Today, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses, creative projects, or simply to add a personal touch to your home, printables for free are now an essential source. This article will dive in the world of "Can You Make Nondeductible Contribution To A Traditional Ira," exploring the different types of printables, where to get them, as well as how they can enrich various aspects of your lives.

What Are Can You Make Nondeductible Contribution To A Traditional Ira?

Can You Make Nondeductible Contribution To A Traditional Ira provide a diverse array of printable materials that are accessible online for free cost. These resources come in various forms, like worksheets coloring pages, templates and many more. The beauty of Can You Make Nondeductible Contribution To A Traditional Ira lies in their versatility as well as accessibility.

Can You Make Nondeductible Contribution To A Traditional Ira

Can You Make Nondeductible Contribution To A Traditional Ira

Can You Make Nondeductible Contribution To A Traditional Ira - Can You Make Nondeductible Contribution To A Traditional Ira, Can You Make Nondeductible Contribution To A Traditional Ira With No Earned Income, What Is A Nondeductible Contribution To A Traditional Ira, How To Make Nondeductible Ira Contribution, Can I Make A Non Deductible Ira Contribution

[desc-5]

[desc-1]

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

[desc-4]

[desc-6]

Capital Preservation Services On Blogger October 2019

Capital Preservation Services On Blogger October 2019

[desc-9]

[desc-7]

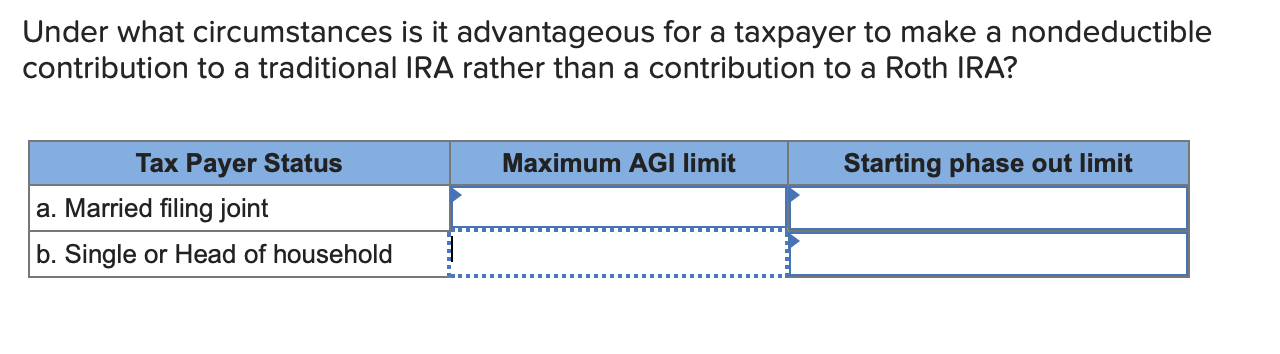

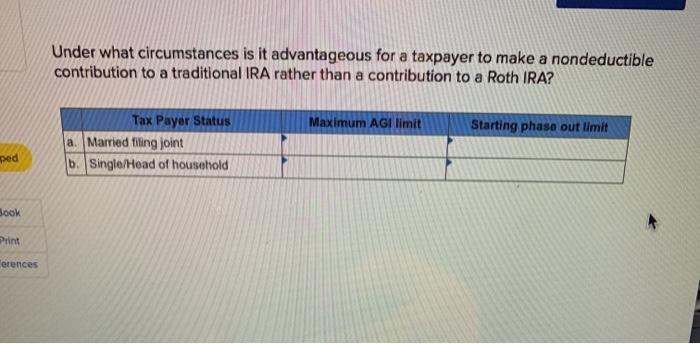

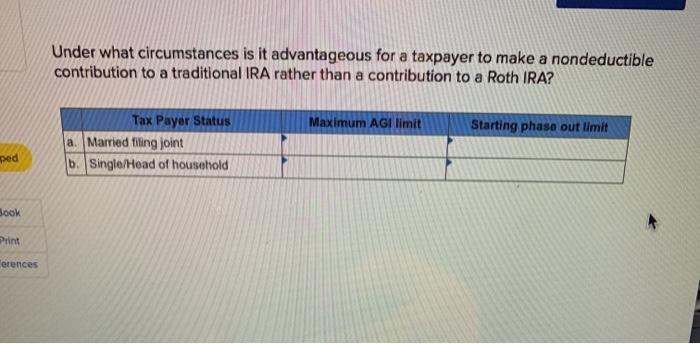

Under What Circumstances Is It For A Taxpayer To Make Chegg

Deductible Pretax Traditional IRA Contributions Vs Nondeductible IRA

Solved Under What Circumstances Is It Advantageous For A Chegg

What Is A Backdoor Roth Contribution Csenge Advisory Group

Traditional IRAs And Roth IRAs Coastal Wealth Management

Solved Under What Circumstances Is It Advantageous For A Chegg

Solved Under What Circumstances Is It Advantageous For A Chegg

Fillable Form 8606 V 1 Fillable Forms Dividend Paying Taxes