In this age of electronic devices, where screens dominate our lives The appeal of tangible printed products hasn't decreased. Whether it's for educational purposes such as creative projects or simply to add an individual touch to the area, Are All Roth Ira Distributions Tax Free are a great source. In this article, we'll take a dive through the vast world of "Are All Roth Ira Distributions Tax Free," exploring what they are, where to find them, and how they can improve various aspects of your lives.

Get Latest Are All Roth Ira Distributions Tax Free Below

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Are All Roth Ira Distributions Tax Free

Are All Roth Ira Distributions Tax Free - Are All Roth Ira Distributions Tax Free, Are All Roth Ira Withdrawals Tax Free, Are Inherited Roth Ira Distributions Tax Free, Are Roth Ira Distributions Tax Deductible, Are Roth Ira Distributions State Tax Free, Are Roth Ira Distributions Always Tax Free, Are Roth Ira Distributions Taxable

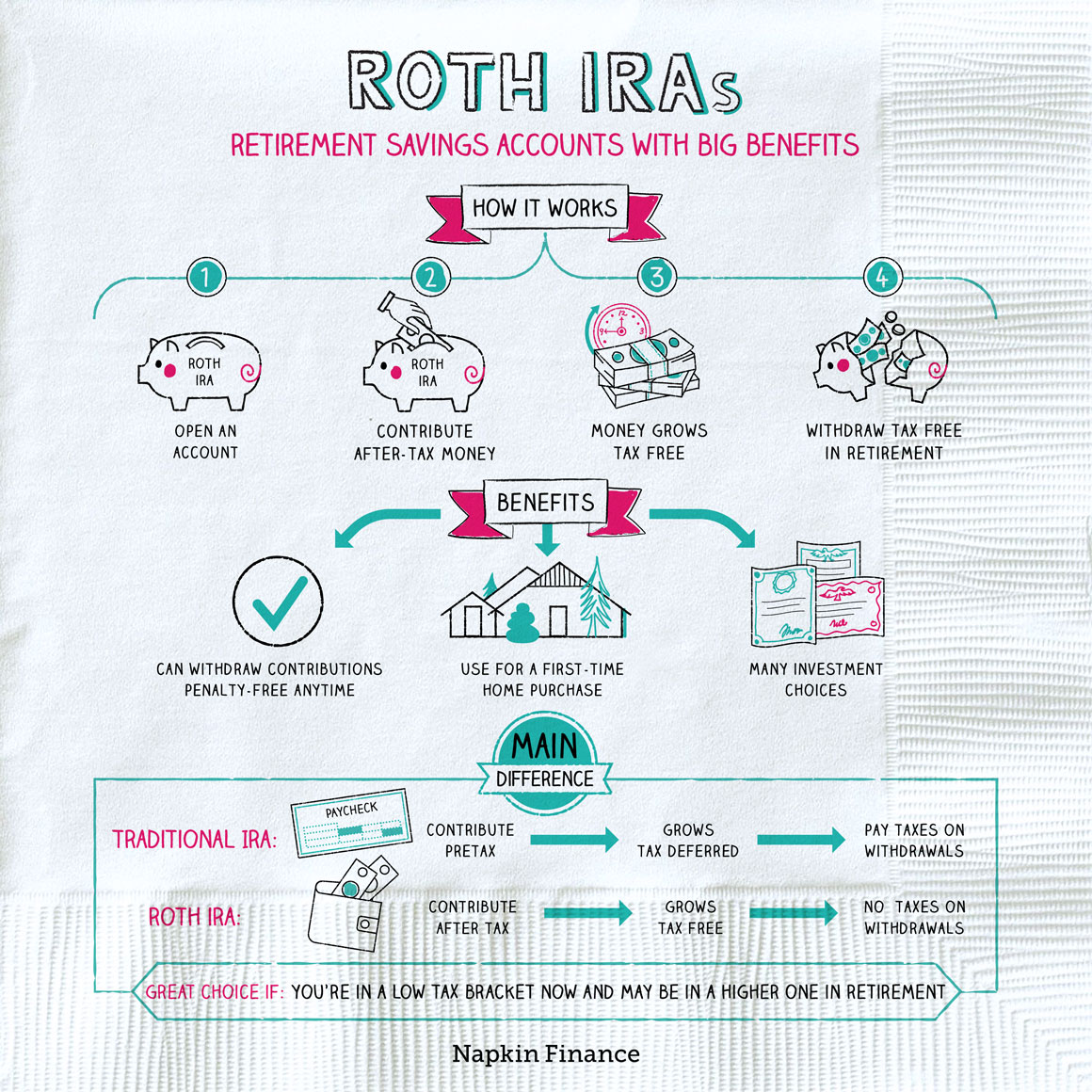

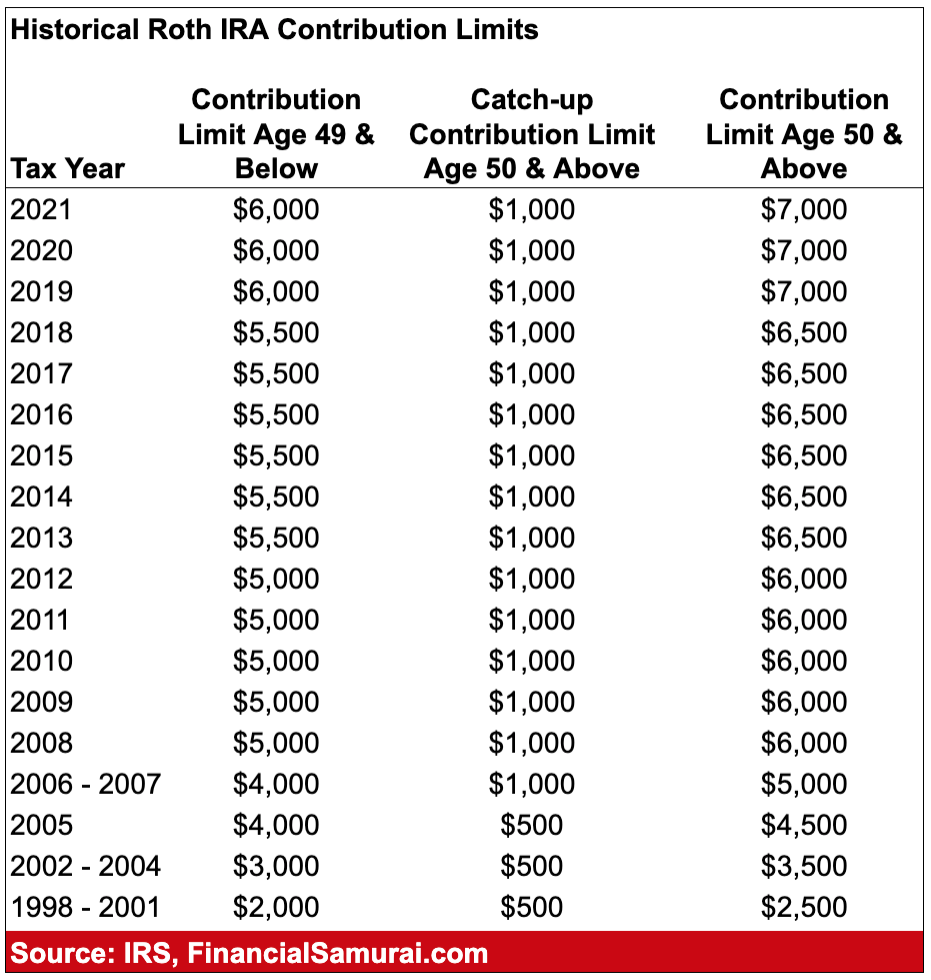

Roth individual retirement accounts IRAs give you after tax contributions that grow tax free until you begin making withdrawals during retirement These withdrawals are not

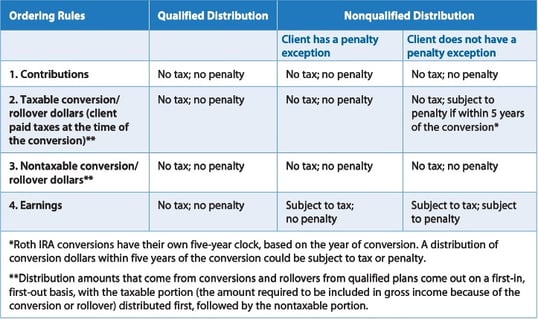

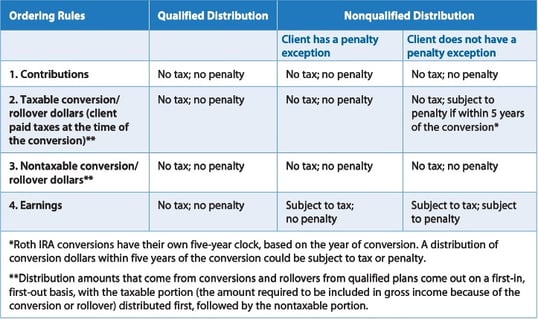

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However

Are All Roth Ira Distributions Tax Free encompass a wide assortment of printable, downloadable items that are available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages, and many more. The benefit of Are All Roth Ira Distributions Tax Free is in their versatility and accessibility.

More of Are All Roth Ira Distributions Tax Free

Roth IRA Distribution Rules Taxation Tax Diversification

Roth IRA Distribution Rules Taxation Tax Diversification

With the Roth IRA the money you contribute isn t tax deductible That means you don t report Roth IRA contributions on your tax return and you can t deduct them from your taxable

Roth IRAs let you save and invest money you ve already paid taxes on In retirement you can make tax free withdrawals Unlike traditional IRAs Roth IRAs have income limits that may exclude some savers though high earners still have a

Are All Roth Ira Distributions Tax Free have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization It is possible to tailor printables to fit your particular needs whether it's making invitations making your schedule, or even decorating your home.

-

Educational Worth: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them an essential tool for teachers and parents.

-

Simple: Quick access to the vast array of design and templates, which saves time as well as effort.

Where to Find more Are All Roth Ira Distributions Tax Free

Qualified Vs Non Qualified Roth IRA Distributions

Qualified Vs Non Qualified Roth IRA Distributions

Contributions Money you added into the Roth IRA can be withdrawn at any time without taxes or penalties That s because you already paid taxes on the money used to fund the account Earnings

Roth IRA flexibility No mandatory distributions allowing for tax free growth and withdrawal at the accountholder s discretion Early distributions Tax free contribution

Now that we've ignited your curiosity about Are All Roth Ira Distributions Tax Free Let's find out where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Are All Roth Ira Distributions Tax Free for various reasons.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad range of topics, everything from DIY projects to planning a party.

Maximizing Are All Roth Ira Distributions Tax Free

Here are some new ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Are All Roth Ira Distributions Tax Free are an abundance with useful and creative ideas that cater to various needs and interests. Their access and versatility makes them a valuable addition to each day life. Explore the wide world that is Are All Roth Ira Distributions Tax Free today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can print and download these materials for free.

-

Can I use the free printables to make commercial products?

- It's dependent on the particular terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Are All Roth Ira Distributions Tax Free?

- Some printables may come with restrictions regarding their use. Be sure to check the terms and conditions offered by the designer.

-

How do I print Are All Roth Ira Distributions Tax Free?

- You can print them at home using the printer, or go to an in-store print shop to get high-quality prints.

-

What program do I require to open printables at no cost?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software, such as Adobe Reader.

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Roth IRA Withdrawal Rules Oblivious Investor

Check more sample of Are All Roth Ira Distributions Tax Free below

Roth IRA Pay Now Withdraw Tax Free Later Napkin Finance

Roth Ira Withdrawal Penalty Choosing Your Gold IRA

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

When Are Roth IRA Distributions Tax Free

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

The 5 Year Rules For Roth IRA Withdrawals Pure Financial Advisors

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg?w=186)

https://www.investopedia.com/retirement/tax...

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However

https://www.irs.gov/retirement-plans/roth-iras

You cannot deduct contributions to a Roth IRA If you satisfy the requirements qualified distributions are tax free You can make contributions to your Roth IRA after you reach age 70 You can leave amounts in your Roth IRA as long as you live

First of all distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time tax free and penalty free However

You cannot deduct contributions to a Roth IRA If you satisfy the requirements qualified distributions are tax free You can make contributions to your Roth IRA after you reach age 70 You can leave amounts in your Roth IRA as long as you live

When Are Roth IRA Distributions Tax Free

Roth Ira Withdrawal Penalty Choosing Your Gold IRA

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

The 5 Year Rules For Roth IRA Withdrawals Pure Financial Advisors

Opening A Roth IRA For Your Kids To Build Wealth And Save On Taxes

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

Form 1040 Line 4 And Line 5 IRA Distributions Pensions And Annuities

What Is A Roth IRA The Fancy Accountant