In this day and age in which screens are the norm The appeal of tangible printed material hasn't diminished. Be it for educational use such as creative projects or simply adding some personal flair to your area, Are Employee Cpp Contributions Tax Deductible are now a useful resource. With this guide, you'll dive deep into the realm of "Are Employee Cpp Contributions Tax Deductible," exploring what they are, how to get them, as well as how they can be used to enhance different aspects of your daily life.

Get Latest Are Employee Cpp Contributions Tax Deductible Below

Are Employee Cpp Contributions Tax Deductible

Are Employee Cpp Contributions Tax Deductible - Are Employee Cpp Contributions Tax Deductible, Are Employer Cpp Contributions Tax Deductions, Are Cpp Contributions Tax Deductible, Are Cpp And Ei Contributions Tax Deductible, Are Cpp Contributions Tax Deductible Canada, Can You Deduct Cpp Contributions

Employers in all provinces except Quebec where Quebec Pension Plan QPP contributions are collected are responsible for deducting Canada Pension Plan CPP contributions from employees who are 18 to 69 years old unless the employee is collecting a CPP disability pension

Can I claim a tax deduction for my CPP contributions No CPP contributions are not tax deductible However they do reduce your overall income for tax purposes What happens if I retire early Can I still collect CPP Yes you can collect CPP as early as age 60 but your benefits will be reduced

The Are Employee Cpp Contributions Tax Deductible are a huge range of downloadable, printable documents that can be downloaded online at no cost. These resources come in various forms, like worksheets templates, coloring pages, and more. One of the advantages of Are Employee Cpp Contributions Tax Deductible is in their variety and accessibility.

More of Are Employee Cpp Contributions Tax Deductible

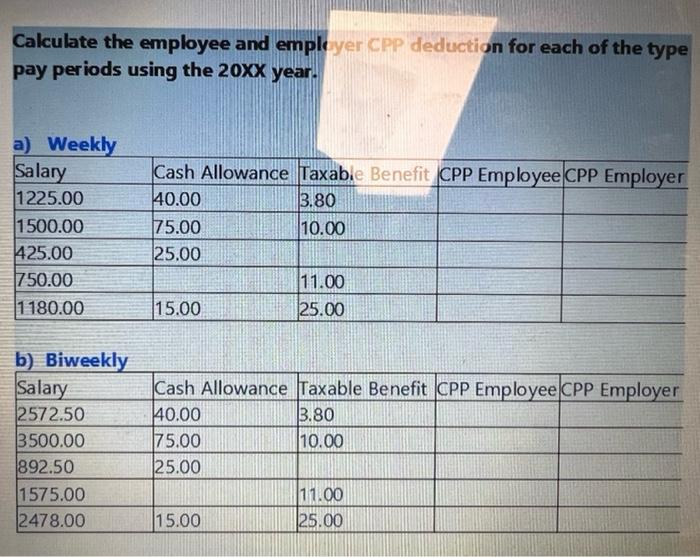

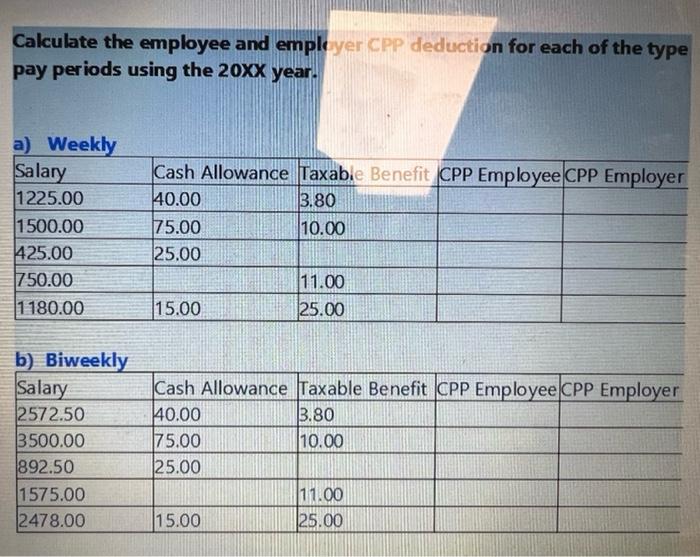

Solved Calculate The Employee And Emple Yer CPP Deduction Chegg

Solved Calculate The Employee And Emple Yer CPP Deduction Chegg

Maximum annual employee CPP contributions in their employment with you minus Employee s contributions to date for the year in their employment with you equals This amount is the maximum CPP contributions that you can deduct from your employee s pay for the rest of the year Calculation example All of Joseph s earnings

The employee contribution to the enhanced CPP is tax deductible A tax break is provided for lower income workers under the Canada Workers Benefit CWB Tax Deductibility of Enhanced CCP Contributions The previous employee CPP contribution of 4 95 of pensionable income forms part of the value on which a tax credit is calculated using the

Are Employee Cpp Contributions Tax Deductible have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: There is the possibility of tailoring the templates to meet your individual needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Impact: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes these printables a powerful tool for parents and educators.

-

Simple: The instant accessibility to the vast array of design and templates helps save time and effort.

Where to Find more Are Employee Cpp Contributions Tax Deductible

Payroll Deductions In Alberta Canada Simplified Weekly Income Tax

Payroll Deductions In Alberta Canada Simplified Weekly Income Tax

The employee gets a personal tax credit of 15 on their portion of the contribution Note for purposes of our course we ve simplified the CPP tax treatment slightly We treat the entire CPP contribution as eligible for the CPP tax credit

These contributions are deducted from the employee s pay and remitted to the Canada Revenue Agency Pension Plan The CPP provides a retirement pension that is based on the contributions made by an individual during their working years

After we've peaked your curiosity about Are Employee Cpp Contributions Tax Deductible Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Are Employee Cpp Contributions Tax Deductible for all uses.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning materials.

- This is a great resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide selection of subjects, ranging from DIY projects to party planning.

Maximizing Are Employee Cpp Contributions Tax Deductible

Here are some ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Employee Cpp Contributions Tax Deductible are a treasure trove of useful and creative resources for a variety of needs and preferences. Their access and versatility makes them an essential part of both professional and personal lives. Explore the vast collection of Are Employee Cpp Contributions Tax Deductible today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Employee Cpp Contributions Tax Deductible really available for download?

- Yes you can! You can download and print the resources for free.

-

Do I have the right to use free templates for commercial use?

- It's all dependent on the terms of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations concerning their use. Be sure to check the terms and condition of use as provided by the designer.

-

How do I print Are Employee Cpp Contributions Tax Deductible?

- Print them at home with your printer or visit an area print shop for premium prints.

-

What program do I need in order to open printables for free?

- The majority of PDF documents are provided in PDF format. These is open with no cost software, such as Adobe Reader.

Future CPP Disability Benefits Are Not Deductible From Loss Of Earnings

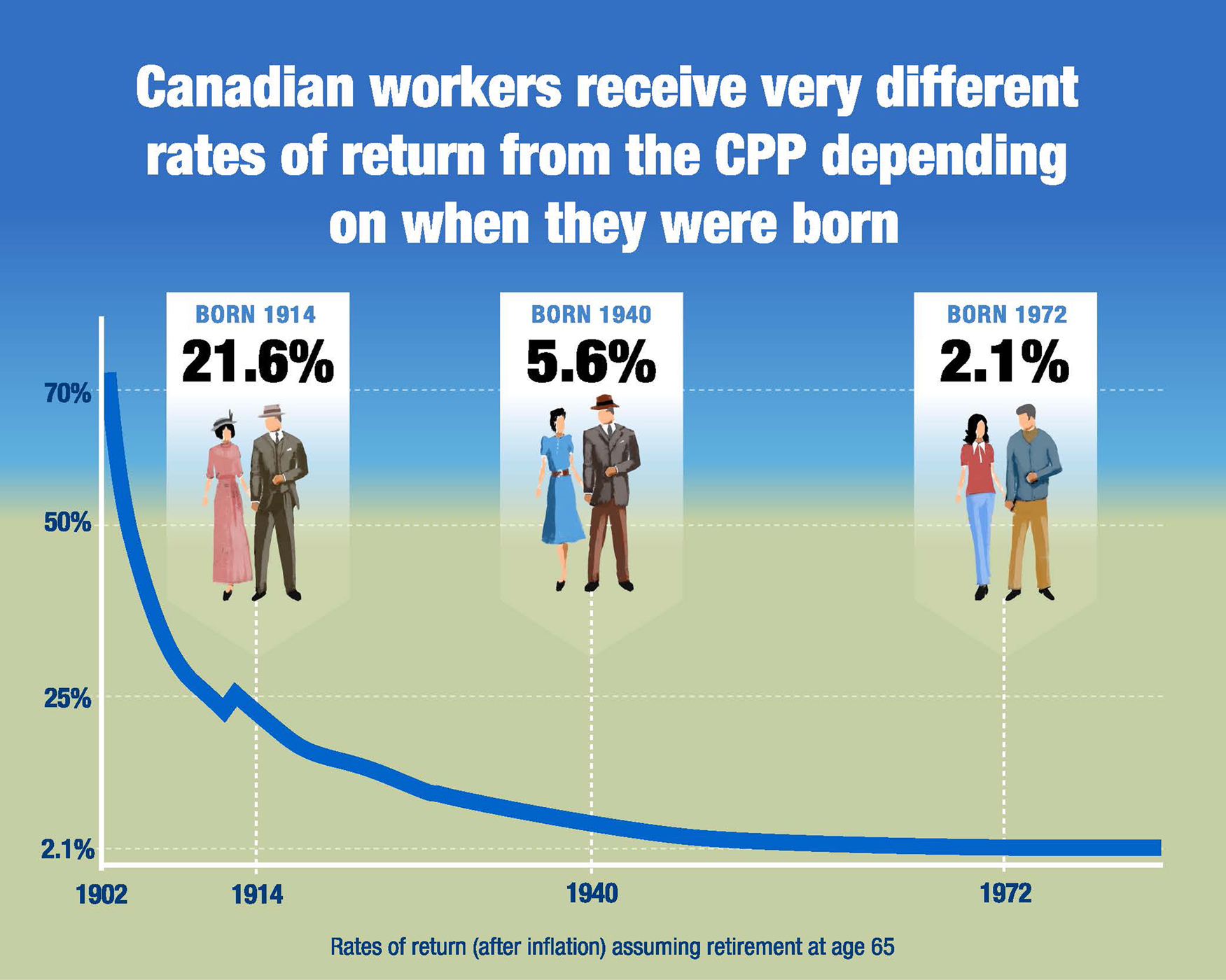

EXPANDING THE CPP WILL INCREASE FORCED CONTRIBUTIONS UNLIKELY TO BOOST

Check more sample of Are Employee Cpp Contributions Tax Deductible below

Are FSA Contributions Tax Deductible

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

ALBAS I Have Received Complaints Over The Fact That A True Savings

2019 FSA And HSA Contribution Limits

Comprehensive Guide To Canada Pension Plan CPP 2024 Protect Your

![]()

Comprehensive Guide To Canada Pension Plan CPP 2024 Protect Your

![]()

When Should Early Retirees Take CPP Boomer Echo

https://canpension.ca/articles/what-you-need-to...

Can I claim a tax deduction for my CPP contributions No CPP contributions are not tax deductible However they do reduce your overall income for tax purposes What happens if I retire early Can I still collect CPP Yes you can collect CPP as early as age 60 but your benefits will be reduced

https://www.canada.ca/en/revenue-agency/services/...

It contains tables for federal and provincial tax deductions CPP contributions and EI premiums It will help you determine the payroll deductions for your employees or pensioners The provincial and federal tables are designed to accurately calculate the deductions provided by the CPP additional contributions in most situations

Can I claim a tax deduction for my CPP contributions No CPP contributions are not tax deductible However they do reduce your overall income for tax purposes What happens if I retire early Can I still collect CPP Yes you can collect CPP as early as age 60 but your benefits will be reduced

It contains tables for federal and provincial tax deductions CPP contributions and EI premiums It will help you determine the payroll deductions for your employees or pensioners The provincial and federal tables are designed to accurately calculate the deductions provided by the CPP additional contributions in most situations

Comprehensive Guide To Canada Pension Plan CPP 2024 Protect Your

ALBAS I Have Received Complaints Over The Fact That A True Savings

Comprehensive Guide To Canada Pension Plan CPP 2024 Protect Your

When Should Early Retirees Take CPP Boomer Echo

CPP And EI Contributions Snap Projections Support 1 888 758 7977

SLM How Long Should You Make CPP Contributions For

SLM How Long Should You Make CPP Contributions For

Comprehensive Guide To Canada Pension Plan CPP 2023 Protect Your