In this age of electronic devices, where screens have become the dominant feature of our lives, the charm of tangible printed materials isn't diminishing. No matter whether it's for educational uses for creative projects, just adding the personal touch to your home, printables for free have become an invaluable resource. For this piece, we'll dive into the sphere of "Are Ira Distributions Taxable After Age 70," exploring the benefits of them, where to find them and how they can enhance various aspects of your lives.

Get Latest Are Ira Distributions Taxable After Age 70 Below

Are Ira Distributions Taxable After Age 70

Are Ira Distributions Taxable After Age 70 - Are Ira Distributions Taxable After Age 70, How Are Ira Withdrawals Taxed At Age 70, Are Normal Ira Distributions Taxable, Do Seniors Pay Taxes On Ira Withdrawals, Are All Ira Distributions Taxable, At What Age Do I Need To Take Ira Distributions

After age 59 and before age 72 After you reach age 59 you can receive distributions without having to pay the 10 additional tax Even though you can receive distributions after you reach age 59 distributions aren t

You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your distribution will be

Are Ira Distributions Taxable After Age 70 provide a diverse assortment of printable material that is available online at no cost. These resources come in various designs, including worksheets coloring pages, templates and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Are Ira Distributions Taxable After Age 70

Are IRA Distributions Taxable If You Are Disabled YouTube

Are IRA Distributions Taxable If You Are Disabled YouTube

Sometimes the answer is zero you owe no taxes In other cases you owe income tax on the money you withdraw You can even owe an additional penalty if you withdraw funds before age 59

Are you age 73 or older and looking to take a required minimum distribution RMD You ve reached that magic age when the IRS requires you to take annual IRA withdrawals See the

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize printables to your specific needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Worth: Free educational printables offer a wide range of educational content for learners of all ages. This makes the perfect instrument for parents and teachers.

-

Accessibility: You have instant access the vast array of design and templates cuts down on time and efforts.

Where to Find more Are Ira Distributions Taxable After Age 70

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Once you hit age 73 the IRS requires you to start withdrawing from and paying taxes on most types of tax advantaged retirement accounts You may also be required to take RMDs from

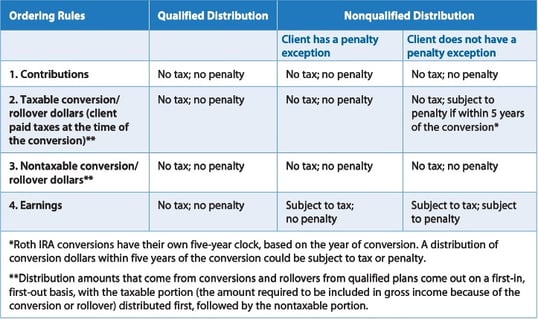

Any distribution is taxed as regular income not capital gains Those before age 59 have a special penalty Roth Contributions go in after tax Yes Qualified distributions are tax free

If we've already piqued your interest in Are Ira Distributions Taxable After Age 70 Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of uses.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a broad selection of subjects, all the way from DIY projects to planning a party.

Maximizing Are Ira Distributions Taxable After Age 70

Here are some creative ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets for teaching at-home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Are Ira Distributions Taxable After Age 70 are an abundance of practical and imaginative resources that meet a variety of needs and hobbies. Their accessibility and flexibility make them a valuable addition to each day life. Explore the many options of Are Ira Distributions Taxable After Age 70 today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Ira Distributions Taxable After Age 70 truly free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions regarding usage. Check the terms and conditions set forth by the creator.

-

How can I print Are Ira Distributions Taxable After Age 70?

- You can print them at home with your printer or visit a local print shop for high-quality prints.

-

What software is required to open Are Ira Distributions Taxable After Age 70?

- Most PDF-based printables are available in the PDF format, and can be opened using free software, such as Adobe Reader.

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Check more sample of Are Ira Distributions Taxable After Age 70 below

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

Roth IRA Withdrawal Rules Oblivious Investor

What Is A Roth IRA The Fancy Accountant

The IRA Distribution Table 3 Must Know Tips The Motley Fool

What Are The New Ira Distribution Rules Tutorial Pics

Opening A Roth IRA For Your Kids To Build Wealth And Save On Taxes

https://www.irs.gov/retirement-plans/retirement...

You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your distribution will be

https://www.nerdwallet.com/article/i…

You can take distributions at any age but distributions taken before age 59 will be taxed at ordinary income tax rates and penalized

You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your distribution will be

You can take distributions at any age but distributions taken before age 59 will be taxed at ordinary income tax rates and penalized

The IRA Distribution Table 3 Must Know Tips The Motley Fool

Roth IRA Withdrawal Rules Oblivious Investor

What Are The New Ira Distribution Rules Tutorial Pics

Opening A Roth IRA For Your Kids To Build Wealth And Save On Taxes

When Are Roth IRA Distributions Tax Free

1099r Form 2023 Printable Forms Free Online

1099r Form 2023 Printable Forms Free Online

Tax Efficient Required Minimum Distributions The CPA Journal