Today, where screens dominate our lives and the appeal of physical, printed materials hasn't diminished. In the case of educational materials or creative projects, or simply adding some personal flair to your space, Are Pension Benefits Subject To Federal Income Tax are now an essential source. We'll take a dive deeper into "Are Pension Benefits Subject To Federal Income Tax," exploring the different types of printables, where they are, and what they can do to improve different aspects of your daily life.

Get Latest Are Pension Benefits Subject To Federal Income Tax Below

Are Pension Benefits Subject To Federal Income Tax

Are Pension Benefits Subject To Federal Income Tax - Are Pension Benefits Subject To Federal Income Tax, Are Social Security Retirement Benefits Subject To Federal Income Tax, Are Pensions Subject To Federal Taxes, Are Pensions Taxable For Federal Income Tax, Are Pensions Subject To Tax, Do Pensions Get Federal Taxed, Are Pensions Taxable Income Federal

Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions

Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an

Are Pension Benefits Subject To Federal Income Tax include a broad range of printable, free content that can be downloaded from the internet at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and much more. One of the advantages of Are Pension Benefits Subject To Federal Income Tax is their flexibility and accessibility.

More of Are Pension Benefits Subject To Federal Income Tax

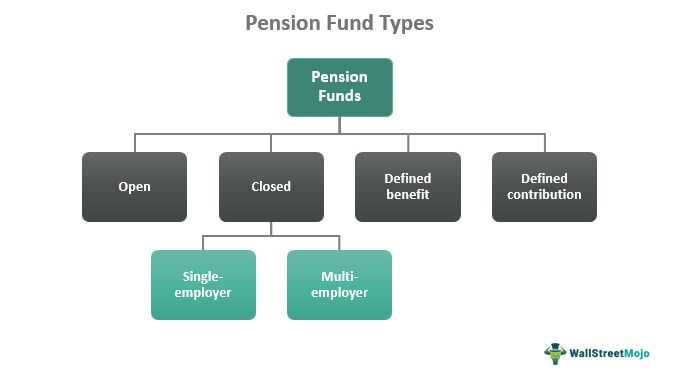

Pension Fund Definition Benefits Top 10 Public Pension Funds

Pension Fund Definition Benefits Top 10 Public Pension Funds

This interview will help you determine if your pension or annuity payment from an employer sponsored retirement plan or nonqualified annuity is taxable It doesn t address

You may owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments But if you take a direct lump sum

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize printables to your specific needs in designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Free educational printables cater to learners of all ages, which makes them a useful source for educators and parents.

-

It's easy: You have instant access various designs and templates cuts down on time and efforts.

Where to Find more Are Pension Benefits Subject To Federal Income Tax

Calculate Income Tax Per Paycheck JaimeMunmair

Calculate Income Tax Per Paycheck JaimeMunmair

The IRS treats pension income you re taxed on as ordinary income so you re taxed on the entire amount at your normal tax rate Because we have a pay as you go system in the

Here s the answer You don t pay tax on the portion of the pension payments that represent a return of the after tax amount you contributed IRS Publication 575 IRS Publication 575 distinguishes the tax treatment

After we've peaked your interest in Are Pension Benefits Subject To Federal Income Tax we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Are Pension Benefits Subject To Federal Income Tax for various uses.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a broad variety of topics, all the way from DIY projects to planning a party.

Maximizing Are Pension Benefits Subject To Federal Income Tax

Here are some fresh ways to make the most of Are Pension Benefits Subject To Federal Income Tax:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Are Pension Benefits Subject To Federal Income Tax are a treasure trove of creative and practical resources that meet a variety of needs and interest. Their access and versatility makes these printables a useful addition to each day life. Explore the plethora that is Are Pension Benefits Subject To Federal Income Tax today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Pension Benefits Subject To Federal Income Tax really for free?

- Yes they are! You can print and download the resources for free.

-

Can I utilize free printables to make commercial products?

- It's dependent on the particular usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables may be subject to restrictions regarding usage. You should read the terms and conditions offered by the designer.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit an in-store print shop to get top quality prints.

-

What software do I need to open printables free of charge?

- The majority are printed as PDF files, which is open with no cost software, such as Adobe Reader.

Federal Income Tax Issues Related To

Are My Social Security Benefits Subject To Income Tax Coastal Wealth

Check more sample of Are Pension Benefits Subject To Federal Income Tax below

Are Pension Savings Subject To Inheritance Tax The Rules Explained

Are Maryland State Pension Benefits Taxable Finance Zacks

Ranked The World s 100 Biggest Pension Funds

Read Federal Income Tax Examples Explanations

Auntie AnneS Net Income What s My Federal Income Tax Rate

Are Pension Benefits Exempt From Debt Collection The Law Offices Of

https://www. irs.gov /individuals/international...

Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an

https://www. nerdwallet.com /article/investing/...

Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security

Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an

Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security

Read Federal Income Tax Examples Explanations

Are Maryland State Pension Benefits Taxable Finance Zacks

Auntie AnneS Net Income What s My Federal Income Tax Rate

Are Pension Benefits Exempt From Debt Collection The Law Offices Of

8 Things That You Probably Didn t Realize Are Taxable Money Talks

K 12 School Districts Your Employees Are Confused About Retirement

K 12 School Districts Your Employees Are Confused About Retirement

INCOME TAX ON PENSION HOW TO CALCULATE TAX ON PENSION IS PENSION