In a world when screens dominate our lives but the value of tangible printed materials hasn't faded away. Whether it's for educational purposes for creative projects, simply to add an individual touch to the home, printables for free are now a useful source. We'll dive into the world of "Are Ira Distributions Taxable In The State Of Pennsylvania," exploring the benefits of them, where to locate them, and how they can enrich various aspects of your lives.

Get Latest Are Ira Distributions Taxable In The State Of Pennsylvania Below

Are Ira Distributions Taxable In The State Of Pennsylvania

Are Ira Distributions Taxable In The State Of Pennsylvania - Are Ira Distributions Taxable In The State Of Pennsylvania, Are Ira Distributions Taxable In Pa, Are Inherited Ira Distributions Taxable In Pa, Are Ira Distributions State Taxable

IRA distributions received before turning 59 1 2 aren t eligible for the exemption and are therefore fully taxable under Pennsylvania income tax law This is

Yes All IRA distributions should be reported on PA Schedule W 2S Wage Statement Summary whether or not some or all of the distributions are taxable If a taxpayer

Are Ira Distributions Taxable In The State Of Pennsylvania cover a large variety of printable, downloadable materials available online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages, and many more. The attraction of printables that are free is their versatility and accessibility.

More of Are Ira Distributions Taxable In The State Of Pennsylvania

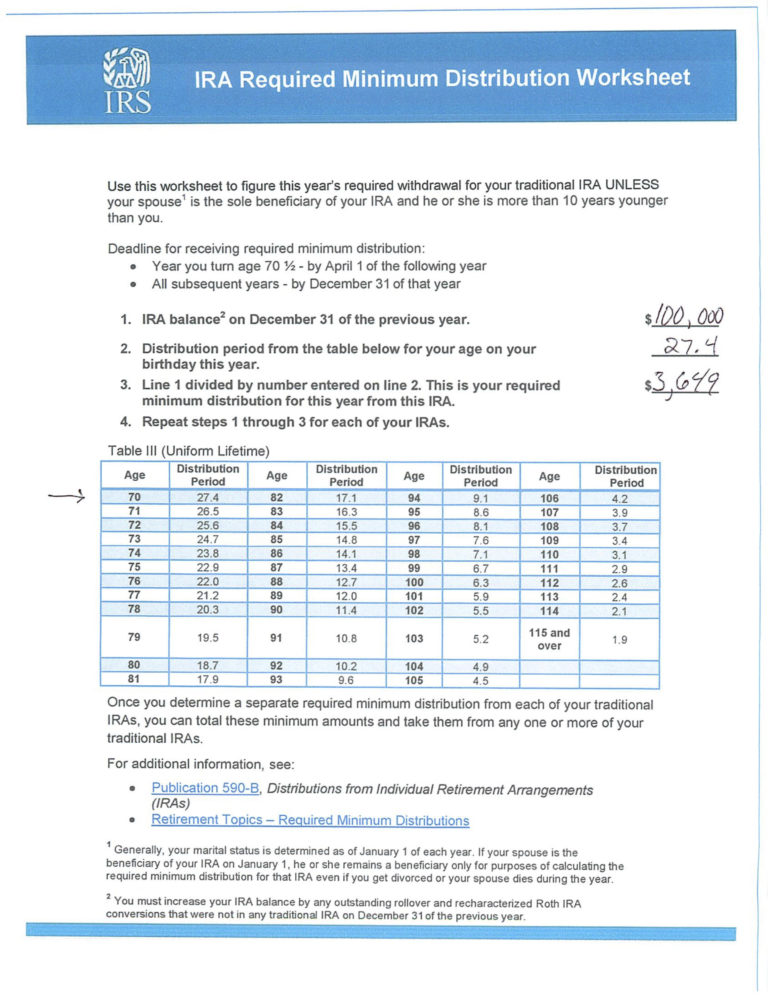

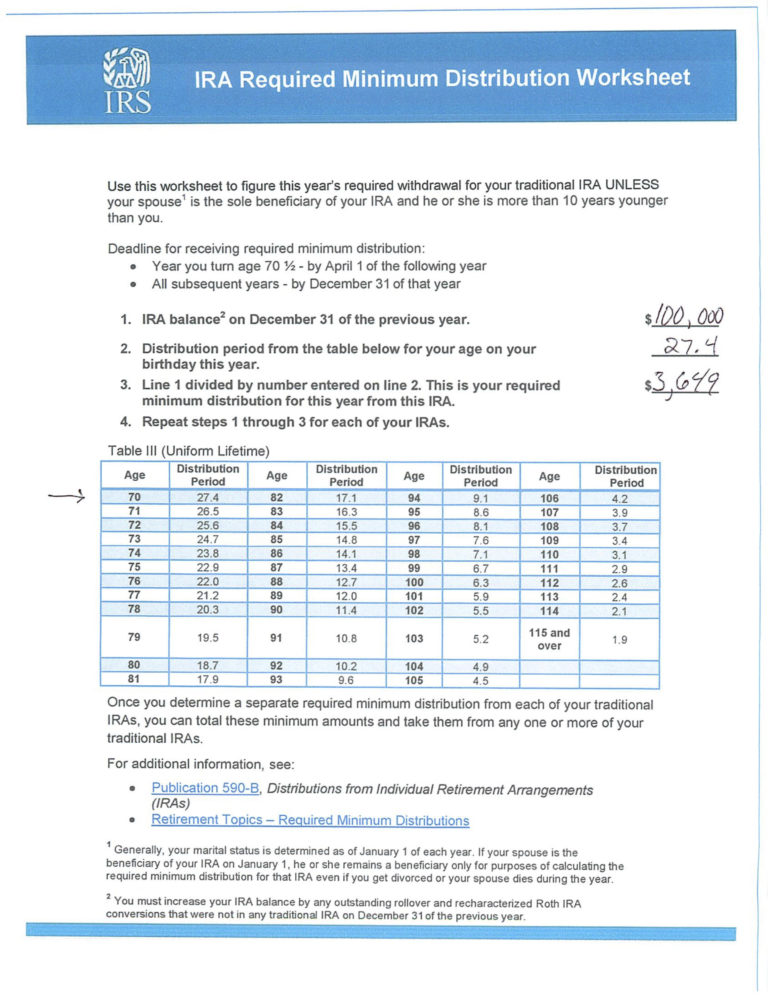

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

So hypothetically let s say you are 65 and receive 15 000 annually in Social Security retirement benefits 10 000 in pension income and another 20 000 from your IRA You will not have to pay state taxes on your

In Pennsylvania IRA distributions are generally not taxable at the state level Exceptions exist especially for early withdrawals If you re unsure about your specific circumstances a personalized consultation

Are Ira Distributions Taxable In The State Of Pennsylvania have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring printables to your specific needs whether it's making invitations for your guests, organizing your schedule or even decorating your house.

-

Education Value Printing educational materials for no cost provide for students of all ages, making them an essential tool for parents and educators.

-

Simple: Access to a variety of designs and templates saves time and effort.

Where to Find more Are Ira Distributions Taxable In The State Of Pennsylvania

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

Some of the retirement tax benefits of Pennsylvania include Retirement income is not taxable Payments from retirement accounts like 401 k s and IRAs are tax exempt PA

Code 1 2 Early Distribution This distribution is taxable for PA purposes unless 1 your pension or retirement plan was an eligible employer sponsored retirement plan for PA

Now that we've ignited your interest in Are Ira Distributions Taxable In The State Of Pennsylvania, let's explore where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of uses.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad spectrum of interests, that includes DIY projects to party planning.

Maximizing Are Ira Distributions Taxable In The State Of Pennsylvania

Here are some fresh ways of making the most of Are Ira Distributions Taxable In The State Of Pennsylvania:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home for the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Ira Distributions Taxable In The State Of Pennsylvania are a treasure trove with useful and creative ideas that meet a variety of needs and interests. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the many options of Are Ira Distributions Taxable In The State Of Pennsylvania to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Ira Distributions Taxable In The State Of Pennsylvania really absolutely free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I utilize free printables for commercial purposes?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright problems with Are Ira Distributions Taxable In The State Of Pennsylvania?

- Some printables may have restrictions regarding usage. Make sure to read the terms and regulations provided by the creator.

-

How can I print Are Ira Distributions Taxable In The State Of Pennsylvania?

- You can print them at home with the printer, or go to the local print shop for premium prints.

-

What program must I use to open printables free of charge?

- The majority of PDF documents are provided with PDF formats, which can be opened with free software, such as Adobe Reader.

What Income Is Subject To The 3 8 Medicare Tax

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

Check more sample of Are Ira Distributions Taxable In The State Of Pennsylvania below

14965412 Note TAX M 1405 TAX INDIVIDUAL MULTIPLE CHOICE QUESTIONS

Roth IRA Withdrawal Rules Oblivious Investor

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Are IRA Distributions Taxable If You Are Disabled Investingin gold

https://www.revenue.pa.gov/FormsandPublications/...

Yes All IRA distributions should be reported on PA Schedule W 2S Wage Statement Summary whether or not some or all of the distributions are taxable If a taxpayer

https://www.revenue.pa.gov/FormsandPublications/PA...

If a distribution from an IRA was received before age 59 and retiring and rolled the entire distribution 100 percent into a Roth IRA directly or within 60 days the

Yes All IRA distributions should be reported on PA Schedule W 2S Wage Statement Summary whether or not some or all of the distributions are taxable If a taxpayer

If a distribution from an IRA was received before age 59 and retiring and rolled the entire distribution 100 percent into a Roth IRA directly or within 60 days the

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Roth IRA Withdrawal Rules Oblivious Investor

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Are IRA Distributions Taxable If You Are Disabled Investingin gold

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Ira Required Minimum Distribution Worksheet Yooob Db excel

Ira Required Minimum Distribution Worksheet Yooob Db excel

Are US IRA Distributions Taxable In France Harrison Brook