In this age of technology, in which screens are the norm and the appeal of physical printed objects isn't diminished. No matter whether it's for educational uses and creative work, or simply adding an individual touch to your home, printables for free are now a vital resource. In this article, we'll dive to the depths of "Are Ira Withdrawals Taxable In Ohio," exploring the different types of printables, where to find them, and how they can enrich various aspects of your lives.

Get Latest Are Ira Withdrawals Taxable In Ohio Below

Are Ira Withdrawals Taxable In Ohio

Are Ira Withdrawals Taxable In Ohio - Are Ira Withdrawals Taxable In Ohio, Are Ira Distributions Taxable In Ohio, Are Inherited Ira Distributions Taxable In Ohio, Are Ira Withdrawals Taxable, Are Ira Withdrawals Considered Income, Do You Pay Taxes On Ira Withdrawals, Are Ira Withdrawals Taxed

This alphabetical list provides an overview of how income from employment investments a pension retirement distributions and Social Security are taxed in every state and the District of

If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio However if your rollover results in recognizing income that is included

Printables for free include a vast variety of printable, downloadable materials available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and more. One of the advantages of Are Ira Withdrawals Taxable In Ohio is their flexibility and accessibility.

More of Are Ira Withdrawals Taxable In Ohio

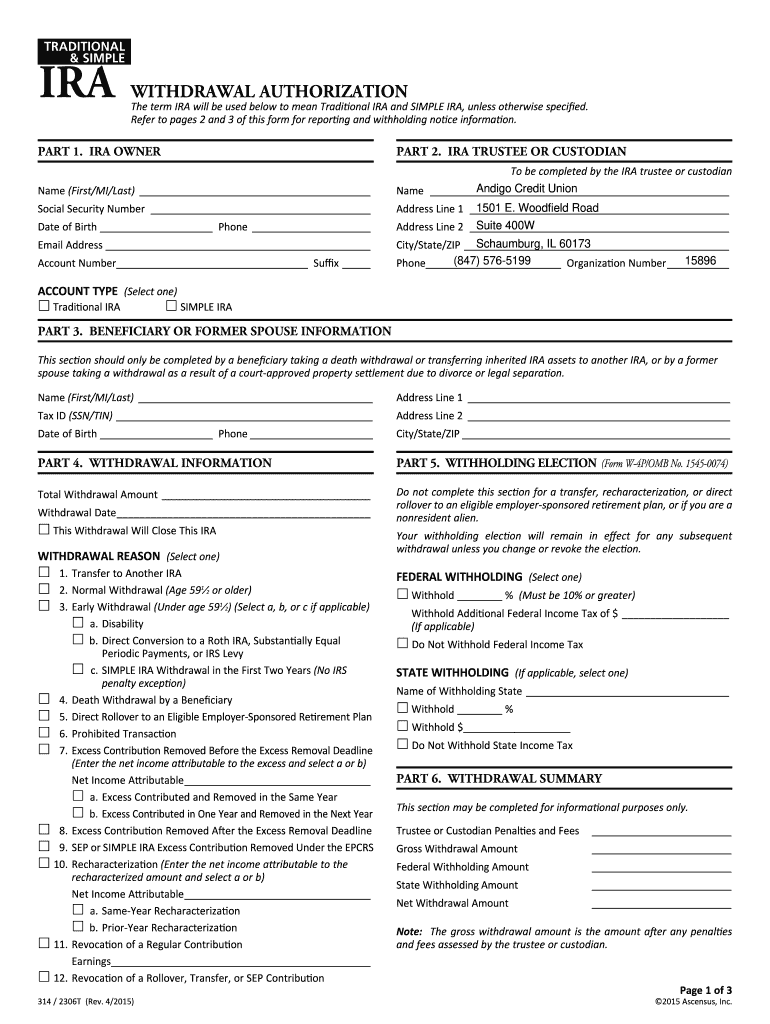

Axos Bank Ira Withdrawal Form Fill Out And Sign Printable PDF

Axos Bank Ira Withdrawal Form Fill Out And Sign Printable PDF

Ohio taxes all of your private retirement income This includes retirement income from all pensions from your employer annuities from either your employer or private insurance arrangements and any retirement

Is an IRA distribution 1099 R taxable by the state of Ohio It would be taxable by your resident state only and due to no income tax there it is not taxable by

Are Ira Withdrawals Taxable In Ohio have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor the design to meet your needs, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Worth: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a great tool for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Are Ira Withdrawals Taxable In Ohio

How To Make Penalty Free Pre Age 59 5 Traditional IRA Withdrawals

How To Make Penalty Free Pre Age 59 5 Traditional IRA Withdrawals

The way individual retirement account IRA withdrawals are taxed depends on the type of IRA For example you ll always pay taxes on traditional IRA withdrawals But with a Roth IRA there

When you withdraw money from your IRA or employer sponsored retirement plan your state may require you to have income tax withheld from your distribution Your

Since we've got your interest in Are Ira Withdrawals Taxable In Ohio Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Are Ira Withdrawals Taxable In Ohio designed for a variety goals.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Are Ira Withdrawals Taxable In Ohio

Here are some new ways ensure you get the very most of Are Ira Withdrawals Taxable In Ohio:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Are Ira Withdrawals Taxable In Ohio are an abundance of practical and imaginative resources that can meet the needs of a variety of people and interest. Their availability and versatility make them a wonderful addition to both professional and personal lives. Explore the vast world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can print and download these documents for free.

-

Can I download free printables for commercial uses?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted regarding usage. Be sure to read the terms and regulations provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to a local print shop for better quality prints.

-

What program do I need to open printables for free?

- Most PDF-based printables are available in PDF format. They is open with no cost software such as Adobe Reader.

Traditional IRA Withdrawal Rules Blue Co LLC

Roth Ira Withdrawal Tax Calculator TaniyaSuphi

Check more sample of Are Ira Withdrawals Taxable In Ohio below

Budget 2016 PF Withdrawals Taxable From April 2016 IBTimes India

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Are 457 Plan Withdrawals Taxable Market Trading Essentials

How Are IRA Withdrawals Taxed YouTube

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

IRA Withdrawal Rules

https://tax.ohio.gov/help-center/faqs/income...

If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio However if your rollover results in recognizing income that is included

https://lifevestadvisors.com/retirement-planning/...

Beneath Ohio s favorable tax treatment for IRA withdrawals lies a complex landscape of federal regulations discover what you need to know to maximize your

If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio However if your rollover results in recognizing income that is included

Beneath Ohio s favorable tax treatment for IRA withdrawals lies a complex landscape of federal regulations discover what you need to know to maximize your

How Are IRA Withdrawals Taxed YouTube

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

IRA Withdrawal Rules

How To Calculate The Taxable Amount Of An IRA Withdrawal

Are Traditional IRA Withdrawals Taxable For Mortgage Payments

Are Traditional IRA Withdrawals Taxable For Mortgage Payments

6 Things To Know About Roth 401 k Withdrawals The Motley Fool