Today, where screens rule our lives The appeal of tangible printed products hasn't decreased. Be it for educational use and creative work, or simply to add some personal flair to your area, Are Teacher Pension Contributions Tax Deductible have become an invaluable resource. The following article is a take a dive deep into the realm of "Are Teacher Pension Contributions Tax Deductible," exploring what they are, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Are Teacher Pension Contributions Tax Deductible Below

Are Teacher Pension Contributions Tax Deductible

Are Teacher Pension Contributions Tax Deductible - Are Teacher Pension Contributions Tax Deductible, Are Teacher Retirement Contributions Tax Deductible, Teachers Pension Contributions Tax Relief, Are Pension Contributions Tax Deductible, Are Personal Pension Contributions Tax Deductible, Are Employee Pension Contributions Tax Deductible

The pension or annuity payments that you receive are fully taxable if you have no investment in the contract sometimes referred to as cost or basis due to any of the following situations You didn t contribute any after tax amounts or aren t considered to have contributed any after tax amounts for your pension or annuity

Your contributions to nonqualified pension plans such as standard annuities are not tax deductible as you contribute after tax dollars to

Are Teacher Pension Contributions Tax Deductible include a broad collection of printable materials online, at no cost. These resources come in various types, like worksheets, coloring pages, templates and much more. The great thing about Are Teacher Pension Contributions Tax Deductible is their versatility and accessibility.

More of Are Teacher Pension Contributions Tax Deductible

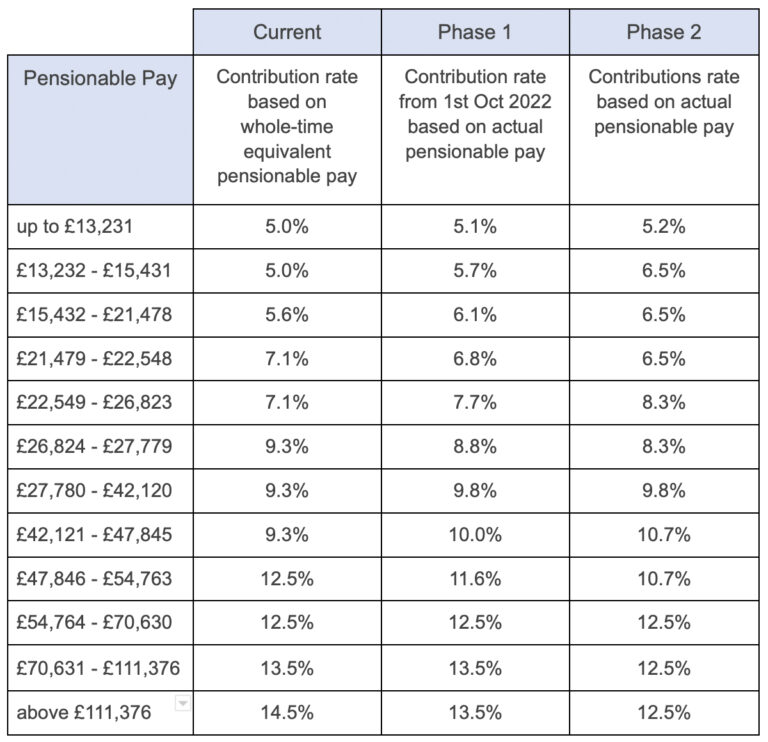

Changes In NHS Pension Contributions Are You A Winner Or Loser

Changes In NHS Pension Contributions Are You A Winner Or Loser

A teacher s employer will deduct pension contributions from their pay before deducting tax thereby giving tax relief on the pension contribution Employers contribute the equivalent of 23 68 of

The effect of income from your 403 b or other teachers retirement fund on your taxes depends on your deductions and exemptions your filing status and the amount withdrawn from the retirement

Are Teacher Pension Contributions Tax Deductible have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor printables to fit your particular needs whether it's making invitations for your guests, organizing your schedule or even decorating your home.

-

Education Value Free educational printables offer a wide range of educational content for learners of all ages, making the perfect tool for parents and educators.

-

Accessibility: immediate access an array of designs and templates, which saves time as well as effort.

Where to Find more Are Teacher Pension Contributions Tax Deductible

Tax Relief On Pension Contributions Chartered Accountants

Tax Relief On Pension Contributions Chartered Accountants

Teacher contributions are mandatory and are made through payroll deductions Similarly employers are required to contribute a set amount for each eligible employee Investment earnings make up a

Where do I put Teacher Retirement System contributions You only enter it from your W2 nowhere else It comes out of your pay pre tax and has already been deducted from the wages in box 1 and you can t deduct it again

If we've already piqued your curiosity about Are Teacher Pension Contributions Tax Deductible Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection in Are Teacher Pension Contributions Tax Deductible for different motives.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing Are Teacher Pension Contributions Tax Deductible

Here are some creative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home for the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Teacher Pension Contributions Tax Deductible are a treasure trove of practical and imaginative resources for a variety of needs and interests. Their accessibility and versatility make these printables a useful addition to both personal and professional life. Explore the wide world of Are Teacher Pension Contributions Tax Deductible to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Teacher Pension Contributions Tax Deductible truly absolutely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I make use of free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright concerns with Are Teacher Pension Contributions Tax Deductible?

- Some printables may come with restrictions regarding usage. Check these terms and conditions as set out by the creator.

-

How can I print Are Teacher Pension Contributions Tax Deductible?

- Print them at home with an printer, or go to a local print shop to purchase the highest quality prints.

-

What software do I need to open Are Teacher Pension Contributions Tax Deductible?

- The majority of printed documents are in PDF format. They can be opened with free software such as Adobe Reader.

PSERS Revises Investment Returns And In Turn Will Increase Teacher

Public Pension Funding It s No Easy Task Opinion Pennlive

Check more sample of Are Teacher Pension Contributions Tax Deductible below

How Pension Contributions Work

School Supplies Are Tax Deductible Wfmynews2

Tax Relief On Pension Contributions FKGB Accounting

Self Employed Pension Contributions Tax Deductible Ways To Make Money

Pension Tax Relief In The United Kingdom UK Pension Help

Pension Tax Relief On Pension Contributions Freetrade

https://finance.zacks.com/pension-plan...

Your contributions to nonqualified pension plans such as standard annuities are not tax deductible as you contribute after tax dollars to

https://www.teacherspensions.co.uk/employers/...

All teachers who are members of the Scheme must have their pension contributions deducted from their gross contributable salaries As only pensionable pay should be included pay figures should be adjusted to exclude amounts where a teacher Has opted out of the Teachers Pension Scheme Is aged 75 or over Is in part time non

Your contributions to nonqualified pension plans such as standard annuities are not tax deductible as you contribute after tax dollars to

All teachers who are members of the Scheme must have their pension contributions deducted from their gross contributable salaries As only pensionable pay should be included pay figures should be adjusted to exclude amounts where a teacher Has opted out of the Teachers Pension Scheme Is aged 75 or over Is in part time non

Self Employed Pension Contributions Tax Deductible Ways To Make Money

School Supplies Are Tax Deductible Wfmynews2

Pension Tax Relief In The United Kingdom UK Pension Help

Pension Tax Relief On Pension Contributions Freetrade

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

Pension Contributions Tax Efficient For Both Employee Employer

Pension Contributions Tax Efficient For Both Employee Employer

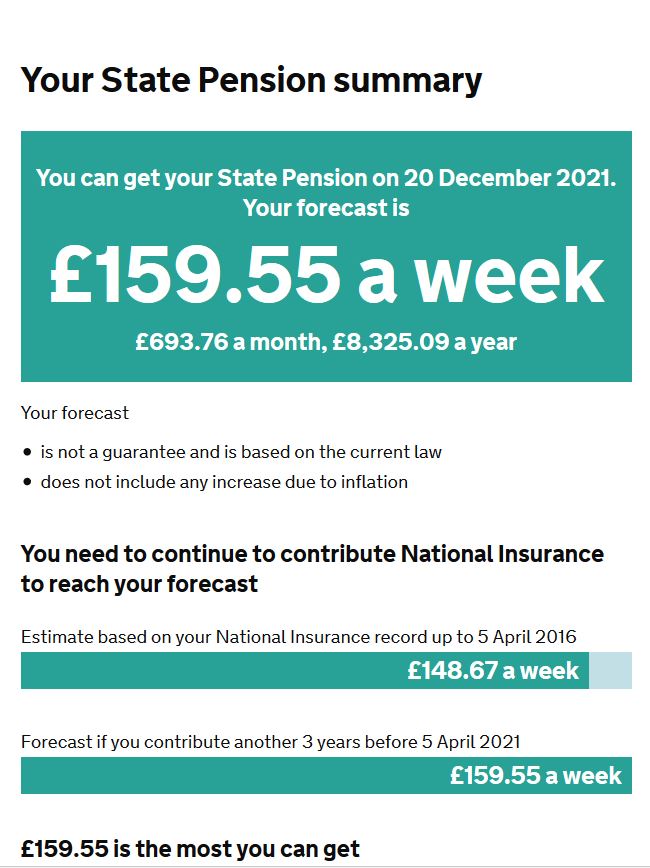

How To Check What Your State Pension Will Be Pounds And Sense