In this age of technology, when screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes project ideas, artistic or simply adding some personal flair to your area, Are Monthly Annuity Payments Taxable are a great source. In this article, we'll take a dive in the world of "Are Monthly Annuity Payments Taxable," exploring their purpose, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Are Monthly Annuity Payments Taxable Below

Are Monthly Annuity Payments Taxable

Are Monthly Annuity Payments Taxable - Are Monthly Annuity Payments Taxable, Are Annuity Payments Taxable, Are Annuity Payments Considered Income, How Are Monthly Annuity Payments Taxed

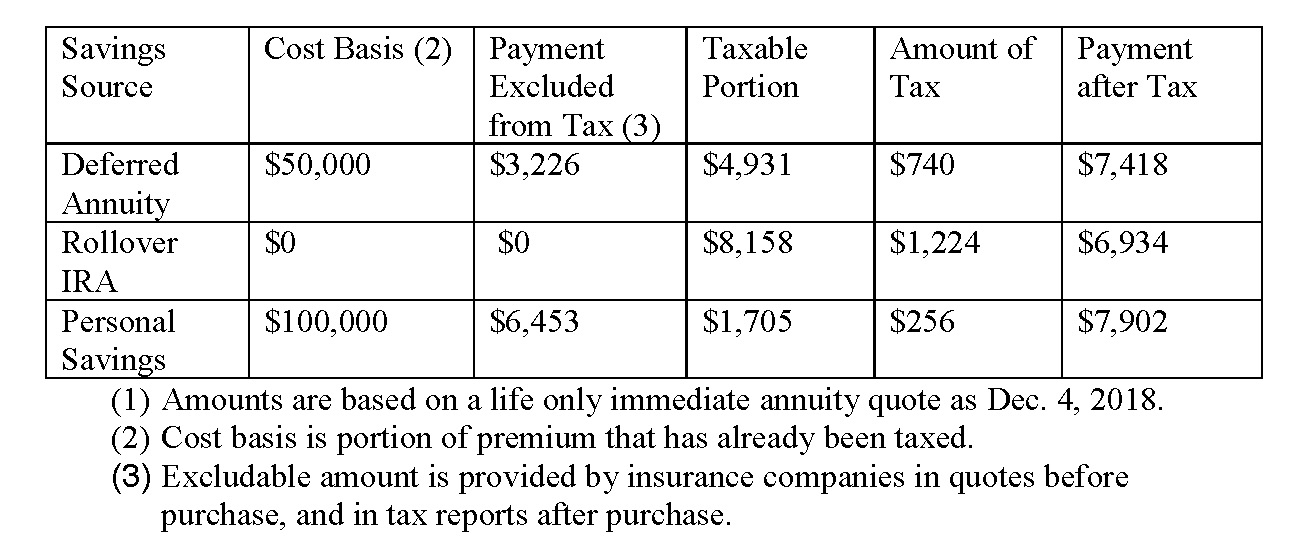

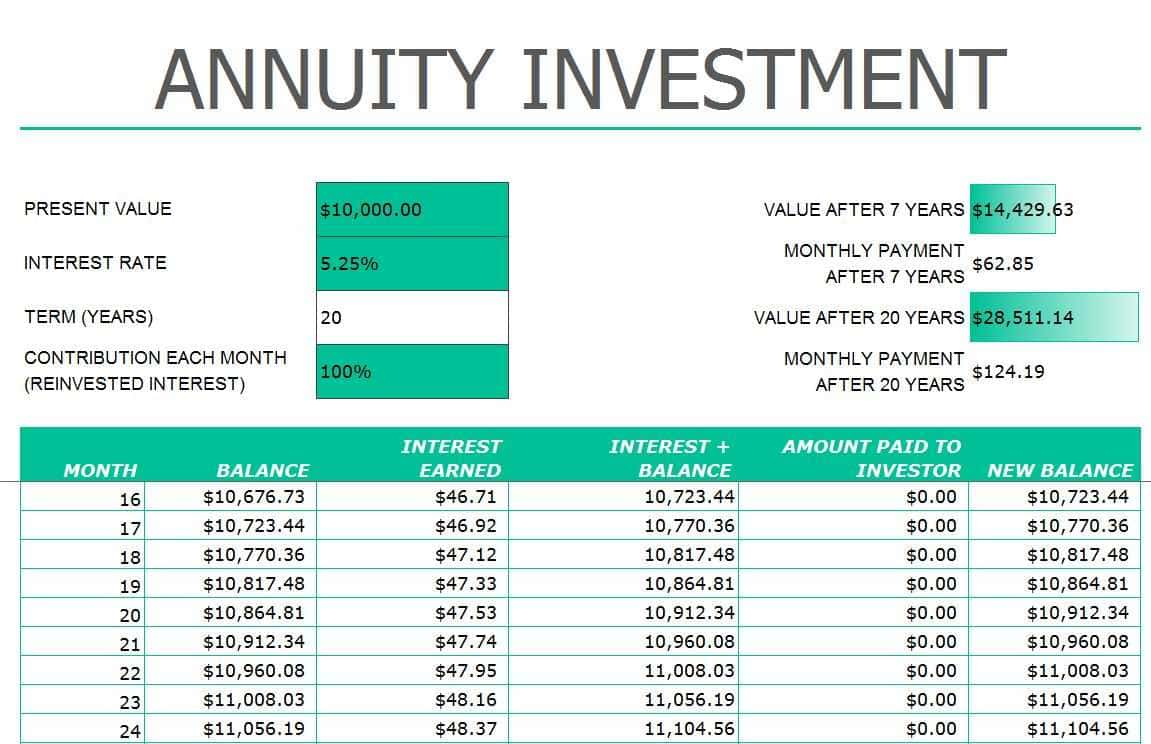

Key Takeaway Non qualified annuities are taxed differently on withdrawal than qualified annuities Lump sum payments from an annuity are fully taxable whereas periodic payments could include partial taxable amounts Annuity Taxation FAQs Are Annuities Taxed Federally Annuities are generally taxed federally as ordinary income

Annuity payments are subject to tax based on how the annuity was funded If your annuity was funded with pre tax dollars typically seen in qualified plans the entire amount of the withdrawals or payments you receive is taxable as income

Printables for free include a vast variety of printable, downloadable material that is available online at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and much more. The appealingness of Are Monthly Annuity Payments Taxable is their versatility and accessibility.

More of Are Monthly Annuity Payments Taxable

Calculating Annuity Payments For An Annuity YouTube

Calculating Annuity Payments For An Annuity YouTube

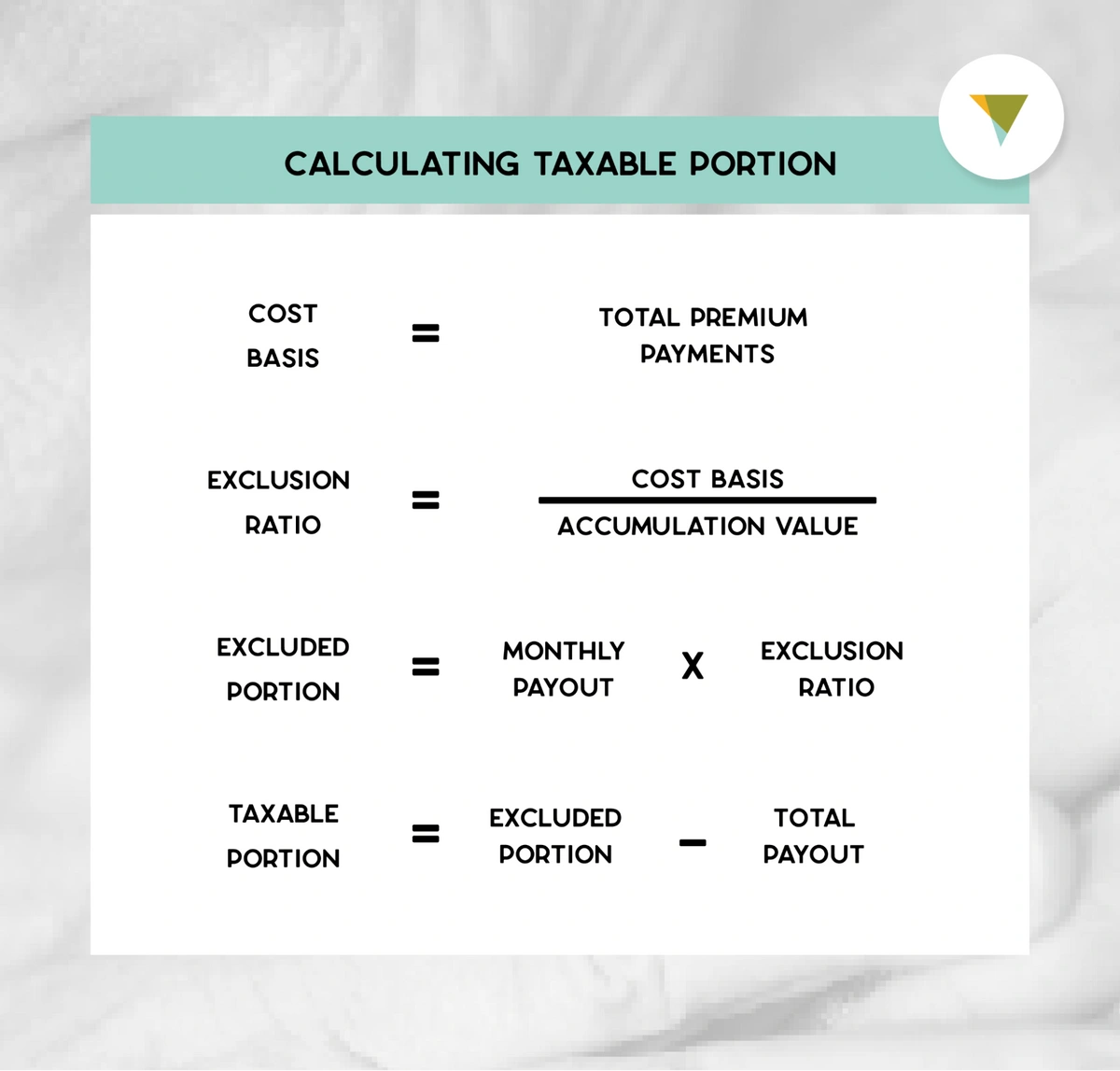

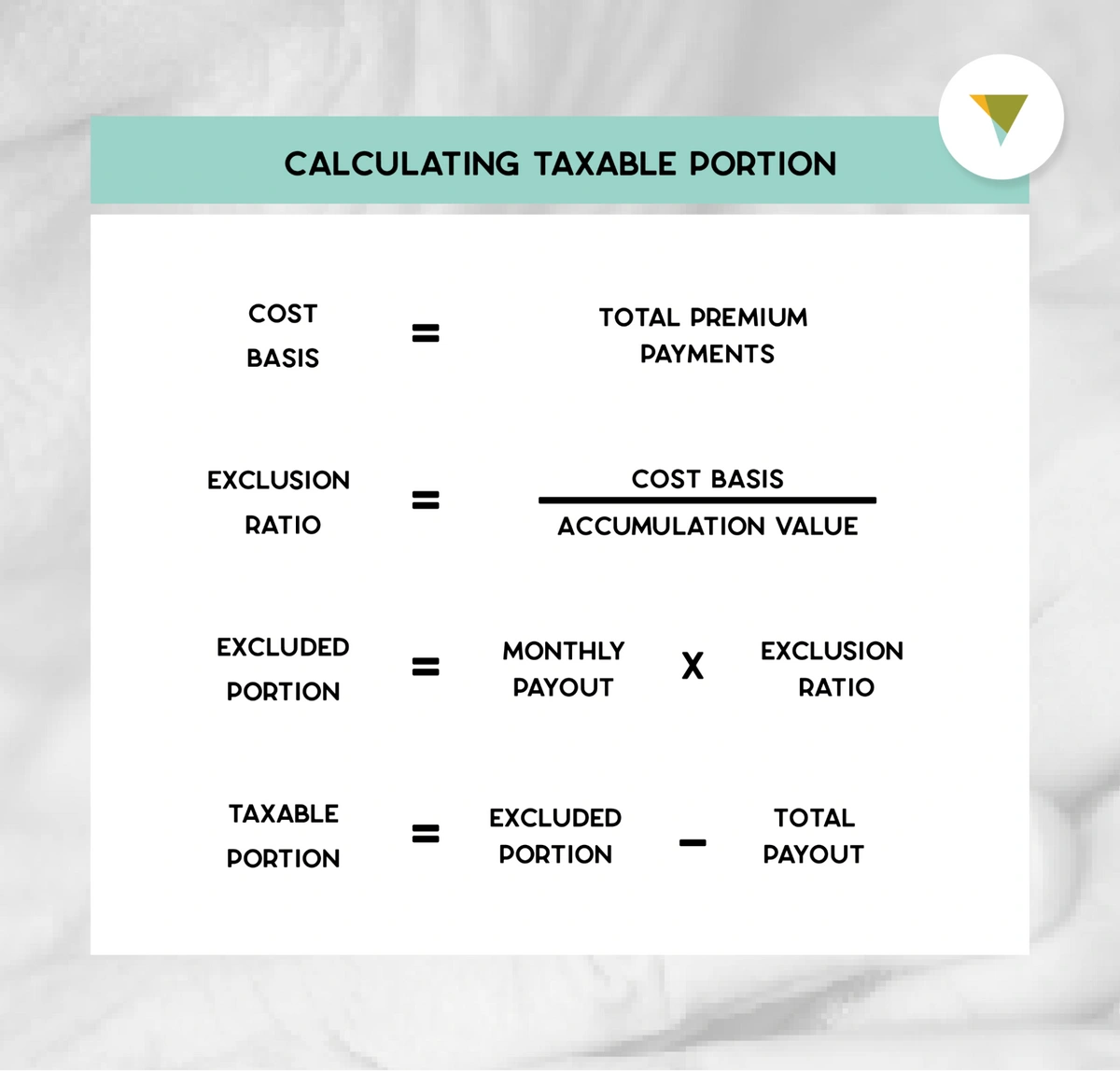

If you have a non qualified annuity you don t pay taxes on your principal To figure out how much of your payment is subject to tax you need to use a metric known as the exclusion ratio

If you annuitize an annuity outside of a retirement plan as opposed to making one or more self directed withdrawals your payments may be partially taxable The IRS allows you to use an exclusion ratio to treat a portion of each payment as a tax free return of your basis

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize the templates to meet your individual needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Education Value Printing educational materials for no cost can be used by students of all ages, which makes them a valuable aid for parents as well as educators.

-

An easy way to access HTML0: immediate access a myriad of designs as well as templates can save you time and energy.

Where to Find more Are Monthly Annuity Payments Taxable

What Is Taxable Income And How To Calculate Taxable Income

What Is Taxable Income And How To Calculate Taxable Income

Unlike 401 k contributions the money paid into the annuity account is not shielded from income taxes Many aspects of an annuity are tailored to the specific needs of the buyer

You can apply for a directive for the relief of the withholding of Employees Tax from your pension and or annuity by completing the RST01 Application by Non Resident for a Directive for Relief from South African Tax for Pension and Annuities in terms of a DTA

Since we've got your interest in Are Monthly Annuity Payments Taxable we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Are Monthly Annuity Payments Taxable designed for a variety applications.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad range of interests, that includes DIY projects to party planning.

Maximizing Are Monthly Annuity Payments Taxable

Here are some inventive ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Are Monthly Annuity Payments Taxable are an abundance with useful and creative ideas that satisfy a wide range of requirements and desires. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the vast collection of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes, they are! You can print and download these items for free.

-

Are there any free printables to make commercial products?

- It is contingent on the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright problems with Are Monthly Annuity Payments Taxable?

- Certain printables could be restricted on usage. Make sure to read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using the printer, or go to the local print shop for higher quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in PDF format. They is open with no cost programs like Adobe Reader.

Annuity Formula As A Standalone Term Could Be Vague Or Ambiguous It

Taxes Archives Jerry Golden On Retirement

Check more sample of Are Monthly Annuity Payments Taxable below

Payments For Regenerative Practices

.png)

Are Annuity Payments Taxable How Are Annuities Taxed Medicare Hope

Annuity Payment Formula Pv Double Entry Bookkeeping My XXX Hot Girl

Immediate Care How To Calculate Annuity Payments 8 Steps with

Expected Present Value Formula Expected Monetary Value Writflx

The Payments World Really Wants To Know Who You Are TechCrunch

https://www.annuity.org/annuities/taxation

Annuity payments are subject to tax based on how the annuity was funded If your annuity was funded with pre tax dollars typically seen in qualified plans the entire amount of the withdrawals or payments you receive is taxable as income

https://www.allangray.co.za/latest-insights/...

As of 1 March 2022 annuity providers will be required to withhold tax for select living annuity clients at a rate that is determined by SARS considering multiple sources of income For these clients SARS will instruct annuity providers on the rate to use via a fixed rate tax directive

Annuity payments are subject to tax based on how the annuity was funded If your annuity was funded with pre tax dollars typically seen in qualified plans the entire amount of the withdrawals or payments you receive is taxable as income

As of 1 March 2022 annuity providers will be required to withhold tax for select living annuity clients at a rate that is determined by SARS considering multiple sources of income For these clients SARS will instruct annuity providers on the rate to use via a fixed rate tax directive

Immediate Care How To Calculate Annuity Payments 8 Steps with

Are Annuity Payments Taxable How Are Annuities Taxed Medicare Hope

Expected Present Value Formula Expected Monetary Value Writflx

The Payments World Really Wants To Know Who You Are TechCrunch

Annuity Calculator Excel Spreadsheet Db excel

Part 2 Find The Number Of Monthly Annuity Payments YouTube

Part 2 Find The Number Of Monthly Annuity Payments YouTube

Weekly Mortgage Payments Vs Monthly Payments