments Here s The Answer Dogwood

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

Child Care In Ontario A Review Of Ontario s New Child Care Tax Credit

Earned Income Credit Calculator 2021 DannielleThalia

https://www.ontario.ca/page/ontario-child-care-tax-credit

Ontario Child Care Tax Credit rate calculation Family income Rate calculation Up to 20 000 75 Greater than 20 000 and up to 40 000 75 minus 2 percentage points for each 2 500 or part of above 20 000 Greater than 40 000 and up to 60 000 59 minus 2 percentage points for each 5 000 or part of above 40 000 Greater than

https://www.canada.ca/en/revenue-agency/services/...

2023 06 14 How much Canada child benefit CCB you can get how the CRA calculates it the payment schedule the child disability benefit and related provincial and territorial benefits

Ontario Child Care Tax Credit rate calculation Family income Rate calculation Up to 20 000 75 Greater than 20 000 and up to 40 000 75 minus 2 percentage points for each 2 500 or part of above 20 000 Greater than 40 000 and up to 60 000 59 minus 2 percentage points for each 5 000 or part of above 40 000 Greater than

2023 06 14 How much Canada child benefit CCB you can get how the CRA calculates it the payment schedule the child disability benefit and related provincial and territorial benefits

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

Tax Credit Or FSA For Child Care Expenses Which Is Better

Child Care In Ontario A Review Of Ontario s New Child Care Tax Credit

Earned Income Credit Calculator 2021 DannielleThalia

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

At What Income Do You No Longer Get Child Tax Credit Leia Aqui Do

At What Income Do You No Longer Get Child Tax Credit Leia Aqui Do

Indiana Lawmakers Consider Child Care Tax Credit For Employers Fox 59