In this age of electronic devices, in which screens are the norm however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education as well as creative projects or just adding an extra personal touch to your home, printables for free are now a vital source. With this guide, you'll dive through the vast world of "Are Single Premium Immediate Annuities Taxable," exploring the different types of printables, where to locate them, and how they can improve various aspects of your lives.

Get Latest Are Single Premium Immediate Annuities Taxable Below

Are Single Premium Immediate Annuities Taxable

Are Single Premium Immediate Annuities Taxable - Are Single Premium Immediate Annuities Taxable, How Are Single Premium Immediate Annuities Taxed, Single Premium Immediate Annuity Taxation, Is A Single Life Annuity Taxable, How Are Single Premium Deferred Annuities Taxed

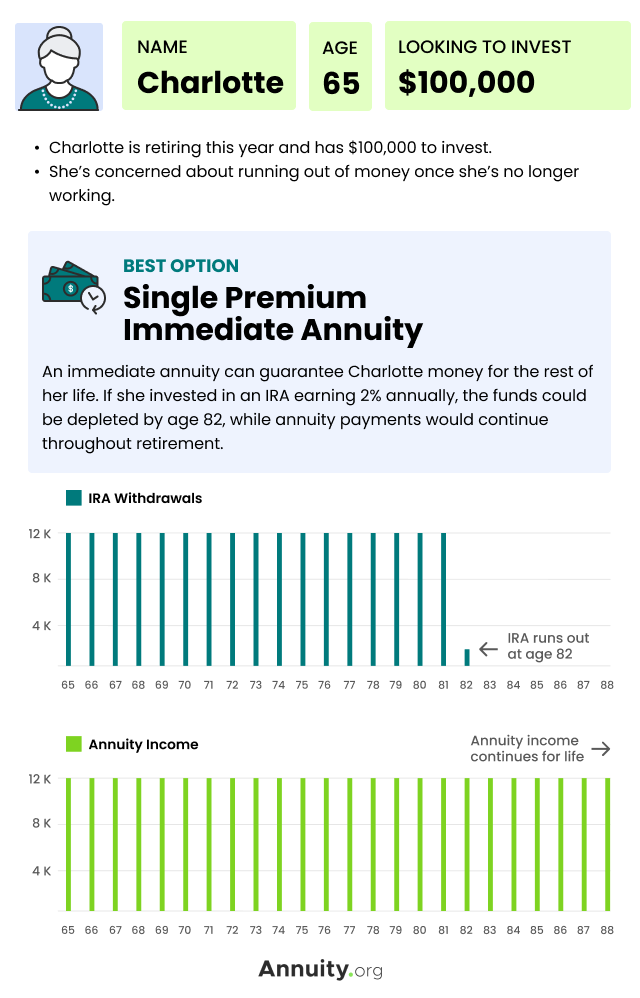

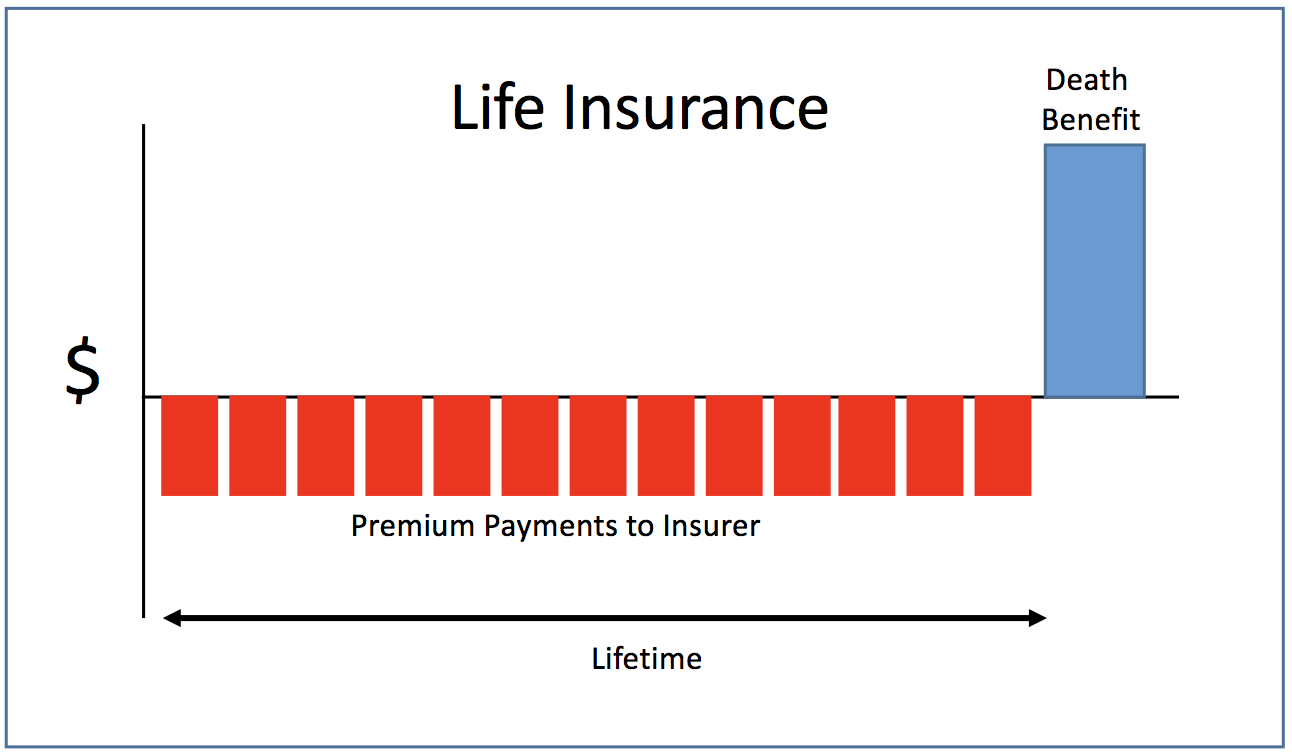

Annuities are subject to taxation and how they are taxed depends on various factors When you take distributions or withdraw from the annuity later in retirement you will be taxed on the growth at your then current tax rate explained annuity and retirement expert Paul Tyler

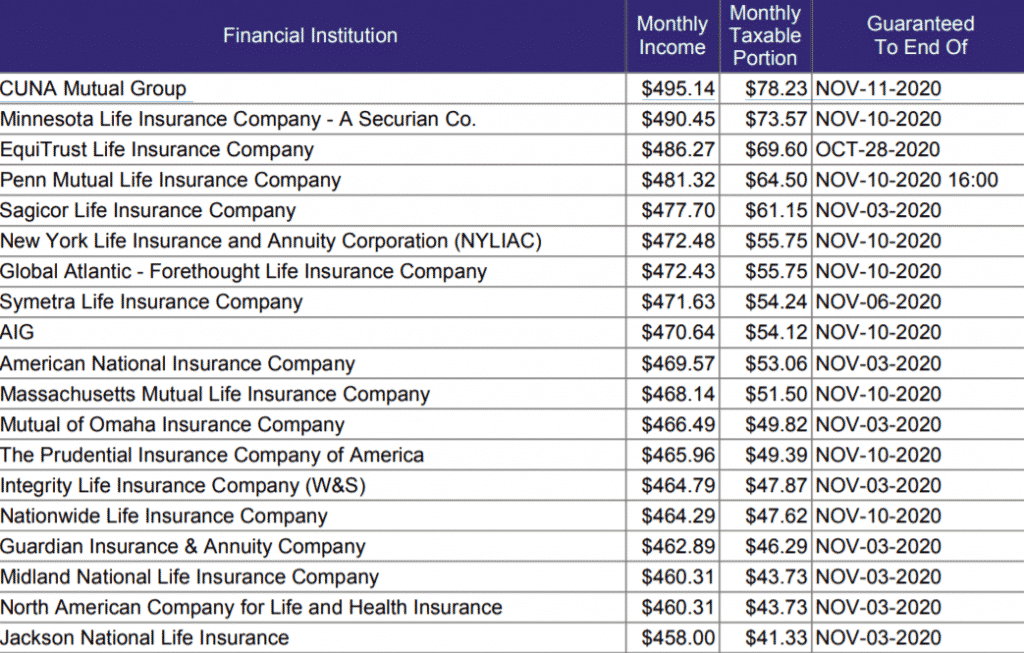

Income from immediate annuities are taxed at ordinary income tax rates but only a portion of payments are taxable This is because immediate annuity income is considered part interest and part a return of principal only the interest portion is taxed

Are Single Premium Immediate Annuities Taxable provide a diverse collection of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and much more. The great thing about Are Single Premium Immediate Annuities Taxable is in their versatility and accessibility.

More of Are Single Premium Immediate Annuities Taxable

Company Tax Computation Format Malaysia 2018 John Lawrence

Company Tax Computation Format Malaysia 2018 John Lawrence

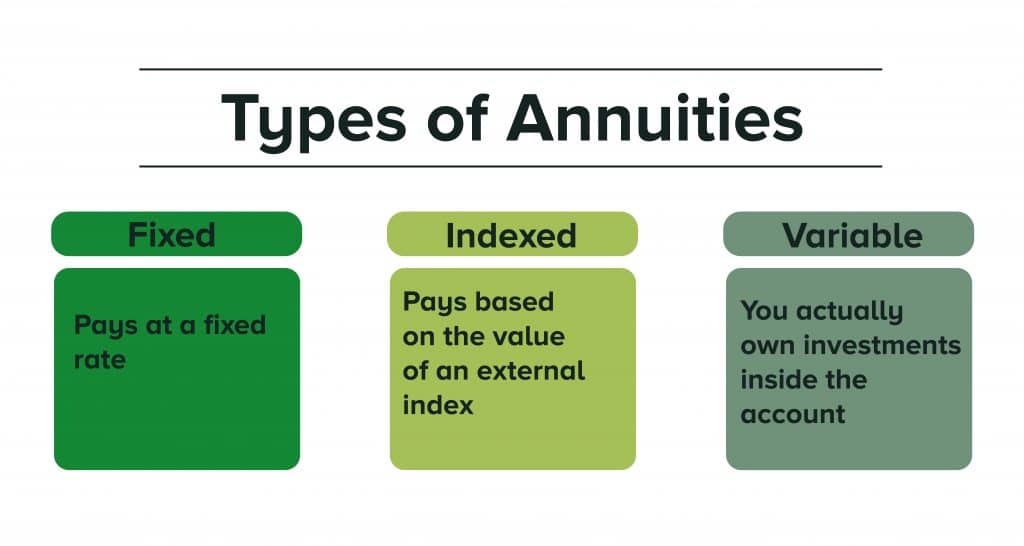

The type of annuity you have may also affect your future tax liability There are many different subsections including fixed annuities variable annuities immediate annuities and deferred annuities For this though we ll discuss the most general versions period annuities and lifetime annuities

Income annuity payments are only partially taxable Your original investment the purchase premium s you paid in a nonqualified annuity is not taxed when withdrawn Only the interest

Are Single Premium Immediate Annuities Taxable have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Personalization This allows you to modify printing templates to your own specific requirements be it designing invitations to organize your schedule or even decorating your house.

-

Education Value The free educational worksheets provide for students of all ages, making these printables a powerful device for teachers and parents.

-

Easy to use: Access to various designs and templates, which saves time as well as effort.

Where to Find more Are Single Premium Immediate Annuities Taxable

Qualified Vs Non Qualified Annuities Taxation And Distribution

Qualified Vs Non Qualified Annuities Taxation And Distribution

As a result immediate annuities can only be funded with a single premium leaving no room for future contributions And finally an immediate annuity can be qualified or non qualified Qualified immediate annuities are purchased with pre tax money from your 401 k Traditional IRA or other qualified plan

Technically the product is a single premium immediate annuity or SPIA because it s bought with a lump sum Most often though it s just called an immediate annuity The product is

Now that we've piqued your interest in printables for free Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Are Single Premium Immediate Annuities Taxable designed for a variety motives.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching tools.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing Are Single Premium Immediate Annuities Taxable

Here are some ideas create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Single Premium Immediate Annuities Taxable are an abundance of fun and practical tools that meet a variety of needs and hobbies. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the wide world of Are Single Premium Immediate Annuities Taxable to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printing templates for commercial purposes?

- It's all dependent on the rules of usage. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright rights issues with Are Single Premium Immediate Annuities Taxable?

- Certain printables may be subject to restrictions in their usage. Check the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home with any printer or head to an area print shop for top quality prints.

-

What software do I need to run Are Single Premium Immediate Annuities Taxable?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost software, such as Adobe Reader.

The Best Annuities For Income And Growth

Single Premium Immediate Annuity SPIA Rates Pros Cons

Check more sample of Are Single Premium Immediate Annuities Taxable below

Global Accessories

Why Choose A Single Premium Immediate Annuity Annuities Retirement

Single Premium Immediate Annuity SPIAs Annuity Broker

Annuity Formula As A Standalone Term Could Be Vague Or Ambiguous It

Single Premium Immediate Annuities Are They Worth It YouTube

Single Premium Immediate Annuity Acquisition

https://www.thebalancemoney.com/what-is-a-single...

Income from immediate annuities are taxed at ordinary income tax rates but only a portion of payments are taxable This is because immediate annuity income is considered part interest and part a return of principal only the interest portion is taxed

https://www.blueprintincome.com/resources/immediate-annuity-taxation

We ve broken down how you may be taxed Annuity taxation can feel complicated but we help lay out the basic rules to how your immediate annuity payments will be taxed If you purchased an immediate annuity with pre tax savings the income payments you receive will be taxed as ordinary income

Income from immediate annuities are taxed at ordinary income tax rates but only a portion of payments are taxable This is because immediate annuity income is considered part interest and part a return of principal only the interest portion is taxed

We ve broken down how you may be taxed Annuity taxation can feel complicated but we help lay out the basic rules to how your immediate annuity payments will be taxed If you purchased an immediate annuity with pre tax savings the income payments you receive will be taxed as ordinary income

Annuity Formula As A Standalone Term Could Be Vague Or Ambiguous It

Why Choose A Single Premium Immediate Annuity Annuities Retirement

Single Premium Immediate Annuities Are They Worth It YouTube

Single Premium Immediate Annuity Acquisition

The Retirement Caf Income Annuities Immediate And Deferred

How Do Annuities Work Simplified Senior

How Do Annuities Work Simplified Senior

Income Annuities Immediate And Deferred Seeking Alpha