In this age of technology, when screens dominate our lives, the charm of tangible printed objects hasn't waned. Whatever the reason, whether for education such as creative projects or simply to add a personal touch to your home, printables for free are now an essential resource. This article will dive in the world of "Are Roth Ira Distributions Taxable In Massachusetts," exploring the different types of printables, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Are Roth Ira Distributions Taxable In Massachusetts Below

Are Roth Ira Distributions Taxable In Massachusetts

Are Roth Ira Distributions Taxable In Massachusetts - Are Roth Ira Distributions Taxable In Massachusetts, Are Roth Ira Distributions Taxable, Are Roth Ira Distributions Subject To State Income Tax, Is A Qualified Distribution From A Roth Ira Taxable

Massachusetts does not recognize the deductibility of contributions that you make when you put money into an IRA and as a result in the year of the contribution while you are

Income from a retirement plan are distributions amounts paid out of the fund to employees who have separated from their employment This income usually has

Are Roth Ira Distributions Taxable In Massachusetts offer a wide variety of printable, downloadable content that can be downloaded from the internet at no cost. These printables come in different types, like worksheets, templates, coloring pages, and much more. The appealingness of Are Roth Ira Distributions Taxable In Massachusetts is their flexibility and accessibility.

More of Are Roth Ira Distributions Taxable In Massachusetts

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

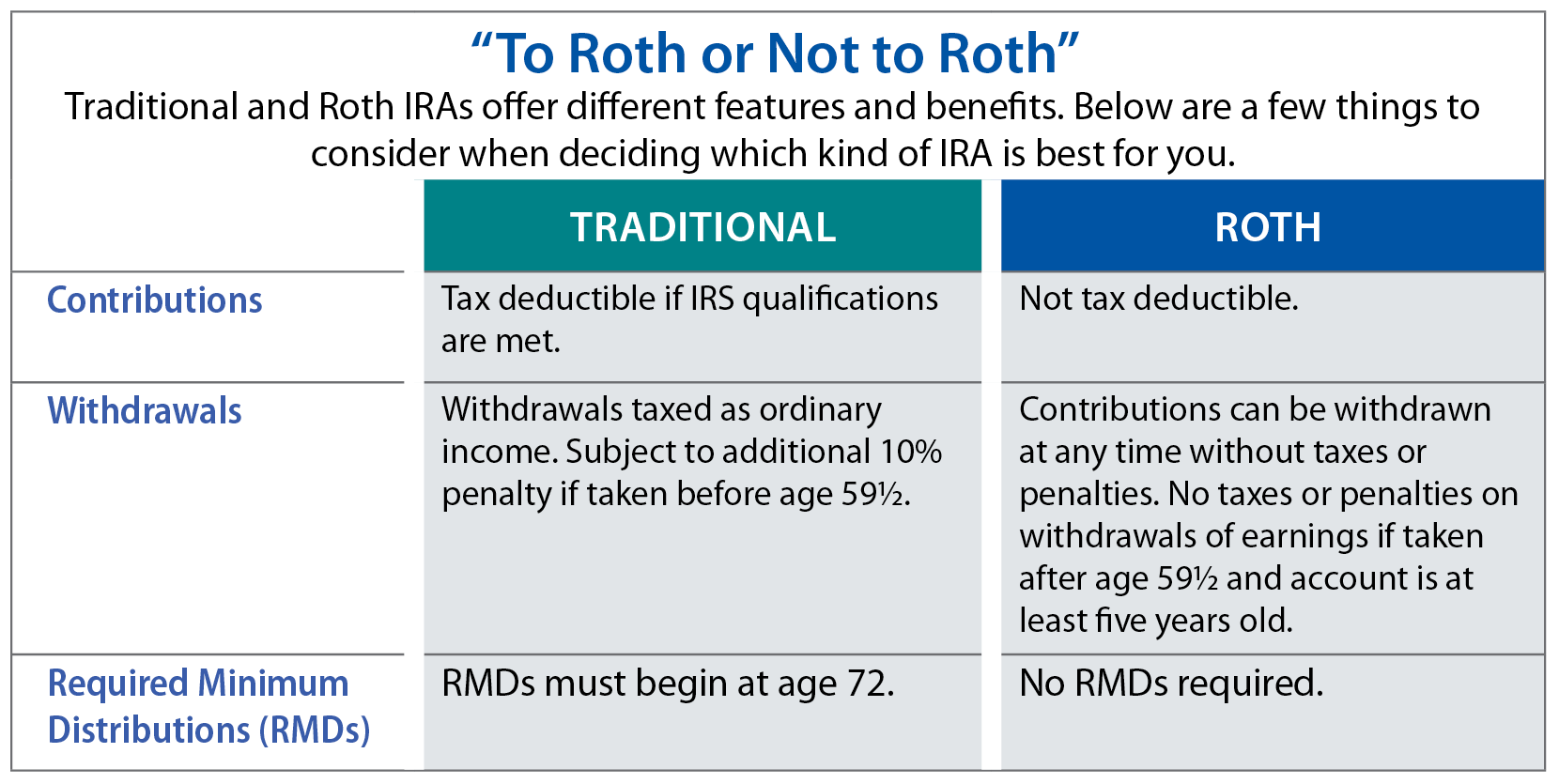

As a way of background your Roth IRA distribution will not be subject to MA tax provided the Roth IRA has been held for five years and meets one of the following conditions

Our Massachusetts retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401 k and IRA income

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor printables to your specific needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational Use: The free educational worksheets provide for students of all ages, which makes them an invaluable tool for teachers and parents.

-

Simple: Quick access to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Are Roth Ira Distributions Taxable In Massachusetts

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Retiradas De Roth IRA Leia Isto Primeiro Economia E Negocios

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However distributions

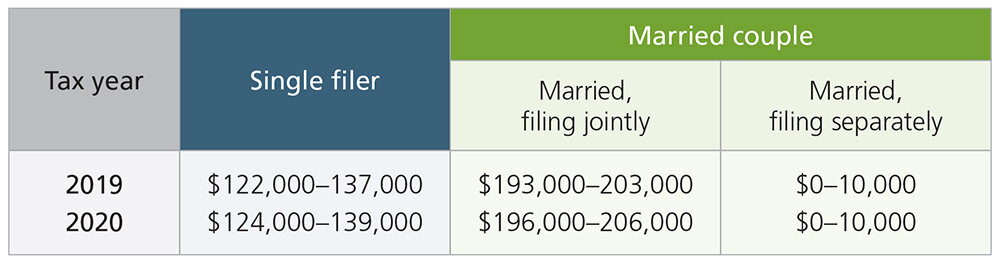

For the year 2010 only an IRA distribution rolled into a Roth IRA may be included in taxable income in 2010 or alternatively an option is available to include 50 of the

In the event that we've stirred your curiosity about Are Roth Ira Distributions Taxable In Massachusetts We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Are Roth Ira Distributions Taxable In Massachusetts suitable for many applications.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad range of interests, that range from DIY projects to party planning.

Maximizing Are Roth Ira Distributions Taxable In Massachusetts

Here are some ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Are Roth Ira Distributions Taxable In Massachusetts are a treasure trove filled with creative and practical information catering to different needs and interest. Their accessibility and versatility make them an invaluable addition to the professional and personal lives of both. Explore the many options of Are Roth Ira Distributions Taxable In Massachusetts today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes they are! You can print and download these resources at no cost.

-

Can I use the free printables in commercial projects?

- It's all dependent on the conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Are Roth Ira Distributions Taxable In Massachusetts?

- Certain printables could be restricted on their use. Be sure to review the terms and conditions set forth by the creator.

-

How can I print Are Roth Ira Distributions Taxable In Massachusetts?

- Print them at home using either a printer at home or in the local print shops for the highest quality prints.

-

What software do I require to open printables free of charge?

- Most printables come in PDF format, which is open with no cost software like Adobe Reader.

Are Roth IRA Distributions Taxable

Are Roth Ira Distributions Taxable On The Massachusetts State Return

Check more sample of Are Roth Ira Distributions Taxable In Massachusetts below

Qualified Vs Non Qualified Roth IRA Distributions

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Roth IRA Strategies For Physicians WealthKeel

Roth IRA Withdrawal Rules Oblivious Investor

https://www.mass.gov › info-details › view-tax...

Income from a retirement plan are distributions amounts paid out of the fund to employees who have separated from their employment This income usually has

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png?w=186)

https://www.mass.gov › info-details › differences...

Roth IRA Contributions are not deductible for either Massachusetts or federal purposes Roth IRA Distributions in excess of contributions are excluded from federal income if

Income from a retirement plan are distributions amounts paid out of the fund to employees who have separated from their employment This income usually has

Roth IRA Contributions are not deductible for either Massachusetts or federal purposes Roth IRA Distributions in excess of contributions are excluded from federal income if

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Roth IRA Strategies For Physicians WealthKeel

Roth IRA Withdrawal Rules Oblivious Investor

/shutterstock_240823573.Roth.IRA.cropped-fd86349be2cd4f42a0ea35dd6956813d.jpg)

Understanding Non Qualified Roth IRA Distributions

Roth Ira Growth Calculator GarveenIndia

Roth Ira Growth Calculator GarveenIndia

+1000px.jpg)

How To Determine Roth IRA Contribution Eligibility Ascensus