Today, in which screens are the norm however, the attraction of tangible printed objects isn't diminished. No matter whether it's for educational uses or creative projects, or simply adding some personal flair to your area, Are Contributions To A Retirement Plan Tax Deductible can be an excellent source. The following article is a dive into the sphere of "Are Contributions To A Retirement Plan Tax Deductible," exploring their purpose, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Are Contributions To A Retirement Plan Tax Deductible Below

Are Contributions To A Retirement Plan Tax Deductible

Are Contributions To A Retirement Plan Tax Deductible - Are Contributions To A Retirement Plan Tax Deductible, Are Contributions To A Pension Plan Tax Deductible, Are Contributions To A Foreign Pension Plan Tax Deductible, Are Employee Contributions To Pension Plans Tax Deductible, Are Contributions To A Roth Ira Tax Deductible, Are Contributions To A Simple Ira Tax Deductible, Are Contributions To A Sep Ira Tax Deductible, Are Contributions To A Rollover Ira Tax Deductible, Are Retirement Contributions Tax Deductible, Are Retirement Plans Tax Deductible

Contributes to an employer sponsored retirement plan such as a 401 k or 403 b and your Modified Adjusted Gross Income MAGI exceeds annual limits If you

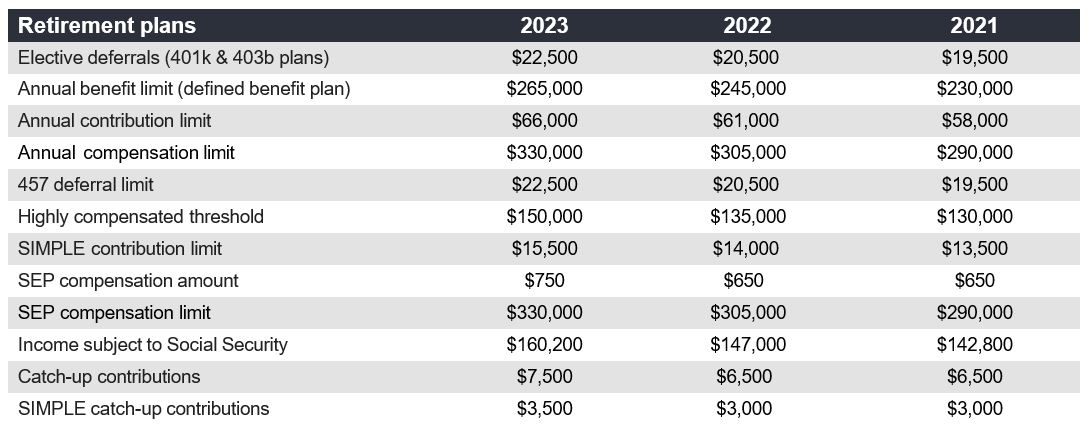

That 6 500 or 7 500 in 2023 is the total you can deduct for all contributions to qualified retirement plans For 2024 this is 7 000 or 8 000 Having a 401 k account at work doesn t

Printables for free cover a broad variety of printable, downloadable documents that can be downloaded online at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and much more. One of the advantages of Are Contributions To A Retirement Plan Tax Deductible lies in their versatility as well as accessibility.

More of Are Contributions To A Retirement Plan Tax Deductible

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

Yes IRA contributions may be tax deductible if you qualify and depending on the type of account you have Contributions to a traditional IRA are deductible while contributions to a

Many investors favor these accounts for their significant tax advantages which can include tax deductible contributions Contributions to a traditional 401 k IRA and other retirements plans

The Are Contributions To A Retirement Plan Tax Deductible have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: We can customize the design to meet your needs such as designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Printables for education that are free cater to learners of all ages. This makes the perfect resource for educators and parents.

-

Accessibility: Fast access many designs and templates helps save time and effort.

Where to Find more Are Contributions To A Retirement Plan Tax Deductible

Are Roth Contributions Right For Me

Are Roth Contributions Right For Me

Making eligible contributions to an employer sponsored retirement plan such as a 401 k or an IRA can potentially lead to a tax credit known as a Retirement Savings Contributions Credit or a

Form W 2 reporting for retirement plan contributions Box 1 Wages Don t include pre tax contributions made under a salary reduction agreement Box 3

If we've already piqued your interest in printables for free Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Are Contributions To A Retirement Plan Tax Deductible suitable for many motives.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free or flashcards as well as learning materials.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast range of interests, everything from DIY projects to party planning.

Maximizing Are Contributions To A Retirement Plan Tax Deductible

Here are some inventive ways ensure you get the very most of Are Contributions To A Retirement Plan Tax Deductible:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Are Contributions To A Retirement Plan Tax Deductible are a treasure trove of fun and practical tools that cater to various needs and pursuits. Their availability and versatility make them a valuable addition to your professional and personal life. Explore the endless world of Are Contributions To A Retirement Plan Tax Deductible today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can download and print these items for free.

-

Can I download free printables in commercial projects?

- It is contingent on the specific terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may contain restrictions on use. Check the conditions and terms of use provided by the creator.

-

How do I print Are Contributions To A Retirement Plan Tax Deductible?

- You can print them at home using either a printer at home or in an in-store print shop to get the highest quality prints.

-

What software do I require to view Are Contributions To A Retirement Plan Tax Deductible?

- The majority of printables are in the format PDF. This can be opened with free software like Adobe Reader.

IRS Announces 2023 HSA Limits Blog Medcom Benefits

Annual Retirement Plan Contribution Limits For 2023 Social K

Check more sample of Are Contributions To A Retirement Plan Tax Deductible below

Retirement Plan On Track 6 Ways To Check

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Infographics 7 Retirement Savings Goals For 2017

How Does Australia Tax Your US Retirement Account Let s Fix The

How Much Is Your State s 529 Plan Tax Deduction Really Worth

2023 Dcfsa Limits 2023 Calendar

https://www.investopedia.com/ask/answers/…

That 6 500 or 7 500 in 2023 is the total you can deduct for all contributions to qualified retirement plans For 2024 this is 7 000 or 8 000 Having a 401 k account at work doesn t

https://www.irs.gov/retirement-plans/ira-deduction-limits

IRA Deduction if You Are NOT Covered by a Retirement Plan at Work 2022 deduction is limited only if your spouse IS covered by a retirement plan See

That 6 500 or 7 500 in 2023 is the total you can deduct for all contributions to qualified retirement plans For 2024 this is 7 000 or 8 000 Having a 401 k account at work doesn t

IRA Deduction if You Are NOT Covered by a Retirement Plan at Work 2022 deduction is limited only if your spouse IS covered by a retirement plan See

How Does Australia Tax Your US Retirement Account Let s Fix The

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

How Much Is Your State s 529 Plan Tax Deduction Really Worth

2023 Dcfsa Limits 2023 Calendar

2023 Retirement Plan Contribution Limits Baker Tilly

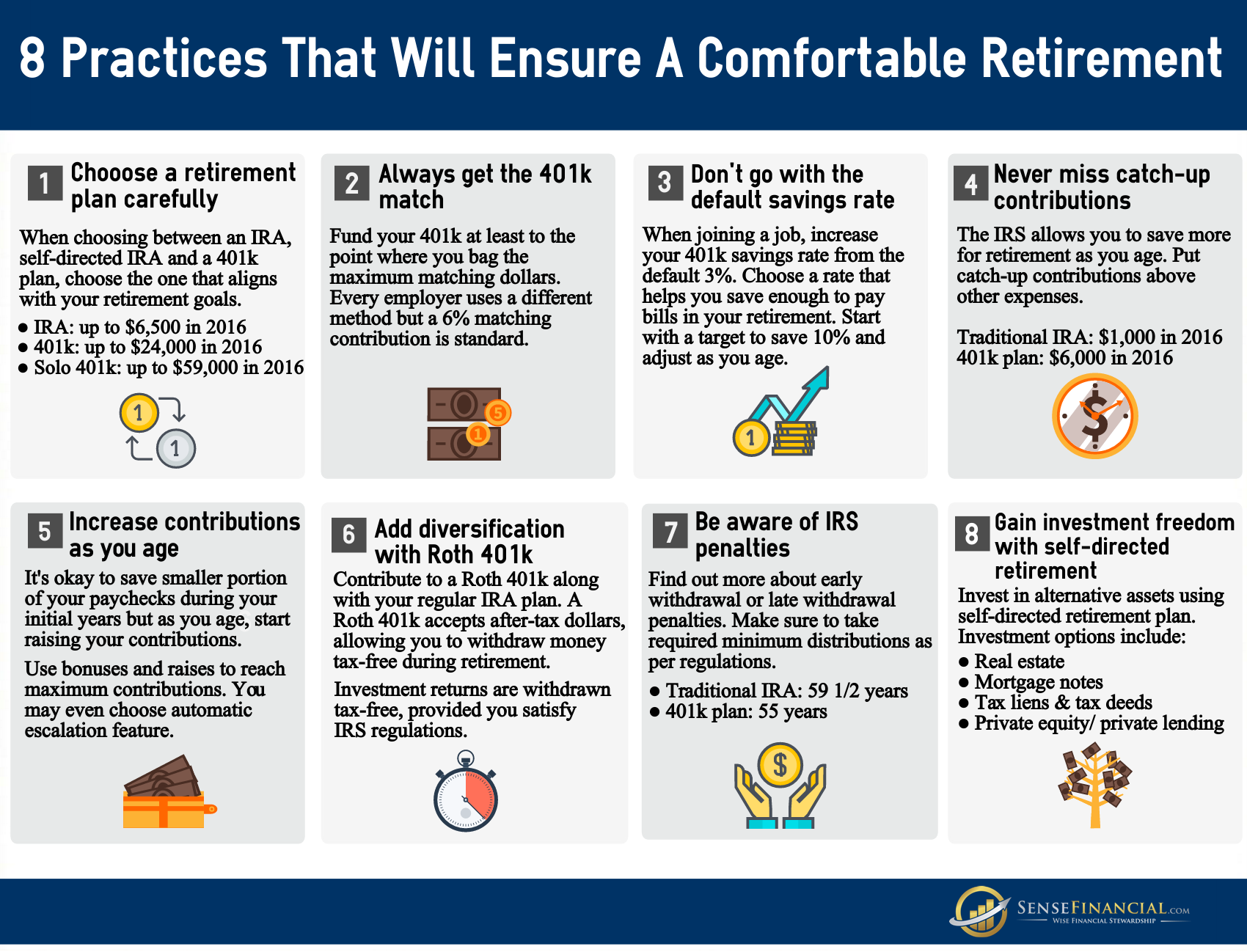

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog